What an insane week we just witnessed.

Nasdaq futures look to be a bit weak after a brutal culling of tech names this week, the internet is going crazy over Elon Musk’s takeover of Twitter after long months of speculation, and Wall Street awaits a FOMC in November that will shape markets fo the rest of 2022.

We’ve thrown together a quick 10 minute Arb Letter to get you up to speed on all the relevant financial markets and global news from this week.

MARKETS

Tech stocks this week got absolutely she-lacked with Facebook/META and Amazon leading investor pain with some impressive drops after earnings. Tech stocks seem to be trading like shitcoin penny stocks at the moment and no investor is safe from these volatile earnings swings.

The DXY (Dollar Index) softened a bit this week off of highs giving crypto some room to run. Worth noting that crypto, particularly Bitcoin and Ethereum, did not react as adversely to large tech sell offs as they have in the past — probably worth keeping an eye on.

Most eyes today are on the Twitter Elon Musk show.

Completing the deal last night after showing up to the Twitter HQ earlier in the week with a literal kitchen sink in his hand, Elon Musk got to firing several high ranking Twitter employees including the CEO Parag Agarawal, and CFO Ned Sega who (per Reuters) were immediately fired and "escorted out" of the building.

Musk also took the chance to can the legal affairs chief, Vijaya Gadde, who was behind the decision to ban Former President Donald Trump's Twitter account.

Sweet sweet justice for us as we sip our morning coffee.

And you all might find this interesting. Elon let the Tesla Engineers go through the Twitter code and infrastructure earlier in the day. Just hours later he moves to fire 3 members of senior leadership on the first fucking day…..

I guarantee you they uncovered some big BS — and we may end up finding out what it was in due time.

Twitter was incredibly refreshing last night as people swarmed to the platform to say things that would’ve had them banned just a week ago — including new truths on the Covid 19 vaccine, theories on the 2020 election, phrases that were previously banned, and more.

Highly suggest going to take a look — seeing what’s on the platform now shows you just how much censorship was at play — literal realities were able to be denied.

Elon will act as CEO and has announced that he will reinstate permanently banned accounts including Donald Trump and Alex Jones.

Now for more market updates.

PCE Core (Personal Consumption Expenditures Excluding Food and Energy) came in at 6.2% YoY, with expected at 6.3% - personal spending is up 0.6% M/M

US GDP grew at a seasonally adjusted annual rate of 2.6% in the third quarter

Amazon plummeted over 20% in after hours trading before recovering after a disappointing 4Q forecast as well as a miss on revenue - the cloud business reported its slowest growth ever with bad sentiment for the future

Revenue for Facebook (META) plunged YOY and shares dropped over 20% to their lowest price since 2016 in after-hours trading on Wednesday - it seems Zuck timed his complete transition to the Metaverse incorrectly - though this could be an interesting buy level

Credit Suisse is set to layoff over 9,000 employees as part of a new “radical restructuring.” to help re shape the bank’s image and raise capital after a series of embarrassing calamities over the last several years. If you want some of the background on the woes that the Swiss bank is currently facing, we covered it in our Credit Sus piece a few weeks ago

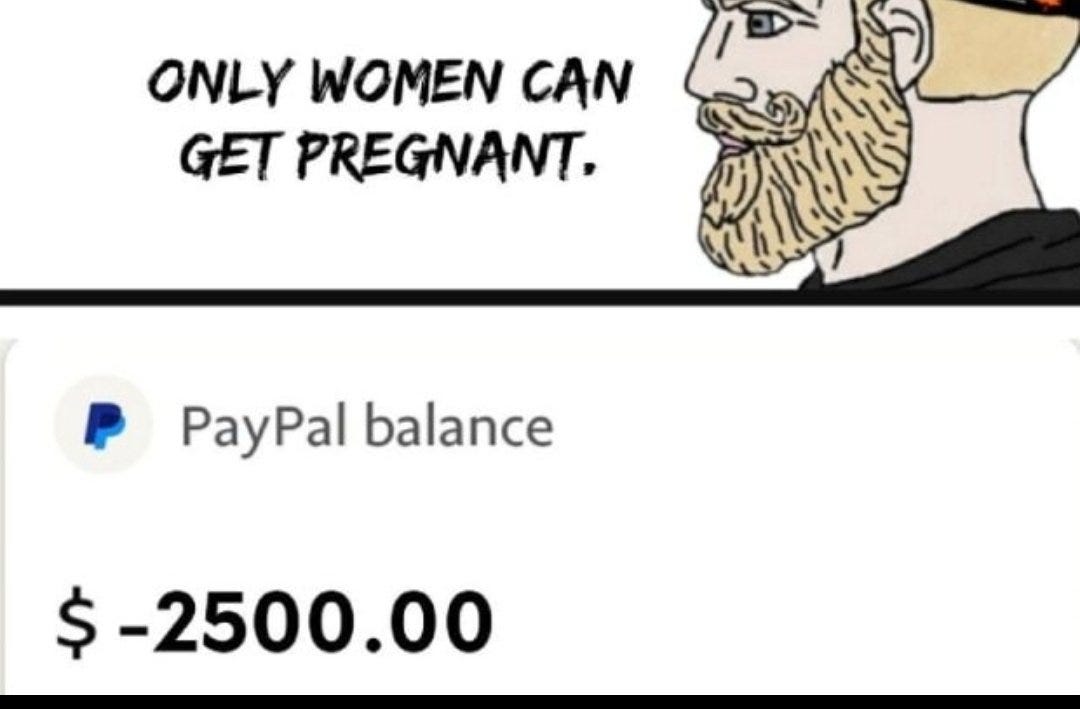

PayPal has reinstated their $2,500 misinformation clause after taking intense criticism last week - I will be shutting down my account today — service sucks ass and they withhold funds all the time

Twitter will be delisted from the New York Stock Exchange (NYSE) on November 8th 2022

Exxon Mobil reported record $19.6 billion net profit in the third quarter of 2022 (insert jesus christ meme)

Net hedge fund outflows reached $21 billion in September this year, almost twice as large as the September average from 2014 to 2021 (Institutional Investor)

We covered censorship, suppression, and shadow-bans in a post yesterday in case any of you are interested. The impacts of the Twitter acquisition on the mid terms and the 2024 presidential elections cannot be overstated — you are going to see an entirely different online discussion and environment now that facts and opinions can circulate freely.

