Happy Friday everyone. When I set out to start Arb Letter I never believed we would amass as many subscribers so quickly.

My initial goal was to cover absolute need to know macro, markets, and global intelligence in a way that was relatable and easy to take in for everyone. We’ve gotten more and more demand for our focus pieces we offer for premium subs and so that’s where we are focusing a high amount of our time and effort.

Things have drastically changed in the last two years and unfortunately, many don’t understand that they will never be the same ever again. It’s a painful reality to digest.

Many went “back” to work their 9-5 after getting any varied number of shots and boosters. Corporations and the media have doubled down on “woke” politics and social media outlets continue to censor and curate content to fit pre determined narratives or to support the right thing.

Violence, social disruption, and aggression is okay if you’re aligned with the proper social causes but is considered extremist if you’re not with the in crowd or virtue lined issues.

Inflation is robbing people of 9.1% of their purchase power every day (likely much higher) and the world seems to be losing it’s mind a bit more each week. Wanton crime is soaring in the US, politics is becoming more partisan each day, and availability of essential like food, gas, basic supplies, and other items is becoming harder.

Governments are being toppled worldwide and war continues to plague many countries. US mid term elections are coming up and as we’ve covered in Arb Letter, we can expect heightened social disruption, protests, and riots soon.

I can’t emphasize how much the information you consume every day is being tailored to fit certain narratives that ultimately don’t benefit anyone else besides the ultra elite in this country and the government. This isn’t tin foil hat speak - it’s literally common sense.

Take a moment to understand you are alive during some of the most historic times in all of human history as we are not only seeing the decay of empires, but the shifting of all kinds of social, economic, and life paradigms.

Markets

Markets have continued to remain highly volatile as the DXY index hits an all time high and relative inflation hedges like Gold are mercilessly slaughtered. The Federal Reserve is in quite a pickle and I don’t envy them at all.

Taken together, these haven flows in combination with large interest rate differentials have led to investors bidding up the dollar at an uncomfortable rate.

Interest rates are pumping higher and higher in the U.S. as the Federal Reserve moves to address down 40-year highs in inflation. Global investors want to get paid the relatively higher interest rates in the United States.

So what they tend to do is they sell their local currency, buy US dollars, invest in select U.S. bonds, and make the difference.

There are hedging costs in this so-called "carry trade," but it's fairly simple in theory and a hedge fund favorite (Yahoo Finance). Let’s get into some updates:

The S&P 500 has lost 16.4 percent in the second quarter, leaving it 20.6 percent below its level at the end of 2021

Bitcoin has been ranging between $18,900 and $21,000 showing some decoupling ability to legacy equity markets

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rebounding from lows sparked by a fresh 40-year high for U.S. inflation as per the Consumer Price Index (CPI).

The troubled crypto lender Celsius has filed for bankruptcy - In their FAQ updated yesterday, Celsius told users that withdrawals are still suspended

Vladimir Putin has signed a law banning #Bitcoin and #cryptocurrency as a means of payment in Russia.

New Zealand has introduced brand new Covid measures

NYC lost over 5,000 Manhattan businesses during COVID pandemic (NY Post)

U.S. and U.K. will “deepen ties” on cryptocurrency regulation, - FCA (Bitcoin Archive)

I am holding steadfast in my crypto allocations adding primarily to my Bitcoin stack and my growing bag of MATIC (who I believe announced a Disney partnership recently).

UPDATE - I planned on sending out Arb Letter this morning but am getting around to it this afternoon - as markets played out today we are seeing some weakening of the DXY index and a rally of QQQ (Tech names) and Bitcoin.

Will be very interesting to see if we start to get some signs of stronger relief bounce as these factors start to collide.

In my opinion we are entering an interesting cross roads where we could see something unexpected happen

Sentiment

“I think we’re in for a lot more pain, probably, in U.S. stocks, just to get back to historical valuations, we could easily go down a third from here.”

Meb Faber, CIO of Cambria Investment Management (NY Times)

"Last week saw a major wash-out in both gold and silver as the markets finally buckled….the last straw was the surge in the Dollar on increasing fears of a global recession on the one hand, but also the conflicting fact that factory orders came in [stronger than forecast and] underpinned concerns that the hawks on the FOMC might get the upper hand in the [Fed's] late July meeting."

Precious-metals specialist Rhona O'Connell at brokerage StoneX

Global News Intelligence

There’s lots of casual use of the word conspiracy these days and we detest it. So many things people thought have been conspiracy have literally turned out to be 100% true in the last two years - makes you wonder how daft most people are that they aren’t picking up on the same old bullshit.

We’ve touched on it before but it’s really important to not let your political beliefs get in the way of you seeing what’s actually going on in the world right now. It all transcends politics - this is a fight between massive world wide government organizations (US/China/Alphabet Agencies), institutions (WEF), and the common people.

We are letting them print our money into oblivion, get into foreign wars, launder our tax money, give us endless useless pharmaceuticals for a potentially man made pandemic, and as mid term elections approach rest assured that certain groups will do literally anything to keep their power.

