It seems that the world has truly regressed in recent weeks. That’s a weak statement considering everything we have lived through in the past two years or so, but this time it does feel different. I’m not sure anyone knows what to truly believe. I myself do not, even after predicting many of the events and directions the Covid 19 pandemic took.

China and Russia are getting cozier, inflation and market indices are out of control, and the US administration seems to have absolutely no idea how to effectively navigate what is going on. Scary times. Rumors of bio weapons labs in Ukraine, Top Tier Gamesmanship in oil markets, and a raging conflict in Europe that could very well drag more countries or the entire world into war.

MARKETS & CRYPTO

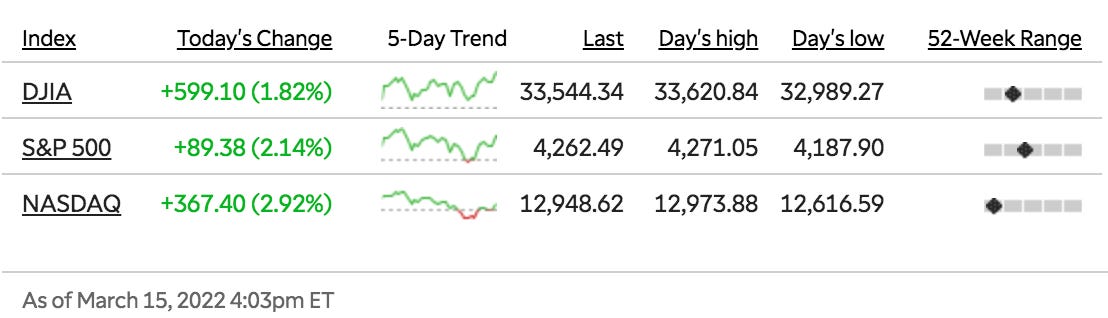

World markets seems to be in a crabby phase ahead of a Fed meeting on Wednesday to hike rates with China getting hammered hard in trading sessions last week and yesterday. Chinese stocks have gotten absolutely obliterated, mimicking the drops they saw in 2008 during the financial crisis. There are widespread concerns about the China’s ties to Russia and the recurrent regulatory pressure within the country. All eyes will be on the FOMC meeting tomorrow where we learn if we either get a 25bp hike or a 50bp hike. As far as rhetoric goes, anything other than a strong hawkish stance will likely pump all markets imho. Not financial advice.

US producer price inflation surges to nearly 10% in February, the highest annual increase on record

US government bond yields rose past multiyear highs on Monday ahead of this week’s Federal Reserve meeting on Wednesday

The US central bank is expected to begin lifting interest rates for the first time since 2018 after its two-day policy meeting, which starts on Tuesday. The yield on the benchmark 10-year Treasury, which rises when prices fall, jumped 0.14 percentage points to 2.15 per cent, its highest level since mid-2019 (Financial Times).Gold declined for a third day as commodities continued to sell-off ahead of a key Federal Reserve meeting where policy makers are set to raise interest rates (Bloomberg)

Intel announces an initial investment of around 33B Euros towards semiconductor R&D and Manufacturing in EU

Alibaba dropped about 4.7% in premarket trading after falling for the past three days and losing more than 27% over the past nine trading sessions (CNBC)

As AMC Entertainment works toward a full recovery from the COVID-19 pandemic, CEO Adam Aron has announced the movie theater chain is making a "bold diversification move" by purchasing a stake in gold and silver miner Hycroft (Fox Business).

