Sup Kings and Lords. Did I interrupt your mundane work day? Good.

My brothers - I am hear to spread the good word on Energy Markets. This is one of the most important financial and market narratives of the year so don’t slack or you’ll sound like a moron the next time you start to ramble about macro.

Do you think about energy often? It’s actually one of the more interesting sectors in my opinion, but in the last several months, it is the focus point for many academics, scholar, traders, and politicians as severe shortages continue to cause global turmoil.

Have you noticed a higher energy bill?

With the War in the Ukraine demolishing not only global supply and food chains, but also international energy markets, we thought this would be a great deep dive for this week ahead of a comprehensive markets review this Friday morning.

Remember that Europe is dependent on Russian imports for about 40% of its gas needs, around 46% for coal and 27% for oil - giving Putin a substantial amount of leverage as Winter arrives on the European continent and natty gas price soars through the roof so that people can survive.

Just this morning Gazprom cut natural gas shipments to Engie, one of the largest energy companies in France, a dastardly move.

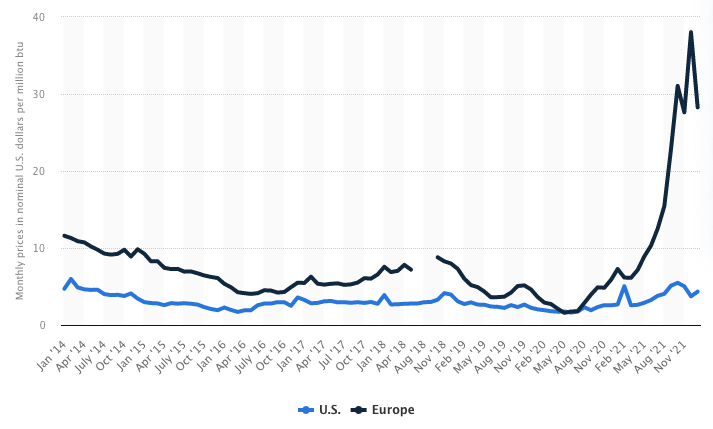

At present European natural gas prices are now around 10 times higher than they were on average over the last decade and about 10 times pricier than in the United States (ForeignPolicy). Think about that.

The situation in Europe is becoming so bad that in Hanover last month, hot water was cut off at public buildings because the city is seeking to cut consumption by 15%.

The United Kingdom just announced a massive 80 percent spike in the rough cap for household energy costs while Germany is now reporting energy bills that are costing residents nearly 400/500 more euros. This will decimate the lower and middle classes and lead to unrest in these countries if it doesn’t subside.

Countries that rely heavily on gas are getting surprise - dicked by the recent shortages and sky high prices (for context in 2021 nearly 40% of the UK's electricity was generated by the process of burning gas).

What you’re partially seeing is economic warfare’s contagion effects ripple throughout the global economy. There are other factors like climate impacts, supply chain issues, etc. - but the War is the major underlying catalyst for the issues we are seeing.

Expect it to get worse in the coming months as Russia uses one of it’s age old strategic advantages - the Winter.

This complete overview will include the following:

Introduction to Energy Markets - The basics

Overview of US Markets - How it impacts us

Overview of Global Markets - War in Ukraine, Natty Gas, etc.

What we see coming soon - Where this is going

If you are a seasoned energy trader or a noob looking to get your first job/interview for energy related jobs, this will be a great summary/refresher.

To be honest, for anyone in an investment analyst, trading, sales, or banking role - this is going to be highly relevant to the eventual impacts you see in the day to day economy moving into Fall/Winter.

The energy crisis that is brewing is a massive one and it will impact almost every human on the globe. This should be a good overview of energy market basics with some case studies for natural gas markets and current events you should 100% be up to speed on if you work in finance in any capacity.

Massive famines are projected to occur in Europe as a result of this energy crisis. In Spain the congress just agreed to implement temperature limitations. Temperature limitations! They are mandating that air conditioning is no cooler than 80 degrees Fahrenheit.

In France lower water levels linked to climate change and the worst drought in over 500 years have made it impossible to rely on nuclear generation that needs water for coolant. The low water levels in Germany have crippled industrial and consumer goods shipped on many of it’s rivers including the Rhine, where the cost to ship has risen 4/5x.

Much of the energy narrative we are reading and hearing about right now is in relation to natural gas, so for now that’s the area we will drill into.

If you’re trading other instruments like equities or crypto, this will still prove to be a helpful basic guide to some of the likely scenarios and dynamics we are seeing in Europe and the rest of the world that will continue to play out in the coming months. Americans will definitely be impacted by this growing crisis as we head into the cold months. Make no mistake.

We’ve also included some extra materials/links/resources for those looking to learn even more about the Energy markets.