Hope everyone had a solid week. Today we’ll cover the ramped up layoffs that are impacting all sectors and companies, some of the new global news updates and current market action.

Tonight we’re going to probably delete 45 Lagunitas IPAs.

If yall missed some of our recent posts you can find them below:

The Simple Blueprint for Getting Rich

Markets

Hide yo kids hide yo wife.

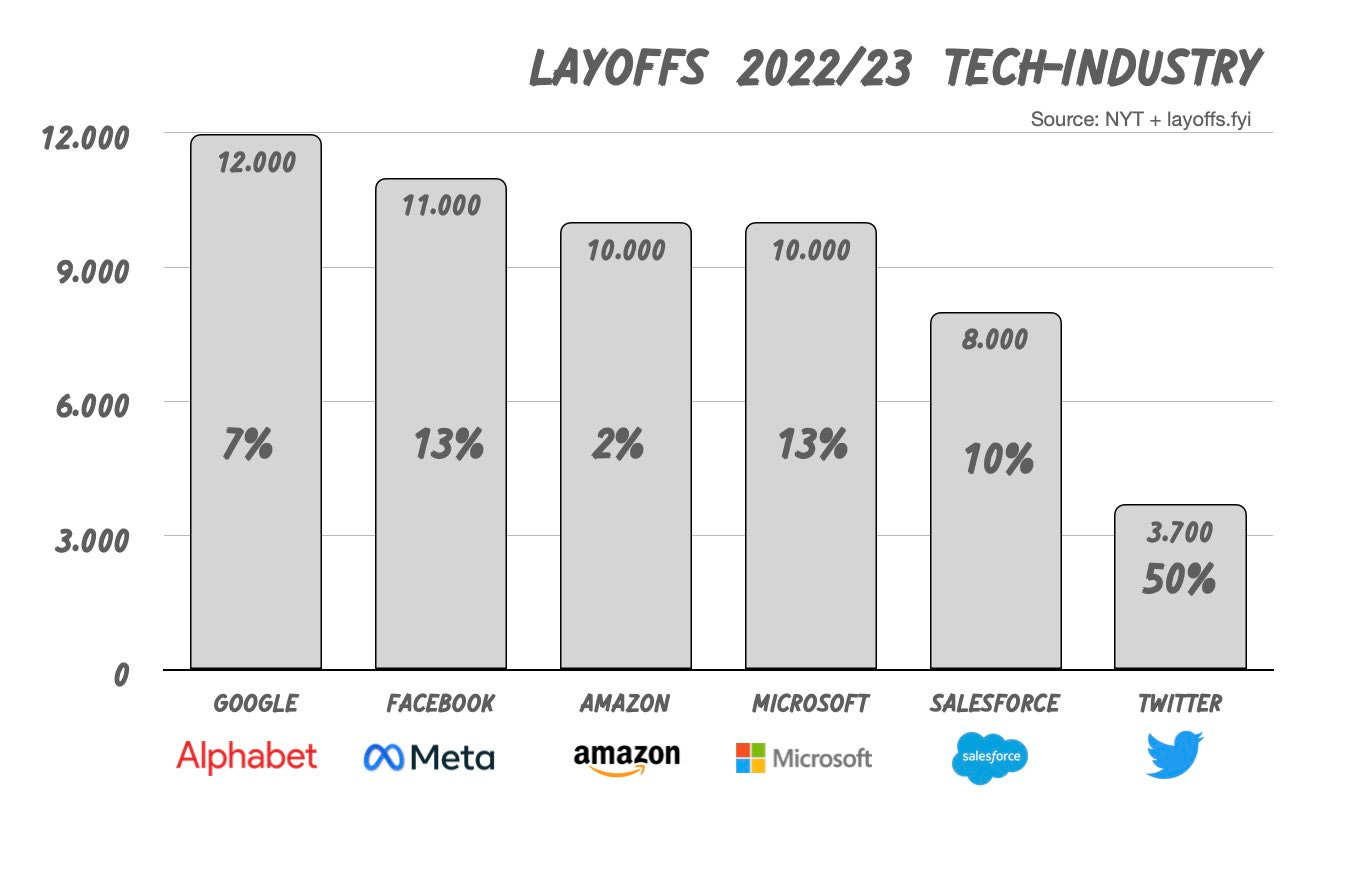

Layoffs are beginning to pick up steam as Goldman Sachs, Google, Wayfair, and other large giants ruthlessly cull their ranks to buckle down for a longer recession. We’ve heard from former colleagues and friends that the firing is indiscriminate and wanton for the most part, targeting all types of roles, people, and levels of the corporate structure.

If you’ve been following us for a while you know we spoke about this last year — many people are going to get offsides here with no plan of what to do if they get axed and no side business or other form of income to lean on.

Don’t be that person. It’s easy enough to prep.

Companies lay off employees during a recession for a variety of reasons. One of the main reasons is to cut costs in order to stay afloat financially and hedge themselves for a substantial downturn in the future.

As consumer demand and business activity decrease during a recession, companies may find that they are no longer generating enough revenue to cover their expenses (you).

In order to address this, they may reduce their workforce to lower their labor costs and become more financially stable.

Additionally, companies may also lay off employees to reduce the amount of excess capacity they have, as they are producing more than they are selling.

Another reason companies lay off employees during a recession is due to a decrease in investment and expansion. Companies may be less likely to invest in new projects or expand their operations during an economic downturn, which can lead to a lack of work for some employees.

It is important to note that, laying off employees is not the only solution for companies to cut cost, there are other options such as reducing overtime pay, suspending bonuses, reducing employee benefits, and implementing hiring freeze.

We’ll be dropping our guide to being unemployed on Monday.

