Putin says Western sanctions are a declaration of war

033: Commodities rip, markets shaky as Ukraine conflict escalates

Well, after two years of a mind numbingly drawn out pandemic or plandemic depending on how you feel, we now, in my opinion could in fact see another World War. At least that’s the feeling I get as we all immaculately turn our collective attention away from the lies, deception, and corruption of our own government to a crisis that the media seems all to eager to promote, escalate, and manifest. We were at peak distrust levels of institutions, markets, and our leaders before the Russia Ukraine conflict “escalated”. Think about that because to me it just seems way to convenient. Seriously. Something is incredibly unsettling about the well manicured and curated “crisis” we are watching unfold, keep your head on a swivel.

People were fed up with the doublespeak and covid bullshit, skeptical of this administration, and getting restless. Inflation destroying the middle class, societal crime up immensely, and just general decay as a result of our policies at home and the woke culture that has permeated every corner of our country. Things aren’t good guys. I am not trying to be a doomer but you can simply feel it in the air. The sheer fuckery of everything transpiring around us. Pfizer trial data has been released if you didn’t hear and it’s bleak to say the least, but again, you likely didn’t even know that because the media has moved on to Putin and Ukraine. Like always, stay alert and don’t believe everything that you are seeing because Plato’s allegory of the cave has never been more applicable. You must ascend or be cast into the droves of normies and sheep that add to their ranks everyday.

MARKETS & CRYPTO

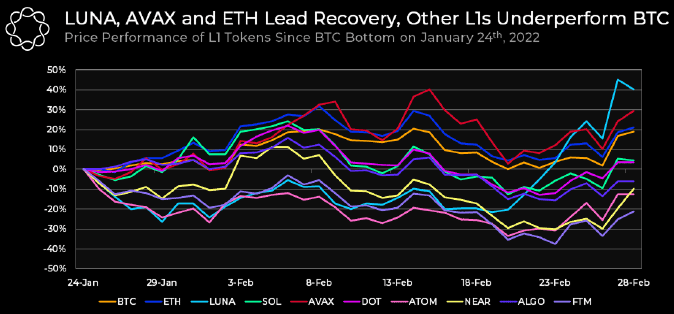

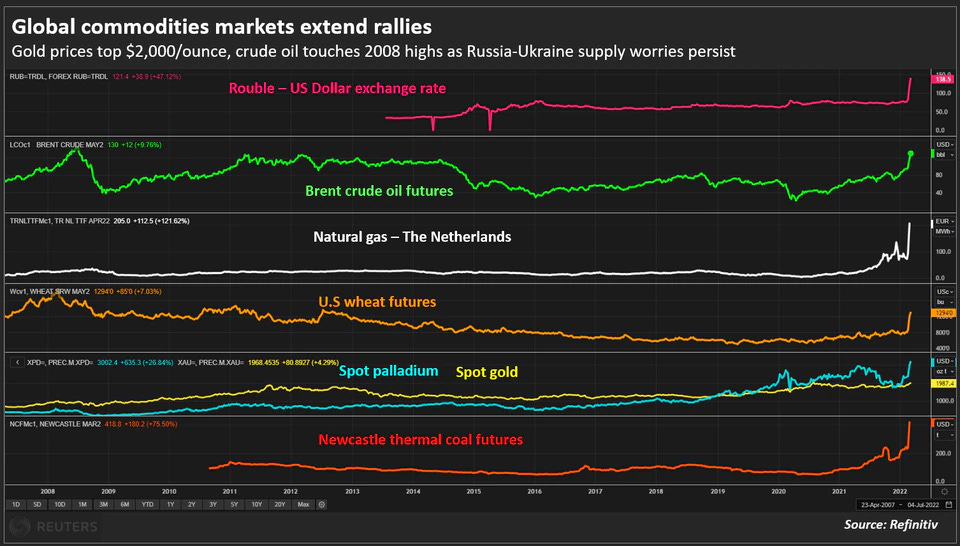

Commodity markets have reacted violently and in a manner that has preceded former recessions recently. Oil has mounted a massive comeback from it’s historically not so far away lows of -$40 to close to $125 this morning. Crypto continues to be a bit of question mark, still outperforming other assets within a shorter term time frame but looking a bit sketchy at the moment.

