Happy Friday folks.

Let’s hop into some of the opportunities that we have in front of us with the chaos that is markets and politics.

Hope everyone had a good week safe from lay offs, annoying bosses, and nonsense.

Big thing to watch for today is payroll reports and their impact on the Nasdaq and other indices today.

Non farm payrolls report comes out this morning with expectations set at 318,000 jobs added in August.

This report will offer us some indication into the course of action the Federal Reserve takes with their next interest rate decision that comes later this month. Seems at the moment most traders are pricing in a .75 bps hike next.

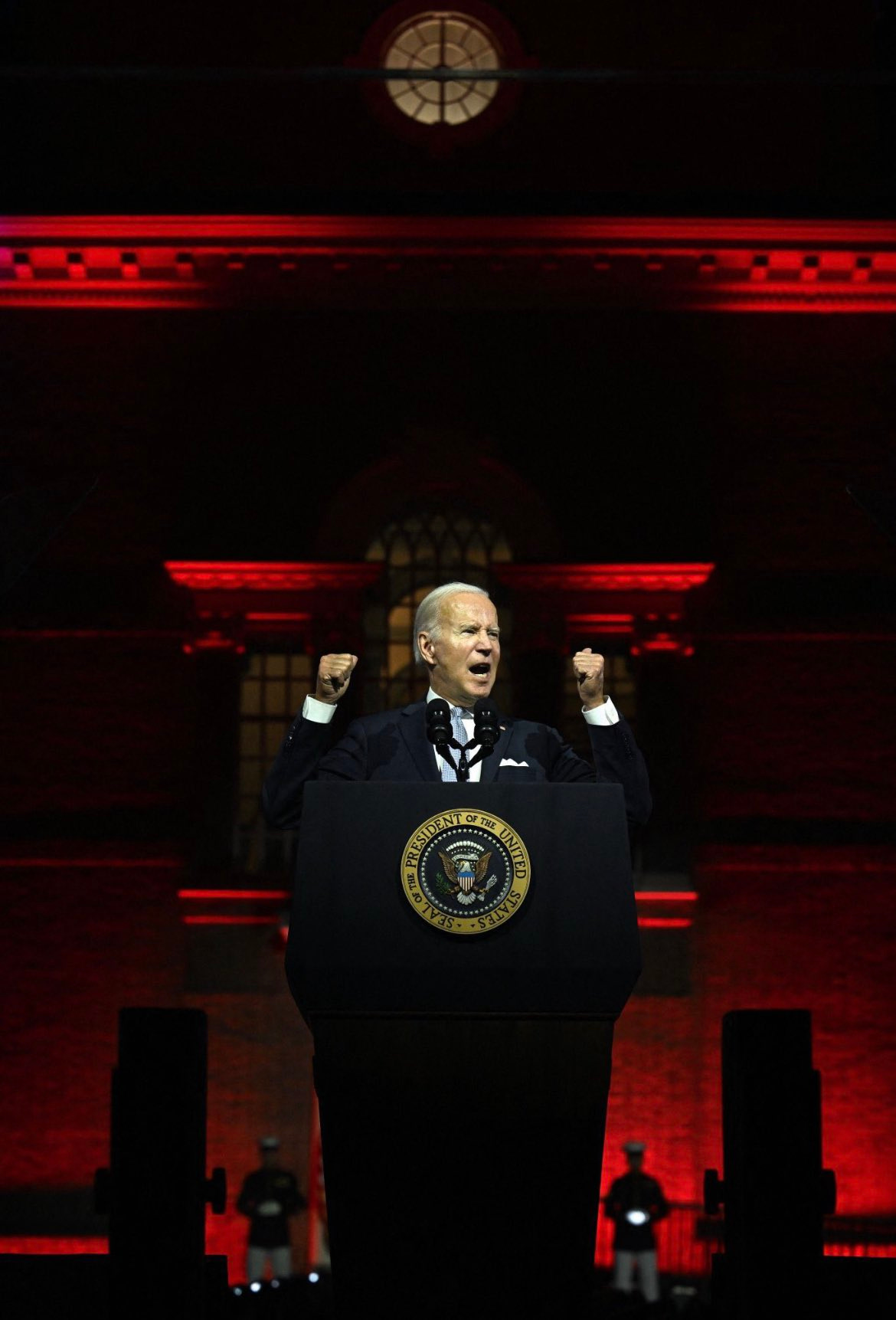

President Biden had a major speech last night in which he called for the preservation of Democracy and called out MAGA republicans as a force working against the unification of the USA. The aesthetic drew criticism from a wide range of pundits and folks on Twitter. What do you think?

Monday we will be dropping our highly awaited Watch Review of 2022 for premium subs. If you want - upgrade to receive! We do 1-2 deep dives a week for paid subs which equates to like 0.80 cents a week. Invest in yourself kings and queens.

MARKETS

Investors and citizens in Europe are facing a potential recession in the Eurozone as energy prices reach all time highs from Putin’s war games in the Ukraine, inflation sky rockets, and cost of living grows in many countries including the UK.

We touched on this in our Energy Mega Post recently. Certain LSEs and power providers in the US are already starting to feel the impact of the energy crisis. particularly on the West Coast.

California has had multiple blackout warnings and in a hilarious instance of irony even told some residents to “not charge” their electric cars because of a lack of electricity.

US investors will be focused on the job/payroll reports today to give some hint as to how the next FOMC meeting will go. Markets finished slightly up on Thursday after a rocky week and Asia markets are quivering along.