It sucks but there are positives that come out of it and I think people could use a tool like this at the moment even if they still have their job given this is likely to get worse.

your job can be a difficult and stressful experience, but it is important to try and stay positive in the face of this setback.

One way to do this is to focus on the things that you can control, such as your attitude and your actions, rather than dwelling on the things that you cannot control, such as the circumstances of your dismissal.

Another way to stay positive is to remind yourself that this is not the end of the world, and that there will be other opportunities for you in the future.

It can be helpful to make a list of your skills and qualifications, and think about how you can use them to find another job. Additionally, it can be helpful to reach out to friends and family for support and encouragement.

You can also seek help from professional career counselors, who can provide guidance and resources to help you get back on your feet. Remember, it is important to take care of yourself, both physically and mentally, during this time. Exercise, eat well, and make time for yourself to do things you enjoy. This can help boost your mood and give you the energy you need to start looking for your next job.

Keep your heads up kings!

But more on this Monday.

Now for some markets news.

Genesis Global has filed for bankruptcy protection in the U.S. Bankruptcy Court for the Southern District of New York.

Asia hedge funds have narrowly averted their first year of double-digit losses since the 2008 financial crisis due to trends that have come about as a result of a reversal of ZERO covid policy in China

Asian hedge funds have generally performed well in recent years. According to Hedge Fund Research, the HFRI Asia ex-Japan Index, which tracks the performance of hedge funds focused on the Asia ex-Japan region, returned an average of 14.5% per year from 2015 to 2020.

This compares favorably to the HFRI Fund Weighted Composite Index, which tracks the performance of hedge funds globally and returned an average of 8.2% per year over the same period. However, it's worth noting that past performance is not a guarantee of future results and that hedge fund returns can be highly variable.

