Well folks, we’ve officially entered a sustained downtrend in global financial markets as the Federal Reserve strengthens it’s hawkish approach to curtailing the devastating impact of inflation. After a year and a half of dovish policy and money printing the chickens have come home to roost. In hindsight I should’ve known that my boomer aunt coming to me and asking if she should buy Dogecoin was a sign of the top.

That or the fact that Cumcoin and Shiba were a thing, and 90% of retail on Reddit thought they were better traders than the entirety of Wall Street. Archegos, the Gamestop debacle, and Cathie Wood’s ARKK success now in retrospect present clear signs that leverage, Covid tailwinds, and the retail phenomena were all components of an insane blow off top fueled by reckless Fed printing and Pandemic market dynamics. Hindsight trading does you no good and the most effective thing you can do for yourself is evaluate the present environment and make adjustments/decisions accordingly.

We could be in for some sustained periods of pain and for many this is likely the first time they’ve experienced down only markets. It’s not fun but there are opportunities if you keep your wits about you and don’t let emotions get the best of you. Let’s talk a bit and give you some context about how to potentially help you weather the storm most efficiently. Your goal in my opinion should be to stack more cash to identify opportunities that will set you apart from peers when markets do recover.

MARKETS & CRYPTO

Stocks dumped on Friday, though to a lesser extent than Thursday’s sell off, with both days overtaking the relief bounce we saw that came after the Fed’s meeting on Wednesday. Initially Jerome Powell’s exclaimed hesitancy to pursue a 75bps hike resulted in the market swiftly pumping. That was short lived this week and gains were quickly erased in equity and crypto markets.

Swiss Bank Dukascopy Wins Approval to Offer $BTC Trading

On the recent DraftKings (DKNG) earnings call (read full transcript), CEO Jason Robbins said the company was very excited by the momentum for sports betting in California - DraftKings (DKNG) is down 53% year-to-date and is 80% off its 52-week high (Seeking Alpha)

Cathie Wood's $ARKK fund has dumped almost all of its $TWTR shares

Fidelity Investments has launched four new exchange traded funds (ETFs) that focus on three growing investment trends: cryptocurrencies; the metaverse; and environmental, social, and governance (ESG) criteria. The Fidelity Crypto Industry and Digital Payments ETF (FDIG) will not offer direct exposure to cryptocurrencies but will invest in companies that support the broader digital assets ecosystem (Investopedia)

Nvidia will be charged $5.5 million as part of a new settlement with the SEC for not properly informing investors about how cryptocurrency miners were increasing demand for graphics cards.

From what I have observed on Twitter and other platforms, sentiment is incredibly bearish from the retail crowd. I think there is some pretty emotional selling going on here. You can’t ignore macro factors and the Fed’s pivot to combating inflation, those things are having real impacts on markets but sometimes it is best to let the battlefield unfold before making any moves. I haven’t sold any crypto or equities through this downturn. I am instead focusing on increasing my cash flows to generate more dry powder for my business and for investing in given assets at some great long term levels.

