Well, there’s no hiding from inflation now as millions of Americans start to feel the very real impact of loosey goosey fiscal policy and irresponsible spending/printing. It seems the pandemic, in conjunction with the Fed’s recklessness has led us to a crossroads where a recession may in fact be the only real cure.

Fortunately there are still some prominent investors and figures who say we are not headed to a recession but each day more information comes out that makes it seems like we may actually already be in one. I am however, becoming increasingly pessimistic on the U Politics front as both sides of the aisle reveal continued corruption, lies, and misdirection ahead of critical mid term elections.

If you missed our paid post Monday on the two reliable ways to offset the impact of inflation on yourself I HIGHLY suggest subscribing and reading it. Inflation is here to stay for now and many people have no idea how to deal with it. We elaborated on the two best ways you can lessen that impact on yourselves or your families. They are straightforward, but like many things in life the devil is in the details.

Summer of Cash Flow

Our paid post Monday will be a deep dive into crypto for anyone interested in being invested in high quality long term projects/tokens etc or just getting started with exposure.

Premium subscribers get :

Subscriber-only posts each Monday

Access all Post Archives (read over 55+ articles at your leisure)

Deep dives, interviews, and focus pieces

Ability to comment on all posts

MARKETS

Wild week for markets and US Politics - inflation is ravaging the nation, Elon has put his twitter bid on hold due to excessive spam accounts and bots, and a red hot inflation number at 8.6% absolutely scorched stocks and crypto Friday. Specifically, the CPI surged 8.6% year-over-year in May, the fastest pace since December 1981.

The sharp rise in consumer inflation was broad-based, but annual increases were particularly stunning in both gas prices (+50.3%) and groceries (+11.9%) (Kiplinger). The Dow Jones was down severely, closing down 880 points for the day, or 2.5%.

Fidelity and Citadel are building a crypto trading platform

US inflation jumps to 8.6% in May, the highest since 1981.

Elon Musk has paused his bid for Twitter

Mastercard will allow NFT purchases with cards in multiple web3 marketplaces

The European Central Bank on Thursday said it will raise rates for the first time in over a decade as its inflation outlook increased significantly (CNBC).

With many businesses and corporations having taken advantage of the soft Fed policy for so long and expanding operations under low rates and money printing, we shouldn’t be surprised to see the immediate impact the Fed’s hawkish pivot has had across businesses in all sectors, even historically inflation - resistant ones like consumer staples. We’ve seen a vicious sell off of tech and growth/innovation names. If you’re any thing like me, you have a massive hole in the side of your ship from tech exposure. Absolute slaughter. Shit blows.

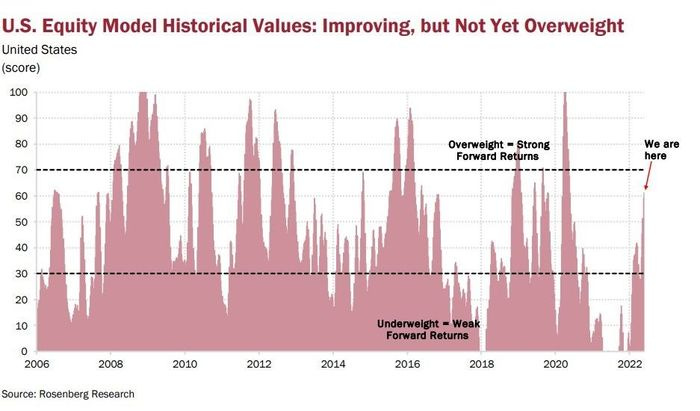

As you plan your weekend, it’s great to take some time to digest all of this information and make a plan for how you intend to navigate this environment. The truth is, there’s likely some excellent deals out there both in equities and in crypto but

I would caution everyone against apeing into anything at this point, given it’s unclear if we’ve reached a local bottom and because it seems likely the Fed will have to raise rates/rate hike cadence to tackle the unchanged inflation levels. Personally, I will likely start adding some tech names I like including $FB, $NVDA, $MSFT, $PLTR but also some names that I see doing well regardless of the economic environment, like $CWHY, $HD, $WMT, and $SWBI.

Anytime Cramer gives you advice do the exact opposite and you will be okay.