The U.S. said over this weekend that it and some of its European partners were considering a potential ban on oil imports from Russia.

The Russian central bank more than doubled its key interest rate to 20% - The Bank of Russia acted quickly to shield the nation’s $1.5 trillion economy from sweeping sanctions that hit key banks, pushed the ruble to a record low and left President Vladimir Putin unable to access much of his war chest of more than $640 billion (Bloomberg)

Visa and MasterCard will suspend operations in Russia. The companies issued statements Saturday saying that they will cease all transactions in Russia over the coming days.

Coinbase and Binance, rejected calls Friday for a ban on Russian users to stop their platforms from being used as a way around the sets of Western sanctions. So far both have refused complying with the request.

Brent crude oil jumps 5.7% to $124.86 a barrel early Monday morning

Chicago wheat hits limit up, rising nearly 7% to $12.94 a bushel

We have recently seen layer 1 token recover well along side Bitcoin. LUNA, SOL, and AVAX all look strong here. $BTC and $ETH are holding their levels but do look a little delicate as the world reacts by the hour to asset price chop and uncertainty.

Commodity prices went on the rampage on Monday morning as industrial buyers and traders scrambled to source raw materials hit by supply disruptions caused by Russia's invasion of Ukraine (Reuters)

Nickel soared 30%, platinum hit a record and gold broke through $2,000 an ounce on safe-haven appeal, while oil and wheat jumped to 14-year highs (Reuters)

Russia and Ukraine together account for roughly 30% of global wheat exports and 19% of corn exports worldwide.

Oil has been the focus of many economists given the volatility and recipe for disaster if certain conditions are met, namely an escalation, or decision to cut of supply from Russia into the United States.

Mark Zandi, chief economist at Moody’s Analytics, an economics research and consulting firm, said he’s reduced his 2022 US growth forecast to 3.5 percent from 3.7 percent after the Russian invasion. He’s also anticipating higher oil prices will cause the consumer price index to increase by 5.9 percent this year, half a percentage point higher than he forecast before the war. Consumer prices were up 7.5 percent in January compared to a year earlier, the fastest pace since 1982.

Oil prices are the wild card for the economy, Zandi said. If the United States and its allies stop importing oil from Russia, or if Russian President Vladimir Putin halts exports to punish those nations for sanctions, the economic hit will get much worse.

A barrel of oil, which jumped as high as $112 last Wednesday by one key measure, could vault to $150 in that scenario, Zandi said. That would cause the average gas price nationwide to shoot close to $5 a gallon and the risk of a US recession to rise with it because the Fed would have to hike interest rates more aggressively (Boston Globe).

While it has all of our attention - check out the Arbitrage Andy Oil Man Drip below.

COP HERE

OIL MAN COFFEE & WHISKEY MUG

SENTIMENT

"The stock market has been buoyed by expectations for a less aggressive Fed and lower yields in aggregate. The threat of higher interest rates has receded somewhat," said Brad Neuman, director of market strategy at Alger (Reuters).

Strategists at Citigroup on Thursday upgraded their rating on U.S. equities, which are heavily weighted in tech stocks, to overweight, describing them as a "classic" growth trade. "Growth stocks were hit by rising real yields, but should benefit as they reverse," the Citi strategists wrote in a note (Reuters).

“There’s an enormous amount happening,” said Kevin Russell, chief investment officer at UBS O’Connor, which manages $11.2bn in hedge fund assets. “There’s been significant change in the policy landscape, geopolitical instability. It’s been a tough environment for risk.” (Financial Times).

