Jesus Christ I wake up to get my cold brew and finish up this week’s edition of Arb Letter and I am seeing more and more chatter about MonkeyPox.

Monkeypox is a virus that causes fever symptoms as well as a distinctive bumpy rash. It is usually mild, although there are two main strains: the Congo strain, which is more severe – with up to 10% mortality – and the West African strain, which has a fatality rate in about 1% of cases. The UK cases have been reported as the West African strain. There are 9 reported cases in the UK as of May 18th (Reuters).

At this point I’d rather mob up with my boys Mad Max style then live inside again for two years or develop monkey hives. While I am on my rant, if you haven’t read the book below, I highly recommend it. You’ll rip through it. All about genetic mutation, West Africa, viruses, and crime, all circling a medical thriller esque story line. Had to read it for freshman year biology.

MARKETS & CRYPTO

Inflation continues to be the biggest theme in financial markets, this week we saw historically inflation resistant sectors like consumer goods/staples stocks take a hit.

Elon Musk continues his antics on twitter this time calling out ESG initiatives. He right about this though, ESG is a massive scam. Simply ways for companies to avoid taxes and virtue signal. There’s been an immediate institution driven backlash to Elon’s acquisition of twitter. in the past several hours it looks like the media/institutions are taking no time before launching the slander game, with accusations of sexual harassment against musk beginning to circulate.

Terraform Labs’ legal team resigns after UST collapse: Block

Melvin Capital is shutting down it’s primary fund after harrowing losses compounded from the Gamestop debacle as well as recent tech routs

Bahamas based cryptocurrency exchange FTX US will expand into stock trading

Investors wiped almost 25% off Target (TGT.N) shares on Wednesday after its profit halved, and it fell another 3.2% on Thursday morning. Walmart (WMT.N) was down 1.3% Thursday after already falling more than 17% in the two sessions after it reported weak results early on Tuesday (Reuters).

BJ's Wholesale Club (BJ.N), fell 16% this week

Pfizer CEO Albert Bourla explained Pfizer's new tech to a crowd at Davos, "ingestible pills" - a pill with a tiny chip that send a wireless signal to relevant authorities when the pharmaceutical has been digested. "Imagine the compliance,"

Ken Griffin commented on the Gamestop debacle in a live interview with Bloomberg this week. Highly recommend checking out the video.

MARKET SENTIMENT

“That looks a lot like the collapse of the internet bubble,” referring to the implosion of technology stocks in 1999 and early 2000.

Scott Minerd - Guggenheim Partners Global Chief Investment Officer

Seemingly safe haven stocks, the staples like Target and Walmart, are not immune,

Cresset Capital CIO Jack Ablin told Yahoo Finance Live on Wednesday

Our post Monday will be our second paid post for Arb Letter. We will be doing a deep dive into Hedge Fund performance in 2022, what the most popular holdings were and are for these funds, and how you can look to Hedge Funds to gleam some lessons about how to weather the volatility we are seeing in markets.

If you guys missed our first paid post, you can access it below. We did a deep dive on Terra LUNA and UST and how to avoid similar crypto ponzis. If you have to stop and think about whether $5 a month is too much to stay up to date on relevant market and global news updates, it’s probably not for you.

