Let’s Get It

I know it’s the weekend but wanted to come in hot with a good early afternoon read to sum up this week’s events and walk through what we can expect next week.

If you guys didn’t get a chance to check out our recent paid post on 10 Ways to improve your life overnight (we sent Tuesday morning) go take a look.

We received a ton of good feedback and appreciation for putting some out that diverges a bit from our raw and realistic tone and aims to help people! It is our most highly engaged post out of 79+ articles.

As I have mentioned before I write this letter for you guys and to get people up to speed and versed on the events, markets, and news of today’s world. There’s a lot of noise to sift through to make sure you are pulling ahead of the masses.

The stakes are only getting higher by the day as the wealth gap grows, governments vie for more and more control and power, and the work place and economy shift in turn with high inflation and poor policies. The weekend’s are a great time to get ahead, study, and plan your moves for the next week so don’t shy away from it.

Feels so much better to take on monday when you are fresh and sharp, than to stumble in hungover and disheveled.

People wonder why they don’t get any further in life but they waste their weekends which are the best times to work on what YOU want and to try and build something that will grant you your freedom from a 9-5 or average life.

Read Below:

10 ways to improve your life overnight

Let’s dive into some high level market and news updates and we’ll see you guys Monday morning for another deep dive post.

Markets & News

Equity and tradfi (traditional finance) markets sold off to a lesser extent than crypto and other risk on assets this past week. The Dow Jones Industrial Average (DJIA) fell about 0.8%, while the S&P 500 and Nasdaq composite fell 2.1% and 1.3% respectively.

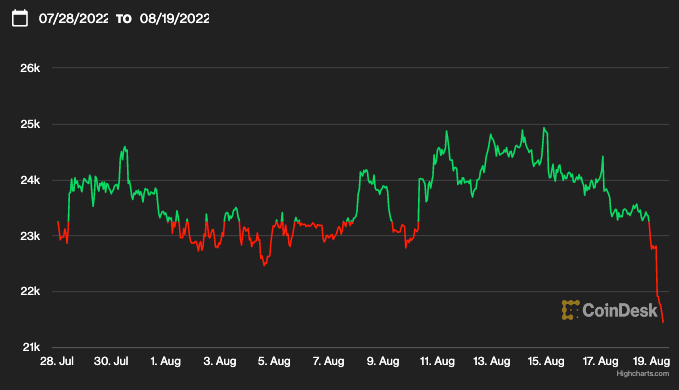

Crypto cooled off it’s supposed bear market rally towards the end of the week with some sizeable selling.

Bitcoin (BTC) sold off sharply in Friday trading, and was recently trading below $21,500, down more than 8% over the last 24 hours. The largest cryptocurrency by market capitalization is down 13% for the week.

ETH sold off as well down as much as 8% Friday and roughly 13% on the week (CoinDesk). We are looking for another 5-10% down to begin DCA-ing into the crypto market once again.

We fully believe that once this volatility and persistent selling ends, we will be in a great spot to continue the uptrend into the next bull market.

It will take an easing of macro conditions for this to happen BUT we can also look for a decoupling from quality projects that have historically performed very well in bear markets ($LINK).

In our eyes the next move in markets will be telling, is this simply a quick bear trap on the road to recovery or is it the start of a much more aggressive sell off in all markets as inflation persists, mid term elections fast approach, and we see what the Fed decides to do as begin to get into Fall.

After almost reaching highs of $25,000 earlier this week, bitcoin has dropped to $21,400, and crypto traders suffered $600 million of liquidations of leveraged bets because of margin calls (CoinDesk).

Coinbase (COIN) was down about 7% to $77 , and shares of MicroStrategy (MSTR), tumbled down 8.2% to $297 Friday in trading

Jake Freeman, a student at USC (big trust fund kid school) made over $110M on BBBY with $25M he got from friends and family. LOL.

The meme stock frenzy has boosted up again drawing in many upon many investors from the retail crowd and the WSB community.

BBBY absolutely tanked after hours Thursday creating a big amount of bag-holders.

Remember - if you’re going to trade meme stocks do it with money that you can completely afford to loose.

Don’t get me wrong, I love chaos and hype, it’s a great time - but make sure you don’t gamble money you need for no reason so you can have a cool story to tell a 4/10 chick at your next date.

Global News

In the aftermath of the Mar A Lago raid - Trump saw an uptick in fundraising when his political committee last week took in $1 million a day on two separate days, according to a Washington Post report confirmed by NBC News.

Kick-boxing world champion and red pill/based influencer Andrew Tate was today removed from major social media platforms Instagram and Facebook for allegedly breaking their terms of service.

