Absolute mind bending volatility the last several days as the global markets rout continues fueled by risk off strategies, Federal Reserve Hawkish comments, and looming rate hikes, all while inflation runs rampant and WWIII ends up drafting all of us to fight in Ukraine so we cant shitpost on twitter and trade stonks anymore. Dark.

I got back into day trading options the last 3 days. This is not financial advice. I am not an options trading pro, and I won’t delve into the Greeks, or any of the more technical aspects right now. However, I do trade chop/vol quite a bit because it’s literally a free high octane casino. I simply sit and wait for large depressions or pumps intraday as chances to hop in with weeklies which are like regular monthly options except they expire every Friday and not every third Friday. Andy, you literally just said to wait for dips and pumps that’s elementary. To which I would respond, you are right but the touch is in finessing the longer trends intra day and getting out quickly if the trends breaks. Also note with weeklies, because they expire sooner, they’ll decay and lose value more quickly as time goes by, so ideally you don’t hold weeklies long term. But anyway. I recklessly day trade options when the market gets volatile because there really isn’t anything like it except gambling in Vegas after deleting a club bottle of Belvedere Vodka and actually winning. Also I like to make money.

Holding the below calls today to see if I can take advantage of a potential green open before the FOMC meeting. I primarily day trade with $QQQ and $SPY. These ETFs provide high liquidity, making it easier to get in and out of positions fast as the market changes direction. Discipline with options trading is important because your bet can go the wrong way quickly, and because options employ leverage, gains and losses can become large quickly. Options can be dangerous if you don’t know what you’re doing so highly recommend reading up on them if you aren’t familiar. I am no expert myself but have recently learned enough to use them offensively on volatile market benders to protect my portfolio and speculate when I feel something is oversold or overbought.

Why options you might ask? Options give you the ability to not only speculate on short term price action with higher potential returns, but they can also be used as an effective hedge against other positions that are selling off in this environment. If we receive interest in the comment section I would consider working on an Options Basics introduction for those interested in learning more. Could aggregate all of the materials, books, sites I have used if people would find it helpful. Let us know below if so.

MARKETS

Today I will be looking to take advantage of the FOMC meeting momentum in either direction and am ready to see how crypto interacts as we’ve seen a bit more decoupling from the Nasdaq and other correlations in the last 72 hours. *Insert decoupler meme. Russia/Ukraine seems to me to be largely a media/political distraction from domestic issues like inflation and crime but I do consider it to be a large macro risk and don’t discount the worse case scenario which includes Russian T-72s in Ukraine in 2 hours and a limit down guaranteed the next market day in equities and potentially a deep deep crypto dump.

That, paired with hawkish action or rhetoric from the Federal Reserve today could be a recipe for a much larger sell off. Though admittedly, I have heard Ukrainian officials don’t describe the situation as urgently as US military officials and politicians are making it out to be, further bolstering my theory above but we shall see. I also have some info on the ground there from people I know that do bad stuff telling me it’s inevitable - anybodies guess at this point.

U.S. stocks sky rocketed back in afternoon trading yesterday to close lower amid uncertainties surrounding the increasingly hawkish Federal Reserve and Russia/Ukraine tension

Microsoft (MSFT) reported Q2 earnings after the bell Tuesday, beating analyst expectations with its cloud service, Azure, seeing revenue jump 46%. MSFT seemed to rally the entire market after hours. Keep in mind Microsoft makes up large percentage of high profile ETFs like $QQQ and $SPY Revenue: $51.7 billion versus $50.9 billion expected

The Federal Reserve hosts an FOMC meeting today (details below) - market will likely react to this in real time, good chance to watch how rhetoric can shift trends quickly. Great way to understand the implications of Fed policy in the market moving forward.