GLOBAL NEWS

As the conflict in Ukraine continues to unfold, the world has reacted with a collective level of cancellation that I don’t think we have ever seen before. Economic sanctions, Disney dropping Anastasia from their collection, sports teams being dropped, sold, and cancelled etc. As Putin digs his grave deeper, I am concerned about how rash some of his next actions will be. Netflix and a swath of American companies have halted business, payment systems, and account access in Russia.

Roughly $600B of war chest funds are basically useless as the Russian central bank scrambles to control the collapse of the Ruble and navigate costly sanctions that are impacting Russian Citizens who have nothing to do with the war. I definitely feel for them. Elon Musk also made his feelings clear recently on twitter

Surely you will see protests increase and also harsher crackdowns as Putin works to contain the bleeding consequences of his actions.

France will announced it will "suspend" mandatory masks and vaccination passports "in most places" on March 14, Prime Minister Jean Castex announced on TF1. Election is on April 10th.

According to the Ukrainian Armed Forces, on March 5, Ukraine shot down two Russian aircraft, capturing three pilots and killing one. Ukrainian forces also destroyed five helicopters and an enemy unmanned aerial vehicle (UAV).

Russia's intelligence agency has allegedly drafted plans for public executions in #Ukraine after cities are captured, via a European intelligence official

According to the National Guard of Ukraine, over 100,000 Ukrainians have recently joined the newly established volunteer branch of the Armed Forces since Russia began the invasion of Ukraine a little over a week ago.

President Vladimir Putin said on Saturday that Western sanctions on Russia were akin to a declaration of war and warned that any attempt to impose a no-fly zone in Ukraine would be tantamount to entering the conflict (Reuters). This is a notable development because of the implications it has surrounding NATO and American involvement in this conflict.

Here are the latest developments from the New York Times:

Russia’s military is trying to add to its gains in the south, moving closer to the vital port city of Odessa, as it tries to cut off the Ukrainian government from the sea.

Outside Kyiv, there have been continuous fierce attacks and counterattacks as Ukrainian forces battle to keep the Russians from encircling it. The vast armed convoy approaching Kyiv from the north still seems to be largely stalled, according to Western analysts, and the Ukrainian military says its forces have been attacking it where they can.

Prime Minister Naftali Bennett of Israel traveled to Moscow to meet with Mr. Putin, according to Israeli and Russian officials. Mr. Bennett’s office said in a statement that the meeting lasted about three hours and took place “in coordination and with the blessing of the U.S. administration.”

A third round of Ukraine-Russia negotiations to begin today at 4 p.m Kyiv time. So far they have proven to be fruitless with steep demands from Russia regarding Zelensky’ capabilities as well as pushes for a Russian stand in PM along with territorial concessions.

The Kremlin recently outlined their demands for bring this war an to end in Ukraine. They include:

Ukraine must change its constitution to guarantee that it won’t join any “blocs” which would include NATO or the EU.

Russia demands that Ukraine must recognize Crimea as part of Russia

Crimea must be recognized as a part of Russia

Ukraine must observe the eastern regions filled with separatists as independent areas

The Ukrainian people have shown incredible resiliency in the face of brutal and indiscriminate Russian attacks on occupied areas throughout Ukraine and around Kyiv. I am looking to hopefully see some kind of resolution in the coming weeks, if we don;t I fear this could devolve into a much larger conflict involving NATO or the United States. At that point in time all markets bets are off.

Let me know in the comments what you think of this wide ban against all things Russia. Do you think it will help the conflict come to a faster conclusion or do you think it poses a threat to escalating the conflict.

Don’t get chewed up trying to trade the chop! JPOW is not coming to our rescue this time unless he makes the absurd move to not hike rates. Preserve your capital and remain balanced and objective in your assessment of global macro risks to your portfolio. Sometimes the best trade is no trade.

Best of luck and see you guys Friday Morning.