Hope everyone had a great week and is looking forward to the MLK three day weekend in America.

This will be a hybrid shorter post for all subs with some relevant world and markets updates but some deeper dives on the WEF summit next week, CBDCs, and China.

Monday we will drop our paid post on our top 10 finance and investing themed books we will be reading this year.

In case you missed it we did our post and interview on the blueprint for getting rich with

earlier this week.It was our single most subscribed post of all time.

If you have some time to kill this weekend definitely recommend subscribing and reading as it is well worth it to pick their brain and see how we were able to implement their templates and ideas to accumulate assets, build a side business, and get on the right track for building serious wealth.

You can subscribe and read the post HERE.

In this post we cover:

How we found BTB - a case study

The influence they had on our success with Arbitrage Andy and Arb Letter

Their proven framework to help anybody in getting rich

My personal finance and business structures (inspired by their framework)

Why their framework is going to separate winners from losers in the next 5 years

Our written interview with BowTiedBull

Markets & Global News

We have seen some moderate relief to the seemingly endless selling that has characterized the end of 2022.

Equity markets finished the week off strong with the S&P 500 remained on track for its best week since November.

The Nasdaq finished up 0.4%. The Dow Jones Industrial Average rose 70 points, or about 0.2%.

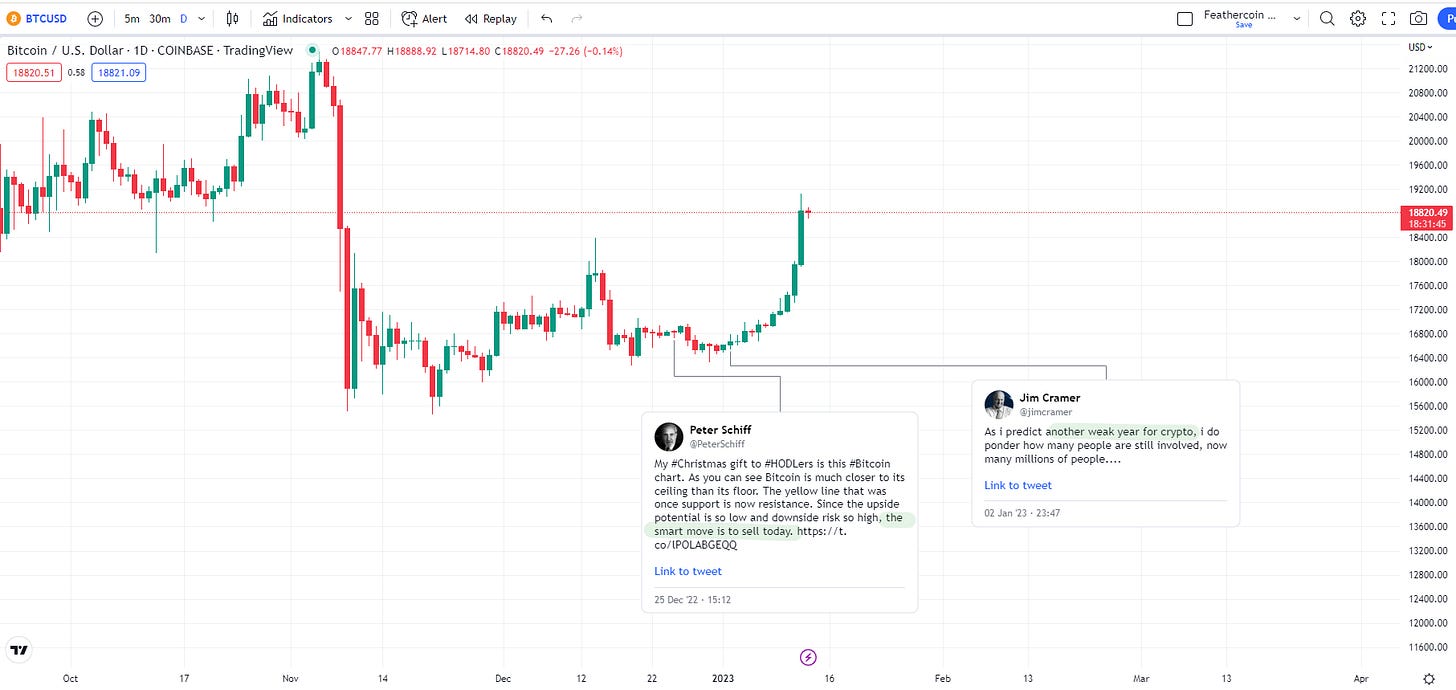

Bitcoin’s price was about $19,341.17, a change of 2.48% over the past 24 hours as of 2:54 p.m. ET. With Ethereum at

We are obviously thrilled to see some short term relief but remain skeptical of a sustained rally with macro still looking quite ugly.

