While I am far from a crypto expert, I have been involved in the space since 2017. I have been involved meaningfully (meaning larger money invested) since October 2020, when I observed a similar trend of momentum and decided to start ape-ing into blue chip projects ahead of most. Through running and building the Arbitrage Andy instagram and Twitter account, we get lots of inbound information and updates on where trends are heading in crypto as well as traditional finance. We can also share some of the top independent resources available on crypto on the web.

That’s why I highly recommend getting involved with a side hustle online these days, you can quickly amass a digital network of sentiment and resources very quickly and it continues to grow as more people become interested in the space or topic.

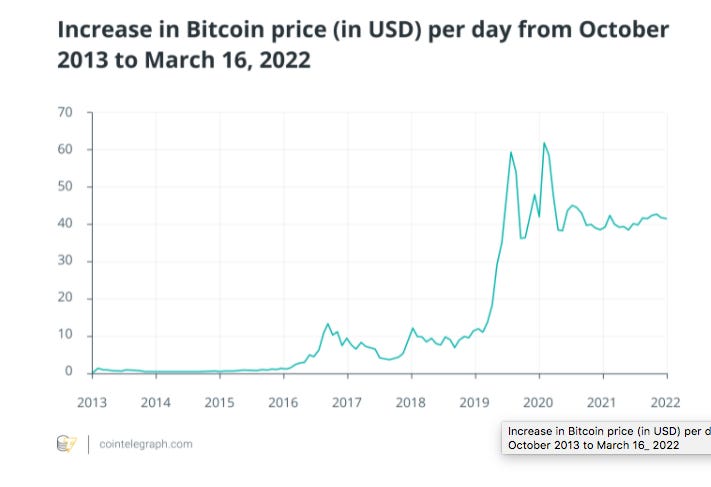

The global cryptocurrency market reached a value of US$ 1,782 billion last year in 2021. Looking forward, the market is projected to reach US$ 32,420 billion by 2027, exhibiting a CAGR of 58.4% during 2022-2027. The Crypto Fear & Greed index is finally showing Greed as of March 29, as more than $300 billion has poured into the market in the last week (Analytics Insight). Long story short - you’re still extremely early if you’re deciding to allocate.

Here are my top crypto picks for 2022 and beyond. This is not financial advice. Keep in mind that I have a longer term time horizon and rarely trade except to re-allocate or take small profits on alts. My strategy is anchored by higher allocations in $BTC $LINK and $ETH. This is my preference based on the research I have done. I may underperform traders or investors with higher risk appetites for alt coins and newer projects, but I sleep more soundly knowing the bulk of my portfolio is in proven assets that I know should grow at well beyond nice rates into the next 2-6 years.

Also recognize that these are what I have so far, there’s not enough time to learn about everything out there and it doesn’t make sense to spread too thin, so I am sure people will have suggestions but for now these are my horses. Keep in mind I plan to allocate to some of these in the near future, some of these are a non position.

In no particular order of importance:

Bitcoin (BTC)

Ethereum (ETH)

Polygon (MATIC)

Cardano (ADA)

Polkadot (DOT)

Solana (SOL) - (Need to buy more)

Chainlink (LINK)

Avalanche (AVAX)- (Need to buy)

Decentraland (MANA) - (Need to buy more)

Sandbox (SAND) - (Need to buy)

BITCOIN (BTC)

The king. Can you call yourself a serious crypto investor without some exposure to Bitcoin? The most sound and efficient form of value we’ve ever seen? Scarce, secure, and quick to move/transfer. At this point if you still have doubts about Bitcoin you’re going to miss out on a store of value that will likely grow immensely in the years to come. The institutional involvement, adoption, narrative all seem to be pointing to hyper-bitcoinization, the takeover of Bitcoin as the premier global store of value over fiat and metals. Downside? At this point the downside is missing out on higher growth projects, but I enjoy the stability and security of owning the most legitimate crypto asset put out thus far. This is why it makes up 30% of my entire portfolio.

