Happy Friday everyone if you missed our paid posts this week How Based Are You and 2023 Father’s Day Gift Guide, you can find them here or in the Substack archive. If you guys wants some refreshing takes on the madness around us or are looking to secure the perfect gift for pops before the Saturday night deadline check em out.

Hope everyone is treating themselves to a nice slutty lunch this Friday to kick off the weekend — maybe some triple Harissa Honey Chicken from Cava if you’re in midtown New York or some Toasties sandwiches.

Ending the week with some quick markets and news updates within the traditional markets and crypto world as quite a bit has transpired.

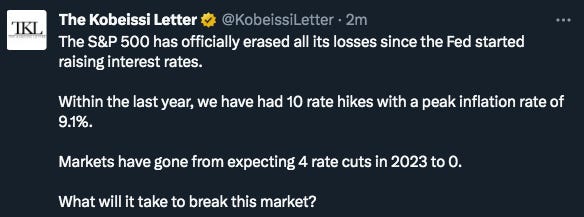

The S&P has reached all time highs, with tech heavyweights like NVDA 0.00%↑ META 0.00%↑ and others continuing to defy macro bearishness.

Virgin Galactic SPCE 0.00%↑ is up nearly 45% in pre market trading on news of commercial flight progress to space and ADBE 0.00%↑ up nearly 5% with a solid earnings beat yesterday. Micron Technology MU 0.00%↑ is up as well following a recent report from Bloomberg indicating the company is close to sealing a $1 billion deal to build a new factory in India.

Market Updates

On Wednesday, the Federal Reserve announced its decision to maintain its key interest rate at approximately 5%, marking the first instance of a rate freeze in over a year. The motive behind this decision stems from the observed alleviation of inflationary pressures for the time being. The Federal Reserve aims to evaluate whether the previously implemented rate hikes have effectively curbed the surge in prices.

Bakkt, a crypto firm owned by ICE (Intercontinental Exchange) announced it will be delisting native tokens for popular blockchains Solana, Polygon and Cardano in light of the regulatory environment in the US (Blockworks) - Don’t care buying more MATIC

Binance is under investigation in France for alleged money laundering. This comes shortly after an announcement thi week that Binance will be leaving the Netherlands after failing to obtain the proper licenses

The renowned asset management behemoth, BlackRock, took its initial strides on Thursday towards the launch of a bitcoin exchange-traded fund (ETF), a contentious topic that has sparked debates between cryptocurrency enthusiasts and federal regulators. The company formally submitted an application to the U.S. Securities and Exchange Commission (SEC) to introduce the iShares Bitcoin Trust.

San Francisco, New York and Los Angeles are at the top of the list of major global cities that will end up with the most empty office space by 2033, according to a recent report in Bloomberg.

According to a recent piece by Business Insider - Lululemon, LU 0.00%↑ LU, employees risk losing their jobs if they try to stop a thief from stealing products while on the clock (Unusual Whales) Makes sense!

Monthly payments for a first time home buyers are up 33% compared to last year, per David Rosenberg of Rosenberg Research (UW)

The SEC charged Pacific Investment Management Company today stating: we announced that registered investment adviser Pacific Investment Management Company LLC will pay $9 million to settle two enforcement actions relating to disclosure and policies and procedures violations involving two funds the company advises.

Hong Kong regulators will push banks to offer services to Bitcoin and crypto firms as they aim to become an "international crypto hub" - Bloomberg News

BlackRock File for Bitcoin ETF

Crypto is in a pretty confusing state at the moment — just a week after the SEC decisions to charge Binance and Coinbase, two of the world’s largest crypto exchanges, BlackRock has come forth with a file for a Bitcoin ETF.

Well it’s certainly comical remembering that Larry Fink, the Blackrock CEO once called Bitcoin an “index of money laundering” and now the behemoth investment firm is filing for an ETF. Common doublespeak for the last 3 years.

These two things split sentiment — on one hand there is a clear and strong effort to regulate the crypto industry and clean up the remnants of the messes and practices that led to countless ponzi explosions, exchange blow ups, and liquidity crises. On the other hand institutions are setting in motion the infrastructure needed to benefit from the crypto markets in the near future.

What is one to think?

