ARB - Omicron, Metaverse, Inflation

021 - Omicron, Dorsey resigns, Metaverse rapidly expanding

ARB 021 - November 30th 2021

Our Thanksgiving festivities were rudely interrupted this past weekend by hysteria surrounding a new strain of Covid originating in South Africa , dubbed Omicron. The greek alphabet designation, which conveniently skipped over”Xi” (so as to not offend the country/leader where this fuck fest originated) is being used to describe an allegedly more deadly AND spreadable variant.

Media outlets have begun panicking and both crypto and stocks dipped heavily initially. We have since seen reassuring bounces but the larger impact remains to be seen as Biden continues to stress more boosters and Vaccines, despite nearly 80% of the country being vaccinated.

Markets

As of 6:22pm ET via MarketWatch

Essential Market Intelligence

Jack Dorsey stepped down yesterday as the CEO of Twitter, replaced immediately by Parag Agrawal, the company's chief technology officer.

Opening statements and testimony began yesterday in the six-week sex-trafficking trial of Ghislaine Maxwell at federal court in NYC

Hedge-fund Size Lord Bill Ackman tweeted over the weekend that he thinks the new omicron variant could be bullish for stocks. Do you trust Bill? Remember he made $2.6B shorting equities in March 2020.

Cathie Wood’s ARK ETFs have picked up PLTR shares worth about $62 million in recent weeks after less than stellar earnings reports. I currently own PLTR Feb Calls and Common Shares right now, definitely a name to hold LONG in my opinion. Citi Bank reiterated their SELL rating 2 weeks ago.

Rising Covid-19 cases and the new Omicron variant could imperil the economic recovery and exacerbate inflationary pressures, Federal Reserve chair Jay Powell is set to tell US lawmakers on Tuesday (Financial Times).

“I think it’s going to be a material drop. I just don’t know how much because we need to wait for the data. But all the scientists I’ve talked to . . . are like, ‘This is not going to be good’.” - Moderna CEO Stephane Barcel on Omicron (almost like he stands to gain!).

On Monday, U.S. President Joe Biden ruled out another lockdown and travel curbs due to Omicron for the time being (CNBC).

Digital asset investment firm Grayscale is launching a brand new product offering exposure to Ethereum Rival Solana according to Forbes.

Omicron Take

While sentiment on the new Omicron Variant is mixed depending on who you ask, one thing is for certain, the powers that be seem intent on dragging out this crisis indefinitely. The media is loving the chaos. Remember two weeks to slow the spread? LMAO. As I have previously touched on, here are the very uncomfortable facts about Covid 19. WARNING If you are easily triggered I suggest not reading further. These are facts the media simply won’t share and officials have actively labeled as misinformation and conspiracy. If you think critically and pay attention, it’s obvious.

Covid is most likely a man made bio weapon that escaped the Wuhan Bio Lab. Soak that up for a minute. What are the implications of this actually being man made. There is strong evidence Fauci helped fund it with gain of function research in Wuhan. If you say well AnDy ItS a CoroNAvIruS FoUnD iN NaTuRe, you’d be correct, they are found in nature. Doesn’t mean it wasn’t manipulated and made more virulent/effective. It’s important you understand that. You can argue the meat market theory all you want, but the evidence has leaked and it has been aggressively suppressed countless times over the last two years. This isn’t a natural occurring virus.

The virus facilitated conveniently timed Mail In Voting in a critical election, allowed wealthy Chinese investors to buy our equity market dip, while also halting pro democratic protests in Xi’s backyard. It destroyed our economy and small businesses, all while spurring incredibly aggressive inflation, destroying the middle class and enriching the asset owning elite. Stock Market all time highs don’t mean our economy is healthy, just like a hyped and constantly coked up frat boy isn’t healthy.

If you got vaccinated/got a booster when is enough enough? Remember this virus has a roughly 99 % survival rate. Ponder that. Then look at where we are and how much hysteria the media is pushing over a less deadly variant. Does that make any remote fucking sense to you? Estimates are that 80-85% of the US population is vaxxed. You think the unvaxxed are the reason this is dragging out? This is all about power, control, and money. I have visited 7 different states since the onset of Covid, all of them with absurdly different Covid approaches. Southern states operating as if nothing is wrong.

The South African government has said that this variant is extremely mild and resembles the common cold. Worth all the hullabaloo? Me thinks not, but I welcome market volatility, more money printing, and new stimulus.

Let me know in the comments what you think of Omicron and the current state of the pandemic.