ETHEREUM (ETH)

If Bitcoin is digital gold, Ethereum is digital money, smart contracts, and web3 all in one. Ethereum is a decentralized blockchain platform that establishes a peer-to-peer network that securely executes and verifies application code, called smart contracts (AWS).

One of the larger bullish factors for Ethereum this year will be the transition from proof of work to proof of stake. Ethereum currently relies on what’s known as proof-of-work, in which miners must complete complex puzzles to validate transactions and create new coins. This process requires a huge amount of computer power, and is often criticized due to its environmental impact. (Fortune).

With the planned upgrade, Ethereum is moving to proof-of-stake, which would let users validate transactions according to how many coins they contribute, or “stake.”

If you own 32 ETH - you can lock up an amount of ETH – the native cryptocurrency of the Ethereum blockchain – for a specified period of time in order to contribute to the security of the blockchain and earn network rewards or interest in ETH.

Latest Market Update

POLYGON (MATIC)

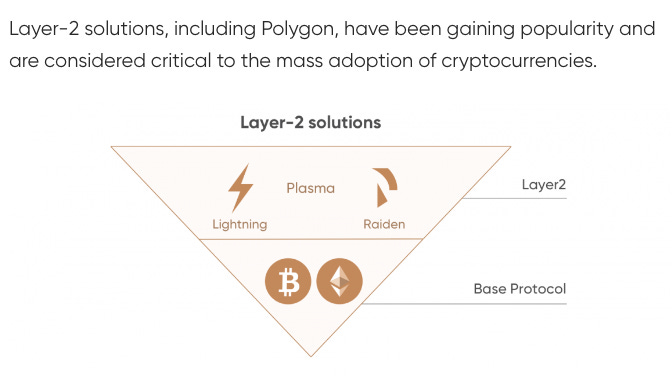

Having received verbal acclaim from Ethereum co-founder Vitalik Buterin, Polygon is one of the best alt-coins of 2022. Polygon is a layer-2 solution for Ethereum, meaning that Polygon leverages Ethereum's applications and security on a separate network that can be added to your Ethereum wallet. I likely don;t own enough MATIC and want to get some more with ETH or BTC profits relatively soon. Seems like a good candidate for a 4-10x.

The end goal of Polygon and other select layer-2 solutions is to rapidly scale Web3 to the retail masses and rest of the world. Utilizing Ethereum's blockchain, users must pay fees that can range from low to high depending on congestion and traffic on the network and the impact on gas fees. On the flip side, users can use Ethereum on Polygon's MATIC network for pennies on the dollar. Coinbase and other major crypto exchanges have announced plans in the near future to integrate transfers to the MATIC network, which could potentially drive more adoption to Polygon in 2022/2023.

CARDANO (ADA)

People seem to have mixed sentiment on Cardano from what I can see and hear and I am not ultimately sure why that is. Cardano certainly boasts impressive devlopment metrics. Cardano is a proof-of-stake blockchain platform and is the first to be founded on peer-reviewed research and actively developed through evidence-based methods.

POLKADOT (DOT)

Polkadot essentially provides a foundation to support a decentralized web, that is controlled by its users, and helps simplify the creation of new applications, institutions, as well as services. Additionally, the history and initial structure of Polkadot is closely associated with Ethereum. The founder is Dr. Gavin Wood, who was the chief training officer and core developer of Ethereum.

Latest Market Update

Polkadot price has rallied 20% in the last two weeks, establishing a new swing high at $23.33.

SOLANA (SOL)

Solana is a smart contract blockchain with an active DeFi ecosystem and over $10 billion locked in protocols and is viewed as a primary competitor to Ethereum. Many see Solana and other smart contract blockchains as "Ethereum-killers". Others see the demand for blockchain products growing to the point where many of the largest smart contract blockchains can be simultaneously fully utilized. I like SOL NFTs and definitely want to add some more exposure in 2022 to both the token and ecosystem.

Solana (SOL) recently jumped past a critical resistance level that had previously limited its recovery attempts during the September 2021-March 2022 price correction period several times. Investors are hopeful of a pump soon.

