Hey all good morning, and hope the first full week back on the horse is going smoothly.

Before we get started today — our first episode of Risk On in 2025 is live. I sat down with

former Army Ranger and fitness guru to talk weightlifting, terror attack schizo theories, fatherhood, personal finance, psychology, and more. Ox writes the top fitness and wellness Substack publication with over 72,000 subscribers.For those looking to get in better shape in the new year, hear about building a business from a young entrepreneur, or entertain some wild Las Vegas Cybertruck explosion theories it’s a must listen.

Today on Arb Letter I want talk through the theme of urgency in 2025.

Time is of the essence on many fronts but primarily in:

a.) crypto

b.) the job market (we will cover new Artificial intelligence updates today along with other pertinent data)

On the crypto front the window to own a meaningful amount of assets is dwindling, at least for major blue chips like Bitcoin and Ethereum. This cycle we are in, if history is any indicator, might have a few months left. While it’s impossible for me to predict the duration of this particular bull run, the broader economic and macro conditions present in the US and world right now should be top of mind as you consider which asset classes to invest your money in.

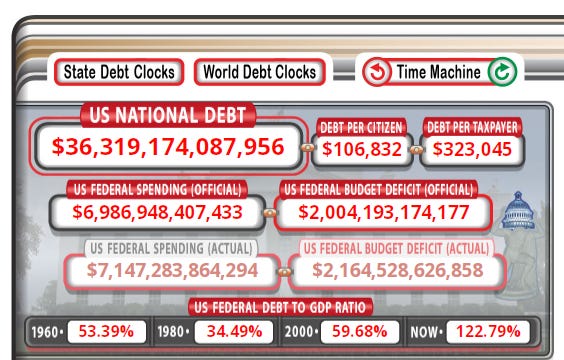

National debt is at ridiculous levels and there are no signs of spending stopping. Inflation is entrenched. Costs are up.

Homes are unaffordable for most with average interest rates on 30 yr mortgages hovering around 7%. It literally makes more sense to buy a house cash than pay nearly the cost of the home in interest over a 30 yr period.

Problem is many cannot do that and are in no position to do that down the line.

We have reached, in my opinion a new era in US and global financial markets and economic health in which this is the new normal. There won’t be any reverting occurring without a substantial black swan or financial meltdown and to be frank, I’m not even sure the powers that be would let that occur, they’d just print more money and devalue the dollar even further.

If you want autonomy, freedom, and a life past wage slaving until you’re 70 — crypto may be one of the last ways to get it.

Bitcoin ended 2024 up 121%, the S&P ended up 23%, Gold was up 27%, the Nasdaq was up 29%. Dominated and it’s not close.

On the job market front we’ve gotten at least some preliminary updates people should be aware of in regards to AGI — an advanced form of artificial intelligence that can perform any intellectual task that a human can do. Not good news for many in various careers.

Currently, AGI does not exist (though Sam Altman referenced it in his most recent blog, more on that later). Most AI today is narrow AI, specialized in limited tasks. However, companies and researchers are actively pursuing AGI, with hopes of reaching this milestone in the coming decades.

You’ve heard me talk extensively about how this is not the world you grew up in, nor is it the world your parents grew up in anymore. This is entirely new ground. Developments like AI automation, shrinking job openings, and the inflationary pressures governments continue to amplify are making it difficult to replicate tried and true strategies that worked for our parents and their parents.

Something’s gotta give and in this case — I do believe it’s the opportunity to live comfortably as “middle class” and to some extent upper middle as well.

We’re in a make it or break it time right now and things are moving fast.

We’re stepping into a year where standing still is the fastest way to fall behind. The systems that shaped financial stability for past generations are unraveling, and the opportunities that remain are shifting rapidly. Whether it’s securing assets in crypto before the window closes, navigating a job market that AI threatens to disrupt, or simply keeping pace with inflation that continues to erode wealth – the message is clear.

The middle ground is disappearing. This year is about positioning, adapting, and moving with urgency. If you aren’t planning for the next wave of disruption, you risk being swept under by it.

Crypto & Shrinking Window of Opportunity

You need to be thinking about the future — now.

Regardless of if you’re 20, 25, 31, 34 — there’s some concerning trends playing out financially and economically in this country despite the happy go lucky bull market and good vibes we have gotten accustomed to since the Covid money printer started up. The COST of living has risen and staying elevated. It’s not going to go back down.

Think about this.