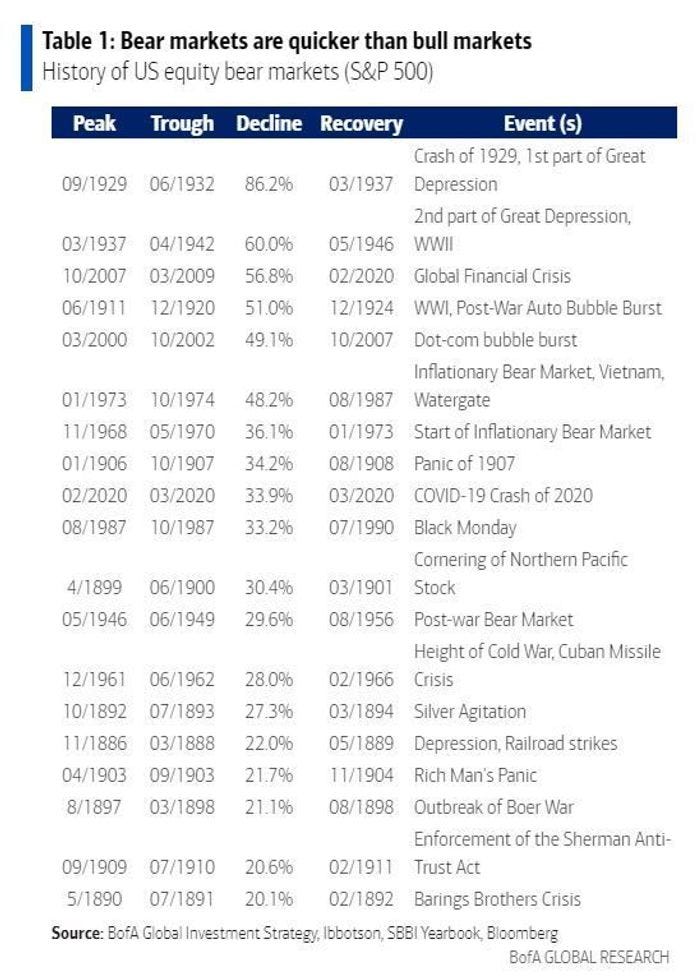

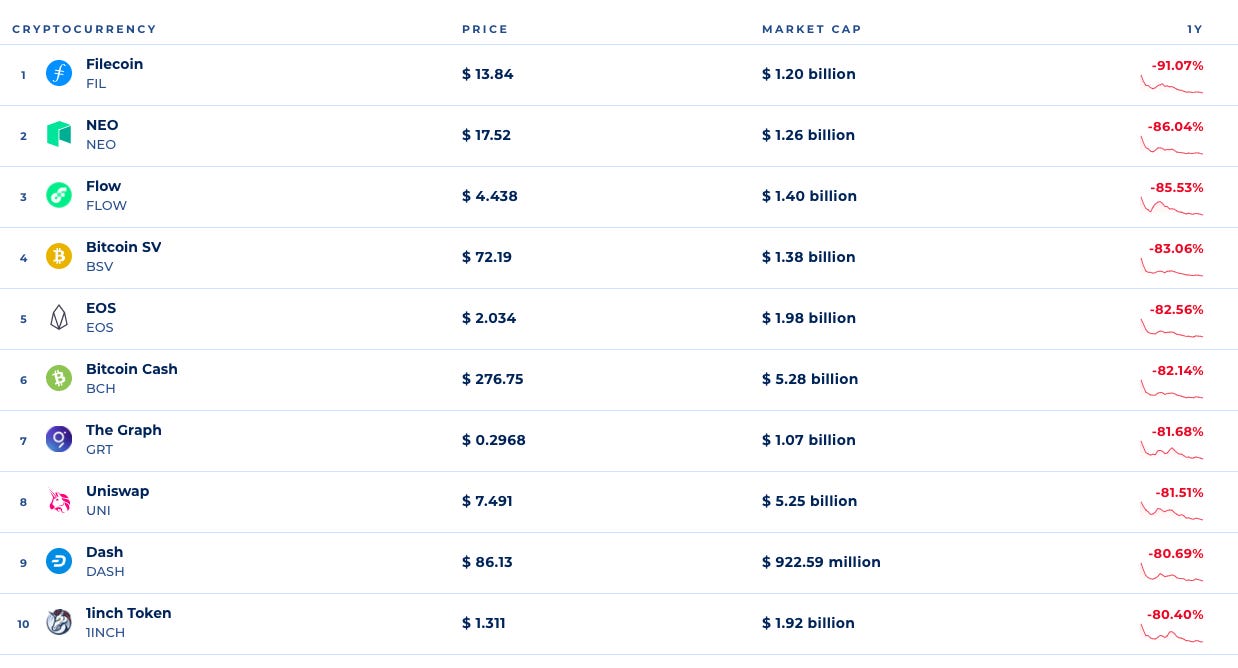

Remember, whales in any market count on weak hands selling out of fear so that they can accumulate even bigger positions, and thus influence. If you can avoid selling assets, they‘re one of your best defenses against high inflation. The ones who can weather these tough times and identify the asset classes that will emerge from this environment on top will be the new wealthy. I’m betting it’s $BTC and $ETH. Energy and Consumer Staples are likely relative safe havens for the time being. My top alt coin investment $LINK is down horrendously, down nearly 70% in a year. But so is every other alt coin. Check out the worst performing tokens/projects in the last year below:

MARKET SENTIMENT

BOFA strategists

"The solid 428,000 gain in non-farm payroll employment in April illustrates that the Fed was right to ignore the misleading contraction in first-quarter GDP,"

Paul Ashworth, chief U.S. economist for Capital Economics

Paul Kim, Simplify Asset Management CEO

Great MorningStar Article summarizing some solid stock pick candidates and consumer/GDP dynamics. Good analysis of FANG names and tech as well.

GLOBAL NEWS

The conflict in Ukraine has escalated over the last several days with US Intelligence involvement in Ukrainian counter attacks on Russian forces being openly admitted in the media by the current US administration. This is a bold move and will likely provoke Russia if it continues.

