ARB Letter -Crypto, Citadel Drama, Fed Trading

014 - What you need to know going into this fine Fall weekend

EXOTIC MARKET INTELLIGENCE.

Friday October 1 2021

EXOTIC MARKETS

Quite a tumultuous week with taper discussions, signs of worsening inflation, supply chain disruptions, and continued political polarization over many different issues in the United States.

This is going to be a very interesting Fall and Winter. Stay warm, hedge, and prepare for the worst. A quick ARB Letter recap of the week before you go act like a complete degenerate over the weekend. Couple big announcements in the coming weeks and a Podcast appearance on Foot Guns where we discuss crypto, NFTs, and defi markets in collaboration with Litquidity and Exec Sum.

Bitcoin (BTC) and Ethereum (ETH) price rallys today coincided with several short contracts for the digital assets being liquidated according to multiple sources

Drugmaker Merck said Friday that its experimental COVID-19 pill reduced hospitalizations and deaths by 50% in people recently infected with the COVID-19. Let me know in the comments if you would take this….

Chairman Jerome Powell said this week that inflation pressures could last longer than expected, citing supply chain bottlenecks as key factor.

Treasury Secretary Janet Yellen commented Thursday that she favors removing the debt ceiling from Congress’ corrupt control. Based?

Congress has once again prevented a government shutdown before Thursday’s midnight deadline. Joe Biden has signed a bill that funds federal operations until Dec. 3. This is bullish for crypto people.

Coinbase Global (COIN), earned its first bullish analyst recommendation this week from JMP Securities…. not sure what to think about that but I consider Coinbase an ironic piece of the crypto landscape. Not very decentralized bro.

U.S. stocks generally climbed higher on Friday as companies tied to the economic recovery rose on Oral Covid 19 care progress. PUMP TIME.

The 10-year Treasury yield fell below 1.50% on Friday.

California Gov. Gavin Newsom announced on Friday that his state will be the first to mandate the COVID-19 vaccine for young children in public and private schools…..

EXOTIC NEWS

CITADEL BTFD

This week we had the pleasure of watching a full on meltdown by whoever is running the Citadel Securities Twitter account as documents and leaked legal PDFs found their way onto twitter from the infamous Robinhood/Citadel debacle we witnessed during the meme stock squeezes.

