Good morning ladies and gentlemen. What an insanely volatile week both in markets and in global news/developments. I am mostly long right now in both equities (where I have taken a beating) and crypto. While there is certainly an argument to be made that we will see more selling I like to think the market has priced in anything but all out combat in Ukraine.

For now I can live with that risk. Friendly reminder and definitely not financial advice but, in times like now when you can get emotional about positions and volatility/chop, I find the best move is often time to sit on your hands. Everyone’s situation is different but this strategy has served me well, especially when I focus my efforts on just making more cash/fiat and working to build while we stay in the trenches.

Be careful out there and realize that anything can happen in an instant. I have decade low confidence/trust in market stability, institutions, and government actions.

MARKETS

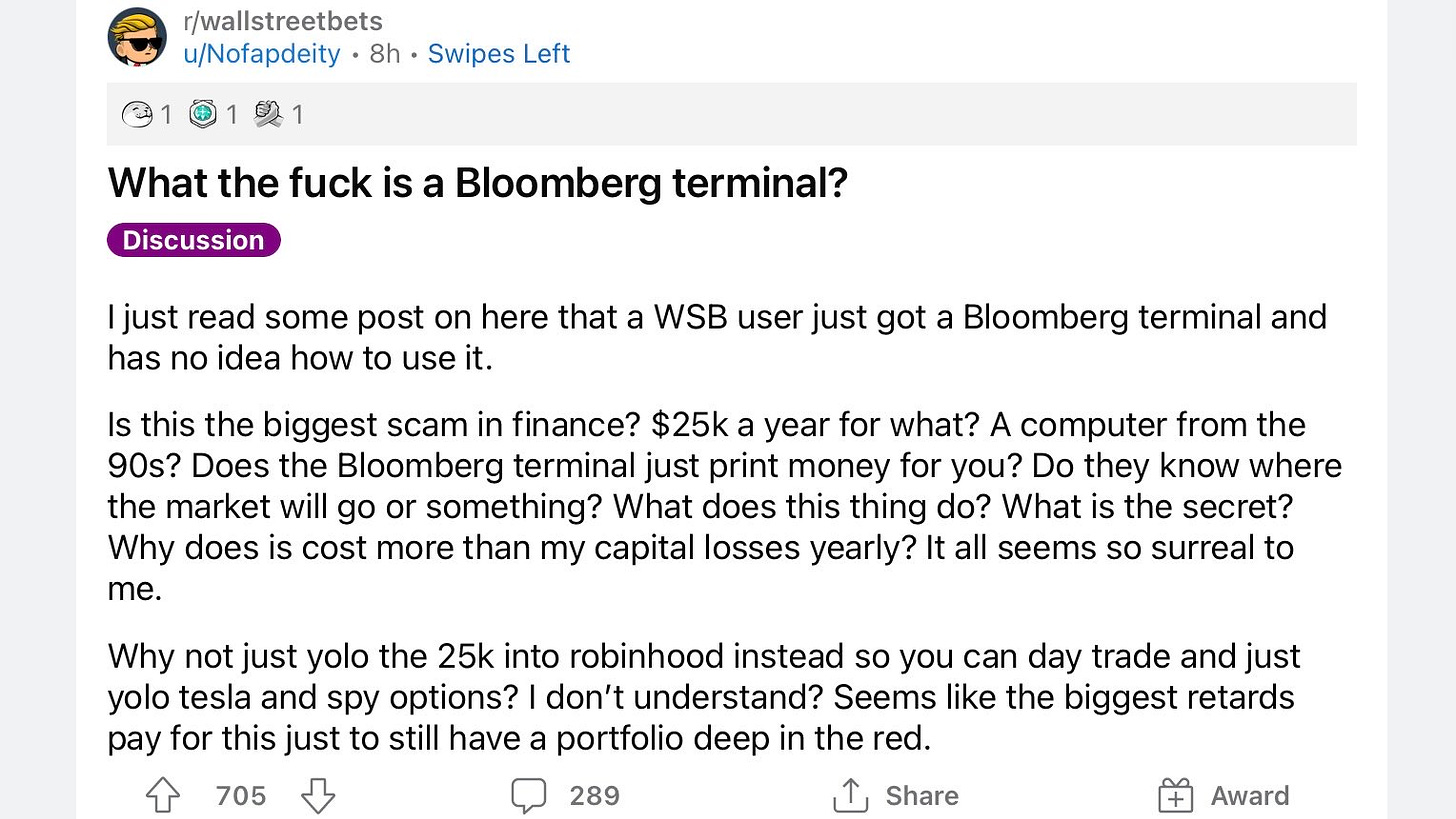

U.S. stock market futures were higher in early morning trading Wednesday after the S&P 500 closed in correction territory amid escalating tensions between Russia and Ukraine. Retail investors continue to be devoured by this incessant chop as evidenced by the Wall Street Bets photo below, clearly there is mounting frustration now that markets are not on easy mode.