Worth mentioning 2022 is shaping up to be the worst year for equity hedge funds ever, with signs they are struggling to adjust to volatile market conditions and rapidly changing economic backdrops. Equity hedge funds, which manage around $1.2tn in assets, lost 8 per cent on average in the first five months of 2022, according to data group HFR (FT)

Among those suffering losses have been Chase Coleman, a high-profile so-called “Tiger cub” and protégé of Tiger Management founder Julian Robertson. Coleman has now lost 52 per cent in his Tiger Global fund this year, said a person who had seen the numbers. Fellow Tiger cub Lee Ainslie, who now runs Maverick Capital, is down more than 34 per cent. Dan Loeb’s $7.1bn Third Point Offshore funds have lost around 14 per cent while his leveraged $2.9bn Ultra fund has fallen 18.4 per cent, according to documents sent to investors. Boston-based Whale Rock Capital, which focuses on tech, media and telecoms, has lost 33.8 per cent in its portfolio containing both listed and private investment (Financial Times).

To put it into perspective these are severe under-performances. If you haven’t read out piece on 2022 Hedge Funds go peep it. These funds are struggling significantly and my gut feeling is that we will continue to see a number of prominent shops blow up and a push for consolidation in the HF industry as the frontrunners stretch the gap between themselves and the bottom bucket funds.

Retail investors continue to get pounded by volatility and choppy intra day stock movements with no clear relief bounce anywhere in sight. To me it feels like we are either in the calm before the storm or already in the belly of the beast.

While equity markets continue to see unprecedented chop and unpredictability, one slightly positive update is a shift to crypto assets by a number of larger institutional investors and hedge funds. Not to say crypto hasn’t had it’s own painful moments in the last 6 months, but we may be observing a shift in risk preferences and theses on which assets are going to outperform these conditions in the long term.

According to PWC’s recent report 38% of traditional hedge funds are currently investing in digital assets, up from 21% a year ago.

“It’s the search for alpha. Everyone is always looking for an angle in,” John Garvey, global financial services leader principal at PwC, said to TechCrunch. “So how are you going to beat the benchmarks? You have to try something different and new and unorthodox.” (TechCrunch).

Check out PWC’s Crypto Hedge Fund Report

MARKET SENTIMENT

“We think the US central bank now has good reason to surprise markets by hiking more aggressively than expected in June…. We realize it is a close call and that it could play out in either June or July. But we are changing our forecast to call for a 75 [basis point] hike on June 15.”

Barclays research note

“I’ve lived through enough bear markets, that if you get aggressive in a bear market on the short side, you can get your head ripped off in rallies”

Stanley Druckenmiller

"The crash in sentiment means that consumers are more and more worried about future economic conditions,"

Jeffrey Roach, chief economist, LPL Financial

GLOBAL NEWS

Here at Arb Letter we cover news objectively. Substack is one of the few mediums on the internet where we can tell it like it is without fear of reprisal, shadow banning, or suppression. The state of US politics right now is absolutely abysmal. If you all want a political edition of Arb Letter I will unleash it, but only if I see some comments asking for one.

For now I will keep it high level, we’ve been sold out by our politicians. To foreign interests, corrupt countries, and massive protected corporation and government entities. It all rapidly started descending downhill after 9/11, when the FBI, CIA, DHS, and NSA became not only politicized, but weaponized, growing in power and answering to very few people. In conjunction our Federal Government grew fat, corrupt, and gluttonous, while many elite Americans and Politicians became fabulously wealthy under boomer tailwinds and hyper generous fiscal policy from the Fed.

Look back over the past, with its changing empires that rose and fell, and you can foresee the future, too.

Marcus Aurelius

Look, say what you want about Donald Trump, as boorish or unpleasant as you find him, but he was a true threat/wild card to the institutional power and existing sub state of Washington and global elite. So he was dealt with accordingly. Smeared. Taboo-ified, his name causing 65% of the population to cringe while he was under media scrutiny that no president likely ever endured. The media amplified and exacerbated January 6th putting the final nail in the image and brand of that Presidency. This was not for no reason.