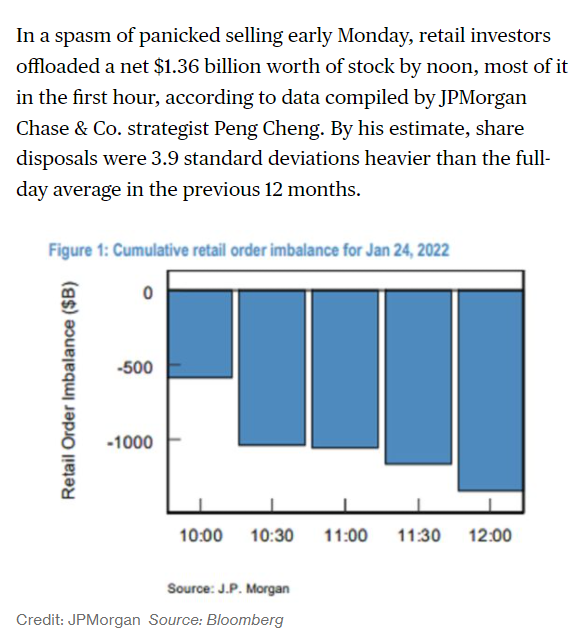

According to Peng Cheng, a markets strategist at JPMorgan, retail investors aggressively dumped stocks at the beginning of the day. By noon, there was a retail order imbalance of $1.36 billion (MarketWatch)

Oil prices climbed over 2% Tuesday due to concerns supplies could become constricted due to the Ukraine-Russia conflict, threats to infrastructure in the United Arab Emirates as well as potential struggles by OPEC+ to hit its targeted monthly output boost.

GLOBAL INTELLIGENCE

Manufacturers have seen their stocks of semiconductors plunge amid the global chip shortage, the US Department of Commerce has warned.

A survey of more than 150 firms found supplies had fallen from an average of 40 days' worth in 2019 to just five days in late 2021 (BBC).

The U.S. State Department recommended Sunday that all U.S. citizens in Ukraine leave the country immediately as Russia’s military continues to build up on the border and in other former eastern bloc countries

The military seized power in Burkina Faso on Monday with an efficiently executed coup, effectively ousting the country’s democratically elected president

New York’s mask mandate will stay in place for the time being after a judge temporarily blocked a lower-court ruling that would overturn the policy recently

The United Arab Emirates and the U.S. military intercepted two ballistic missiles fired by Yemen's Houthi rebels over Abu Dhabi early Monday, authorities said, the second attack in a week that targeted the Emirati capital (US News).

The U.S. State Department recommended Sunday that all U.S. citizens in Ukraine leave the country immediately as Russia’s military continues to build up on the border and in other former eastern bloc countries

Karin Strohecker of Reuters did an excellent piece on how a conflict with Russia could impact global markets. This isn’t just your run of the mill LONG defense calls. Some great concepts and ideas here to take into consideration. Full article below but here are the main points:

SAFE HAVENS - In forex markets, the euro/Swiss franc exchange rate is seen as the biggest indicator of geopolitical risk in the euro zone as the Swiss currency has long been viewed by investors a safe haven. It hit its strongest levels since May 2015 on Monday though some of that was due to a widespread selloff on Wall Street.

GRAINS & WHEAT - Four major exporters - Ukraine, Russia, Kazakhstan and Romania - ship grain from ports in the Black Sea which could face disruptions from any military action or sanctions.

NATURAL GAS & OIL - Energy markets are likely to be hit if tensions turn into conflict. Europe relies on Russia for around 35% of its natural gas.

COMPANY EXPOSURE - Listed western firms could also feel the consequences from a Russian invasion given exposure to Russian associated companies

REGIONAL DOLLAR BOND AND CURRENCIES - Russian and Ukrainian assets will be at the forefront of any markets fallout from potential military action.

You know I love myself a sick and twisted defense play during times of crisis but these are some more nuanced facets of the conflict that will undoubtedly reverberate immediately if and when Putin and his massive force push into Ukraine.

Read Karin’s full article here - highly recommend

OTHER UPDATES

If you don’t follow us on twitter make sure to follow to keep up to date on memes, market commentary, partnerships, and more. Some free alpha and absolute degenerate market commentary as well.

We are working to finalize edits and production of the Peter Tuchman interview Podcast and will hopefully have it by next week.

The Wall Street Bulls NFT collection minted Wall Street Bulls Interns this past Sunday. You can view mine and my other NFTs HERE on my OpenSea account. Let me know in the comments if there are any low key projects we should be keeping an eye on. I am thoroughly impressed with the execution by Wall Street Bulls on this project. My collection looks rare af tbh.

Good luck trading this week.

Andy

Let us know if you guys want to see any more in depth write ups on basic options trades

Interested in options