One wonders why announce something like this? Only real reason would be to drag the United States into the conflict or goad Russia to strike back more aggressively thus dragging a NATO response into the mix. It doesn’t really make sense and I think the conflict will get hotter soon.

The Labor Department's April jobs report showed a better-than-expected 428,000 non-farm payrolls returned across the U.S. economy last month

Federal regulators are limiting the use of Johnson & Johnson’s COVID-19 vaccine over blood clot side effects. You really can’t make this shit up lol.

Carbone restaurant is preparing for Miami’s big Formula 1 Grand Prix this weekend, dinners are priced at $3,000 per person.

Nigeria's airlines are to stop domestic operations from Monday in protest at the spiraling cost of jet fuel.

Ukraine’s deputy prime minister says all women, children and older adults have been evacuated from a Mariupol steel mill long besieged by Russian forces.

A leak from the Supreme Court, showed a draft opinion signaling the possible overturning of Roe v. Wade. Expect riots and unrest. The left will use this to create distractions ahead of mid terms to excuse domestic issues.

U.S. President Joe Biden pressed Congress to pass his massive $33 billion Ukraine aid package during a recent visit to the Lockheed Martin plant in Troy, Alabama - the factory that manufactures Javelin anti-tank missiles (CNBC).

The most intense battles in recent days have been taking place in eastern Ukraine, where both militaries are entrenched in a fierce push to capture or take back territory. Moscow’s offensive in eastern Ukraine has focused on claiming the industrial Donbas region, where Russia-backed separatists forces have been fighting since 2014.

The Covid narrative has taken a sudden turn with more data dumps by Pfizer and a recent announcement by Johnson & Johnson that their vaccine causes blood clots. What’s funny is the way the media and other outlets are trying to construe the news, saying the company still should give it to people with no other choice? Lot’s of doublespeak and obfuscation.

I personally know people who had Johnson & Johnson and have reported blood clots. This shit is serious folks. Everyone getting Covid I know is fully vaccinated lol. Seriously it’s wild at this point people are still eating up propoganda. On top of the J&J release the media and Billionaires who recently rabidly turned on Elon Musk for his purchase of twitter, seem to be gaslighting the populace even further as clear questions start to arise on the origins, severity, and dynamics during the Covid 19 pandemic. One thing is alarmingly clear to me now and that is that the efficacy of all of these vaccines is questionable to say the least. Covid was about power and political obedience. More on this is the next edition of Arb Letter, deserves to be flushed out. There is substantial back stepping going on. Just watch Bill Gates literally downplay the entire thing below:

This week the woke left is throwing everything they have at Elon Musk. Why are they so terrified at the prospect of free speech? The New York Times recently tried to blame him for apartheid in an article, there are rumors Google and Apple might kick Twitter from app stores, and Biden has developed the Ministry of Truth. Call me nuts but the “conspiracy” theorists are starting to sound like the only sane people in the room. This all happening in real time is absolutely absurd to watch.

SHOP LEHMAN BROTHERS MERCH DROP

Arbitrage Andy Store

Arbitrage Andy Twitter

*DISCLAIMER - None of this is financial advice, it is important that you do your own research and make your own investment decisions. I am a former trader and currently work within sales/financial technology/brand building/e comm.

Because I have built such a massive digital network building Arbitrage Andy & Arb Letter, Arb Letter looks to leverage that information and sentiment for you to make informed financial & life decisions that cut through the noise and bias of modern media and news.

Escape mutants (like omicron) are one reason why vaccine efficacy is declining, and why there's only 1 coronavirus we've ever beaten (and nature helped us on that one, lol). Failing efficacy is not a surprise to scientists, but vaccines did their job by accelerating selection of less lethal variants. The scientific and engineering feat of developing and launching a vaccine in the time they did is one of the modern miracles of medicine.

J&J failure is a reminder that vaccines have a really high threshold for success (forget your Pareto 80/20 rule... a 99/1 rule isn't good enough because people are pissed if it's not 99.9999/0.00001), and it's hard to hit that threshold for efficacy/side effects even when the virus isn't staying one step ahead. BCG (for tuberculosis) is a more spectacular failure, and the Black Plague vaccine failed because it caused too much inflammation.

Also media gets science wrong on a good day when there's no agenda. So when there's a coordinated vaccination campaign, good luck on seeing any actual science. But y'all know science isn't how people are persuaded in the first place. It makes sense from a policy perspective, even if you disagree with the policy. Not trusting the vaccine campaign because of who's pushing it also makes sense.

Great letter