Well it’s certainly comical remebering that Larry Fink, the Blacrock CEO once called Bitcoin an “index of money laundering” and now the behemoth investment firm is filing for an ETF. Common doublespeak for the last 3 years.

Well one theory discussed is that tradfi (traditional Finance) firms are working with the SEC and government to clear the way for a Wall Street takeover of the crypto industry. At the moment firms like BlackRock, Citadel, and others are wading through the wreckage that is crypto, seeking out opportunities and scooping up assets for pennies on the dollar.

Commentary and opinions on the state of crypto are coming from all kinds of bulge bracket banks and buy side firms as of late. With the growing complexity of if select alt coins are “securities” or “commodities” clarity for assets outside of BTC is blurry at best.

JPMorgan strategists stated that the United States Congress has the option to either classify ether (ETH) in the same commodity classification as bitcoin (BTC), or place it in a novel "other category" that imposes less burdensome regulations compared to securities.

According to a note written by JPMorgan strategists led by Nikolaos Panigirtzoglou on Thursday, it is a possibility that a distinct "other category" will be introduced specifically for Ethereum and other cryptocurrencies that possess sufficient decentralization to avoid being labeled as securities. This would likely mark the regulatory framework needed to boost retail and widespread institutional confidence in buying back these assets after months of aggressive selling.

This proposed "other category" would entail more restrictions and safeguards for investors than what is currently envisioned for commodities, yet would be less demanding than the requirements imposed on securities (The Block).

In the meantime Robinhood and other crypto companies have made the decisions to elist popular * assets. “Earlier this week the SEC sued crypto companies Binance and Coinbase and alleged that a number of cryptocurrencies are unregistered securities. This includes Solana, Polygon, and Cardano…” Robinhood said in an email to Blockworks.

I can’t remember where I first heard the expression “watch what they do not what they say” but I think it’s particularly relevant to the crypto discussion at the moment. At Arb Letter we firmly believe crypto and blockchain tech is here to stay and I think that’s evidenced by the abundance of institutional interest despite what the legal or regulatory noise is indicating.

Remember that a core use case of Bitcoin and other select cryptos is that they are decentralized. so to some extent it is concerning to see traditional finance sharks move into position to potentially control and influence the markets heavily. On the other side of the coin — without these blessings and adoption steps, it’s likely that crypto struggles to gain the widespread use and adoption it needs to grow meaningfully into the future.

A deal with the devil perhaps but mabe a deal we can all profit from into the future.

But in regards to the BlackRock ETF filing - this is likely bullish news — BlackRock has a nearly 575-1 record or 99.8% acceptance rate for filed ETFs.

“I think it’s absolutely inevitable that all the value in the global financial system will be on a blockchain because of its security, transparency, and user control risk management properties”

—Sergey Nazarov, Chainlink

“Bitcoin and nostr are the only two truly censorship resistant technologies at scale”

— Jack Dorsey

Global News

No later than Sunday, America's director of National Intelligence must, by law, "declassify" and make public all "information relating to the origins" of Covid (Disclose TV)

US releases further $205 million in Ukraine aid

President Biden has asked Stoltenberg to continue as NATO chief moving forward - According to two sources familiar with the discussions, President Biden endorses a proposal put forth by NATO Secretary-General Jens Stoltenberg, which states that Ukraine will not be required to fulfill a "membership action plan" (MAP) in order to become a part of the alliance, as reported by Axios.

Bill Gates made a recent trip to China to meet with President Xi, a rare occurence given the heightened tensions between the West and China over the last year. “You are the first American friend I have met in Beijing this year,” Xi told Gates in Beijing

Texas Republican Gov. Greg Abbott has signed a law barring transgender college athletes in the state from competing in sports that align with their gender identity (CNN)

During a recent CONCACAF Nations League semifinal soccer match between the United States Men's National Team and Mexico, tensions escalated significantly. The game witnessed the issuance of four red cards, resulting in the ejection of two players from each team. Additionally, there were reports of homophobic chants from Mexican supporters, and the match was prematurely concluded with time still remaining, following an early whistle

Americans are now drinking as much alcohol now as in Civil War days, a new report from the National Institute on Alcohol Abuse and Alcoholism has found.