Saudi Arabia in Talks to Price Its Oil Sales to China in Yuan (WSJ) This was predicted by a number of financial meme and anonymous pages for the record - More on this in the news section

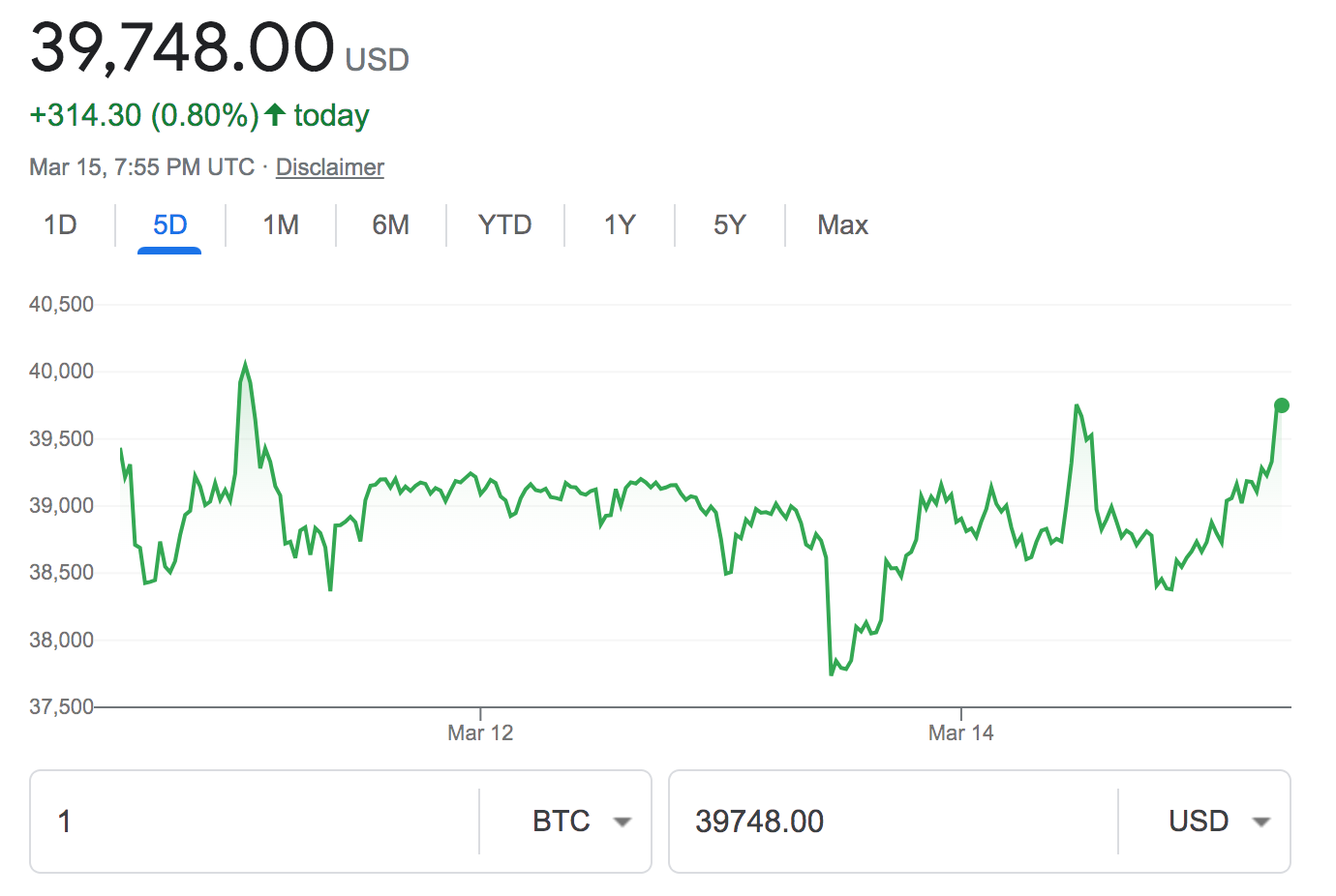

Crypto twitter has been unusually silent perhaps due to the fact that many retail and professional traders and investors alike are likely underwater at this point, with alt coins down bad and blue chips like $BTC and $ETH crabbing around annoying ranges for the last month. One thing seems obvious, crypto exchanges are growing fast, and big institutional players are allocating sizeable amounts of capital and man power to position themselves for the next pump.

