Good Morning young lords

Hope everyone had a solid week - seems to me weeks are blurring together recently as I resist the urge each and every day to put on a flannel, sit on the porch, and delete fall beers.

Today we’ve got some great summaries of markets and global news along with a deal sled offer to sweeten the Friday afternoon where everyone inevitably clocks out by 1:30pm ET.

I don’t know about you guys but I am antsy. Feels as if there’s something in the air, like everyone’s waiting for some big event, market or otherwise to play out.

One thing is for sure, many retail and institutional investors haven’t seen markets like this in an incredibly long time.

Estimates have come in that over $10 trillion has been wiped out from the US stock market this year alongside the decline of major indices, crypto routs, and tech/innovation names getting slaughtered.

To get you ready for Fall we synced back up with our partners at W.M. Gibson to get you some prime access to casual all purpose deal sleds that have Genuine calf leather and durable rubber soles with texture for traction. Really just an excellent all around sled with solid material that can hold up right next to pricier sleds.

If you need another durable and flexible pair of sleds before we get into the full swing of football season and the holidays then go check them out, they’ve been a reliable partner for 3 years with us on Arbitrage Andy and Arb Letter.

Because we are the everyday man’s originator use:

Code: ANDY for 15% off

No frills just value.

Check Them Out Here

Markets

The US economy shrank by about 0.6% during 2Q, according to the last gross domestic product estimate from the Bureau of Economic Analysis that was released Thursday, remember that this fits one of the technical definitions of. a recession.

Europe’s financial and economic woes seem to grow with magnitude each and every day now. On the heels of the Bank of England’s announcement that they would be pivoting to buy 65 billion pounds of U.K. bonds, inflation continues to soar in European countries like Germany and the Netherlands (who is seeing 17% inflation).

Germany has also seen Food CPI jump to 19% YOY in September which represents the highest food price inflation since the start of that very statistic lol.

The CPI accelerated from 7.9% to 10% over the past month in the Eurozone, suggesting that European countries are loosing the fight to keep inflation manageable on the brink of a painful looking Winter season as the Euro hits a 20 year low in recent weeks.

And just general shower thoughts here but it really is an eyebrow raising moment to see a pandemic, potentially global war, sky high inflation, faltering stock markets, and a massive climate push by the World Economic Forum and other groups all at the same time.

Really makes you wonder what the hell is going on behind the curtains.

Markets got shit on again on Thursday as the Dow Jones Industrial Average fell 1.5%, the Nasdaq dumped a salt in the wound 2.8%, and the S&P 500 fell down 2.1%.

Hope everyones been making money with put options. Things look grim as I wake up on Friday morning.

Eurozone inflation has reached 10%, which is the highest level ever recorded

US Core PCE (personal consumption expenditures price index) came in today at 4.9% YoY vs expected 4.7% YoY. This gives us a sense of where we think consumer prices might be heading

The U.S. dollar has been ripping this year and recently hit a 20-year high with no signs of DXY cooling off in the short term. Cash is in fact not trash at the moment

Uniswap Labs is apparently putting together a $100M to $200M funding round at a $1 billion valuation according to TechCrunch

Volkswagen priced the Porsche initial public offering (IPO) at €82.50 ($80) a share, raising roughly €9.4 billion - shares are up 5% on the first day of trading on the Frankfurt Exchange

One of our favorite crypto assets that has been torturing us for months, Chainlink ($LINK), had a great week at the 2022 Smartcon Conference in NYC. Sergey Nazarov, co founder, spoke with ex google CEO Eric Schmidt and announced LINK staking in December as well as an initial partnership with SWIFT to merge tradfi and digital finance together (this is fucking huge).

XRP has won another small victory is court. The SEC has been overruled for a second time in its attempt to withhold select documents Ripple Labs considers critical for its case (CoinGecko)

At $37.44, ARKK 0.00%↑ now needs to compound 86.86% per year until 12/17/26 to return the 40% annualized that Cathie Wood said innovation strategies could return over 5 years - lmao good luck with that (via Funwithnumberz twitter).