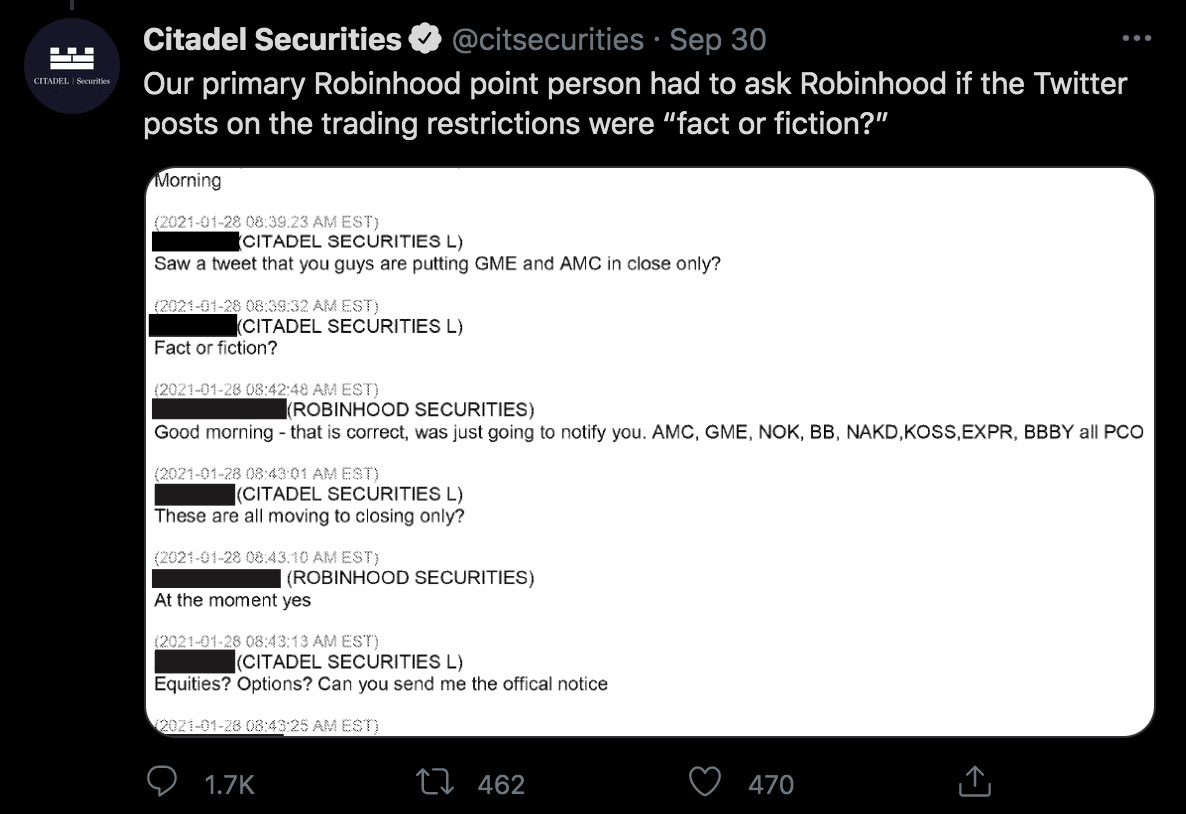

With hashtags like #KenGriffinLied and #CitadelScandal still dominating retail investment social media, Citadel used its suddenly hyperactive Twitter account to both defend itself and make clear that Robinhood acted alone in restricting access to certain meme stocks at the height of January’s short squeeze. Righttttttt.