Climbing mortgage rates are hitting potential homebuyers and refinance candidates hard. Total mortgage applications decreased by about 13.1% last week to their lowest level since December 2019, according to the Mortgage Bankers Association (CNBC).

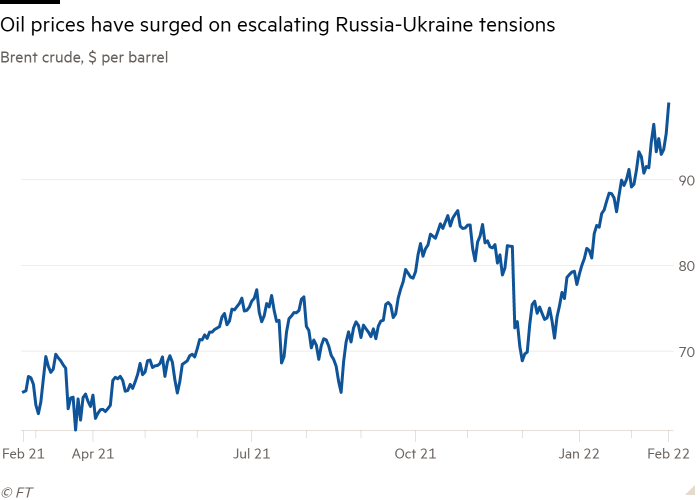

Oil prices are swinging in dramatic a manner, with the recent peaks pushing close to $100 a barrel, escalation Ukraine could impact this drastically in hours

$AMD, the chip maker, had market cap that surpassed rival Intel’s on Tuesday during trading. AMD market cap surpassed $188B compared to Intel’s $182B

The Trump SPAC Digital World Acquisition Corp. (DWAC) rose in trading on Tuesday after former President Donald Trump's new social media app named Truth Social launched this past weekend. The app saw over 170,000 downloads on the app store in the initial 24 hours of launch

The Biden administration said it is making moves to set aside about $450 million from the Bipartisan Infrastructure Law this year towards the goal unclogging U.S. ports.

INDUSTRY SENTIMENT

This is a new section we want to include to give you an idea of how leaders in the financial space synthesize their thoughts and ideas on current events. Let me know in the comments if you like this, happy to continue doing it for Crypto and Global News sections as well.

“There was some optimism among investors we spoke to as the White House’s Russia sanctions were not as sweeping as originally expected, but our sense is that this saga is far from over and most of our contacts expect both additional sanctions in the days ahead as well as a targeted legislative package,” wrote BTIG’s Isaac Boltansky (BNN Bloomberg)

“There is still an overhang of doubt regarding Russia’s intentions and how far they plan on going with this process, but for now the expected case is what has happened as opposed to anything more than that,” wrote Brad Bechtel, global head of FX at Jefferies LLC (BNN Bloomberg)

CRYPTO

While crypto has been closely correlated to tech stock and equity movement recently, my theory is that as macro tensions with Russia ease it will decouple once again. Sentiment on Financial and Crypto Twitter/Social Media is extremely bearish at the moment. Surely most retail traders are down at this point and holding sizeable bags. I say this because the same happened to me in 2017.

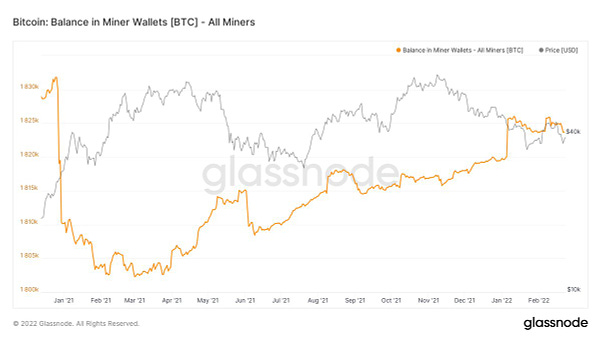

Bitcoin and more generally crypto, in my experience, can tend to make big moves when participants are sidelined and we know from metrics that dry powder is high right now in crypto with most folks selling over the last several weeks. On chain metrics as of late have actually looked surprisingly optimistic along side several high profile whales that have bid heavily during parts of this chop.

Will Clemente is a great resource on Twitter who covers Bitcoin as well as many different aspects of on chain analysis. If you haven’t done so already I highly recommend curating and compiling a good list of Will had the following to say Tuesday about Bitcoin:

In focus on Wednesday was the supply delta metric, which looks at the portion of the BTC supply held by short-term and long-term holders respectively.

Its creator, Capriole founder Charles Edwards, notes that while "not perfect," supply delta has been able to call at least local price tops. As of this week, it was printing a bottom for long-term holder share, which traditionally appears around price bottoms.

Long-term holders are defined as wallets with no selling in the past 155 days, while short-term holders conversely sell during that period (Coin Telegraph)

While I think any crypto investor or trader is sick of this volatility and uncertainty to me there is one shining aspect of what is going on if you isolate adoption from all of the noisy macro and traditional market noise. Institutional interest. We mentioned last week VC inflows are at the highest levels ever for crypto, Larger and more traditional institutions are sneakily acquiring, investing, and buying this volatility at a faster pace than most notice.