I remain bullish into the FOMC meeting tomorrow and I am hoping to see further decoupling if possible. My alts remain largely underwater for the time being but they are longer term holds and always have been. I still suspect some folks have become long term bag holders by circumstance rather than choice due to poor investments. Focus on quality projects and accumulate.

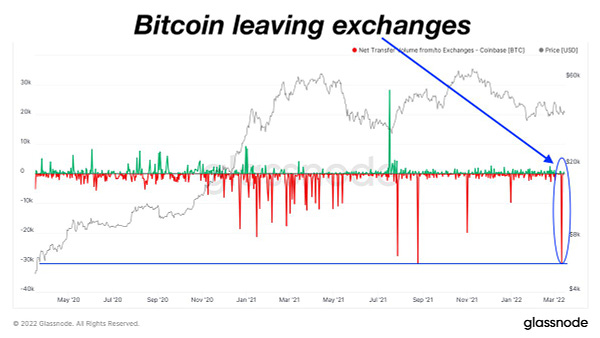

As I mentioned in the last Arb Letter the on chain and technicals of Bitcoin right now, do indicate that Bitcoin is being taken OFF exchanges at a very high rate. The implication here for anyone who doesn’t understand this is that as Bitcoin is taken off exchanges it generally indicates a longer term bullish view.

It takes time to take on and off exchange and you do suffer slower liquidity as a result of taking Bitcoin off an exchange and moving into cold storage or into a wallet. If you haven’t used a wallet or cold storage before it requires several minutes to sync, enter codes, and access/transfer assets. Something to consider, especially as we head into the FOMC meeting with anticipated hikes.

SENTIMENT

“The selloff is overdone, but so is everything else,” said Andy Maynard, head of equities at China Renaissance Securities. “The market is crazy -- there’s no fundamentals anymore. This might be worse than the 2008 financial crisis.”

"What makes me increasingly wary that the $BTC low is not yet in for 2022 is the fact that we are yet to see a capitulation style spike in volume that has occurred at all the recent lows in late 2019, early 2020 and mid-2021," Billy Yates, Analyst, wrote in his latest BTC analysis.

GLOBAL NEWS

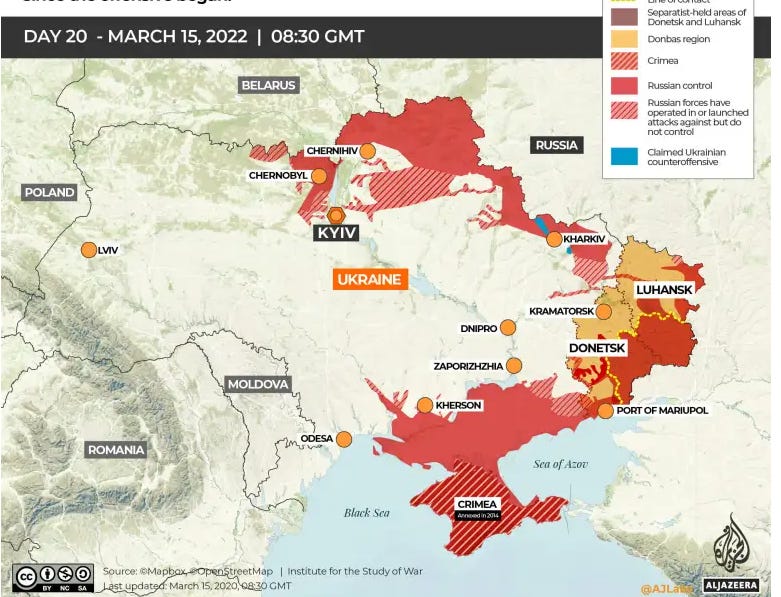

As the world continues to lay witness to some of the most significant military engagements of our lifetime, other pieces of the world order seems to be shaking loose. The Biden administration continues to deal with domestic pressure over inflation, Ukraine involvement, high crime, and supply chain woes that continue to plague most Americans. Elections are on the horizon and politicians will begin to shift views and stances accordingly in the coming weeks and months. Different countries have begun to get involved in the conflict in varying capacities including Syria, who is sending roughly 30,000 mercenaries to Ukraine to fight for Russia.