Metaverse Basic Plays

Below is a compilation of basic Metaverse tokens to get you quick exposure to the rapidly growing sector that some argue could be way bigger than the internet. Important to understand this is the forefront of crypto and some of these tokens have pumped substantially in recent weeks. Do your own research and don’t invest more than you can lose. I urge most to approach this with a very long term view, but I do expect some selling soon given the aggressive 10x to 100x run ups of some of these projects. I have compiled this basic info from various exchanges and websites.

Decentraland (MANA)

Decentraland is a blockchain-based virtual reality platform. Decentraland was first described in a white paper published in March, 2017. Decentraland is a virtual world where users can buy, develop, and sell land, a non-fungible ERC-721 token that represents the ownership of virtual land in Decentraland (Gemini).

I unfortunately dumped my small MANA bag this summer when it was trading at $0.65 to move funds into LINK and BTC (got impatient) so I missed out on this recent giga pump, but given the validation for both the use case and rapid acceleration of developments ($FB, etc.) within the broader metaverse, I will look to add some exposure if given the chance. Worth noting the Grayscale Trust holds a MANA position and has for quite some time.

Sandbox (SAND)

The Sandbox is a virtual world where players can build, own, and monetize their gaming experiences using non-fungible tokens (NFTs).

The Sandbox is a virtual world where players can build, own, and monetize their gaming experiences using non-fungible tokens (NFTs). Players can create digital assets in the form of NFTs, upload them to the marketplace, and integrate into games with The Sandbox Game Maker. The Sandbox virtual world is made up of LAND – digital pieces of real estate – in The Sandbox metaverse that players can buy, and on which they can build virtual experiences (Gemini).

Enjin

Enjin is a platform that lets people create and manage their NFTs. It integrates with several gaming platforms and allows players to use items across multiple different games, or sell it on the unique marketplace.

Recently, Enjin launched a $100 million fund to support and build metaverse projects on Efinity. This support will primarily be in the form of equity investments and token purchases in up and coming metaverse projects. I know what you are thinking “Andy how do I know if Enjin is any different from any of the other countless tokens and projects. Answer is you don’t but at this point I truly think it will pay massive dividends to have exposure to a range of Metaverse tokens. Enjin provides the solutions that enable the building of the metaverse, whose economy is expected to exceed that of the physical world (Market Realist).

