Painful painful day yesterday in the markets.

Selling across the board.

More sellers than buyers.

US Equity markets got slammed Thursday and today’s open.

AMZN 0.00%↑ is getting murked and so is INTC 0.00%↑ .

Amid the backdrop of growing geopolitical unrest, there are murmurs of not only an incoming recession, but also drastic market swings depending on the outcome of the US election in 2024.

As of this morning Fed swaps are now pricing in three rate cuts by the end of 2024. Many traders, investors, and figures online seem to think that rate cuts automatically mean up only mode — and while opinions vary, there is evidence that this doesn’t necessarily ring true.

While Fed Rate cuts typically lower borrowing costs for things like as mortgages, auto loans and credit cards over time, it’s not a guarantee of immediate bull vibes as evidenced by the price action today.

The stock market is unlikely to soar when the Federal Reserve starts cutting interest rates. That's the conclusion of an analysis of all initial rate cuts since 1994, the year when the Fed began publicly announcing changes to its target federal-funds rate

—Barrons

The Dow Jones got pounded yesterday — down 2% by 12pm ET. Friday looks like it could be worse.

This comes on the heels of the ISM Manufacturing Index falling to 46.8, its lowest level since August 2023 (Kobeissi Letter). Geiger Capital on X added — the ISM Employment Index is now at it’s lowest level since 2020 — if you exclude Covid, this is the lowest level since right after the financial crisis in 2009. Jobs came out this morning and things are not looking good. The US Economy added 144K jobs in July vs. expectations of 176K.

The unemployment rate rose to 4.3% vs. expectations of 4.1%.

The Fed is clearly now behind the ball — one could make the argument rate cuts needed to come sooner, now they will be forced to play catch up.

In the last 48 hours:

Economic activity in the manufacturing sector contracted in July for the fourth consecutive month and the 20th time in the last 21 months

The Bank of England cut interest rates from 5.25% to 5%

Intel plans to lay off thousands of employees this year and pause dividend payments in the fourth quarter, stock crashes more than 12% after hours (Insider Paper)

SNAP 0.00%↑ is down 28% after reporting Q2 2024 earnings

Iran is expected to launch a large-scale counterattack on Israel within the next 48-72 hours

Unemployment rose to 4.3% above expectations of 4.1%

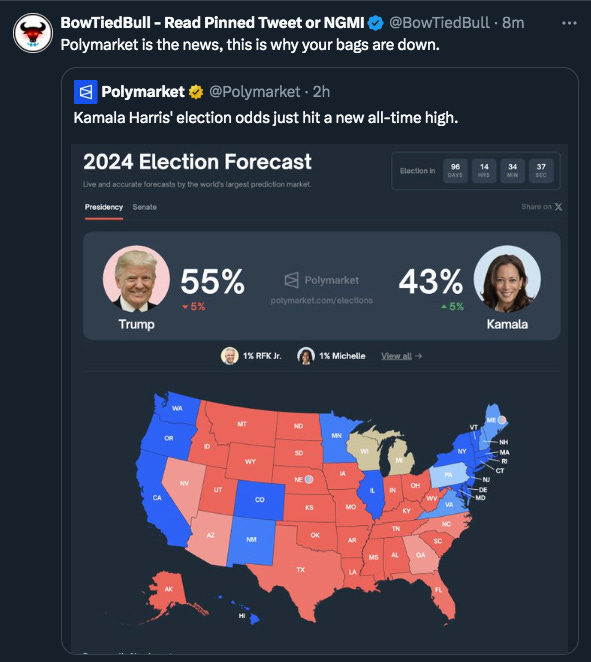

Crypto markets are increasingly taking into account the fact that Kamala SEEMS to be gaining traction — whether she actually is remains to be seen but the media machine is doing all it can to give that impression and betting odds are adjusting accordingly.

Today we will cover all of the action in stocks and crypto including some of the reasons why the market is dumping so hard.

It’s a time where many are losing quite a bit of money — but there are some silver linings depending on how you are positioned.

Fortunes are made in bear markets — and while I don’t think we are going to enter a complete down spiral, it’s worth doing a review of your portfolio and allocations to ensure you can stop bleeding in certain spots and be ready to pick up some great deals if we see further downside movement.

Question is — are we about to see a massive global dump of risk on assets as fears of a potential recession are speeding up? With everything going on politically and socially in the world the economic markets can amplify the uncertainty felt all across the globe. Not only that but blow ups can serve as catalysts for larger issues if institutions are heavily exposed to some of these assets.

Given the contentious US election approaching, the geopolitical risk events accelerating around the world, and the Fed’s lackluster fight against inflation the perfect storm could be brewing. It’s time to lock the hatches, buckle down, and lock in as they say.

Fortunes will be made and lost in the coming months and volatility is certain.

Goal of today’s guide is to give you the most concise and encompassing view at just how many red flags are popping up in markets, so you can adjust accordingly.

Let’s start with stocks — what scenarios might play out between now and next year, and some of the ways I am hedging my exposure given recent unpredictability.