Facebook (META) announced layoffs this week amid restructuring efforts

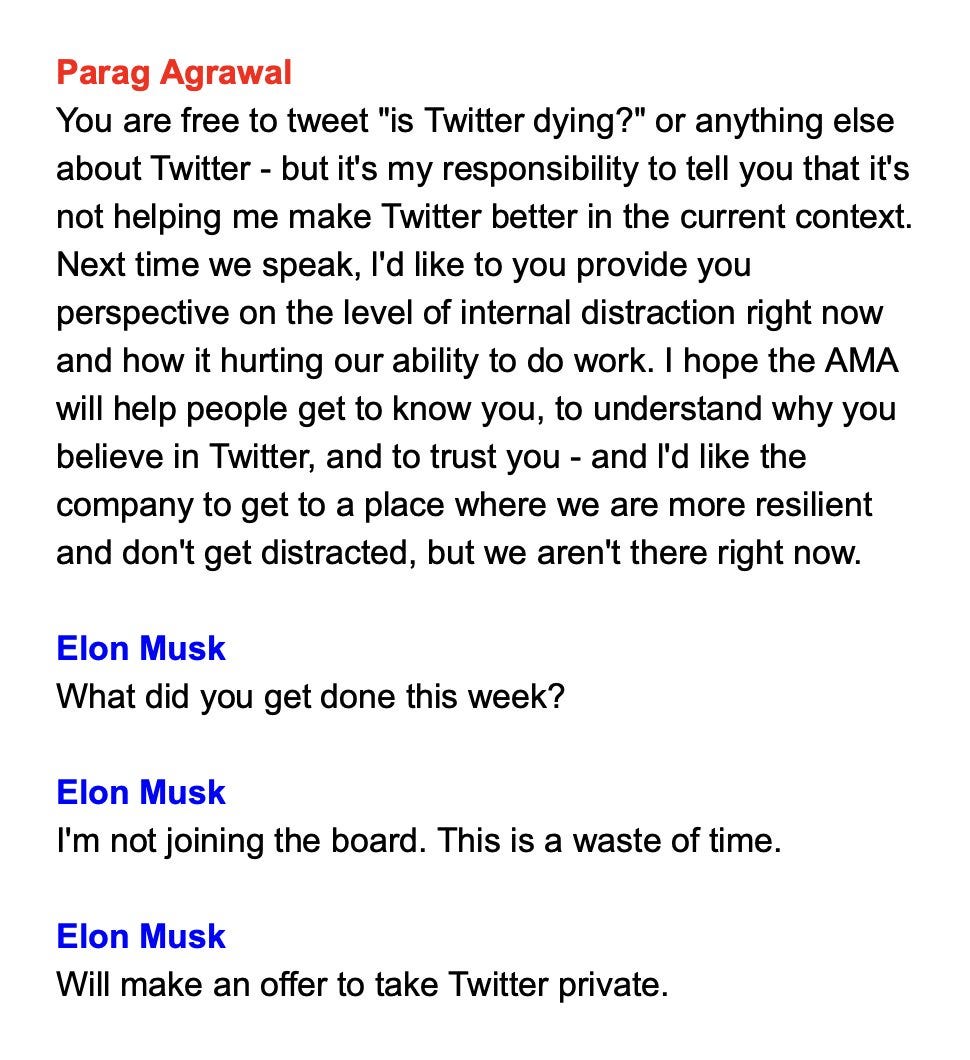

Spicy text exchanges between Elon Musk and various tech moguls have begun to leak onto social media

In regards to equities I am mostly an observer at the moment with the exception of some DCA adds of MSFT and NVDA. Solana (SOL) has become the subject of much chatter and speculation on twitter due to it’s aggressive sell off after relentless VC shilling and dumping. $SOL trades near $32 at the moment.

This is one that will likely double or triple easily once macro settles and we see some more strength enter crypto markets again.

$XRP poses an interesting short term trade as they gain momentum in the SEC case. I don’t know enough about Ripple to give you a long term theses but I do know that they should see some really solid momentum assuming the verdict is positive for the future of the company and token.

Larger whales are also starting to take notice of Bitcoin during these volatile times in which it seems a different central bank runs into massive issues each day.

Stanley Druckenmiller the billionaire investor spoke at a CNBC Delivering Alpha conference this past week and had some interesting points to make with the news of the Bank of England buying 65 billion pounds of U.K. bonds and how he sees that impacting other central bank action in the years to come.

He criticized the risks the Fed is taking and noted, “We’re taking this massive gamble where you threaten 40 years of credibility with inflation, and you’re blowing up the wildest raging asset bubble I’ve ever seen”.

He also quipped, "If you remember, the Fed did $2 trillion in QE after vaccine confirmation,” the billionaire explained. “At the same time, their partner in crime, the administration, was doing more fiscal stimulus — again, post-vaccine, after it was clear emergency measures weren’t needed — than we did in the entire great financial crisis.” (Bitcoin.com).

I could see cryptocurrency having a big role in a Renaissance because people just aren’t going to trust the central banks.

-Stanley Druckenmiller

"Markets had become, I think, overly cushioned by central bank guidance and central banks operating in an environment where they felt they could offer it with a reasonable degree of confidence”

-Daragh Maher, head of research for the Americas at HSBC (NPR)

Global News

****WARNING - GRAPHIC PHOTOS TODAY (We believe in raw and unfiltered coverage of the War in Ukraine, readers are warned today due to graphic images of a Russian attack)

On the global level we’ve seen the War in Ukraine define energy markets, supply chains, and the state of geo political tension with the recent Nord Stream 1 + 2 sabotages. This is likely to dominate news cycles through at least Spring of next year.

Investigations are still being made into who potentially committed the act but the Baltic Region and Western Europe are on edge in the face of Putin’s double down in Ukraine and stern rhetoric from NATO, Western Leaders, and European figureheads as well.

We covered our take on what we think is going to happen last week - but I am curious how all of you are thinking about Ukraine. Are you tired of us being involved? Do you think there’s anyway it ends peacefully or is hope lost and we are simply inching closer to a larger conflict involving the West/NATO and the Russians?