In terms of Bitcoin continuing to follow global equities, meanwhile, Ki Young Ju, CEO of on-chain analytics platform CryptoQuant, argued that it was not all bad news for those hoping that Bitcoin would decouple to become an asymmetric hedge against global uncertainty.

"Good News: BTC is getting adopted by traditional institutions. Its ownership is changing by new players who trade stocks. Bad News: BTC is not a safe-haven asset. For now," he summarized (Coin Telegraph)

Another helpful indicator looks at the amount of money in stablecoins, which crypto traders and whales flock to in times of chop. The all exchanges stablecoins reserve is an indicator that shows the amount of fiat-tied coins being held in exchange wallets.

An increase in the value of this metric implies investors have pulled out of their positions in volatile markets like Bitcoin, waiting for the right opportunity to jump back in (The Bitcoinist).

GLOBAL NEWS

Markets have been responding with chop to Ukraine/Russia conflict escalations as well as the continued combo of high inflation and anticipated hike activity from the Federal Reserve. Keep in mind physically, there isn’t much stopping Putin from rolling through a wide swath of Europe aside from a tentative NATO. His tone and words used in his recent address are certainly inflammatory and potentially hint at motivations far beyond simply re-taking Ukraine. This is a rare instance in modern times where we may actually see the widespread application of modern military force. The results could be extremely horrifying with a high loss of life if the conflict devolves into war, so keep that in mind as you read through the countless memes and jokes people are making online about this. Also worth mentioning this isn’t a casual series of actions and Putin’s decisions could very well drag the world and us into a larger conflict involving the world’s armies.

It appears that the U.S. has potentially turned a corner on our fight against the omicron variant, with new daily Covid infections plummeting 90% from the pandemic high less than roughly six weeks ago

BREAKING - Large-scale cyberattack is underway in Ukraine. Multiple ministry, public sector, and bank websites are down supposedly, more on this in coming hours on twitter

Ukraine announced plans on Wednesday to declare a state of emergency, as the nation prepares to defend itself from an expected Russian invasion in the coming days or weeks.

Tanks and other heavy military machinery ripped through the outskirts of Donetsk in eastern Ukraine for the second consecutive night Tuesday while Ukraine’s president called up his military reserves as Europe’s worst crisis in decades appeared to be taking a turn toward all-out war. (NY Post).

Putin this week officially recognized Donetsk and Luhansk regions within Ukraine as independent given both regions contain high concentrations of pro Russian. separatists. If you couldn’t gleam it from Putin’s address and from his expertly woven story containing anecdotes of historical events in Europe, this is a sneaky way to gain the upper hand and some critical momentum in Ukraine without straight up poppin off and starting an armed conflict, though that could be next. Experts have mentioned recently that something about Putin seems off in his demeanor, tone, and just general presence. We will see in the coming days if Putin potentially has bigger ambitions than simply repositioning troops into contested regions.

Has Putin struck at a key time when he knows the West has literally paralyzed itself with woke culture and arguments about inclusiveness in the military while burdened by extreme inflation, supply chain issues, and a uncontested political mess/division of the people? I would argue yes, he surely knew that this was a critical window of time to strike. Putin has strategically prepared for this very moment for years and is now making a strong concerted effort to expand and spread once again, the Soviet spirit throughout westernized Europe. It’s a symbolic crusade, one in which he undoubtedly is striving to regain much of the territory, resources, and influence that was lost when the Soviet Union collapsed.

In response to Putin’s speech and movements of Armor and Troops into these regions within Ukraine, the United States has decided to throw a marble at the proverbial tank.

“This is the beginning of an invasion, and therefore this is the beginning of our response,” a senior US administration official said. “If Putin escalates further, we will escalate further using both financial sanctions and export controls, which we have yet to unveil.” (CNN)

OTHER UPDATES

If you don’t follow us on twitter make sure to follow to keep up to date on memes, market commentary, partnerships, and more. Some free alpha and absolute degenerate market commentary as well.

Move Size Mugs are back in stock as well as our JPOW Stickers, listed below:

Wish everyone a safe week of trading, remember to keep your head on a swivel as we live through what will surely be some of the most tumultuous times in recent years. See you again on Friday.

Andy

Andy - as a blogger, merch guy, manager of popular meme account, whatever your main hustle is, and part time size lord you clearly get a lot done with the time you have.

The nature of markets and social media is such that your attention is constantly required making it hard to accomplish anything else.

Most content surrounding being productive and efficient is cringey pseudo-intellectual, hustlecore bullshit marketed at #girlboss types. So would be interested if you have a system or method for this. Thx

As always, great analysis. I always look forward to opening ARB Letters because I know I'm going to get some no-bullshit, straight to the point information from someone who knows his sh*t. Thank you.