It’s important you understand that and remember me saying this. There will be a major event in the next several months used to further distract or strike fear into the American populace. It’s all about control.

Could be Monkeypox, another Covid strain, a false flag terror attack, more mass shootings, an internet outage, worse food availability, the list goes on and on. Be vigilant.

The Covid 19 Pandemic served many purposes but among them was the control and power that the pandemic gave to government officials, rich elite, and others in key industry positions (pharma etc.).

Then we moved to the next big thing which happened to be devoted unquestionable support and fervor a war in Ukraine.

Once again - another major distraction for the American people from the woes of how the US is doing domestically.

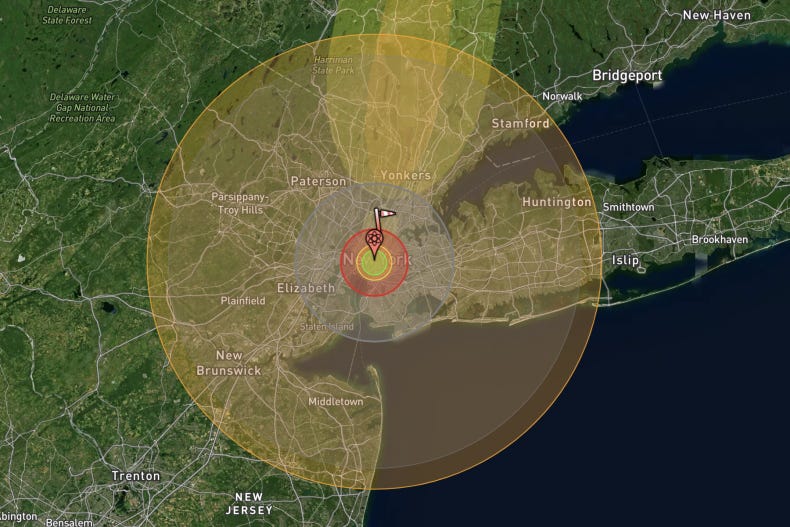

Let’s talk about one of the more recent examples of what I am talking about. Recently NYC played the following Nuclear preparation video. Begs the question, why is this being pout out now? Seriously. Also, for the record - this video is an absolute fucking joke - it’s woke politics meets raw reality.

My dad and I were catching up about this development the other day on the phone (he was a Navy pilot towards the tail end of the Cold War and focused specifically on studying offensive Soviet nuclear capability and how to counter it.

Much of this circulated around counter submarine warfare but a good deal was centered around the capability the Russians have in their ICBM arsenal years after the Cold War.

If a nuclear weapon detonates in New York City and you live in New York City you will be vaporized instantly, this video is complete false hope, which makes it even weirder. You won’t even have 2 seconds to get inside and if you somehow managed to, your building would be atomized into dust almost immediately.

Even people across the river in NJ would have their eyeballs burnt so severely they would blindly hobble around until the blast or radiation finished them off. This isn’t fear porn - it’s reality.

On Monday, New York City’s Emergency Management Department released a 90-second public service announcement that featured desolate Big Apple streets and sirens that told residents what to do in the unlikely event the city is struck by a nuclear weapon.

“So there’s been a nuclear attack. Don’t ask me how or why,” says a woman who’s walking a deserted city street. “Just know that the big one has hit, OK? So what do we do?” (NY Post)

Lmao. Don’t ask me how or why?! If that doesn’t scream pre conditioning for a false flag event or Russian nuclear counter to Western aggression I don’t know what does.

One of the other odd pieces of these warnings is that they advise you to “tune in” to media for updates.

First of all LOL - as if I am going to trust the media during one of these situations and second of all - nuclear blasts cause an EMP, effectively wiping out all electronics, airborne planes shut down, all power is gone instantaneously. Absolutely useless advice which, once again, makes these warnings very very odd. New signs are popping up in NJ malls and around the Tri State area. Why is this?

These are the kinds of things we recommend people be aware of as we move into increasingly desperate conditions for leaders, politicians, and governments. As supply chain suffers, food supplies falter, inflation runs rampant, and people get priced out of basic lifestyles we will start to see increased frustration and anti establishment attitudes - that is unless…….. they can distract the public effectively from their incompetence.

With the War in Ukraine dragging on for some time now and the rhetoric between Russian officials and Western leaders growing increasingly hostile, there is always a threat of nuclear calamities, nuclear weapons have been mentioned by both sides throughout this conflict.

We’re not implying some grand conspiracy here but we are telling you to be vigilant. We are in hairy times right now and we will all likely see some pretty insane stuff transpire that makes the pandemic look mild.

We’ll be dropping a deep dive paid post on Monday focusing on conflict we are seeing escalate throughout the globe with a more specific piece on nuclear capability by nation and risks we think pose material threats to Americans in the near future.

Lot of rebellions against governments, inflation fueled riots, and unrest - which shows some opportunities in certain financial markets but also acts an an indicator for the bigger things we may see come in the future.

Andy, I haven’t read this one yet, but was amped to wake up and see I have a new Arb Letter to read on my long flight back home to the U.S. These are always a treat to read - keep up the great work!