Markets

The SEC charged firms Gemini and Genesis for the sale of unregistered securities this week, yet another moronic decision by the SEC

Citadel’s Ken Griffin has urged NYC mayor Eric Adam’s to make the stopping of rampant crime a priority in the new year according to the New York Post

MetaMask launched a beta program for Ethereum staking.

The gold market pushed to new session highs on Friday afternoon

More than 3,000 employees at Goldman Sachs were laid off last week, some through calendar invites that were dubbed “business meetings” Some employees showed up early in the morning to these faux meetings only to be informed they were being fired - worth noting Global investment banking fees nearly halved in 2022, with $77 billion US earned by the banks compared to $132.3 billion one year earlier, Dealogic data showed (CBC)

Bed Bath and Beyond soared 179% this week - These losses, combined with high costs to borrow shares, make Bed Bath & Beyond “one of the most squeezable stocks in the market,” Ihor Dusaniwsky, head of predictive analytics at S3 Partners said (Yahoo Finance).

In 2022 hedge funds delivered broad-based annual returns of 10.3%, according to the benchmark HFRI Fund Weighted Composite Index from Hedge Fund Research

More than $200 million in shorts (bets against price rises) have been liquidated in the last 24 hours as the major cryptocurrencies rallied (Coindesk)

Mortgage rates also jumped last week, with the 30-year rate moving up to 6.48% and the 15-year mortgage coming in at roughly 5.70%

Cryptocurrencies got a much appreciated bounce this week on a decent CPI print that many are interpreting as the first steps towards an easing in fed policy since JPOW and co. started aggressively hiking rates last year — popping the everything bubble.

Cathie Wood’s is still bullish on TSLA citing that as supply chain bottlenecks ease we should see an increase in demand. Tesla is cutting prices in the United States and throughout Europe again.

It may be worth re-examing your exposure to AI ETFs and other relevant technologies as Artificial intelligence had a huge moment in 2022.

The chatbot ChatGPT is tearing up internet band-with and interest with a scary real chat AI tool. You can ask the chatbot to come up with all sort of explanations, scenarios, and pieces. Sky-net is on the way. The tool has sparked online debates and conversations about the future of AI.

Some are of the opinion that this will be a fad that passes quickly but one thing is for sure — the technology displayed is impressive despite it’s limitations. One can easily imagine a world in which many many jobs are replaced with seasoned AI systems.

Global News

US politics are heating up with the discovery of sensitive files in President Biden’s garage and the recent drama re: house speaker that infected the Republican camp.

Vaccines and Covid policy are coming under more and more scrutiny as the CDC admits there may be a link between strokes and the vaccines. The CDC and FDA both announced further investigations and this news hit Fox, CNN, and other mainstream Western outlets Friday night.

Additionally cardiologists in the UK admitted for the first time on the news that there is likely an association with increases in sudden deaths from cardiac arrest and the MRNA shot. =

We think the Biden document scandal is odd timing as well. Similar to the Trump episode, we feel this might be an attempt to get one or both of these men out of the way for the upcoming elections but what do we know….

Germany will make a decision on sending Leopard battle tanks to Ukraine next week, a move that could exacerbate tensions

Attorney General Merrick Garland on Thursday appointed a special counsel to investigate the presence of classified documents found at President Joe Biden’s home in Wilmington, Delaware, and at an unsecured office in Washington dating from his time as vice president (AP)

New report drops indicated that U.S. military personnel reported more than 171 unexplained UFO sightings since March of 2021

U.S health authorities now say that stroke may be a side effect of the updated Pfizer mRNA vaccine. The CDC is apparently investigating. As we’ve said for an incredibly long time, this is just starting.

