Amid all of the insanity in global markets, politics, and the US right now — crypto has continued to shine despite intense volatility on the heels of the jarring bear market that left many retail investors holding the bag and a myriad of exchanges insolvent, in court, or blown up forever.

This week Grayscale Investments, largest Bitcoin fund traded over-the-counter ($14B AUM), has achieved a significant triumph over the United States Securities and Exchange Commission in its push to transform its Grayscale Bitcoin Trust (GBTC) from an over-the-counter offering into a publicly listed Bitcoin ETF (Exchange Traded Fund). On top of this win that immediately pumped markets we saw a classic uno reverse move from major insitutions who are all lined up to get Spot ETFs approved including BlackRock, Fidelity, Wisdomtree, VanEck, and others.

Time is of the essence as they say — as we approach the late majority stage of the adoption cycle for Bitcoin and other blue chip crypto/defi assets (something we will expand on visually in today’s post). Hint - you don’t want to be in this group.

We will see a similar phenomenon play out with crypto and Bitcoin that we did during the pandemic with equities.

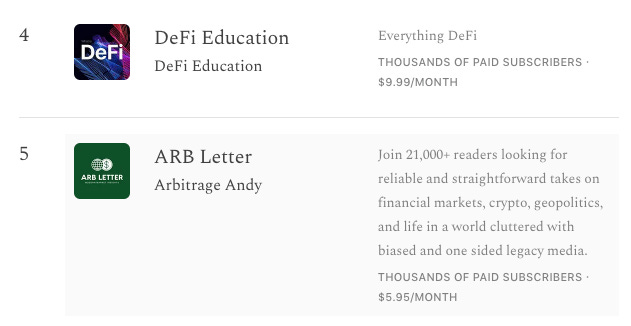

Right now we continue to hold the #5 spot for top crypto publications on Substack. We humbly sit behind our online homies

and BowtiedOwl who runs .One of the reason for this — that I continually hear about from subscribers is because of my focus on the basics.

If you’ve subscribed to Arb Letter since the get go — or followed me on Instagram before we were aggressively shadowbanned into the depths of the earth, you’ve seen these principles reinforced continually and you’re likely in the money since we’ve reiterated these concepts since 2017.

But for those who feel underallocated or underexposed today’s post will reinforce the concepts that help you make money reliably in crypto and with Bitcoin. There are MANY scammers, money grabbers, charlatans, and bad actors in crypto that have flourished over the past several years due to ignorance by investors, new technology, and social media.

As someone who’s been in the space almost 7 years now — my conviction has never been stronger that we are going to see some mind blowing price action and developments on the crypto front before the middle of 2024.

In many respects this actually could be the last decent chance people have to get allocated before momentum picks up and the average person gets priced out of seeing the benefit of this rapidly growing technology that the world’s most influential people and most powerful organizations are laying the groundwork to benefit from.

The bottom line is — it’s not too late. For those that have held out for years thinking crypto is a scam or super sketchy, you should be re-examining your convictions. For those involved already but maybe have a bad taste in your mouth from the exchange blow ups and bearish volatility , it’s a great time to re-examine WHY you’re in crypto and what steps you can take to be better prepared for the next bull run.

There’s a huge difference between someone who casually owns .25 BTC and 2 ETH vs. someone who DCAs regularly and owns 3 BTC and 15 ETH. The former will make some good cash but it won’t even be remotely life changing. The latter has the potential to have $90K turn into $300,000 to $450,000 if the next bull run takes us to where I think things are trending.

A simple example to put it into perspective — you’re getting a very narrow window to accumulate assets that could see mind blowing upside — don’t fall into the pattern most retail normies do and write crypto off now because it’s not exciting or trending. It’s inherently cyclical. Feel free to share ideas in the comments, but I doubt any other asset class at the moment offers this kind of upside long term unless you’re cutting exotic OTC wholesale precious metals deals with a desk at JP morgan.

Remember — it’s easy to buy when everyone’s throwing their cash at any crypto available to buy on Robinhood or Binance — it’s hard to buy when people legitimately think it’s all over (maybe for good).

The advantage we have now — with the signals from insinuations, legal entities, and markets is that BTC and ETH are not going anywhere.

Use that clue to position yourself. A major risk of crypto (that it won’t be allowed to continue, or that it will be banned or shut down entirely) is not fully nonexistent but has been relatively put to rest moving forward barring some absurd world ending or tyrannical scenario.

Today’s guide will be one of the best aggregated resources for the following:

The top online accounts to follow to keep up with crypto and markets

An honest take on where we are in the cycle and what likely comes next

An overview of who owns all the Bitcoin and how it is distributed

The steps you need to take to take advantage of the coming pumps and adoption

Crypto will offer the patient and calculated the chance to make life changing money and potentially even generational wealth.

It’s a matter of time.

Let’s start with where we are in the cycle and what to expect next.

"The inevitable approval of Bitcoin ETFs in the US is moving closer."

—Bloomberg Senior Macro Strategist