Happy Friday everyone.

Hope everyone is surviving layoffs and managing to get through some of these tougher times economically, socially, and mentally.

A lot going on right now.

I hope everyone has a great weekend! It's important to stay informed about market updates, so make sure to catch up on any news you may have missed.

Additionally, take some time to get some physical exercise in, whether it be going for a run, hitting the gym, or simply taking a walk. Lastly, don't forget to spend time with your loved ones and family. It's always important to make time for the people who matter most in our lives.

MARKETS

Early Friday morning, Dow Jones futures decreased slightly, while S&P 500 and Nasdaq futures experienced a slight decline - likely due to Intel's poor financial performance and recently released outlooks.

Gold prices remained relatively stable on Friday, as investors waited for the release of U.S. inflation data later in the day, to assess the Federal Reserve's position on additional interest rate increases.

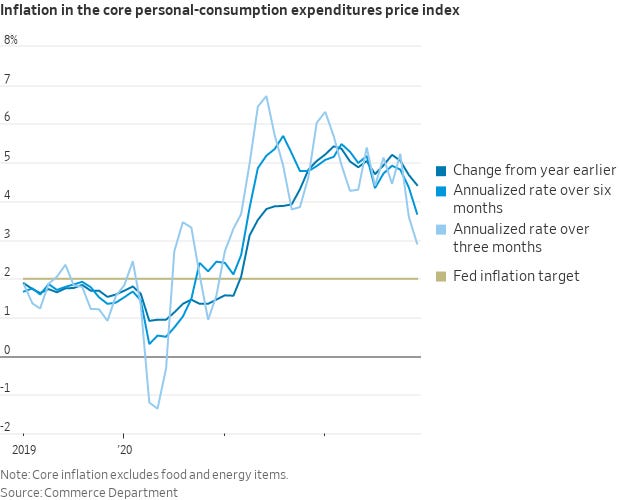

Investors are currently looking forward to the release of U.S. personal consumption expenditure (PCE) data, which is the inflation measure most favored by the Federal Reserve and the one that could have a meaningful impact on where the markets go in the short term.

*****U.S. stocks opened lower Friday morning as investors digested data and results from the Federal Reserve's preferred gauge showing signs of inflation slowing.

Citadel has made $65.9 billion for investors since Griffin launched his hedge fund in 1990. The firm made $16B in 2022 for investors - the largest gain in hedge fund history.

Intel's financial results for December revealed substantial reductions in the company's revenue, profit, gross margin, and forecast, both for the quarter and the entire year. The report was not well received by investors, causing the stock to drop by over 9% in after-hours trading, despite the fact that Intel did not reduce its dividend.

CVS and Walmart will cut Pharmacy Hours as a staffing shortage Continues - WSJ

Bed Bath & Beyond says it has defaulted on a JPMorgan loan

According to an annual report by LCH Investments (Institutional Investor) Chairman Rick Sophers, hedge funds incurred losses of $208.4 billion in the worst year for the market since the 2008 financial crisis. Almost 9% of those losses can be attributed to one hedge fund firm, Tiger Global, run by former size lord Chase Coleman.

The stock prices of companies within the Adani Group fell for a second consecutive day after Hindenburg, the short selling firm, disclosed its short position in the conglomerate's companies, highlighting multiple allegations against the conglomerate's companies, saying the group has "engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades." (CNBC). Bill Ackman says the (Adani Group) allegations are likely 'highly credible,' and compared them to those of Herbalife

Home sales in the US have now fallen for 11 consecutive months (Unusual Whales)

ASML, a Dutch manufacturer of chip equipment, expects to see a significant increase in revenue in 2023 as the semiconductor industry anticipates a resurgence of growth in the latter half of the current year

US Natural Gas Storage is about 5% above 5yr average

According to Bloomberg a greater number of Americans are struggling to keep up with their car payments than during the financial crisis. In December, the percentage of subprime auto borrowers who were at least 60 days behind on their bills increased to 5.67%, surpassing the crisis peak of 5.04% in January 2009.

