Happy Saturday morning guys, good news is spring is near it would appear, at least in NYC.

Hell of a week. Nuclear war talk, crypto face melting pumps, food shortages, soaring inflation, and several high profile events directly associated with broader crypto adoption by institutions (listed below).

There’s also been a rise in haters (you only take flak over the target) and very obvious suppression/shadow banning of our content on Instagram and other platforms, which has been happening for roughly a year. As I mentioned when I started Arb Letter, all I wanted was the ability to have my content and commentary fairly and objectively viewed and received by my followers.

That unfortunately, is very much not the case right now and I continue to get anecdotes and evidence that the powers that be are trying super shady and weasel like ways to suppress us and our takes and limit our reach. Hopefully we can build it stronger here.

Thank you all for supporting Arb Letter.

MARKETS & CRYPTO

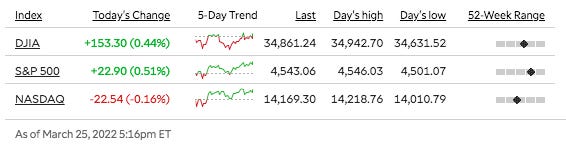

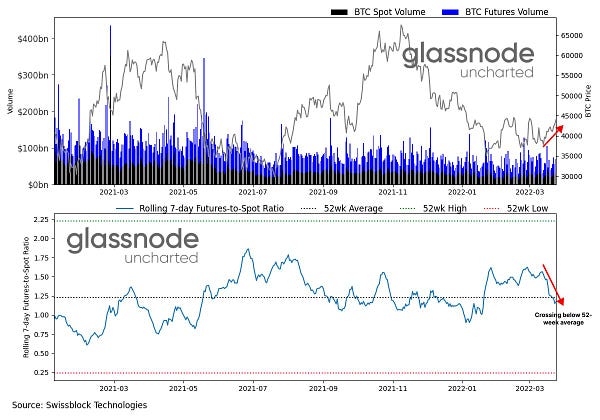

We’ve seen crypto begin to decouple from legacy markets that slowly moved up over the last week with a little bit of chop. As the world digests the Fed’s proposed rate hike schedule, certain assets have been performing very well in the face of uncertainty, including Bitcoin. Friday $BTC ranged between $44,200 and $45,500 and currently sits at around $44,200 as I type this.

In my humble opinion the amount of institutional and corporate activity we have seen in the last 3 weeks certainly suggests Bitcoin will be with us for a very long time. It has simply gotten to big to fail and look, i know I talk about it a lot, but the reality is I think it will be one of the smartest decisions anyone can choose to make in the next 10 years. Things are getting very, very bleak on the economic and fiat world order front.

US Treasury 3 Month/10 Yr Yield Curve hits 192 basis points Friday morning, which is the steepest since January/February 2017 - what the hell does that mean Andy you ask? A steepening curve typically indicates stronger economic activity and rising inflation expectations, and thus, higher interest rates. When the yield curve is steep, banks are able to borrow money at lower interest rates and lend at higher interest rates (Investopedia)

Cyrptocom is sponsoring the World Cup

Investors should look to buy FAANG stocks next time they plunge and analysts turn bearish, CNBC’s Jim Cramer said Friday. Thanks for the obvious info bro.

Israel's biggest bank, Bank Leumi, will start to offer #Bitcoin

and Ethereum trading

New York’s pension systems want to dump nearly $300 million invested in the Moscow stock market, but can’t because Russia has blocked foreigners from selling shares (NY Post).

The largest U.S. oil and gas company Exxon Mobil is using excess natural gas to mine #Bitcoin- Bloomberg

The Goldman Sachs landing page has changed to a crypto an web 3 inspired theme. Probably means nothing lol.

MicroStrategy CEO Michael Saylor says, “If you feel robbed by inflation, Bitcoin will give you your money back.”

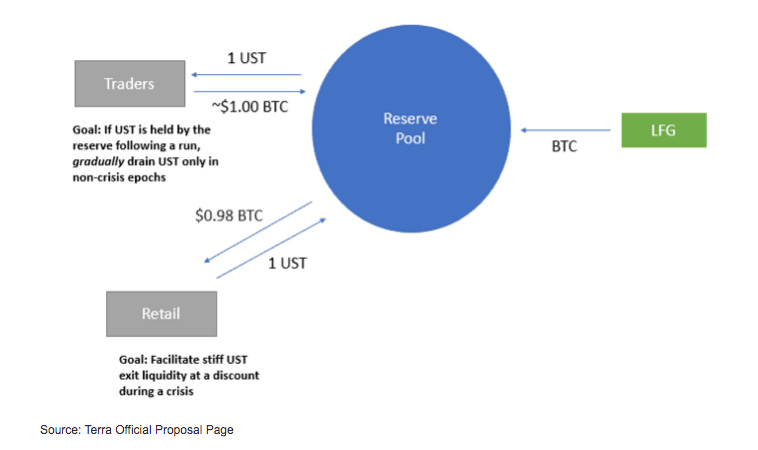

LUNA is buying around $3B worth of Bitcoin to use as reserves for their stablecoin LUNA terra. Looks like they are executing with clips of $125M spot buys. Worth noting if they succeed in this stable coin structure it will be a blue print for most institutions to get involved and use $BTC as a reserve currency.

One of the more interesting developments in crypto has been the LUNA story that unfolded over twitter over the last week. Keep in mind this is only a single buyer lol.

Do Kwon, the Co-Founder, and CEO at Terraform Labs, the company building the Terra protocol and ecosystem – put the cryptocurrency community on fire a few days ago with a single tweet.

