Ponzis, Size Lords, and Sell Offs

046: Arb Letter - Equity & Crypto Market Losers and Potential Opportunities

Well folks another week of volatility comes to an end. We had a seismic crypto meltdown, some more bloody tech selling, and the crypto equivalent of Margin Call with the LUNA God Dump.

Excited to announce Monday will be the launch of our first paid post. As I have shifted my overall online efforts to building Arb Letter, we have received overwhelming demand for more content and commentary. We put a great deal of effort and time into sourcing and organizing the deliverable each week and given the demand and expressed willingness from subscribers to pay for access to more granular content, we’ve settled on this launch.

Monday’s paid post will be a deep dive on the LUNA/TERRA debacle, how to avoid ponzis, and it’s implications for current crypto investors. Free subscribers will continue to receive one Arb Letter per week with our basic aggregated market updates and global news round up.

Paid subscribers get access to another paid post each week that will include focus pieces, extra resources on discussed topics, and more Arb Letter content with signature commentary plus the ability to comment and interact with the community. This is where we will eventually launch our interview series as well, focused on traditional markets, finance, and other business/life figures.

Times are turning turbulent, but that’s the perfect time to ensure you are getting real and down to earth intelligence on markets, life, and global developments to position yourself in the best manner possible. Cutting out the noise is vital.

For the cost of a watered down Venti Iced Coffee per month you can get all relevant market & global news updates in one place delivered to you in an unfiltered and relatable manner.

Join 12,000+ Investors, traders, salespeople, tech kings, bankers, and others.

MARKETS & CRYPTO

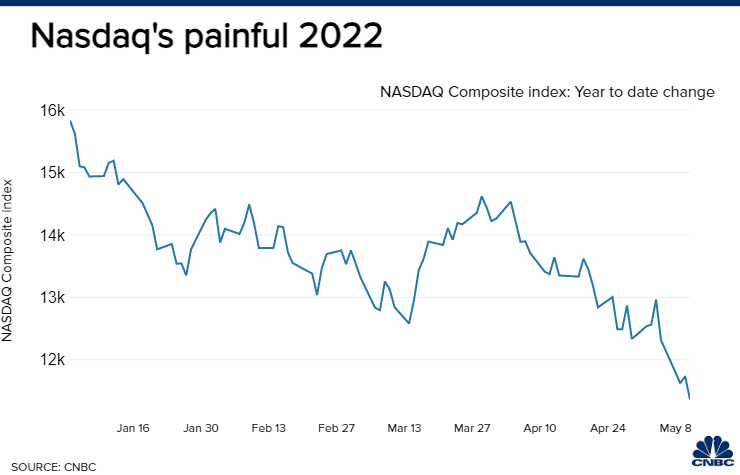

U.S. stocks dumped Thursday as the indices moved back and forth between gains and losses, struggling to come back from a recent losing streak caused by continued inflationary pressures and fresh worries that the Federal Reserve's hawkish efforts may be more aggressive than anticipated in the coming weeks and months. Tech stocks continue to see heavy selling pressure, with a small relief bounce today.

Apple has been passed up as the world’s most valuable company by Saudi Aramco.

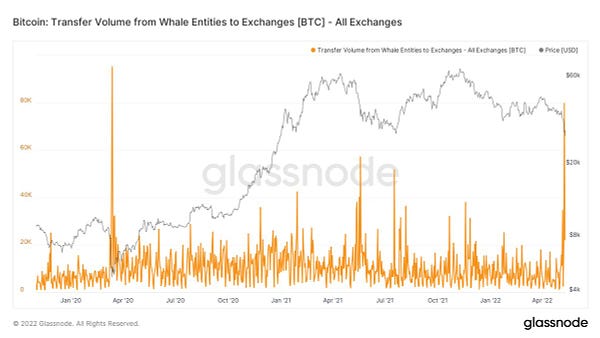

Bitcoin and crypto markets continued their violent sell off Thursday morning with $BTC trading between $25,500 and $29,000.

Terra validators decided to halt the Terra blockchain yesterday to prevent potential governance attacks following damaging $LUNA inflation and a significantly reduced cost for entities to attack.

The sell-off in cryptocurrencies yesterday was incredibly violent, it absolutely deleted more than $200 billion from the market. There are worries of broader contagion effects on the market given the inclusion of BTC as collateral and VC Exposure to Luna.

Crypto exchanges in the US appear to be suffering more of a downturn than their global competitors. Trading volumes at Coinbase have steadily fallen since the beginning of the year, while more internationally focused Binance saw an uptick in volume last month (Bloomberg)

The world’s largest asset manager, Blackrock, and hedge fund giant Citadel Securities denied claims that they had a role in the mega dump of terrausd (UST) and terra (LUNA).