INFLATION UPDATE

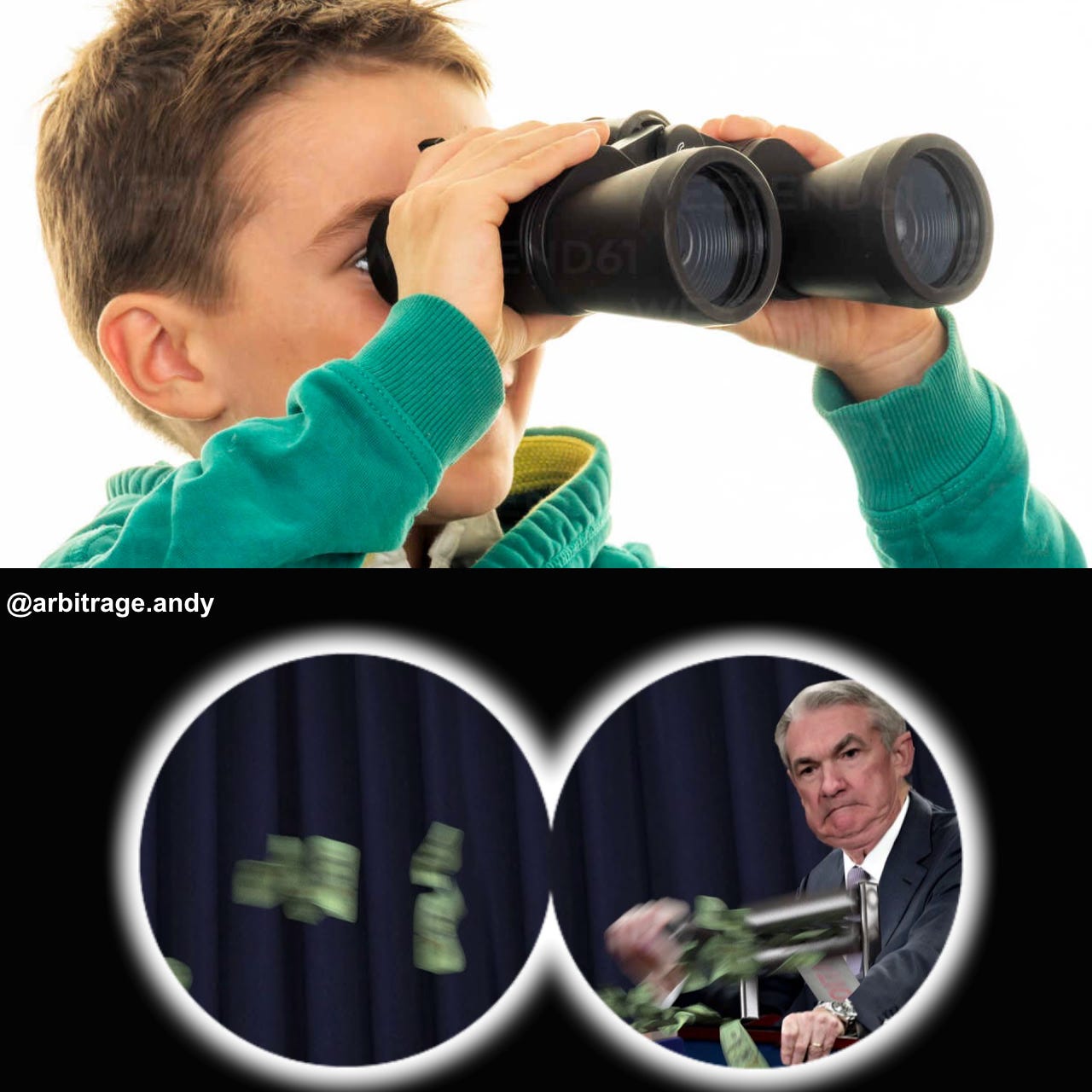

Jerome Powell and Janet Yellen testified to Congress on the state of the US Economy this week. Powell, who has shied away from the severity of Inflation throughout the entire pandemic, has suddenly taken a complete 180 degree stance:

“We tend to use [the word transitory] to mean that it won’t leave a permanent mark in the form of higher inflation,” Fed Chairman Jerome Powell told Congress on Tuesday. “I think it’s probably a good time to retire that word (Transitory) and try to explain more clearly what we mean.” (YahooFinance).

If you’ve followed me in the last two years, we called this quite awhile ago. It was never transitory. That’s a bullshit word to buy time and divert attention from how serious this problem will be and is becoming. You simply cannot print 40% of the entire US Dollar supply in a short time period and expect no consequences to occur. The supply chain is in shambles, the stock market is on it’s 12th night of an insanely aggressive bender, and is running out of energy/stimulants FAST.

Fiat is very much dying, and the Fed had a strong hand in expediting the decline. Starting with our departure from the Gold Standard, the US has become bloated in excess and greed, printing money freely with little short term consequence. Select crypto assets have seized their chance in this environment to flourish with one of the most important qualities of the new asset class: scarcity. I have mentioned this before of course, but crypto and digital assets are the future, people will be priced out of very basic goods and services very very soon.

It’s not official financial advice of course, because I am a 29 year old former degenerate commodities trader/sales lord who’s still trying to make it in life myself, but I am heavily allocated in inflation proof assets like Bitcoin, FANG stocks, and Ethereum. Without exposure to these, you will likely lose substantial buying power in the coming years, what other choices do you have? 7% a year in stocks?

Looking forward to diving into the controversial Cardano later this week, as we have received dozens of questions on it. I will also do a snapshot review of my exact crypto allocation for beginners and those that are curious about my risk approach. Everyone stay safe, use your brain, and good luck trading.

Arbitrage Andy Christmas List drops tomorrow

Thoughts on 'Omicron Take':

Is COVID-19 the product of a lab? Most likely. Was its release scheduled to coincide with other global events? Very doubtful of that.

I tend to think it's much more likely the outbreak falls on human error. The net effect of this virus on global business is staggering not to mention the death count is higher than anything we have ever seen. To insinuate its release as intentional, would mean the China's government is wildly stupid as this is hurting them much more than it's hurting us.

As for the U.S. response. I see this as a long-term outlook, which I think is frustrating those with a day trader mindset.

The government is going to keep pushing vaccinations because if COVID-19 is truly indestructible we need as many workers as possible to maintain the country's GDP. As China becomes an unreliable trading partner, U.S. manufacturing will have to return to meet demand. We know that the Pfizer and Moderna vaccines have the highest efficacy of any COVID vaccine on the planet. Which means the survival rate of Americans is higher than the rest of the world.

I tend to think that those that are making vaccinations an individual rights issue, are only seeking to profit in the short term. Ultimately, whether you believe this "bio-weapon" was discharged intentionally or not— we are now living through an endless war. The winner will be the country that can weather the situation the best with the most survivors. Fatigue is high, but this is unfortunately our new reality.