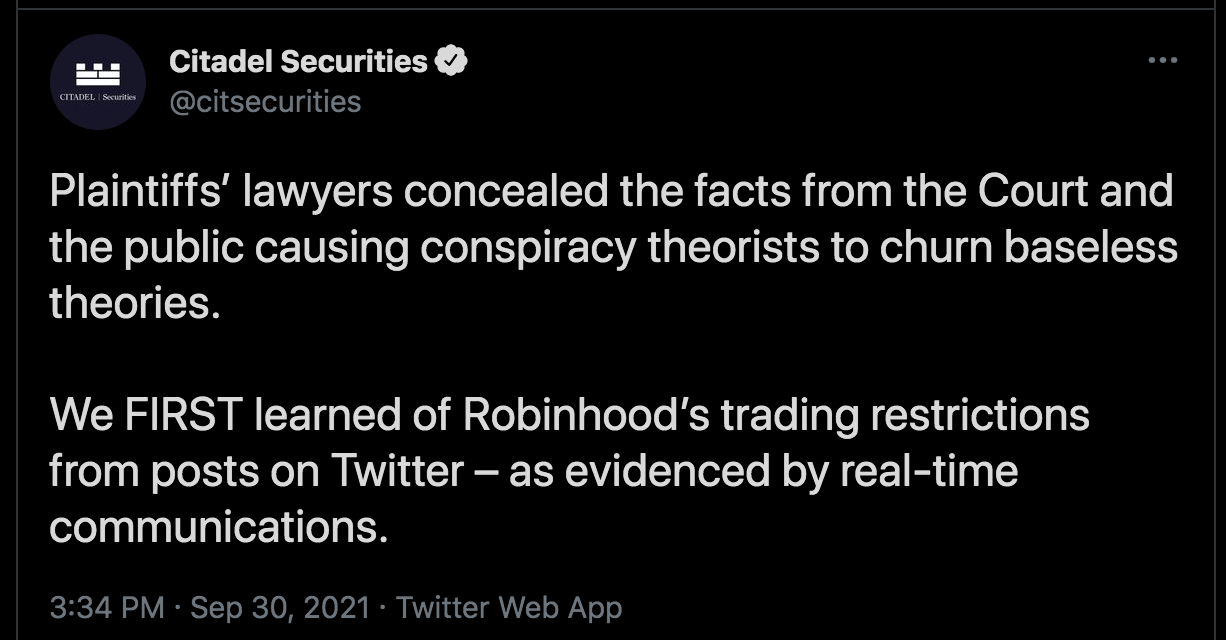

In a short Twitter burst Thursday afternoon, Citadel clapped back once again at its online accusers. After claiming that the lawyers who filed an explosive revised lawsuit in a Florida federal court “concealed the facts from the court and the public causing conspiracy theorists to churn baseless theories,” the financial services giant opened up on the zero-commission trading app that sells more than half of its order flow to Citadel Securities (MarketWatch).

Social pressure is mounting on Citadel Dave Portnoy of Barstool DMed Vlad Tenev, the CEO of Robinhood - asking bluntly if Vlad dumped his shares before Robinhood halted AMC trading as well as trading among other meme stocks like NOK, GME, and others. If you are feeling petty head on over to twitter and troll the Citadel account. It’s content gold. Whoever they have running the account is rattled to put it lightly. I highly encourage you to get up to speed and follow the beef as it continues to unfold.

UPDATE AS OF 3:39pm ET - * Unconfirmed but rumored that the SEC is now investigating Vlad Tenev

FED RESERVE RETIREMENTS

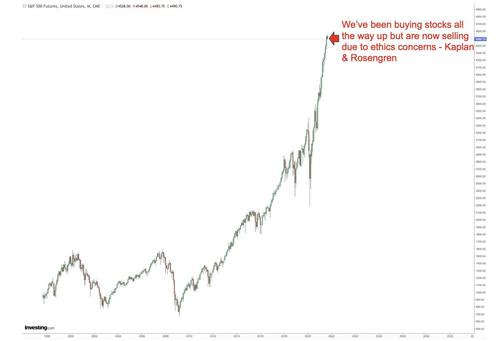

Regional Fed Reserve Presidents Eric Rosengren and Rob Kaplan have conveniently retired and stepped away for “medical reasons” after their involvement and activity in trading during the 2020 pandemic that coincided with their respective roles as Dallas and Boston regional Presidents. Given the men’s respective positions and some of the implications of trades they both made during times of extremely bullish fed policy is insidious to say the least.

Earlier in September, Kaplan and Rosengren were called out for owning and trading individual stocks, which many saw as a conflict of interest to their roles at the Federal Reserve. Reportedly, Kaplan executed large-dollar trades in companies including Apple, Amazon, and Delta Air Lines (Market Realist). Rosengren owned a series of REITS, while also being an outspoken bear on real estate publicly, as the Fed worked to quell some of the initial market issues when the pandemic crashed the market in March 2020. Both men traded securities while being at the helm of monetary and fed fiscal strategy in the face of aggressive inflation and COVID. The conflict of interest was uncovered a bit too late I would say. Lmao.

Although Rosengren cited health concerns as he stepped down, Kaplan alluded to the issues at hand influencing his departure. “The Federal Reserve is approaching a critical point in our economic recovery as it deliberates the future path of monetary policy. Unfortunately, the recent focus on my financial disclosure risks becoming a distraction to the Federal Reserve’s execution of that vital work,” Kaplan said in a statement (Market Realist).

In my opinion the conflict of interest present in both of the regional Fed President’ roles was far from hard to see. While Powell has announced thorough reviews of ethics standards at the Fed, unfortunately this comes a bit late as we approach the top of a market entirely fueled by money printing.

For more, check out the Arbitrage Andy (Instagram, Twitter, Merch Store).