In a speech Friday Putin mentioned the US as setting the precedent for nuclear usage in Japan in WWII. However he also asked Kyiv to come the negotiation table as they are ready for “talks” could be hyper bullish if he isn’t full of shit

Europe’s top financial regulators and economists have issued an unprecedented and dire warning about “severe risks to financial stability” across the continent

A veteran FDNY EMT Lt. Alison Russo-Elling, was stabbed to death his week by a 34 year old man in Queens, NY

Putin will hold a signing ceremony on Friday afternoon to “officially” annex four areas of Ukraine after a shammy referendum and votes (that were cast at gunpoint) were held in Luhansk and Donetsk in the east of Ukraine, and in Zaporizhzhia and Kherson in the south of the country

Recent reports indicate Dr. Fauci and his wife's net worth increased over $5 million dollars during the pandemic - how?!

The first openly trans Army officer has been charged in a plot to give U.S. military medical info to the Russians to help aid them in war against Ukraine

On Friday the German government announced a price cap for household and private business natural gas prices at a total cost of up to €200 billion (Disclose)

Former CIA Director John Brennan said he thinks Russia is behind the sabotage of Nord Stream 1 and 2

AMZN is one of the first US Companies to test the usage of a CBDC or a central bank digital currency (which we covered in our past earlier this week). Essentially Amazon purchases in Germany, Spain, or France won’t be bought with euros but with a digital currency created by the European Central Bank.

Anyone else think it’s ironic this is being trialed and implemented while nearly all currencies and financial markets are in dire straits? No just me? ok.

Hurricane Ian struck as a monstrous Category 4 hurricane and ended up being one of the strongest storms to ever to hit the U.S. The storm destroyed piers, ruined homes, and knocked out electricity to 2.67 million Florida homes and businesses

Just this morning Russian forces shelled a civilian convoy in Zaporizhzhia killing 25 and wounding 62 people.

The scene was grisly and gory with civilians blown to bits in the streets as they tried to escape the convoy and their cars, many of which were torn apart entirely by shrapnel.

Breaks my heart to see families and civilians caught in senseless violence.

It’s worth noting that this was a humanitarian convoy filled with people looking for relatives, bringing food and water to loved ones, and trying to help get people out of conflict zones. The irony is that Zaporizhzhia is one of the territories that Putin just annexed.

What a welcome party.

Regardless of how you feel about the conflict or where your allegiances lie, it’s just awful to see civilians get caught up in the crossfire, which, in this case seems recklessly and carelessly directed to civilian heavy areas by the Russians.

Keep in mind for the civilians living in these contested regions/oblasts of Ukraine that Putin is unofficially “annexing” they are stuck between a rock and a hard place.

Putin carried out voting in these regions with armed troops to ensure compliance and many of these self identifying Ukrainians are being conscripted or forced to serve the Russians and fight their own country. That or they are shot.

As contention and conflict continue to get worse in the region all eyes are on a potential nuclear incident or break out of conventional war with other countries.

A recent US News and World Report Survey of over 17,000 people globally found that three-quarters of respondents agreed with the statement, “I fear we are moving closer to World War III.

In an address today, Putin spoke about the annexation as well as his thoughts on Western aggression. He stated that the annexed territories will not be up for discussion at any negotiation stating, “ we urge Kiev to immediately halt military operations and return to the negotiating table.

Putin didn’t just comment on geo politics also addressing several issue she has with the West including the push for gender change experimentation on children and what he calls “doing the work of Satanism”

He concluded with a bold statement reported by Axios, “15% of Ukraine is now a part of Russia”.

Have a few bevvies for me tonight

And that’s it for this week. We are doing an Options trading focused deep dive for those trying to learn to trade them as well as a huge interview coming with one of our digital contacts on weightlifting and staying in incredible shape with a job, family, and the hustle of modern day life.

If you’re interested in staying on top of the world of crypto, financial markets, and global news in a easily synthesized and straightforward way join our community of thousands of hedge fund managers, bankers, analysts, traders, tech bros (and gals), entrepreneurs, crypto folks, and everyday people by subscribing to Arb Letter.

Table stakes macro and markets commentary with no frills.

Paid subs have access to our deep dives each week, as well as full access to our entire archive of 103+ articles.

Our readers range from total beginners to founders and fund managers. We provide something valuable for all subs in our 2-3 articles a week.

Most popular recent posts

25 Finance & Business Movies for Fall

A Massive Global War is Looming

Disclaimer: None of this is to be deemed official financial or life advice. Arb Letter is the commentary and opinions of a former trader, tech sales, and markets professional. All opinions and commentary are my own.

You’re a free subscriber to Arb Letter. For the full experience and to receive all of our posts, interviews, and deep dives, become a paid subscriber.

Do you guys think the War in Ukraine will escalate meaningfully? What about the use of tactical or battlefield employed nuclear weapons?

I'm calling it now, Odessa by November 29th.