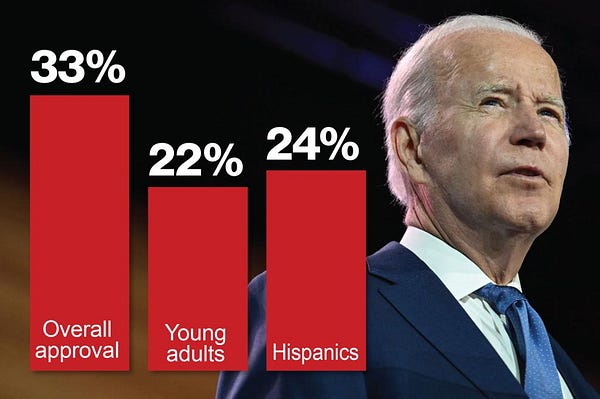

After pulling off 80,000,000 votes Joe Biden and the current administration are objectively underperforming and I am thinking we are watching many Americans waking up as they experience record inflation, gas price increases, food shortages, and a waning economy. Approval ratings are painfully low and hot button issues continue to occupy the media ahead of mid terms.

Am I implying Joe Biden is solely responsible for the long term woes our country faces? Of course not. But him and his administration have certainly done nothing but amplify and create further blunders. I don’t hate the guy by any means, but I do think he is unfit to be President physically and mentally. Come on people. Shits getting serious out there.

An armed man attempted to kill Judge Kavanaugh at his home this past week - The man, Nicholas John Roske, 26, said he was upset about the shooting in Uvalde, Texas, and impending decisions on abortion and guns, a federal affidavit says (NYT)

European Commission President Ursula von der Leyen met President Volodymyr Zelenskyy, suggesting that Ukraine will learn by the end of next week whether it can begin the process to join the EU

Russian troops are now in majority control of the city of Severodonetsk, the center of the ongoing struggle for Ukraine's Donbas region.

Vicious street fighting continues to play out in the eastern city

President Biden has been dealing with a declining economy, a war in Ukraine, and crippling inflation/gas prices at home in the United States. More recently he seems to be aggressively leaning into gun control, proposing a range of expansive measures in the wake of 5+ mass shootings in 6 months. He seems to be using this issue as fodder for the election.

"Keep marching. It's important. Look, this has to become an election issue. The way people say 'this isn't going to affect my vote,'...too many people are dying, needlessly,"

President Biden recently also called on Congress to ban the sale of assault weapons or up the age to purchase them from 18 to 21. New York is already pushing for these measures as well.

On the other side of the world China continues to show it’s hand in the Pacific and other contested regions, including in it’s own backyard.

Recently Chinese Defence Minister Wei Fenghe met US counterpart Lloyd Austin at an Asian security summit in Singapore.

The Chinese military has been flying fighters dangerously close to Taiwan over the last month, either as a show of force to keep the US deterred from involvement or likely as a precursor for things to come. The relationship between China and Taiwan is complex, but the division originates from a civil war/conflict dating back to the 1940’s and 1950’s.

The issue now being, that Taiwan has democratically elected officials and its own state structure. That’s why the country, with westernized culture and ties, \has proven to be a thorn in Beijing’s side for the last 30-40 years.

Sorry for the delay today and hope you all have a good weekend. I will see our paid subs on Monday for a crypto deep dive on recent updates, my strategy for weathering the bear market, and the best resources I have in my network for keeping up on market news, developments, and getting ahead of big price moves.

Andy

SHOP LEHMAN BROTHERS MERCH DROP

Arbitrage Andy Store

Arbitrage Andy Twitter

*DISCLAIMER - None of this is financial advice, it is important that you do your own research and make your own investment decisions. I am a former trader and currently work within sales/financial technology/brand building/e comm.

Because I have built such a massive digital network building Arbitrage Andy & Arb Letter, Arb Letter looks to leverage that information and sentiment for you to make informed financial & life decisions that cut through the noise and bias of modern media and news.

Absolutely do a political issue. I trust you to be objective and also to include your sources/state where you're being biased -- if you happen to be about a certain issue.

Please do a political newsletter. As long as it is objective and always gives both sides I know I would personally be interested in it. Politics plays a key role in finance and I enjoy reading oyur takes!