Markets

What’s up legends, hope everyone was able to make some profit on the nice market surge we saw this week across asset classes. Inflation is slowing, mid term season is fast approaching, and from a business side we are definitely in the slow days of August (if you’re in sales or trading it’s dead af lol - everyone who matters executively is in the Hamptons spilling drinks on their track pad intermittently checking emails).

Quick Arb Letter to get you all up to speed on what you need to know from the week ending 8/12.

If you missed our CPI overview earlier this week you can read it HERE. The drop to 8.5% for the CPI print Wednesday was the headline of the week, causing equities, crypto and other assets to pump up until early this morning where we are starting to see some light selling resume.

Though this is a small slowdown of inflation, it seemed to be enough to get some of the folks with higher risk appetites out into the open and hopefully we see a strong market pump into the weekend but I am not holding my breath.

Some major updates this week in markets for crypto, some recovery of key tech stocks, and broader indices.

With the developing news of Blackrock and other firms getting further into crypto, it makes one wonder why US Regulators have repeatedly denied a spot ETF. Definitely some games being played while the whales scramble to get infrastructure in place for the next bull run.

The Ethereum Merge is officially scheduled for some time in mid- September

Blackrock offering spot Bitcoin services to clients - putting some heat on Grayscale, the world’s biggest investment vehicle for cryptocurrencies currently

(RIVN) Rivian posted an automotive business loss for the quarter of roughly $1.7 billion.

Johnson & Johnson has announced it will discontinue production of its talc-based baby powder in 2023 as it deals with over 40,000 legal claims that the product caused people to fall ill with various cancers

Mexico’s central bank and Argentina’s raised interest rates to tackle soaring inflation

The founder of crypto exchange Huobi Global, Leon Li, is in alleged talks to sell a majority stake in the company in a transaction that would value the firm at $3 billion or more, Bloomberg reported on Friday. Buyers are FTX and Justin Sun’s Tron per reports, but Sun has denied on Twitter involvement in conversations.

The House of Representatives on Friday afternoon is set to pass the climate, health-care and corporate tax legislation now known as the Inflation Reduction Act (CNBC).

Seychelles-based Huobi is one of the largest crypto exchanges, with a daily trade volume of over $1 billion, according to CoinGecko. (Coindesk).

At this intersection in the market we like to highlight some of the equity names that are receiving the most interest and display high trading volumes insinuating institutional players and funds are switching allocations and placing bets for the next couple of months.

Could be worth taking a look at accumulating some of these names on red days as they’re all likely to be good long term bets for the next 10 years. Your 401K and brokerage can always use some more quality names instead of Shiba Coin positions.

Some of the names we aggregated with Tradingview that have the highest trading volume include:

AMC (AMC Theaters - go apes)

AMD (Advanced Micro Devices)

SNAP (SnapChat)

NVDA (Nvidia)

DIS (Disney)

AMZN (Amazon)

PFE (Pfizer)

RIVN (Rivien Automotive)

DKNG (DraftKings)

Large hedge funds are continuing to play in NFLX, FB, DIS, and other names that have gotten beaten up quite a bit from the bear market that started off this year.

There is also talk of increased SEC scrutiny of hedge fund crypto holdings. On an unrelated note Melvin Capital is now under investigation for some of the intricacies of the Gamestop/AMC debacle - we will continue to cover that story as more news comes out.

Crypto continues to see a range of ponzis, laundering activities, and other scams play out months after many large lending firms and players were aggressively deleveraged in a cascading sell fest.

On August 8th the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned virtual currency mixer Tornado Cash, which has been used to launder more than $7 billion worth of virtual currency since its creation in 2019.

Pretty wild blow up here - essentially any currencies or assets that touched this exchange are fucked. Celebrities are getting doxxed for having used the service and many are worried about having come into contact with tainted funds because of the structure of the mixer.

“Today, Treasury is sanctioning Tornado Cash, a virtual currency mixer that launders the proceeds of cybercrimes, including those committed against victims in the United States,”

Under Secretary of the Treasury for Terrorism and Financial Intelligence Brian E. Nelson

Global News

This week’s big news was the raid of former President Donald Trump’s residence in Florida over alleged sensitive documents. AG Merrick Garland spoke yesterday doubling down and saying he personally approved the warrant for this raid.

This comes on the heels of the following updates:

The Florida federal magistrate judge who signed off on a search warrant authorizing the FBI raid of former President Donald Trump’s Mar-a-Lago resort donated to Barack Obama’s 2008 presidential campaign — months after he left the local US Attorney’s office to rep employees of convicted pedophile Jeffrey Epstein who had received immunity in the long-running sex-trafficking investigation of the financier (NYpost).

At first we heard nothing of the nature of the documents but the warrant itself was ordered unsealed on Thursday and we’ve come to receive some updates since on the exact nature of the documents.

The Washington Post reported the FBI sought, among other unlisted items, a set of classified documents related to nuclear weapons during their search of Donald Trump’s residence at his Mar-a-Largo crib in Palm Beach, Florida. Do you believe Trump had nuclear documents lol? Sounds wild and far fetched but who knows these days, I am literally never surprised anymore.

"I personally approved the decision to seek a search warrant in this matter"

-AG Merrick Garland

We’ve touched on it before in Arb Letter but institutions are becoming under heightened scrutiny in recent months. Public reactions to the raid were not good and Thursday a man showed up at FBI headquarters in Cincinnati.

42-year-old Ricky Shiffer showed up with a nail gun and AR15. Apparently Shiffer tried to break into the headquarters in Cincinnati before fleeing, shooting at State Troopers, and eventually getting killed in the process.