Google's parent Alphabet plans to cut about 12,000 jobs, more than roughly 6% of its global workforce

Wayfair to cut 10% of global workforce including 18% of corporate

Rumors are starting up that Jacinda Ardern, the former New Zealand Covid Tsar will join BlackRock as a senior executive when her tenure as Prime Minister finishes

T-Mobile says data of 37 million customers hacked

Netflix shares are already gaining Friday, after the video-streaming giant unveiled a leadership change and posted better-than-expected subscriber growth (WSJ)

KKR has limited withdrawals from a real estate investment trust after investors sought to pull out more money, per Bloomberg (Unusual Whales)

The SEC has charged Sam Bankman-Fried with defrauding FTX investors along with Caroline Ellison and Gary Wang

Avalanche $AVAX price rallied recently on news of an integration with Amazon

For the first time since 2018, larger hedge funds outperformed smaller hedge funds. The evidence: HFRI Fund Weighted Composite Index, which gives equal weight to funds of all sizes, fell -4.25% in 2022, while the HFRI Asset Weighted Composite Index, which gives more weighting to the larger funds, rose: 0.97%. (WSJ)

As a reminder during a recession, investors often look to traditional "safe haven" assets such as cash, Treasury bonds, and gold.

These assets tend to hold their value or increase in value during economic downturns, as investors flock to them as a safe place to store their money.

Additionally, stocks of companies in certain sectors such as consumer staples, healthcare, energy, and utilities tend to perform well during recessions as they are considered defensive stocks.

On the crypto front the big news today and for the next week will likely be the Genesis bankruptcy. We hope this is somewhat factored in but we will have to wait and see how the market reacts to the formal announcement and ensuing contagion.

Genesis Global filed for bankruptcy protection in the U.S. Bankruptcy Court for the Southern District of New York.

Genesis Global Holdco owes more than $3.6 billion to its top creditors according to The Block.

The list includes numerous claims involving well-known crypto firms. Gemini Trust Company, which has for weeks been involved in a public spat with Genesis’s parent company Digital Currency Group, tops the list with a claim of $766 million.

Other noteworthy claims include $151 million owed to crypto fund Mirana Corp.; $150 million owed to troubled crypto lender Babel Finance (through an entity called Moonalpha Financial Services Limited); a $53 million claim lodged by VanEck New Finance Income Fund; a $30 million claim belonging to Plutus Lending, a division of the crypto platform Abra; and a $19 million claim from Cumberland DRW, the trading firm (The Block)

At this moment we aren’t adding to any crypto positions. We want to wit and see if this rally is sustainable or if it will coincide with other legacy markets and mark the top of a nice dead cat bounce before the markets digest layoff news and perhaps dump once again.

It is promising to see Bitcoin pump in the face of such strong macro negatives and reclaim $20K mere months after an event as detrimental to the space as FTX.

We remain bullish long term and our conviction has not been altered.

Debt Ceiling

Andy! I am hearing about a debt ceiling…. what does that mean? I have a monkey brain and need help understanding!

I got you fam.

Predictions on the US economy have begun to become more grim by the week with big bank size lords predicting an inevitable official recession and default on US debt which reached the debt ceiling set by Congress on Thursday of this week.

The debt ceiling is a legislative limit on the amount of national debt that the United States government is able to accumulate. This limit is set by Congress and is intended to control the level of federal borrowing. When the federal government spends more money than it takes in through taxes and other revenues, it borrows money by issuing Treasury bonds, bills, and notes.

The debt ceiling limits the total amount of these securities that the government is allowed to have outstanding at any given time. When the government approaches the debt ceiling, Congress may vote to raise the limit in order to allow the government to continue borrowing.

If the debt limit is not raised and the government is unable to borrow more money, it may be forced to default on its debt obligations or to make drastic spending cuts. The debt ceiling has been a contentious issue in U.S politics, as some argue that it is necessary to control government spending, while others argue that it is a harmful constraint on the government's ability to manage the economy.

Bank of America analysts wrote in a note to clients this week that a default in late summer or early fall is “likely,” while Goldman Sachs called the possibility that the government would not be able to make good on its bills a “greater risk” than at any time since 2011 (NY Times).

Markets Sentiment

Dear Mr. Speaker:

Public Law 117-73 increased the statutory debt limit to approximately $31.381 trillion on December 16, 2021. As you know, the debt limit is the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations, including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments.