GLOBAL NEWS

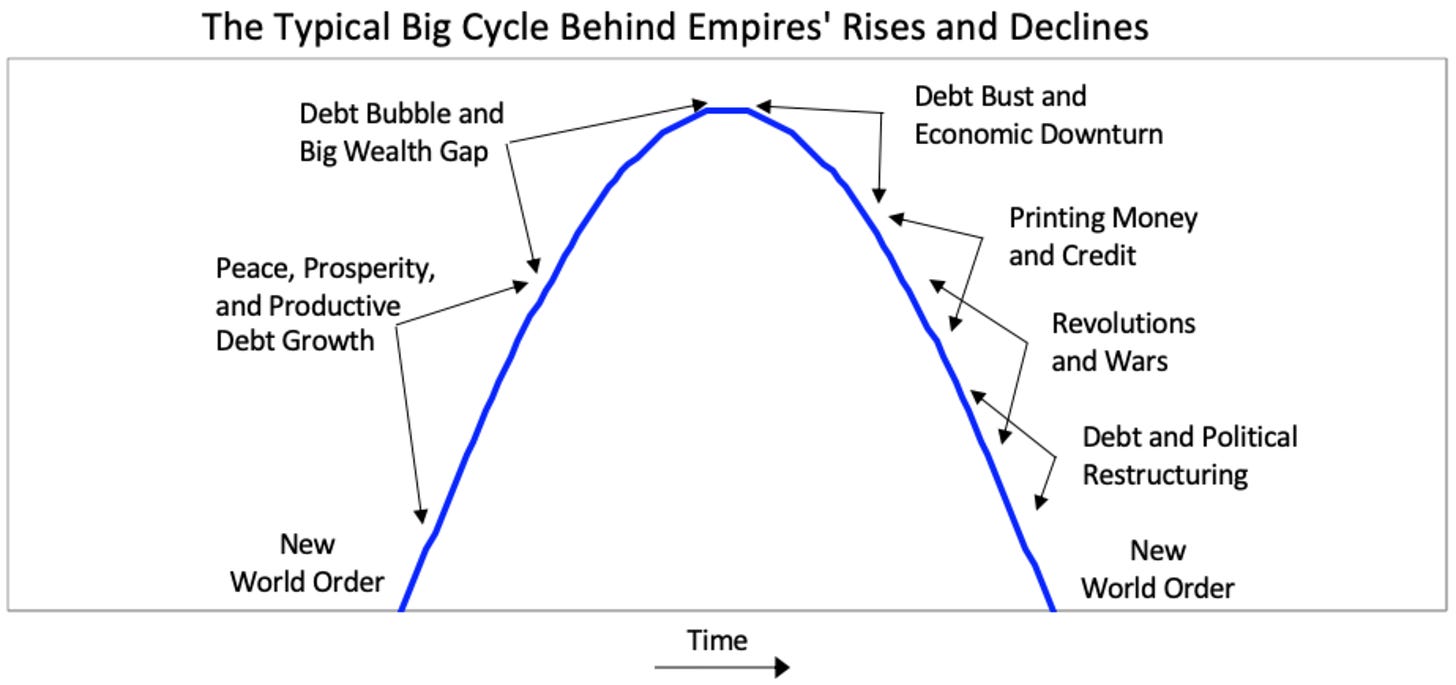

Here at Arb Letter we are students of history. In my opinion, based on the domestic situation in the United States, as well as the international conflicts that are growing in magnitude, conditions in markets, but also socially are going to continue to decline rapidly into summer in the United States. What doe that mean? Well I’ll tell you.

You can see in our Substack archive that we can incorporate history into many of our posts. There’s a reason for that. Particularly you’ll notice this in the Eat bugs, live in a pod, and own nothing edition and the more recent Guns in America edition of Arb Letter. Read through them if you haven’t as they were some of the most highly engaged reads we put out.

When we look to history we can see how similar events and circumstances that we are currently going through might evolve, transform to, or end up playing out. Similar to the markets, past performance isn’t an indicator of future success, but enough can be gleamed from history to position yourself advantageously, and that’s why I love it. At this point it doesn’t matter who helped contribute to the mess we have before us, but one things for certain, this administration has absolutely bungled literally everything they’ve touched. It’s actually insane and at this point it doesn’t matter who you support, you’re first priority needs to be yourself.

We hear a lot about the moniker - good times create weak men, weak men create hard times, hard times create strong men, strong men create good times. I think you can likely deduce where we are in that progression timeline. I’m not going to mince words in this next part because I intend to keep Arb Letter unfiltered and rooted in reality so you guys can take advantage of some of my knowledge and the items I’ve discussed with many professionals and like minded individuals.

You’d be surprised how many tips/rumors you hear when you run a 250K Finmeme Account and Newsletter. You’d also be shocked at how many people have interesting contributions to these conversations but feel stifled in the current environment.

Here are the three major risks I see in the short to medium term in the United States. These will impact almost everyone.

Political Unrest (BLM, Roe V. Wade, Elections)

Social Unrest (Food Shortages, Inflation, Supply Chain, Power Grid issues)

Financial Risk (Markets/Crypto/401K/Brokerage etc.)

These are very real. They’re not conspiracy and they certainly aren’t tin foil hat worries. What we are witnessing is the falter of the West. It’s actually uncanny how many similarities there are between ancient Rome’s fall and the USA today.

“The long years of war, however, had taken a heavy toll on the Roman Economy. Steep taxes and requisitions of supplies by the army, as well as rampant inflation and the closing of trade routes, severely depressed economic growth”

CATO Journal

Let’s start with the facts as I see them. This isn’t mean to be a negative pity parade, but whether you’re 18 or 69 these themes are going to impact you, so it’s best to flush them out and make a plan, we’ve been insulated from true conflict in the Wet for some time. Everything is cyclical in life, this is no different.

COVID19 Pandemic was a power game, I truly believe it was a social/economic man made bio weapon employed to disrupt Western economies/elections. Our own politicians abused it as a chance to increase their control, power, and concentration of wealth at the expense of us

Inflation is rampant and dire. People in lower/middle class are suffering immensely and racking up credit card debt that will ensure they never have a chance to transgress social class, own a home, etc. This will cause social unrest eventually.

Geo political foes like Russia and China are accelerating moves to counter western influence. Some bold territorial aggression as well like Ukraine/Taiwan

Vaccines are STILL being pushed on children and adults despite evidence of growing reports of side effects, recalls, and ineffectiveness. I respect everyone’s decision on this but imho at this point the push is laughable.

Socially, people are anxious and on edge. Go out and order food, go shopping, look at servers/people, observe. Many have been mentally defeated by the massive Psy Op campaign over the last two years. Can’t say I blame them, it’s been incredibly difficult and I don’t know how some people are getting by.

