Hey guys, hope the week is going well. Today is the anniversary of D-Day. Worth taking a few moments to reflect and consider the sacrifice made by the greatest generation to liberate Europe. The men of that era embodied qualities that are extremely rare to find these days and their efforts stand in stark contrast to the corruption and softness of the current era.

Today we’ve got a classic post outlining the facts you need to be up to speed on in markets and global news.

I will outline some of my current plays in equity markets and touch on expectations for crypto as we get into the full swing of summer.

Financial Markets

Markets are continuing to pump hard — Nvidia surpassed $1,100 and has since let off some steam. Meme stocks like AMC and GME are pumping once again despite endless halts that quickly lead to short lived sell offs.

The total cumulative Spot Bitcoin ETF flow has surpassed almost $15 billion USD as funds and institutions continue to buy this week

According to MacroEdge there have been 18,301 job cuts this month

Credit card delinquencies have surpassed pre-pandemic levels and continue to rise. Severe credit card delinquencies, those 90 days overdue, have now climbed to 10.7% — the highest since 2012, per CNN.

Mexico's peso has fallen over 2%, hits seven-month low against US Dollar (Spectator Index)

Federal regulators made a deal allowing them to proceed with antitrust investigations into Microsoft, $MSFT, OpenAI and Nvidia, $NVDA, in the AI industry, per NYT/Unusual Whales

A group of investors in Credit Suisse Group AG bonds that got wiped out when UBS Group AG rescued the bank in a Swiss government-brokered deal are suing the European country in a US court (Bloomberg)

Shares of Bitcoin miners such as Stronghold (SDIG), Core Scientific and TeraWulf (WULF) climbed more than 15% this week. Gains in Iris Energy (IREN), Mawson (MIGI), Cathedra (CBIT) and Argo Blockchain exceeded 10% (CoinDesk)

Equities

Gamestop, as we called out over a week ago, has begun it’s second leg higher, potentially rallying around news that Roaring Kitty has scheduled a livestream for June 7th, 2024 GME 0.00%↑

This was obvious if you understand the Gamestop phenomenon at all, you have a bunch of degenerates who are intent on sticking it to “the man” and you surely have an absurd amount of fuckery on the institutional side. Anyone short is in a dangerous position right now.

One of the dynamics to keep an eye on with Gamestop is the sheer amount of call options RoraringKitty owns — if he chooses to exercise them before the June 21 expiry I am reading that there are quite literally not enough shares available.

On paper Roaring Kitty is now worth over $580 Million dollars.

If Gamestop hits $69/$70 he becomes a billionaire.

Pretty wild considering he started with $50,000.

On the equities front I am placing one of my tried and true strategies for changes of administration.

With the highly partisan US election approaching I have aped into a handful of call options on several names that jumped after the Trump trial case concluded.

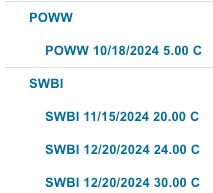

These include Smith & Wesson SWBI 0.00%↑

Ammo Inc. POWW 0.00%↑

Strum Ruger co. RGR 0.00%↑

The thesis is simple.

You can see the legs of this play I have above. $30 is aggressive for Smith & Wesson but hey I am willing to send it as i expect unprecedented chaos in the winter. Other names you could dabble in include Vista Outdoors, Olin, and the company that makes bodycams for cops (forget the name starts with a “T”).

As social unrest climbs in the next several months we will see gun and ammo stocks appreciate. Not only do will people scramble to buy firearms for self defense but we may also see some panic buying if the Biden regime gets cocky and decides to try and roll out further 2nd amendment restrictions if they think a second term is locked in.

Guns are cyclical and there is heavy institutional ownership of a few of the names, so while I see the outcome as binary — either these turbo pump or they remain mostly flat an will give me a chance to cut if I feel like things are calmer/or Trump could actually win.

Again - degen play but wanted to share here.

As of now the primary allocations in my brokerage outside retirement accounts are NVDA 0.00%↑ AMZN 0.00%↑ MSFT 0.00%↑

I keep it simple.

I have a few hail mary calls on TLRY 0.00%↑ and FEAM 0.00%↑

Crypto

This week Robinhood announced a $200M deal to purchase Bitstamp. We’re seeing quite a bit of renewed flow volume into the Bitcoin ETFs and I suspect as soon as the Ethereum ETFs go live ETH is next up to turbo pump to the $5,000 to $6,000 range (easy trade).

Full transparency I have swapped most of my APU back to ETH as I feel it’s more valuable right now, however I still hold all of my PEPE and have a nice bag. By now you should have realized PEPE is highly correlated to ETH movements. If ETH goes on a turbo run when the ETFs live I expect most ETH based meme coins to rocket.

My best piece of advice right now is to remain patient.

We have not yet entered the mania phase of this cycle. When we do, it will be almost impossible to pick the wrong crypto asset. Everything will turbo send and you will wish you had spent more time allocating.