Michael Jordan is finalizing the sale of the Charlotte Hornets

Pope Francis has been released from the hospital after 9 days after surgery

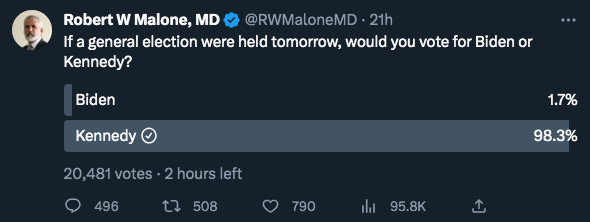

Robert F. Kennedy Junior’s presence as a presidential candidate is growing slowly with some momentum gathered from his recent interview with Joe Rogan in which he spoke impressively on a number of issues impacting the US.

Three hacker groups (Killnet, REvil and Anonymous Sudan) from Russia have promised to carry out the largest cyber attack in the history of the banking sector in Europe under the slogan "No money, no war" (@wayofftheres Twitter). A prominent US cybersecurity agency has reported that multiple federal government agencies in the United States have fallen victim to a worldwide cyberattack orchestrated by Russian cybercriminals. The attack leverages a security flaw in commonly used software. Eric Goldstein, the executive assistant director for cybersecurity at the US Cybersecurity and Infrastructure Security Agency, stated on Thursday to CNN that their agency is offering assistance to affected federal agencies whose MOVEit applications have been compromised.

The House of Representatives oversight Chairman James Comer has said there is evidence of $20-$30 Million of illegal payments made to the Biden family - worth noting this has received virtually ZERO coverage in US media. “This is going to be hard for Biden to explain, this is not going to go away, and I think eventually the mainstream media is going to start asking the real questions,” Comer added on a Fox News interview (Zero Hedge). This week President Biden snapped at a reporter who asked why he was referred to as “the big guy” asking “ Why did the Ukraine-FBI informant file refer to you as 'the Big Guy'?" Biden responded asking why the reporter had asked such a “dumb question”.

If you get a chance today definitely check out the Joe Rogan interview with RFK Jr. Some great level headed conversation which is refreshing for a change.

Dr. Robert Malone, the Inventor of MRNA vaccines who was censored and silenced throughout the Covid 19 pandemic, polled his 1M followers recently on who they would pick if the general election was held tomorrow and the results were deafening. It seems at this point that American sentiment and support for Joe Biden is reaching all time lows.

It will be interesting to see if the Democratic party continues to distance themselves from Joe as we get closer to a pivotal election in 2024.

