Good morning everyone.

I have mentioned this before, but my mom had a good quote she used to tell me when I was younger that has stuck with me over the years:

“Just because something is — doesn’t mean it should be”.

This quote came to my mind Friday as we watched a range of developments in financial markets play out.

We’re in a unique point in time in which the corruption, manipulation, and gaslighting we are seeing in politics is also beginning to reveal itself in financial markets. This matters to most people, because it impacts their wealth, livelihood, and ability to earn income.

Back when I was in trading — I worked at a smaller lesser known shop. I kid you not when I say it was the single closest thing to Wolf of Wall Street that probably existed in 2017 for a fresh out of school kid. Out of control, objects flying, hard partying, a complete lack of HR, insane arbitrage in the products we were trading, over the counter products, face ripping deals, and a ruthless culture internally in which your own coworkers would steal your client if it meant another $50,000 on their year end bonus check. I enjoyed it and learned some great skills but eventually I wanted to move on to something more sustainable.

Plus I got tired of blatantly d*cking over everyday folks — there was a pretty fine line between scalping someone and giving them a fair trade — scalping meant more money to me immediately.

One thing I learned in selling to the buy-side, working with hedge funds, and brushing shoulders with mainstream finance types was a lot of them were extremely unhappy — the pressure was insane, everyone was jaded, and competition was ruthless to be in the 1%.

Don’t get me wrong I sacrificed my health and mental well being to make some good money in my early twenties but I took notice of the lack of fulfillment and backwards values many have in that industry.

Plus the true “hardos” aways rubbed me the wrong way. You know, the absolute douchebags. The guys who take that “identity” way too seriously and lose a bit of their humanity in the process. Nepotism, true privilege, and “prestige” had a way of generating some of the most obnoxious people possible.

I’ve had to earn everything I’ve ever gotten, no handouts or nepotism, no internship handed to me senior year of undergrad, and no powerful connections or political relationships to get me through any doors.

That’s one major reason I sought the opportunity to create my own thing through Andy and Arb Letter — I didn’t like the corporate culture, games, and rules people had to follow to survive in those environments — it’s never really been my thing. I’ve never really like to conform. Generating satirical, irreverent, and funny content was one of the ways I worked through the stint I had. I just didn’t take it that seriously, either through humility or disinterest.

Point I am making is that while I love money, finance culture, and nice things, I fully understand the “anti institutional” attitude that emerged when the first Gamestop saga unfolded. The game is rigged, but when that played out I think many people saw just how rigged it actually is now with the advent of algorithms, order routing, big money, and high frequency trading. We watched Ken Griffin literally lie to congress, Vlad Tenev actually turn off buying, and Roaring Kitty get brought to testify for liking a stock that ended up punishing reckless short sellers?

I get that attitude even more now as my politics and world view changed during the Covid pandemic and last 4 years. Put simply you have the “establishment” and “elite” and you have everyone else who is at a material disadvantage. If you’re “in” — you don’t care because you benefit from the corruption. The SEC doesn’t really care, big money doesn’t really care, and politicians who get kickback don’t care.

It’s become more obvious in past years that the “establishment” will do anything, including breaking the law or lying, to make sure they win. This goes for all pursuits in markets, politics, and society. Technology and new monopolies/conflicts of interest exacerbate this phenomenon.

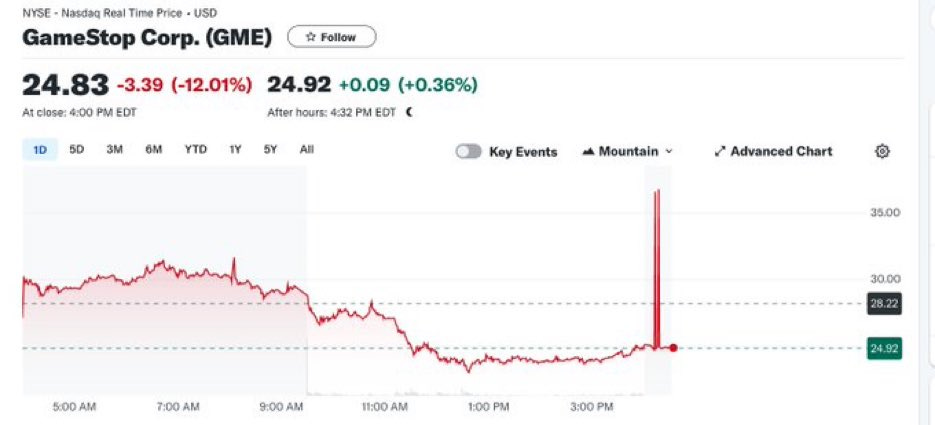

Last week Gamestop surged again and Keith Gill returned from the abyss. The stock rallied hard until it got too much attention again, then it methodically dumped as gill live streamed for the first time in many years.

Around the same time that the momentum for GME 0.00%↑ stopped, crypto began a uniform sell off dumping across the board with seemingly no explanation considering the ridiculous amount of buying we’ve seen recently.

The short answer is — we are watching blatant manipulation of key assets and stocks that retail and the “little guy” all have positions in.

Being able to understand why and how this is taking place is a critical skill if you want to remove emotion from the equation and ensure you have the will to hold through these periods and profit. Nothing is as it seems at face value. You have to be able to see how blatant some of this really is — it’s completely in our faces.

The amount of deception and gaslighting going on these days is truly remarkable — entire swaths the population are operating with inaccurate or false information on everything from the conflict in Ukraine to the Hunter Biden Trial to Bitcoin to stocks.

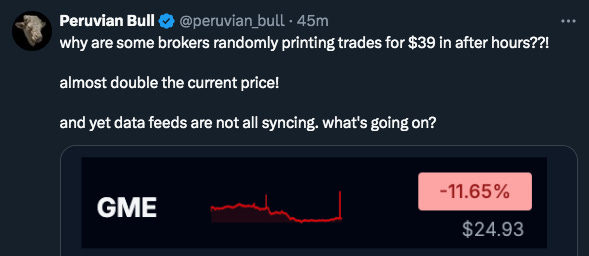

The amount of strange “glitches” and “prints” on GME price is bizzare. Something is absolutely going on behind the scenes.

Thursday we will put out a deep dive on geopolitics focused on Russia’s move into the Caribbean this week as well as regional developments surrounding China. If you havent already done so be sure to subscribe to receive.

Today we’re going to explain the following:

What to expect next in crypto, which meme coins will transcend the sell off

What spurred the sell off in crypto Friday, will we keep dropping?

How to profit in the current market and protect your capital

What’s really going on with Gamestop and why it’s going to…