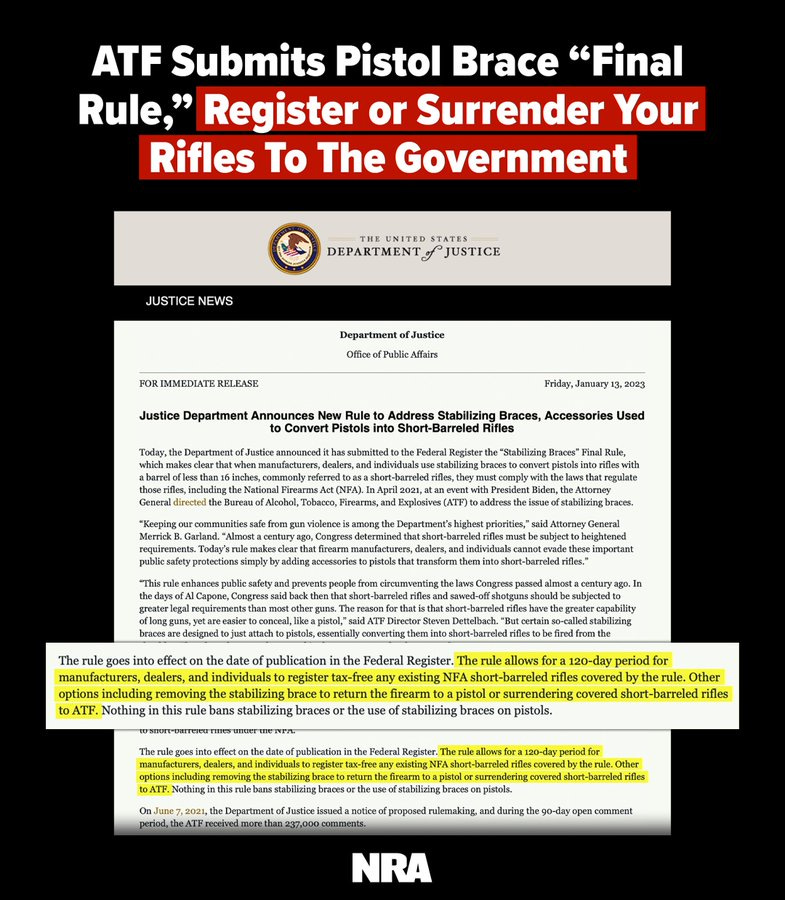

The Bureau of Alcohol, Firearms, Tobacco and Explosives (ATF) finalized a new regulation Friday that will treat guns with stabilizing accessories (pistol braces) like short-barreled rifles, which require a federal license to own under the National Firearms Act. There are tens of millions of firearms that fall under this new update. Certainly overreach and we’ll expand on this next week (Fox News)

The recent ATF ruling is strictly about registration and the government being able to monitor who has what.

But like we said more on that next week.

World Economic Forum

The World Economic Forum will hold it’s annual summit in Davos next week, though it appears attendance will be down from prior years.

It is estimated up to 2,500 delegates, 5,000 armed security professionals, and over 2,000 private jets will fly into the small town/ski resort.

This years gathering named "Cooperation in a Fragmented World" will be held from Jan. 16-20, with a varied range of panelists and keynote speakers including South African President Cyril Ramaphosa, former U.S. Secretary of State Henry Kissinger, World Health Organization Director General Tedros Ghebreyesus, U.N. Secretary General Antonio Guterres, and the actor Idris Elba (CNBC).

The World Economic Forum (WEF) was founded in 1971 by a man named Klaus Schwab, a German economist with a shady family past.

The organization is based out of Geneva, Switzerland, and its alleged mission is to improve the state of the world by engaging leaders in partnerships to shape global, regional, and industry agendas.

However in recent years the WEF has been seen as a key player in massive global controversial schemes like Climate Change, CBDCs, Vaccine Passports, and more.

The WEF holds an annual meeting in Davos, Switzerland, where political leaders, business executives, and experts from various fields gather to discuss pressing global issues and potential solutions while burning absurd amounts of private jet fuel.

Many would argue that the WEF is not inherently evil, but if we look at some of its actions and policies they certainly make the hair on your neck stand up and remind us of SPECTRE from James Bond.

Like any organization, it is open to criticism and there are varying opinions on the WEF's effectiveness and impact on the world.

The WEF's primary focus according to their leaders is to improve the state of the world through public-private cooperation.

So it is important to consider the WEF's goals and actions in any evaluation of the organization BUT we’ve seen a growing number of concerning narratives and viewpoints come out of the organization recently.

The WEF was implicated in some of the recent developments involving Dutch Farmer’s months ago that hit social media and the news cycle.

But these themes of noble causes actually being power grabs aren’t just persisting internationally.

In the US ESG related motivations have led to a hot debate about the possibility of banning gas stoves. Consumer Product Safety Commissioner Richard Trumka, Jr. walked back comments about banning gas stoves after intense online and social media backlash to the idea.