A Russian superyacht seized in Gibraltar after its owner was sanctioned is to be sold off in the first such auction since Vladimir Putin launched his invasion of Ukraine (Independant)

Chinese President Xi Jinping could meet Vladimir Putin in a mid-September catch up at a regional summit in Samarkand, it has been reported by The Guardian

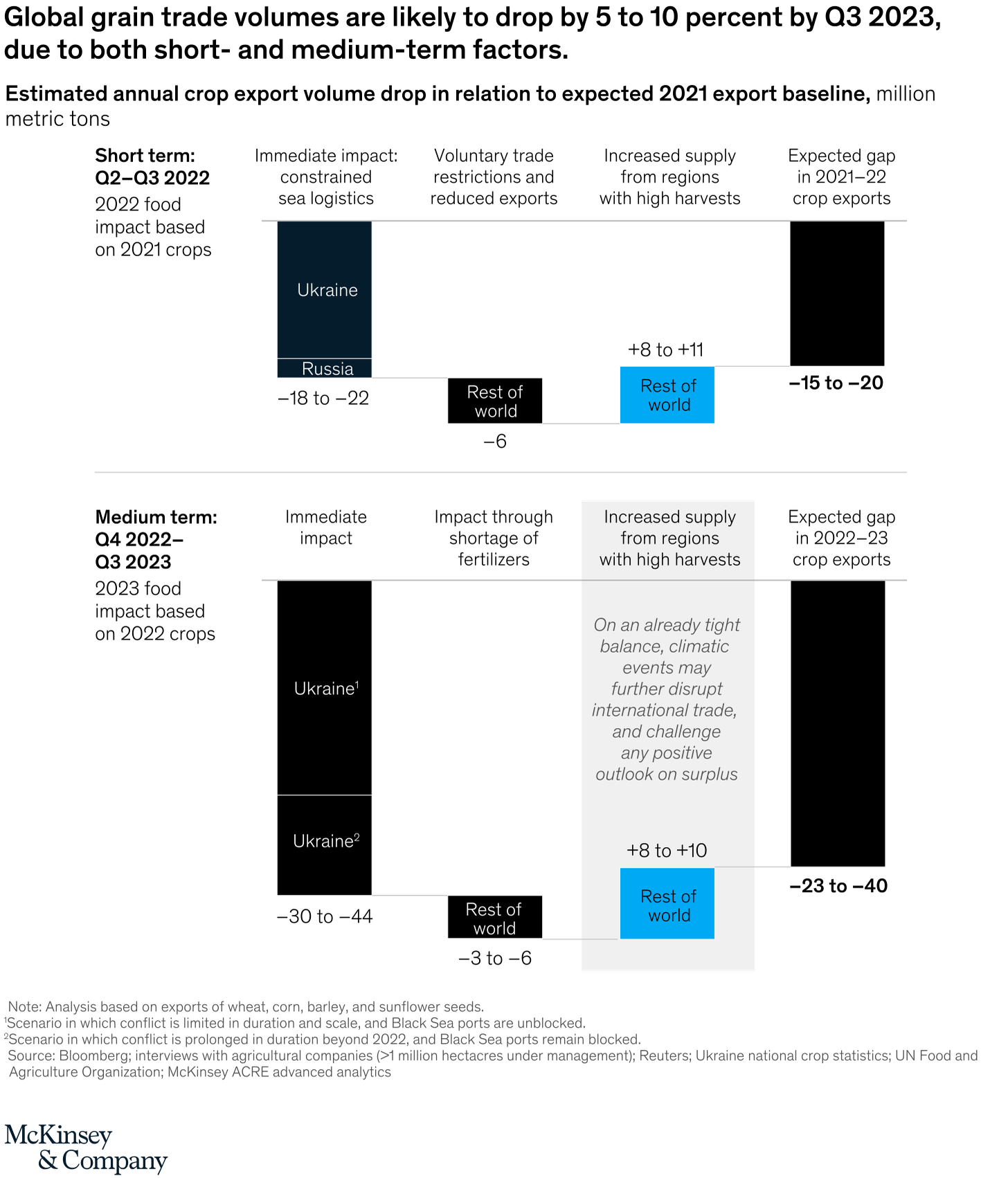

As the War in Ukraine continues to drag on and Russia isolates themselves from the West and rest of the world, continued impacts on the food supply and supply chain throughout the world continue to amplify.

In a recent study by McKinsey they outline the dynamics on specific products endemic to these countries.

Europe is continuing to see the impact of the ar in Ukraine and the high inflation that seems to be persisting into a range of different countries.

Prices charged by varied German industrial producers rose over 37.2 per cent in the year to July, which the Federal Statistical Agency said was the highest increase ever. k We’ve covered the growing threats emerging to the rest of the developing world and the US as a result of the supply chain flattering and lack of grain exports from these countries.

This announcement drove a lot of the fear we saw and the panic selling that persisted into the end of last week in many different markets and asset classes.

In the US while inflation has slowed a bit - wage growth and the labor market show some signs of weakening/softening. The good part of the recent jobs data is the suggestion that maybe the economy can avoid a recession. The worst-case scenario: the wage-price spiral that some economists have feared since inflation starting taking hold over the economy becomes entrenched (CNBC).

“The issue of inflation will not go away in 2023 - supply bottlenecks and geopolitical tensions are likely to continue. Meanwhile, Russia has drastically reduced its gas supplies, and natural gas and electricity prices have risen more than expected.”

-Bundesbank president Joachim Nagel

Next week we will be looking for the opportunity to scale back into certain alt coins and tech stocks. I think we certainly could already be in/or about to approach a recession but that doesn’t mean some of the quality assets we frequently talk about in this letter aren’t solid buys right now.

We’ll continue to over political/election developments as we feel that is one of the largest variables in the United States right now outside the inflation riddled and slowing economy.

Enjoy your weekend, decompress, have some tequila, pet your dog, you know the drill.

See you guys Monday.

Andy