Elon Musk this morning said he is temporary halting his deal to buy Twitter for $44 billion

Chase Coleman’s Tiger Global tumbled 15% last month, pushing its 2022 losses to 44% and wiping out nearly all of its gains since 2019, according to Bloomberg News. Its biggest holdings as of the end of 2021 included JD.com, Microsoft and Sea Ltd, which are all down double digits this year. (CNBC).

Ethereum has been holding up around a decent historical level on the ETH/BTC pair.

Seems now could be a good time to potentially stack ETH ahead of the merge later this year.

Down bad? Let me know in the comments which projects/tokens/assets have been the most painful to hold through this downturn. While drawdowns suck, I am particularly focused on identifying which assets will stand the test of time over the next several years.

MARKET SENTIMENT

“Inflation appears to be entrenched within many areas of the economy and regardless if we have witnessed inflation peak, a persistently slow grind lower will be more problematic for the Fed to simultaneously cool inflation without tipping the economy into recession,”

Charlie Ripley - senior investment strategist at Allianz Investment Management

“If you owned growth stocks this year - like we did at Altimeter - you got your face ripped off,”

Altimeter Capital’s CEO Gerstner (CNBC).

“We are aware of a recent story that suggested Gemini made a 100K BTC loan to large institutional counter-parties that reportedly resulted in a selloff in LUNA. Gemini made no such loan”

Gemini

“Rumors that we had a role in the collapse of UST are categorically false. In fact, Blackrock does not trade UST”

Blackrock

GLOBAL NEWS

Natural-gas prices in Europe moved higher Thursday and Friday after Russia unveiled a new set of sanctions on energy companies that could further threaten supply across the continent. Oil is up on the day and there are discussions of additions to NATO. Tension is growing between Russia and Sweden/Finland. The United States is now openly admitting to aiding Ukraine in strikes on Russian targets.

Ukraine's foreign minister said Friday that his country is willing to engage in diplomatic talks with Russia to unblock grain & food supplies and reach a political solution for the war in Ukraine but won’t accept any ultimatums

Ukraine has managed to drive drive Russian troops away from the second-largest city of Kharkiv in the fastest advance since Russian forces moved away from Kyiv and the northeast region over the past month. Moscow has continued bombarding villages north of Kharkiv.

US Defence Secretary Lloyd Austin spoke to his Russian counterpart Sergei Shoigu on Friday, calling for an immediate ceasefire in In the Ukraine, Reuters reported.

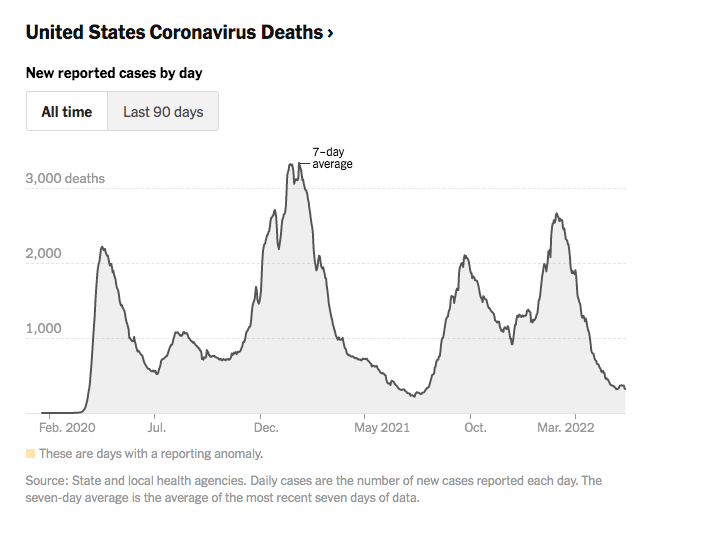

President Biden, anticipating the milestone of one million American lives lost to Covid-19, said in a formal statement on Thursday that the United States must stay committed to fighting a virus that has “forever changed” the country (NY Times)

ANNOUNCEMENTS

I’ve mentioned it several times before but BowTiedBull, formerly known as Wall Street Playboys, have been one of my biggest influences and quasi mentors since I got into finance, sales, e commerce, and crypto/equity investing.

Regardless of who you are or what you do, their information and style of writing can benefit anyone and I highly encourage you to check them out. If you’re looking to get more out of your life and get better - they’re the ones that can help supplement that growth and help you see through the fog of modern society.

Arbitrage Andy Store

Arbitrage Andy Twitter

*DISCLAIMER - None of this is financial advice and should be construed as such, it is important that you do your own research and make your own investment and life decisions. I am a former trader and currently work within sales/financial technology/brand building/e commerce. These are my OPINIONS & COMMENTARY.

Because I have built a sizeable digital network building Arbitrage Andy & Arb Letter, Arb Letter looks to leverage that information, contact base, and sentiment for you to make informed financial & life decisions that cut through the noise and bias of modern media and news.