He had told Bloomberg in an interview this week that a ban was "on the table" for gas stoves, which research has allegedly linked to health problems including asthma.’

We’re not surprised our government is making more moves to make everyday people more dependent on them, if say the power were to go out or if it were to get shut off.

"We need to be talking about regulating gas stoves, whether it's drastically reducing emissions or banning gas stoves entirely…… (this) is a powerful tool in our toolbox and it's a real possibility here, particularly because there seem to be readily available alternatives already in the market."

—Consumer Product Safety Commissioner Richard Trumka, Jr

Some of the other key themes and topics to be discussed in Davos this year include:

Cost-of-living crisis

Energy crisis

Food scarcity

You can read the full pre summit report HERE.

Ironically - there is much to be had and to profit from with these crises and issues so we question the WEF’s outwardly “noble” intentions as they relate to these core issues that have been made worse by politicians and interest groups for two years now.

We’ve long been proponents to be weary of the WEF and anything they touch.

CBDCs

The World Economic Forum have been long advocates for CBDCs - newly appointed Sunak of the UK is a big champion of it and a friend of Claus Schwabs.

Check out their entire page on CBDCs.

As a refresher:

CBDC stands for Central Bank Digital Currency. CBDCs are essentially digital versions of fiat currencies, but are issued and backed by a central bank or authority. They can be considered as an alternative to physical cash and commercial bank deposits. CBDCs are designed to work in parallel with cash and commercial bank deposits, rather than replacing them.

CBDCs are digital assets that are issued and backed by a central bank. They can be used for various transactions, such as paying for goods and services, and can be held by individuals, businesses, and financial institutions.

CBDCs differ from cryptocurrencies such as Bitcoin in that they are issued and backed by a central bank, and their value is linked to the underlying fiat currency.

While CBDCs are still at an experimental stage, there are many central banks researching and testing the possibilities of issuing them in their economies across the world.

Some countries have announced plans to issue CBDCs in the near future, while others are still exploring the potential benefits and risks of issuing them. This includes:

Moving forward with efforts to introduce its central bank digital currency (CBDC) amid sanctions and financial restrictions, the Bank of Russia is preparing to offer solutions for processing cross-border CBDC payments, the Russian press unveiled (Bitcoin.com).

Proponents of CBDCs claim that there are benefits to the tools such as increasing financial inclusion, reducing costs and increasing the speed of transactions and also helping to mitigate the risks of financial crises.

But also there are risks and challenges to be addressed like cybersecurity, privacy and, a potential impact on monetary policy and financial stability.

We lean this way — recognizing that a central currency or CBDC controlled, owned, and managed by a central government is a bad bad idea that will only led to tyranny and abuse.

After all a large part of our thesis on way crypto/defi will eventually dominate the world circles around this concept of being your own bank and not being dependent on an institution or group to get your money or hold your wealth.

China

One of the largest and most important macro forces for this year will be China.

While it is difficult to predict exactly how China's economy will fare in the coming decade, as it is influenced by a variety of factors such as global economic conditions, trade policies, domestic reforms, and geopolitical developments.

In past years, China's economy has grown at a steady pace, driven by its large population, increasing domestic consumption, and manufacturing exports. However, the Chinese economy has also faced some challenges, including a decline in labor productivity, a shift away from manufacturing to services, and an aging population.

The Chinese government has implemented policies to address these new challenges, such as investing in infrastructure, technology, and education, and promoting domestic consumption and innovation.

But with the reversal of ZERO covid policy and mounting domestic political pressure on Xi, it will be very interesting to see how the country’s leaders approach key decisions on geopolitical influence, supply chains, and potential further unrest at home.

Reuters reported that the nation is working on a stimulus package worth more than $143 billion to support its semiconductor industry

"From our perspective, policymakers are taking concerted action to lift growth across all fronts…..

This is the first time since 2019 where domestic macro policies and Covid management are aligned in supporting a growth recovery, rather than acting as countervailing forces”

— Morgan Stanley recent note on China

Hope everyone has a great long weekend - we will be back Tuesday morning for paid subs!

Disclaimer - I am a 30 year online business owner, former trader and salesmen, and financial meme account brand. None of this should be considered formal financial or life advice — all views are my own opinion. You should thoroughly research financial decisions you make and know the risks involved.

We strive to synthesize and distill the best information on various topics out there combined with our no nonsense commentary on markets, politics, and life.

We’re still learning as well so make sure to drop a comment, add some feedback, or share our two cents so the community can become that much better.