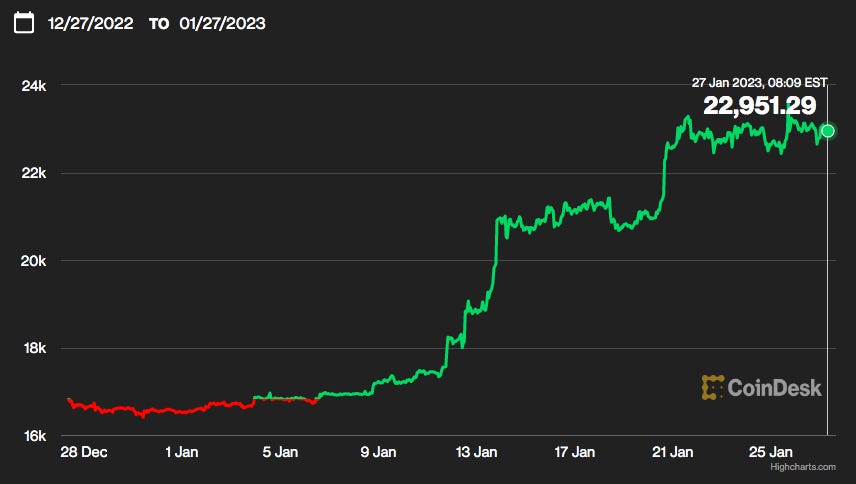

Bitcoin and Ethereum have had some solid runs in the last several weeks leaving sidelined traders and blown out retail investors a bit anxious about a broader move up.

According to CoinDesk Bitcoin’s price is $22,921.17, a change of -0.71% over the past 24 hours and Ethereum’s is is $1,572.76, a change of -2.46% over the past 24 hours, as of 8:26 am ET.

We are long our traditional allocations of BTC, ETH, and LINK with some MATIC exposure.

At a high level - I think it’s incredibly impressive we have managed to claim back these levels shortly after the FTX debacle has played out — I would’ve thought that would end up being a much larger detriment to sentiment and price recovery for some time.

We’ve seen some resiliency from select alt coins including Solana, Matic, Link, and others.

Solana (SOL) is aiming to regain its position among the top 10 cryptocurrencies by market value, currently trading at only a 25% lower price than before the collapse of FTX. Following the massive scandal involving Sam Bankman-Fried, we saw Solana’s value dropped nearly 70% as the market rejected the crypto for it’s links to the ponzi fraudster.

In yet another instance of corrupt politicians leveraging their positions to insider trade, the Pelosi’s made a strategic dump of Google stock before a major negative news event.

Nancy Pelosi sold $3 million of Google stock a month before the DOJ announced they were suing them over

According to a report filed with the House, Pelosi sold 30,000 shares of stock in Alphabet Inc, the parent corporation of Google, in three separate transactions between December 20th and 28th, 2022.

Each transaction involved the sale of 10,000 shares and was valued between $500,001 and $1,000,000, resulting in capital gains of more than $200. The total value of the trades was between $1.5 million and $3 million. Taken together, the trades involved 30,000 shares and between $1.5 million and $3 million of assets (Fox Business)

TRADES WE ARE IN RIGHT NOW

Currently I am long tech with some QQQ 0.00%↑ and TQQQ 0.00%↑ call options to hopefully benefit from some short term relief fueled by the signs of easing inflation and the relatively stagnant nature of macro chaos right now. These are mostly YOLOs to take advantage of a potential violent swing up.

I am picking up more Intel (INTC), Nvidia (NVDA, Advanced MicroDevices (AMD), and other dividend stocks like 3M (MMM) and AT&T (ATT).

We are sitting on our hands at the moment for crypto but will likely be adding some more MATIC, LINK, and ETH soon if the broader pump seems like it will continue into February.

Market Sentiment

"Closing In on the Peak: We expect the Fed to step down to a 25bp hike. The FOMC is unlikely to signal the end of the tightening cycle, but softer data flow over the next six weeks should move the Fed towards a pause"

—Morgan Stanley

GLOBAL NEWS

The War in Ukraine has reached a stalemate, with both sides unable to gain a significant advantage. However, there is much discussion about providing Ukraine with armor and tanks to mount an effective defense as spring arrives. The White House signaled a move to also provide Ukraine with M1 Abrams tanks.

This would enable the Ukrainian military to better defend against the Russian-backed separatists, who have been accused of using heavy weapons in the conflict.

Some experts argue that providing Ukraine with more advanced military equipment could help to deter further aggression from Russia, while others warn that it could escalate the conflict. The situation remains complex and the international community is closely monitoring the situation.

Other European countries like Norway and Poland - who have the same German-made vehicles - will also be allowed to make similar donations after Berlin gave them its permission (BBC).

We expect a larger Russian offensive to continue once thawing and warmer weather arrives and there are initial reports of a large amount of Russian troops massing once again at the Ukrainian border.

Global inflation seems to be cooling, with the US showing signs of slowing. The annual increase in prices slowed to 5% in December from 5.5% in the prior month and a 40-year high of 7% last summer, according to fresh government data (MarketWatch).

It is difficult to predict what will happen in the short term financial markets, there are several macroeconomic factors that could impact it such as inflation, China's economic policies, and other global economic events. These factors can lead to increased volatility in the markets. As an investor, it is crucial to be prepared for this volatility.