The major theme we are tracking closely at the moment is the chance of a Federal Reserve Pivot or easing of hawkish policies as we approach the highly anticipate meeting in November.

This morning a U.S. government report showed that an inflation gauge the Federal Reserve closely monitors and loves (PCE price index), rose a bit slower than estimated last month.

This comes on the heels of a rumor that BlackRock economists have been speaking with financial advisers, saying that they potentially expect "pivot language" during the next Federal Open Market Committee (FOMC) meeting in November where a 75bps rate hike is expected.

Crypto and defi — despite this vicious bear market — continue to receive interest from large institutional clients and players.

In its recent survey of 1,052 institutional investors in Asia, Europe and the United States, Fidelity found digital asset adoption was up in the U.S. and Europe by 9% and 11%, respectively, to 42% and 67%. Asia experienced a slight decline in adoption but remained the leader at 69% regardless (Coin Telegraph)

We continue to accumulate $BTC and $ETH where possible and will start to add select alt coins if we see a continuation of strength into the weekend.

We’ll go over some of the specific developments we are on the look out for on Monday for paid subs.

There is vast opportunity at the moment to become wealthy during the next bull cycle.

GLOBAL NEWS

Tensions have continued to escalate between various nation states throughout the world.

This week Russian President Vladimir Putin gave a lengthy speech in which he criticized the West for only seeking domination and referred to Nancy Pelosi as Grandma.

In his speech Putin accused the West of “fueling the war in Ukraine” and weaponizing the US Dollar. In regards to whether Russia is ready for peace talks Putin said, “It’s not a question about us — we are ready for negotiations — but the leaders in Kyiv decided not to continue negotiations with Russia”.

This draws reinforcement on our theory that the West is prolonging this conflict through proxy methods.

Several high profile brands ended partnerships with Kanye West after his anti semitic comments over the last several weeks including Adidas and Gap.

He even got thrown out of Sketchers headquarters apparently — although if we’re being honest that’s probably a huge win. Kanye has lost his billionaire status as a result of all of the partnership cancellations.

Inflation continues to worsen globally.

South Korea said yesterday that North Korea fired a ballistic missile toward its eastern waters. This comes weeks after several missiles flew from North Korea over Japan - triggering air raid sirens

Janet Yellen says she’s not seeing signs of a recession in the US economy (Unusual Whales)

The US is set to send Ukraine an additional $275 million in military aid and weapons - I don’t even remember what the total is any more at this point

Russia has filed a complaint with the UN Security Council demanding an international investigation into the United States’ “military-biological activities” in Ukraine, the Russian foreign ministry said Thursday (Insiderpaper)

Inflation in Germany soared to 10.4% in October - coming in higher than expected once again

In yet another idiotic climate stunt in Europe protesters glued their heads to the famous painting 'Girl with a Pearl Earring', this marks the 3rd event in a few weeks and follows the lame attempt at protest at the BlackRock HQ in NY by a group with coal and pitchforks

Nancy Pelosi's husband was "violently assaulted" in a San Francisco home by an intruder — more details emerging by the minute — speaker Pelosi was not home when it happened

A narrative has continued to circulate, mostly pushed forward by the Russians, that the Ukrainians are preparing some kind of dirty bomb to be used in the conflict.

For those that do not know a dirty bomb is a nuclear weapon improvised from radioactive nuclear waste material and conventional explosives (Oxford), In laymen’s terms it’s a crude nuclear device that can contaminate a large area.

We aren’t sure exactly what the veracity of this claim is — and it could be a complete psy op by the Russians who want to set the stage before setting something off themselves and then blaming Ukraine.

So far the Pentagon has denied this is true and so have the Ukrainians.

One thing is for sure — the stakes are getting higher in Ukraine and the nuclear rhetoric is not slowing down. It will be interesting to see how this conflict continues to develop as our countries other foes like China and North Korea begin to flex their muscles internationally.

Putin wasn’t the only one to make a rousing speech recently. President Zelensky of Ukraine had some strong words for his people.

We will continue to monitor the situation in Ukraine closely and we’ve spoken about our concerns on the nuclear front many times over the past several months — those concerns are now amplified as world leaders seem to be dragging us closer and closer to a larger conflict.

Would love to hear everyone’s opinions and feedback on the events that transpired this week so we’ll open up comments to all subscribers today.

Hope everyone has a nice relaxing weekend.

I will see paid subs Monday for a deep dive on crypto developments we are tracking in this bear market.

*None of this should be construed as formal financial or life advice. I am a former commodities trader and tech sales exec who grew a financial meme page and digital brand. I now commentate financial market developments, global news, and life for over 17,000 investors.

As we approach the "terminal rate" it is natural for Fed to alter it's tone to be more neutral, the pivot is likely to provide an inflection point, but directionality of the future vector cannot be determined at this time. Trade carefully.

Tech def looks like the tip of the spear on the recession front. Businesses starting to pull back resulting in ad revenue getting crushed.

Personally picking up some Nov calls in case we do hear pivot language from the Fed and things rip after.