Latest Market Update

CHAINLINK(LINK)

Chainlink or as many holders including myself like to call it “Painlink”. If you’ve followed me for a little bit you likely know that I am a huge Chainlink bull. Admittedly the token has been in a lower range consolidation for awhile after pumping to a high of 51 during the last bullish crypto wave. This is to be expected imho, because we need to see a certain level of adoption by institutions in crypto for Chainlink token price to appreciate significantly. The effect is lagging.

Chainlink is a long term bet that widespread adoption of smart contracts accelerated while a need arises for real world data to be linked to blockchain infrastructure. This requires an oracle which allows smart contracts on Ethereum to securely connect to external data sources, APIs, and payment systems. In short - it provides verifiable truth. Sergey Nazarov, the Co-founder of LINK spoke at a Barclays crypto conference this past week. This is a long slow burn.

Latest Market Update

AVALANCHE (AVAX)

Similar to Ethereum and Cardano, Avalanche provides blockchain software that can create and execute smart contracts powered by a native token (in this case, AVAX). Since its launch in 2020, Avalanche has rapidly grown, thanks in no small part to its comparatively low gas fees and fast transaction processing speeds. (Forbes)

AVAX is another project I need to do more accumulation on. I hear good things from crypto vets on twitter and the name has started to pop up way more often now in my conversations within the crypto community.

Latest Market Update

From July 12, 2020, to April 1, 2022, AVAX’s price has risen more than 2,000%, from $4.63 to $97.58.

DECENTRALAND (MANA)

Most of you have heard me mention MANA before, and I do have a small position now. Decentraland is a 3D virtual reality platform where users can create and monetize content and applications. Decentraland is based on the Ethereum blockchain. I have actually played in Decentraland, and while it seems premature and not super impressive right now (think modern looking Minecraft world) I do see room for growth, partnerships, and expansion.

Latest Market Update

Decentraland continues to trade around its resistance level, but could see some bullish movement on news if further adoption, devlopment, Metaverse Narratives

SANDBOX (SAND)

Launched in 2011, The Sandbox (SAND) is a virtual world based on blockchain technology, providing a decentralized platform for game-playing. The token caught attention around the time we saw metaverse related projects, including MANA, pump towards the end of the last bull pump.

More recently Sandbox appears to have broken out without bullish continuation.

Another attractive aspect of The Sandbox (SAND) are its 3D editors – games that can be produced and animated by players through the use of these editors, and can then be sold for SAND tokens. SAND is Sandbox’s own digital currency. As well as monetizing digital assets, SAND also allows players to contribute to the development of The Sandbox (SAND) platform, through acting as a governance token which allows users to take part in decision-making procedures. (Bitcoinist)

Latest Market Update

The Sandbox has a detailed roadmap, planning to deploy the platform to mobile devices by the end of 2022

As per usual, I recommend a DCA ( Dollar Cost Averaging) strategy over a longer time period with a focus on nailing super down days for entries. Build up solid caches of solid projects you have done research on and add to them regularly. With any luck, you will catch some solid upside and have exposure to an emerging asset class that many people still have no education on at all.

Bullish or bearish on some other projects/tokens? Drop your favorite internet ponzi projects in the comments.

You can shop our crypto store HERE.

Disclaimer: None of this should be deemed legal or financial advice of any kind. These are opinions and commentary by a 30 year old former commodities trader with experience in e commerce, brand building, sales, investing, and fin-tech.

Your portfolio is heavy on EVM chains, with Ada and Sol as the main chain hedges, and some high-risk Metaverse plays. Given your bets on the chains, why Ada and Sol as competitors long-term instead of Algorand, Atom, or even Tron/others?

Stacks has been building DeFi on BTC and lots of room to grow.

Why do you think those two Metaverse coins outperform various NFT infrastructure plays long-term?

Good stuff here Andy - one I added to my radar in the past yr that I've been accumulating is $CVX or Convex, the defi king of the Curve Wars. It's some gigabrain work and DAOs/protocols/orgs continue to accumulate it as well in the ETH alt world. There is a lot of good content around it on CT if you're interested in exploring it further. Keep up the good work!