One way to do this is by saving money for black swan events and to make sure you are set if you lose your job or have issues with cash flow. Monitoring any volatile investments you may have is a good idea - set stop losses and a point where you will cut bait on losers if large updates come to light.

Additionally, staying on top of global news events will help you stay informed and make better investment decisions. This will ultimately increase your chances of success as an investor in the long run and hopefully position you to come out on top when we see profound bull runs again.

For now it a game of survival and it is anyone’s guess what the next big event will be that will shake or pump markets to Valhalla.

Germany has confirmed it would send 14 of its state-of-the-art Leopard 2 battle tanks to Ukraine after weeks of intense pressure. The Leopard 2 is a German main battle tank (MBT) of the third generation, developed by Krauss-Maffei in the 1970s. It was put into service in 1979 and superseded the Leopard 1 as the primary battle tank of the West German army.

A state of emergency was declared in Auckland over severe flooding this morning

According to Bloomberg, the recent new plan being considered by the FDA would involve healthy adults receiving a single dose of the Covid-19 vaccine each fall, while children, elderly individuals, and those with compromised immune systems would receive two doses.

On Thursday, the Detroit Lions announced that former linebacker Jessie Lemonier died. He was 25.

A Judge has ordered the immediate release of Paul Pelosi attack body-cam footage and Paul Depape testimony

The former Prime Minister of Pakistan accused the former President of Pakistan of plotting his assassination

The Russian Foreign Minister says BRICS is preparing to launch new common currency.

Belgium will provide Ukraine with 92 million euros in military aid.

An FBI agent who had initially investigated the Donald Trump Russia collusion has been arrested for colluding with Russia this morning

Ford has recalled 462,000 vehicles for rear camera display failure (Reuters)

On a quick side note……

We’re excited to announce our markets and geopolitics podcast will debut soon.

We will keep you guys appraised of the launch date and we are busy working on content and proof of concept for how we want to run it.

Super excited to launch this new piece of the Arb brand.

Stay tuned.

Pfizer Bombshell

If you missed it a bombshell video dropped from the investigative guerilla reporting team at Project Veritas. Regardless of how you feel about them or their methods, one cannot deny that the revelations uncovered in their recent videos is alarming and shocking.

It all but confirms that Covid was likely man made — contrary to what the great Tony Fauci claims and has continued to claim for 2 years.

Within the video there are some shocking discoveries. Pfizer is actually considering altering vaccines to change their function and attributes in order to effectively front run the need for vaccines (that they obviously would provide).

Basically setting the forest on fire to generate a need to put water on it. Watch the whole thing to see how truly absurd things are at Pfizer.

Jordan Walker - Pfizer Director, Research & Development Strategic Operations MRNA, spills the beans on dangerous experiments being conducted at Pfizer and on discussions internally to potentially make moves to mutate the virus themselves so that they can make vaccines for different strains AHEAD of time.

Truly fucked.

When confronted by Veritas about his statements on what he thought was a Grindr date, Walker goes crazy attacking the Veritas crew and smashing an iPad in desperation. No doubt the smug scientists realized in an instant his career is over and no company will likely hire him ever again.

You can find that video on Twitter, it is some of the wildest footage we have seen and honestly looks more like Snooki losing her shit at the Jersey Shore House than it does a desperate and outed man realizing his life is over in more ways than one.

He’s probably going to be sued by Pfizer as well for divulging company secrets.

At this point in time the video is the most watched video in all of Project Veritas history surpassing nearly 12.5M views.

“It appears that they are recapitulating exactly what was done at the Wuhan Institute of Virology”

— Dr. Robert Malone on the Veritas Videos

Google and other outlets are already suppressing the videos and have scrubbed the internet of this man’s presence completely. There is essentially ZERO coverage of these damning videos by the mainstream media.

We know from the twitter files released earlier this year that Pfizer and other companies were in constant communication with execs at Twitter to suppress tweets and content related to vaccines and efficacy.

Needless to say — a lot has changed and been brought to light in re: to the pandemic, vaccines, and the mandates that were forced on us for so long. I hope people realize how sinister and f*cked this stuff was so that it doesn’t happen again in the future.

I will see paid subscribers Tuesday for a mega update on crypto, where we think it will go in 2023, and what projects/tokens to make sure to avoid if you care about your money being preserved.

Enjoy your weekend kings and lords and I will see you all Tuesday morning.

Disclaimer - I am a 30 year online business owner, former trader and salesmen, and financial meme account brand. None of this should be considered formal financial or life advice — all views are my own opinion. You should thoroughly research financial decisions you make and know the risks involved.

We strive to synthesize and distill the best information on various topics out there combined with our no nonsense commentary on markets, politics, and life.

We’re still learning as well so make sure to drop a comment, add some feedback, or share our two cents so the community can become that much better.

What platform generated the AI girls?