As more countries enter the fray, my fear is that we see the likelihood of this conflict growing bigger skyrocket.

Ukrainian President Volodymyr Zelenskyy recently urged Russian troops to surrender saying "we will treat you as humans have to be treated, with dignity," in his latest address.

Sen. Joe Manchin on Monday said he opposes President Biden’s nomination of Sarah Raskin, a climate change psycho, to serve on the seven-member Federal Reserve board — likely blocking her nomination (NY Post). Good.

Elon Musk, the CEO of Tesla and founder of aerospace company SpaceX, challenged Russian President Vladimir Putin on Monday for a "single combat" "I hereby challenge Vladimir Putin to a single combat," tweeted Musk

New Covid-19 lockdowns in China sent oil prices back below $100 a barrel, casting fresh doubt on a global economic expansion recently slowed down by the conflict in Ukraine, high inflation levels, and the end of the Federal Reserve’s unhinged dovish policy. Convenient that China has just announced the resurgence of Covid at a time like this.

Several journalists have been killed in Ukraine the last several weeks as reports of Russian troops firing on vans and unmarked cars grow by the day.

A Fox News cameraman and a local producer working for the network were killed Monday in Ukraine by Russian fire - details below

Sen. Richard Blumenthal (D., Conn.) said he and Sen. Marsha Blackburn (R., Tenn.) are set to introduce a resolution that would, if passed, say the Senate supports sanctioning all Russian banks--including the one that allows Russia to export energy (WSJ).

American and NATO equipment has been recorded on social media platforms throughout European countries in close proximity to Ukraine, note the camo shifting from desert to forest

Saudi Arabia is in active talks with Beijing to price some of its oil sales to China in yuan, people familiar with the matter said, a move that would dent the U.S. dollar’s dominance of the global petroleum market and mark another shift by the world’s top crude exporter toward Asia.

US Secretary of State Antony Blinken on Tuesday said there will be an independent Ukraine "a lot longer than there's going to be a Vladimir Putin," as the Russian leader continues his unprovoked invasion of the country.

"One way or the other, Ukraine will be there and at some point Putin won't," Blinken told CNN's Wolf Blitzer on "The Situation Room."

His comments come as new satellite images show widespread destruction across Ukraine, including damaged houses in a village near Kyiv and smoldering homes in the besieged city of Mariupol, where more than 2,500 civilians have died, Ukrainian officials estimate. The top US diplomat said Tuesday that the US is trying to prevent as much death and destruction as possible (CNN)

President Biden's national security adviser, Jake Sullivan, expressed "deep concerns" about China's relationship with Russia during a recent meeting with top Chinese diplomat Yang Jiechi in Rome on Monday, a senior administration official told reporters (NPR). More recently China has revamped their Covid narrative stating that many provinces have moved into lockdown recently and that daily cases have surpassed 4,000, a sky high increase from the nearly 50-100 cases per day they reported nearly everyday of the last year and a half.

I cant help but ask myself if this is a convenient second employment of a tried and true socio-economic weapon that was already used in the United States for the last two years to severely weaken the United States. Likely the Chinese are ramping up the narrative again because of their conversations with Russia. They must punish the United States supply chain to make up for the litany of sanctions being forced on Russia and her allies.

Later this week we will have a full review of the FOMC Meeting taking place this week and the subsequent market action we see as a result. We also will continue to cover the Russia/Ukraine conflict as well as we can. Markets certainly have jitters and bears are more confident than ever that we are mere inches from a recession. The S&P 500’s performance this year is in line with historical recessions for what it’s worth. I myself am a contrarian and hope to see some sort of bullish action soon, though I do admit it difficult to focus on an aspect or devlopment that is promising at the moment.