People are severely underestimating the impact the ETH ETFs will have on the space AND they are underestimating how much Bitcoin is being bought by the big institutions — when the dust settles Bitcoin is going to put in a rapid violent move upward and that’s when I suspect the masses begin to flood in. This week the Franklin Templeton CEO said the next wave of adoption will be the very large institutions.

In the short term (leading into this weekend) I think we could see some more chop and coiling, CoinDesk reported today that Bitcoin spot selling on exchanges is weighing on prices with a built up of short derivatives positions around the $72,000 level.

A potentially more dovish Fed and the elusive rate cuts people have been wanting could change the tide and give crypto the fuel it needs to enter the next pump phase.

Central banks in the developed economies have started easing monetary policy, with the ECB and the Danish central bank both cutting benchmark rates by 25 basis today being the latest examples (CoinDesk)

I remain turbo bullish on crypto although my small position in Gamestop is entertainment enough on the equity front.

Next week I will put out a crypto centric post that maps out exactly which insitutions and funds are active and what moves they are making this year. This should give us a good sense of the scale of adoption moving into the second half of the year.

Geopolitics & Global News

As the world prepares to watch the US presidential election play out, several conflict regions are having new catalysts added to them that might increase the chances of all out war — particularly Ukraine.

Donald Trump ally and associate Steve Bannon must begin his 4-month sentence for his contempt of Congress conviction before July 1, a judge ruled today

Israeli media report that the country is set to be placed on a UN 'black list' of states that violate children's right (Spectator Index)

The New York City Police Department is preparing to revoke former President Donald Trump's license to carry a gun, a senior police official told CNN (CNN)

A Polish soldier has been stabbed to death by an illegal migrant at the Polish border wall with Belarus (Visegard24)

Russia to are set to begin Air and Naval exercises in the Caribbean Sea in the upcoming weeks as warships & aircrafts head to Cuba.

Health experts are warning of a new sexually transmitted fungal infection (TMVII) that has been detected in New York City — the first case in the US, (NY Post)

A new study suggests that COVID vaccines might be partly responsible for a rise in “unprecedented” excess deaths in Western countries over the past three years, (NY Post) - Insider Paper

US to send new $225 million military aid package to Ukraine (AP News)

France is set to transfer Mirage-2000 fighter jets to Ukraine (Spectator Index)

Biden Shits Himself in Normandy?

On the heels of an unusual piece by the New York Times, that called out Biden’s age and diminishing focus, it seems that even the legacy media and left leaning outlets are at the point where they simply cannot keep playing the defensive game for Biden anymore.

Biden has once again made a fool of himself in Normandy for a June 6th honorary event for D-Day. Surrounded by WWII veterans Biden shakes Macron’s hand and then proceeds to either squeeze one out in a half squat or look for an invisible chair. Shortly after his wife led him out of the event.

I feel sorry for the guy at this point — politics has been put above decency and nobody has the gall to simply say that he is physically incapable of doing the job anymore. It’s a liability — especially with Kamala lurking around looking for her big chance to shine if Biden goes kaput.

Keep eyes out for a late switcheroo from the Democrats — my eyes are on Newsom.

If you missed my thoughts on the Trump trial — you can find that post below. It’s spicy and for paid subs only.

Russia

In yet another concerning development in Europe — it was confirmed this week that the Biden administration signed off on the use of american weapons for strikes inside of Ukraine.

The New York Times has reported that Ukrainian officials have confirmed the country's military is now using American weaponry strikes on the Russian city Belgorod.

Biden clarified this as best he could in an interview by saying the green light was given for “border areas” but the Russians reacted predictably, escalating rhetoric instantly.00

Putin, alluding to the use of nuclear weapons this week, told international reporters and journalists, ““For some reason, they believe in the West that Russia will never use it”

Reacting to the news that the Biden administration is providing Western weapons for strikes inside of Russia, Putin remarked:

“If they consider it possible to deliver such weapons to the combat zone to launch strikes on our territory and create problems for us, why don’t we have the right to supply weapons of the same type to some regions of the world where they can be used to launch strikes on sensitive facilities of the countries that do it to Russia?"

I’ve said it before — but the entire conflict in Ukraine seems to be a sandbox for our politicians in DC who seem to be doing everything they possibly can to piss of Putin and risk escalation. Germany has signed off on these strikes from Ukraine as well and German media has been making warnings to it’s citizens about a potential future war, going as far as to recommend where to hide in the event of a bombardment.

People love to mock or criticize those of us who warn that WWIII is fast approaching. What they don’t understand is that we have literal morons running our international relations and diplomacy. The risk has never been higher because we have individuals who are making decisions based on emotion and self interest as opposed to logic and pragmatism.

I will see you all Tuesday.

Have a great weekend. Make sure to follow us on Twitter and Instagram for updates on markets tomorrow.

Gemini Crypto Sign Up

Arbitrage Andy All In One Link

Arbitrage Andy Twitter

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before investing and ensure you have a good understanding of your personal risk tolerance.

Great that you added the Gaudreau brothers at the end. It is tragic and he was one of the better representations of the NHL. I will miss watching him play but feel worse for family he left behind.