I am writing to inform you that beginning on Thursday, January 19, 2023, the outstanding debt of the United States is projected to reach the statutory limit. Once the limit is reached, Treasury will need to start taking certain extraordinary measures to prevent the United States from defaulting on its obligations.

—Janet Yellen to Speaker McCarthy

“The ESG thing is happening away from me…..I like what ESG has done in changing the agenda of boards. But I don’t see what ESG has otherwise done to generate real change.”

—Jeff Ubben of ValueAct Capital (FT)

Global News

The War in Ukraine has dominated global news headlines for almost a year now - but where odes the conflict stand right now?

Putin’s weaponization of energy lost a bit of it’s effectiveness as Europe experiences a warmer than usual Winter season. This removes some of the leverage that the Kremlin has in it’s interactions with NATO and Western Europe. At present, most officials agree that the conflict will likely continue on the ground well into the Spring. Major concerns include the question of what Russia will do if they actually lose this conflict.

Remember that Russia's original invasion of Ukraine in 2014 was a complex and multifaceted event, but the main reason was due to the political and economic changes that were happening in Ukraine at the time.

The Ukrainian government, led by President Viktor Yanukovych, had been moving closer to the European Union and away from Russia's sphere of influence.

In November 2013, Yanukovych suspended talks on a trade agreement with the EU and instead sought closer ties with Russia. This led to protests in Ukraine, which eventually led to Yanukovych's ousting in February 2014.

Russia saw this change of government as a threat to its own interests, as Ukraine has long been considered a buffer zone between Russia and the West.

The new government in Ukraine was pro-Western, and many of its leaders had ties to the EU and the United States. Russia also worried that the new government would move to align itself more closely with the West, and possibly even seek to join NATO.

This has always been about Ukraine’s capacity to side with Western Powers and influence.

President Zelensky announced this week he will participate in World Economic Forum in Davos, to sign new ‘reconstruction’ loans with BlackRock - how wonderful!

Six people are dead, including a police officer, after a shooter opened fire from an apartment balcony and then killed themselves in a Georgia (the country) city on Friday, officials said (Global News)

Germany's Defense Minister Pistorius says, "we don't fear Russia," but no decision yet on Leopard tanks for Ukraine.

The computer glitch and outages that forced the temporary suspension last week of US domestic airline departures was caused by a contractor mistakenly deleting files, the country’s aviation regulator said on Thursday - Damage to a database file had already been pinpointed by the Federal Aviation Administration (FAA) as a probable cause of the January 11 issue (Insiderpaper)

Bank of Japan Governor Kuroda signaled the country is dealing with the hottest inflation since 1981 this week

India the country is expected to log the best performance of any major economy. The World Bank is estimating growth of 6.6%, compared to just 0.5% for the United States and 4.3% for China (CNN)

Japan plans to downgrade COVID-19 to flu status according to CTV

Former South Carolina governor and United Nations ambassador Nikki Haley said she's close on making a decision to run for president in 2024 (Fox)

The World Economic Forum meeting in Davos, Switzerland continues to highlight the concerning ideas and proposals of some of the world’s most unhinged far left leaders.

Former PM Tony Blair this week called for the implementation of National Digital infrastructure to support mRNA vaccines.

Morale Boost

And since I know all of you young kings worked super hard this week here is a throwback of Bar Rafaeli in SI Swimsuit. Probably from early 2000’s.

Have a good weekend.

Andy, I enjoyed todays AI post. A welcome break from your recent collapse of civilization rants.

Other topics I would love to see discussed: are investments in fine art, farmland, collectable coins actually worthwhile vs equities

role of fine art in society

will small modular nuclear reactors actually take off?

keep it up brother!

Yo thx to you and BTB for layoff warnings last year. To de-risk i added 2 extra W2s (wfh) in Q4 and that move is providing incredible peace of mind during all the layoffs announcements.

If I somehow survive all 3 w/o layoff, will peel off some in Q2 so I can get more hours into ecomm biz