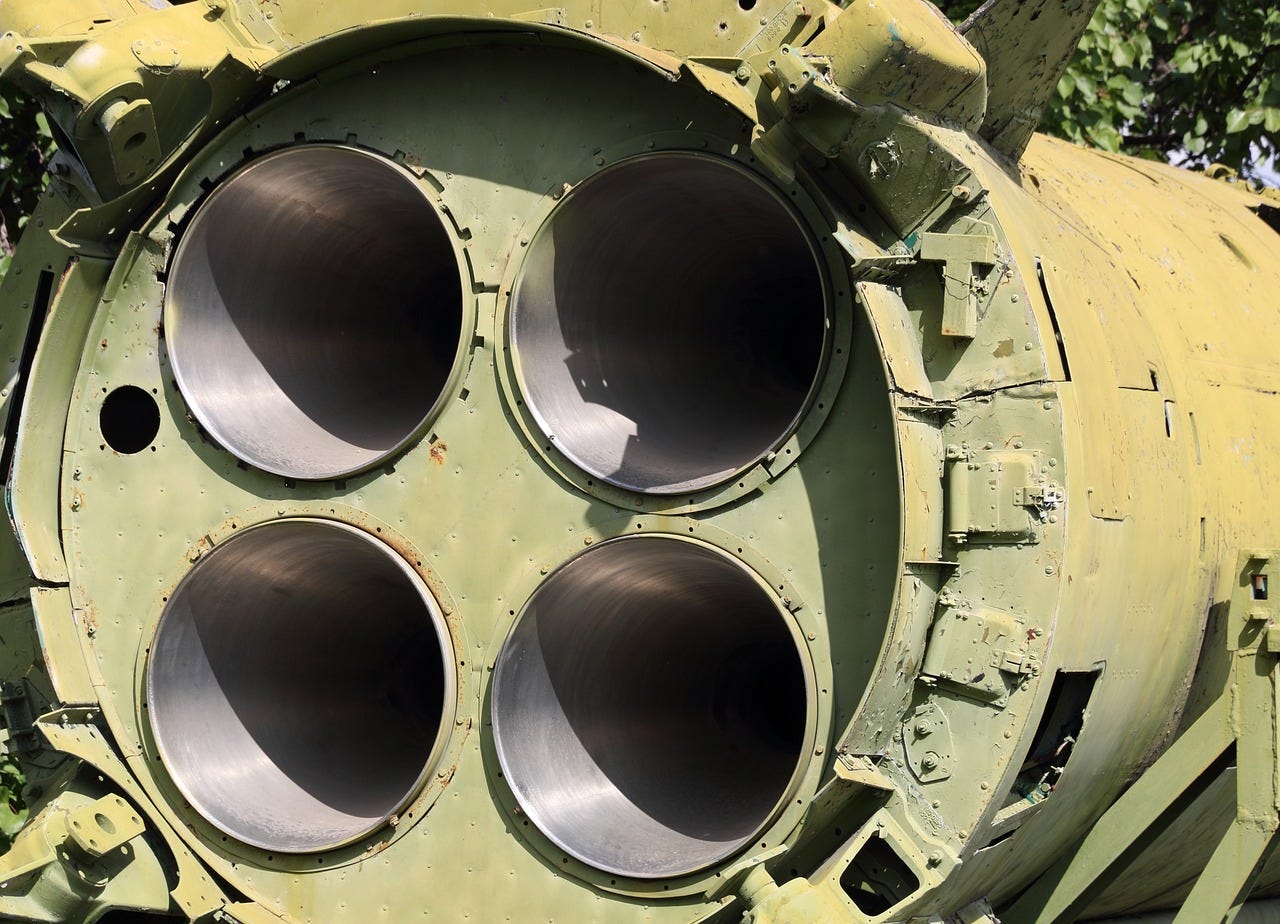

Russia Moves Tactical Nuclear Weapons to Belarus

In our rants we put out about the War in Ukraine one of the chief risks we think people glaze over is the threat of nuclear escalation.

Not since the Cold War or the Cuban Missile Crisis have tensions been this high. The US, with tactical nuclear capability in several NATO countries including Turkey, has a good capability spectrum if Russia were to act up in Eastern Europe — in response the Russians and their ally states in the region are making moves to position themselves defensively or, in the worst case, offensively if the conflict were to escalate.

According to the recorded statements of Alexander Lukashenko, the authoritarian leader of Belarus, Russian nuclear weapons, possessing three times the potency of those employed in Hiroshima and Nagasaki during World War II in Japan, have already been delivered to Belarus, which shares a border with Ukraine.

Lukashenko's disclosure was broadcasted on Tuesday and follows closely after Russian President Vladimir Putin's recent announcement that tactical nuclear weapons would be stationed in Belarus starting in July.

During the televised remarks, which aired on both Russian and Belarussian state television channels, Lukashenko asserted that he would not hesitate to employ these nuclear weapons or participate in Russia's conflict with Ukraine in the event of any aggression directed towards Belarus.

Lukashenko emphasized, "God forbid I have to make a decision to use those weapons today, but there would be no hesitation if we face an aggression." He further stated his intention to consult with Putin prior to deploying any nuclear arsenal.

On the conventional front Russia has amped up missile attacks in recent weeks with this week having an unusual amount of intensity.

See you guys Tuesday for our second deep dive into how to build an ECommerce business and brand. For those of you without side hustles or businesses this will be incredibly valuable in the coming months and years.

I’ll talk about some of things that helped me build up Arb Letter and Arbitrage Andy as well as the best ways to come up with ideas for products and services.

Enjoy the long weekend.

Andy

So ironic, yet not surprising how fast the perspective on Bitcoin and cryptocurrency changes within corporations and government. Just 6 years ago Bitcoin being labeled a Ponzi scheme to now being adopted and desired by these same groups. In the grand scheme of things it hasn’t been long and there’s plenty of money to be made long into the future. HODL and don’t chase dumb shit coins.