Safeguard Your Wealth & Prepare for 2025

361: Crypto dumps, Fed language sparks stock sell off

Happy Thursday lords.

We relaunched the Arbitrage Andy store if you want to check it out.

The market chop has arrived.

The Federal Reserve did us a solid and equity nuked markets with hawkish talk. The Dow Jones Industrial Average closed down for the 10th day in a row, the longest losing streak since 1974 and BarChart on X pointed out that S&P 500 Value Stocks have declined for 13 consecutive days which is the longest losing streak in history.

Is the top in?

Federal Reserve Chair Jerome Powell announced a quarter-point interest rate cut, lowering the target range to 4.25%-4.5%. While acknowledging that inflation has eased from its peak, he emphasized that it remains above the Fed's 2% target, which calls for a cautious approach to any future rate adjustments.

Powell reinforced the importance of measured monetary policy as the U.S. economy continues to face inflationary pressures and uncertainty. You’ll remember Adam Kobeissi of the Kobeissi Letter and I discussed this very concept (lingering persistent inflation) on our episode of Risk On earlier this fall.

The markets reacted negatively to the announcement, with significant drops across major indices, reflecting concerns about the Fed's slower pace of cuts and broader economic outlook. Powell's remarks highlighted the balance the Fed must maintain between supporting growth and controlling inflation as the country moves into 2025.

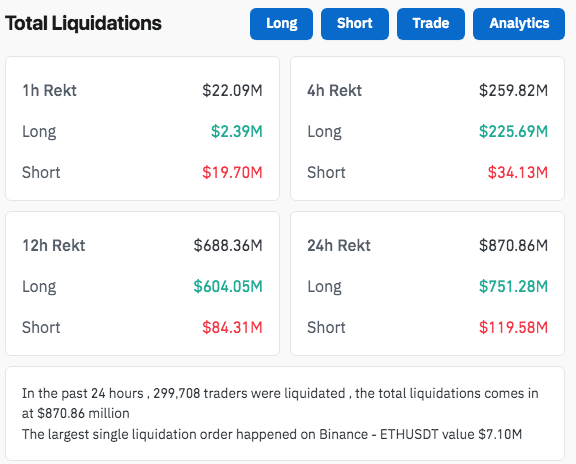

Crypto did not like this — Glassnode data shows you the amount of liquidations yesterday as of 11pm ET — not pretty for those who longed the local top.

The good times never roll forever — we were bound to cool off a bit, it’s just unfortunate that this may not just be a short term hiccup despite the supercharged last few weeks.

You’ve got to understand for some time now — really since Covid fundamentals have been nowhere to be found, we printed a fuck ton of money, rates haven’t come down on mortgages, the stock market is being propelled by a finite number of big names, the Fed has been waffling back and forth, national debt is insurmountable, the cost of things is ridiculous, the labor market numbers were fixed by the Biden administration, it’s just a huge fugazzi and yet — we keep plugging along.

People keep crying wolf about recession but it’s like we won’t allow that to happen. Can that even be allowed to truly play out? How devastating would a massive financial crisis be to the country? The world? To the security and stability of the United States. Me thinks we are wayyyyy to far ahead of our skis and there is zero chance we can regain our balance.

But hey — if the party is still raging that works.

Then you have crypto — more specifically Bitcoin, which has climbed tremendously in this macro landscape baffling skeptics and rewarding those who think there may be something seriously wrong with the trajectory of the global economy and fiat landscape. It’s a bet on the future in a time where many paradigms are changing.

2025 is going to be a monumental year on several fronts and it will be far from boring.

I think many will have the chance to become rich or transcend social class, either from crypto, selling businesses, or from smart moves in high paying careers. As far as markets go — if you aren’t already wealthy, there’s a blueprint that will help you get there. This depends on ignoring the guaranteed noise and distractions that are going to ramp up in 2025.

While others are losing their heads — you need to stay composed and abide by the basics that brought us the success we have had so far. What makes this financial and social landscape unique is that we appear to be close to major disclosures — that is, cracks so big start showing it’s difficult to hide the truth. Could be the labor market, equities, a global conflict escalating, or some sort of black swan many of us would struggle to predict right now. All I know is the psychological aspects of these events will take a toll on the majority of people, similar to the pandemic.

One group of people in 2025 will:

Get sucked into the latest “thing”

Make little progress in dead end jobs and pursuits

Display the same Do-Do bird logic with major events as they did during Covid

Not adapt to clearly shifting financial paradigms

Fall behind

The other camp of people will:

Seize the opportunity in crypto and new technology

Remain skeptical of official narratives and media viewpoints

Attack new initiatives and pursuits to hedge themselves against change

Adapt to the speed with which the global financial landscape is shifting

Pull ahead

It’s really another iteration of 2024 except on the financial front the stakes appear to be getting much higher.

We’ve got people saying the majority of the US will be on universal basic income in 10/15 years if things do not change or correct.

We’re going to cover quite a bit today including the bird flu outbreak in the US, updates on what I would now classify as true UAPs/UFO’s (NOT DRONES), equity markets, and the recent Chinese telecom hacks in the US.

In 2025, amidst the noise and chaos, crypto stands as the ultimate contrarian bet for life-changing wealth.

While traditional markets wrestle with uncertainty, blockchain innovation is accelerating, paving the way for disruptive applications in finance, AI, and beyond. With institutional adoption at a tipping point and regulatory clarity on the horizon, the next wave of growth could dwarf anything we've seen before. The question isn’t whether crypto will survive the turbulence—it’s whether you’ll seize the opportunity to be part of its meteoric rise.

Let’s get it.

It's both rebellion and conformity that attack you with success.

Amy Tan