Politicians, undoubtedly motivated by self preservation, are supporting a focus in attention to distractions from the awful state of affairs in the US, whether this is mass shootings, Roe V. Wade, Ukraine War coverage, Racial issues, etc. They want you distracted and divided while they continue to rob the treasury, knowing full well the end (or some large revolutionary/shift/reform) is near.

Food shortages and supply chain woes continue. Honestly out of all of the above, this is the scariest. At this point I genuinely don’t know if most of these are naturally occurring or intentional. You look at something like lack of baby formula, food processing plant fires, or Bill Gates buying farmland and it just doesn’t feel right.

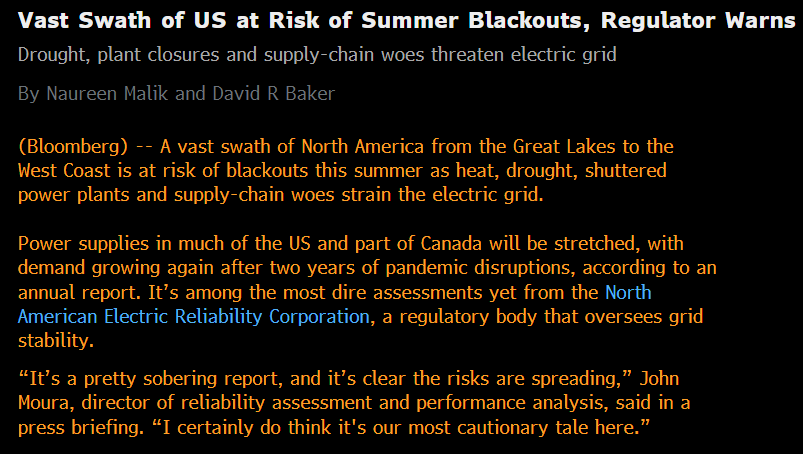

Power Grid/Energy Crisis instances could become common this summer for a variety of reasons. When the power goes out all rules go out the window.

For me, the single biggest shift I have observed socially in our domestic population is the decline of institutional influence. Roughly 50% of the country wants MORE government involvement in their lives (handouts, stimulus, mandates, wokeism etc.) and 50% is pulling away hard from institutional involvement in their lives and actually moving back to the basics. Work/Life Balance, family, business, and freedom. Note that you could be a liberal or republican and fall into either group. It’s not so much about politics in my opinion as much as it is about how you live your life and the values you have.

Self governance and independence are what I seek. The ability to care for my family and loved ones, protect them physically, earn without a boss, become financially free, get more time back, move to a place with more space where it’s easier to be mentally healthy, and just generally become a self sufficient lord (run a business, gardening, working out, etc.)

Why? Because, hopefully now you see just how fragile our reality and government is. They don’t have your best interest at heart guys and various groups have been working for probably 25+ years to degrade and weaken the fiber of what made America so formidable. They don’t give a shit if you work in a cubicle in a crime ridden city for 30 years with 2 promotions paying 50% tax for useless wars, money laundering schemes, vacation homes, and foreign countries, all while they hoard baby formula. This doesn’t have to be a political thing guys, it’s just the facts of how our current government interacts with 98% of the population.

They’ve shown you their hand, they don’t care at all and have sold out to foreign interests a long time ago. Do something for yourself and your family. Understand with hard work, ownership, and grit, you can overcome this 2022 dynamic, just as your ancestors did through hundreds of years of war, strife, and conflict. Get tougher. I promise you, you’re going to need to be in the coming years (reminder for myself as well).

Hope to see you guys Monday for our paid post on Hedge Funds.

A great civilization is not conquered from without until it has destroyed itself from within.

Ariel Durant

1) will read Chromosome 6 cuz why not BUT Robin Cook is a terrible author (read Coma years ago)

2) check out Strauss-Howe generational theory if you haven't already done so

Back 👏 test 👏 your 👏 statements 👏

Why are you writing a finance newsletter with no actual data? Look at the way markets have reacted to past pandemics and wars and base decisions on that. Fear mongering and emotional investing don’t lead to outperformance.

The conspiracy theory stuff is lol. Farmland: have you heard of FarmTogether? AcreTrader? Farmland is a good portfolio diversifier and 31% of american farmland is owned by investor groups. Is continued financialization of asset classes good for society? Maybe yes maybe no, but 600 years of financial history says it will continue either way.

Think of it another way, Imagine you are Bill Gates’ family office CIO. You have $125bn in AUM. Where do you park it? Treasuries? Stocks? Bonds? Even a diversified portfolio is still a whale position. Bill Gates reportedly owns 300k acres of farmland. The US has 911 _million_ acres of farmland. So Bill Gates’ CIO takes a $500M position in farmland for diversity, and it’s only a 0.3% position of AUM, and only 0.04% of the US farmland and you think that’s material?

What is your research process, actually?