The US unemployment rate increases to 3.7%, the highest since February 2022. Sharpen them resumes folks! It’s getting hairy.

August Payrolls came in at 315K, Exp. 297.5K, Last 526K

Xcel Energy, an electric provider based out of Colorado, prevented 22,000 people from using their thermostats on Tuesday due to an “energy emergency.” (Yahoo Finance).

New restrictions were imposed on the exports of chips from Nvidia Corp to China and consequently shares fell almost 11% in Thursday trading, wiping out more than $39 billion in market value.

This sucks - huge part of my long term portfolio, but I do think that the sentiment is an overreaction. Likely adding some in the coming weeks.

US federal prosecutors charged Neil Phillips a Portfolio Manager based out of a London hedge fund that historically received backing by George Soros. He was charged with conspiracy to manipulate currency markets, which is funny given Soros’ record of killing it shorting the pound and other currencies. Like father like son.

The SEC along with the Commodity Futures Trading Commission have called for comments on a proposal that would mandate large advisers to certain hedge funds to report exposure to crypto (CoinTelegraph).

Carlyle Group Co- Founder David Rubenstein mentioned “I have bought companies that service the cryptocurrency industry”. Pays to mention Rubenstein is a former critic of blockchain and crypto.

Generally - while I think we could be in for more chop and short term pain, I am a buyer of tech stocks at these levels. Alphabet (GOOGL) Amazon (AMZN) and Microsoft (MSFT) in my opinion are excellent buys right now if you have a long term investment horizon.

In respect to crypto, it seems that there are some rigidly strong bid walls at $19/20K that have yet to be broken. It would take another large leg of equity sell offs to drag BTC down to the $17K level.

In the meantime the resiliency for $20K+ is interesting for sure and as BTC forms a potential triple bottom, I think people could definitely be surprised by a violent move up along with ETH who takes advantage of merge tailwinds.

I was called a Perma-Bear on HBO’s show Industry and for good reason - I am generally skeptical and pessimistic when it comes to humans and markets. That being said, OI do think we’ve exhausted bad news to some extent (today’s market pump off bas unemployment news is testament).

I am more of a cautious buyer at these market levels than a paper hands seller. Remember that the best time to buy is when people have capitulated and are CERTAIN markets are going way lower - similar to when everyone (including myself) thought BTC would hit $75K/$100K. The pendulum swings both ways and a crucial part of trading is being aware enough to see these trends and pick up on the sentiment. Food for thought.

GLOBAL NEWS

President Biden had a major speech last night in which he called for the preservation of Democracy and called out MAGA republicans as a force working against the unification of the USA.

The aesthetic drew criticism from a wide range of pundits on both sides of the aisle and folks on Twitter. What do you think?

We put out a post yesterday outlining the likelihood of Civil war as many mainstream analysts and commentators have put out their feelings on the topic recently. A recent poll even highlighted that many Americans expect conflict of some sort in the near future. If you care to read you can HERE.

The federal trial for singer R. Kelly, 55, continues in its third week

The German far-left party known as "Die Linke" has said it will take it to the streets amid sky high prices for electricity and gas.

As we outlined in our last energy post, we can expect growing unrest on the continent of Europe as people can’t gain access to the basic heating and energy needs they require to survive.

UN investigators have announced they have found "credible evidence" of torture and other violations amounting to "crimes against humanity" against Uyghurs in China. China has called the report a farce.

G7 finance ministers have agreed on a plan to impose a price cap on Russian oil imports

The chairman of Russia's Lukoil - a massive oil company second only in size to Gazprom, Ravil Maganov, has died after apparently falling from a 6th story hospital window in Moscow, reports say.

So you can reasonably assume Russian secret police or FSB, pushed him from the window at Putin’s direction. Bourne Ultimatum type shit lol.

There was an assassination attempt on the Argentina’s vice president, Cristina Fernandez de Kirchner at a football match Friday morning. The gun jammed.

We will continue to track energy developments in Europe and how they impact the US and rest of the world. We consider this one of the largest and most important current issues given the magnitude and chain reaction effect it will continue to have well into the winter months.

Some Thoughts

As the world around us descends into madness, it can be easy to lose perspective and get caught up in the emotions of all of it.

At Arb Letter we feel it is of utmost importance to always be real. Be real with your assessments of the world, markets, and where you stand.

You can’t make appropriate calibrations to your personal growth, habits, and focuses if you’re always riled up by inflammatory political rhetoric or discord servers screaming a recession is coming “sell ALL your shit!!!!!”

You also can’t better yourself if you live in delusion.

Some tips I have for keeping yourself leveled during all of the chaos center around putting yourself first and not surrounding yourself with toxicity, which wears on you mentally and physically.

Take a break from social media

Spend more time with family

Learn a new skill (options trading, excel models, DAOs, etc.)

Workout and stay physically fit whenever you can

Develop a stronger network

Establish your risk tolerance, allocate appropriately, and focus on making more cash

REMEMBER. Warriors are built in dark times. Without the darkness there cannot be light and vice versa. Commit to bettering yourself anyway you can while most are filling their lives with useless dopamine hits and lack of substance.

You will emerge from the other side of conflict and uncertainty a much better version of yourself, ready to take advantage of any break life throws your way.

Have a great weekend guys! See you Monday for our Watch Review of 2022.

Great summary as we head into LDW. Interested to see where NVDA goes from here - I am personally short on a near-term horizon (especially in light of ETH merge), and think we may see sub $100.