Garland took the chance to also condemn what he called "recent unfounded attacks on the professionalism of the FBI and Justice Department agents and prosecutors" in connection with the raid.

As expected the Trump raid is heightening tension in the US between the left and right.

As mid terms approach quickly, several new pieces of information have been coming out that suggest we will once again see a very highly contested 2024 election and mid term race by both sides.

There are rumors that Joe Biden will be running against Trump in 2024 - obviously quite a bit has to happen before we will have clarity on either candidate here, but that would be absolutely wild to witness AGAIN.

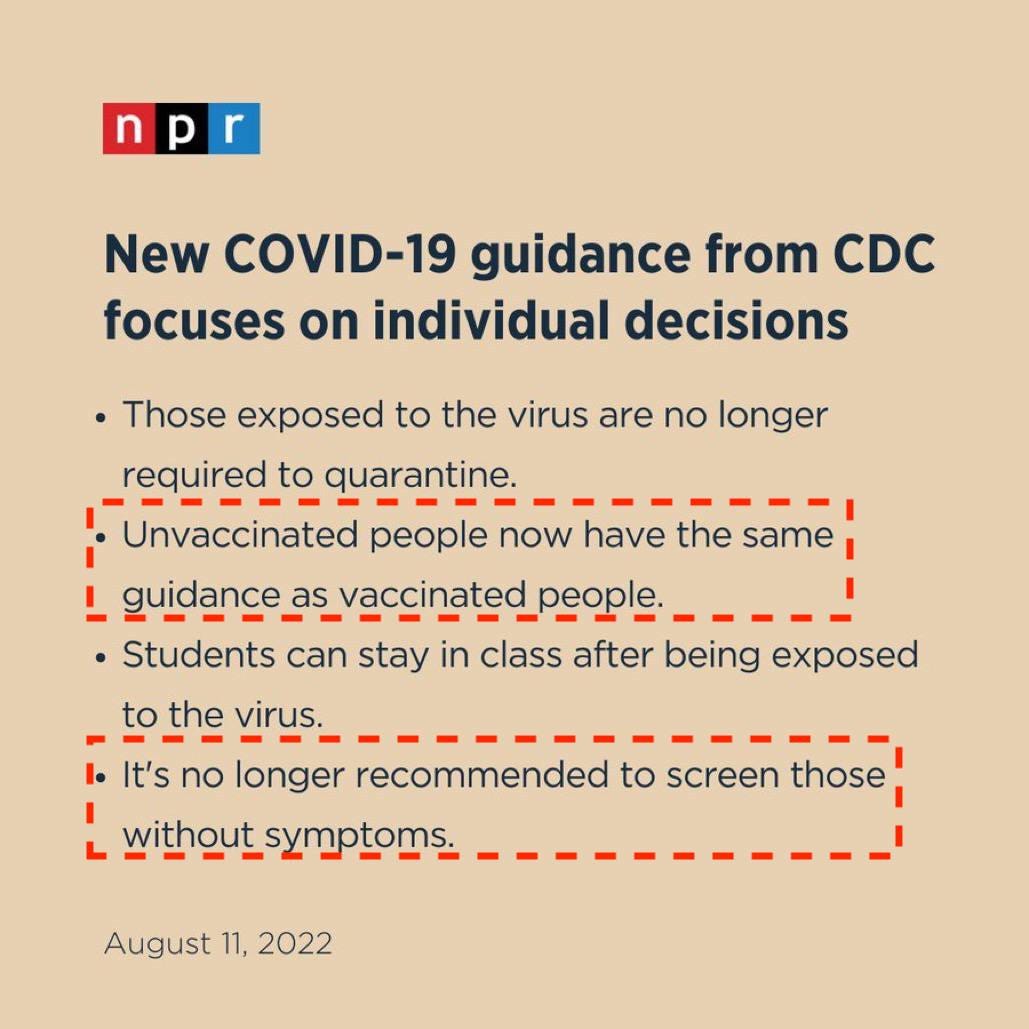

The other major update that will probably be drowned out on your media feeds and channels is that the CDC just put out some major recommendation updates re: Covid 19. Pretty much sums up what we’ve been saying about this for over a year but we’ll let you guys form your own conclusions.

Lots of distractions and new things to be worried about so expect this to fall completely out of view in a few months, even more than it already has in a laughably short amount of time.

This is pretty wild to me. After all of the fuss, firings, segregation based on vax status we come full circle and literally get the CDC saying it doesn’t matter now. Is this them saying we give up?

Is it them saying it never mattered that much? Think we can all agree that we were not given the full story since the beginning of this pandemic over two long years ago.

“Prior infection and vaccination confer some protection against severe illness, and so it really makes the most sense to not differentiate with our guidance or our recommendations based on vaccination status”

CDC scientist Dr. Greta Massetti

Morale Boost

Given this was a long and grueling and boring summer week I thought all of the soldiers could use a nice morale boost before the weekend with a throwback to Marisa Miller from the days of SI Swimsuit.

Consider it a sending off gift for the week, pure aesthetic perfection from the good ole days. Make sure you’re taking care of yourselves this weekend and getting to the bag any chance you can.

See paid subs Monday for a deep dive on the new IRS/Tax implications that all Americans will have to deal with.

At Arb Letter we send out one free market related post per week to all subscribers. To get access to our archive of 75+ articles, our community, and extra deep dives/focus pieces each week on global news, markets, and current events consider subscribing to premium for the cost of a Gatorade per month.

We have over 1,000 premium subs comprised of hedge fund managers, banking analysts, traders, tech folks, and more.