UST with $10B+ in BTC reserves will open a new monetary era of the Bitcoin Standard. P2P electronic cash that is easier to spend and more attractive to hold (Crypto Potato)

He is literally alluding to what could be a blueprint for major institutions to be able to use BTC as reserves. This is a use case, that even my crypto reluctant friends in traditional finance have given credence to. Think about it. As a reserve asset Bitcoin is ideally suited, given it is decentralized, sound, easily transportable, sendable, and above all else: is limited.

The fact Bitcoin is finite is becoming more clear to more people in the current geo political brawl and sanction filled economic landscape we are witnessing unfold. In a world of fraud, corruption, laundering, and misappropriation, what else is more valuable? You can see the proposed structure below.

Terra has been buying in batches/clips of $125 million, and Pentoshi (one of the crypto accounts and OG’s on twitter I highly recommend following) argued that:

2.5-3k BTC per day of supply removed over a long period of time = huge impact. Those who are short have to cover higher at some point as supply itself dissipates. What is scarce, becomes more so. This clip can bring back the apes, in which Do Kwon is the lord of the Apes.

You heard him. LORD OF THE APES. ITS APE SZN BOYS.

GLOBAL NEWS

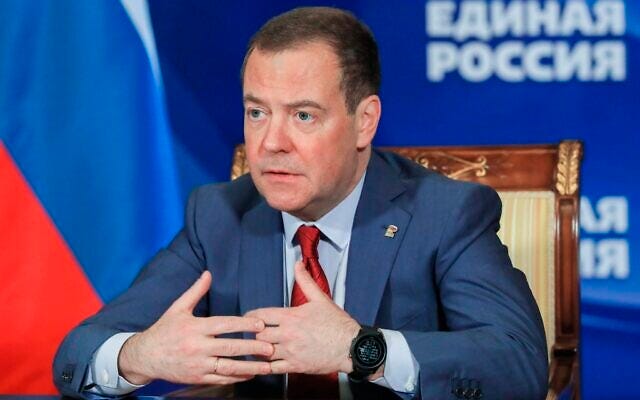

While the Russia/Ukraine conflict continues to demand the majority of people’s attention on the global scale, that’s not without reason. Events have escalated with Russian Security Council Deputy Chairman and the head of the United Russia Party, Dmitry Medvedev recently speaking to Russia’s Nuclear Strategy

Russia says objectives of the first phase of its military operation in Ukraine have largely been accomplished. Enter confused face.

Russian ex-president and the deputy head of security council Dmitry Medvedev says Moscow can choose to strike an enemy country with nuclear weapons even if it does not use such weapons first.

“We have a special document on nuclear deterrence. This document clearly indicates the grounds on which the Russian Federation is entitled to use nuclear weapons,” The Guardian quotes him as saying in the interview.

“Number one is the situation when Russia is struck by a nuclear missile. The second case is any use of other nuclear weapons against Russia or its allies. The third is an attack on a critical infrastructure that will have paralyzed our nuclear deterrent forces,” Medvedev says.

“And the fourth case is when an act of aggression is committed against Russia and its allies, which jeopardized the existence of the country itself, even without the use of nuclear weapons, that is, with the use of conventional weapons,” he adds. (TimesofIsrael).

Scary stuff. Especially considering it looks like more countries could get involved recently.

One of the most notable theaters of the Ukraine conflict is the city of Mariupol, which has all but been completely annihilated as civilians are caught in the streets with house to house fighting, artillery barrages, and roving bands of Russians. Recently I saw anecdotes of dark actions by select groups of Russian including but not limited to: Rape, executions, and theft.

A strategic port on the Sea of Azov in the Donetsk region of southeastern Ukraine, Mariupol was a chief target of Moscow-backed separatists who have been fighting Kyiv’s forces since April 2014 -- but had remained under government control. Since February 24, when Russia launched an unprovoked, large-scale invasion of Ukraine, it has been hit harder than any other big city. (RERL.org).

Some broader updates from Al Jazeera:

Joe Biden describes Vladimir Putin as a “butcher”.

Kremlin warns comments could “narrow the window” for mending US-Russia ties.

Five people wounded in missile attacks on Lviv.

Ukrainian President Volodymyr Zelenskyy calls on energy producing countries to increase output to stop Russia from using its oil and gas wealth to “blackmail” other nations.

Ukraine says it has reached an agreement on the establishment of 10 humanitarian corridors to evacuate civilians.

Russia says it is now focused on fully capturing Donbas in apparent shift in strategy.

U.S. President Joe Biden stopped in Poland on Friday to meet with U.S. troops, President Andrzej Duda and Ukrainian refugees, in a bid to signal Western unity against Russia's onslaught (CNBC).

Kim Jong of North Korea recently released a piece of state propoganda that looks more like a 1980’s action movie than anything to be taken seriously at all. Complete with his two top generals, an allegedly working missile and watches, glasses, and cool guy facial expressions. WATCH MY REMIX HERE.

OTHER NEWS

Our new website and store is live. New merchandise added, centralized media/news articles on Arb Letter & Arbitrage Andy and some additional resources and book lists.

Talk to you guys Monday - enjoy the weekend.

Andy

Make sure to follow us on Twitter:

Arbitrage Andy Twitter

Arb Letter Twitter

*DISCLAIMER - None of this is financial advice, it is important that you do your own research and make your own investment decisions. I am just a 29 year old former trader and current sales/technology/brand building professional looking to make it like anybody else. Because I have built such a massive digital network building Arbitrage Andy & Arb Letter, Arb Letter looks to leverage that information and sentiment for you to make informed decisions that cut through the noise of legacy media and news.