How to trade inflation and volatility

091: Strategies to preserve capital, crypto bull catalysts, hedge funds

Like most people I love a good bear market bounce.

Up until today when CPI numbers came out it appeared there was a chance of the continuation of the positive up trend we saw from markets, particularly in crypto and select tech stocks.

But, inflation came in yesterday at 8.3% above expectations of 8.1% and markets immediately dumped hard.

We saw BTC (Bitcoin) and ETH (Ethereum) which had displayed impressive rallies ahead of the ETH merge this week, fall rapidly right after the news broke.

Here’s the thing, there is no tried and true recipe for beating this environment. There are some basic techniques that can help you preserve, capital, avoid ducks/ponzis, and make it to the other side where glorious green candles await us, but for the most part it is a waiting game.

Investors at hedge funds, institutions, and other large investment vehicles are seeking out more and more defensive strategies during a continually volatile market environment where historical correlations mean nothing and nobody knows what comes next.

The elephant in the room now is what comes next? Did we just lose our chance at the local bottom?

Personally, I think that was a solid rally that could’ve continued had the inflation print been better but alas - that’s not the way this casino works and now we will have to factor in more rate hikes into our overall strategy.

On a side note we’ve put out several pieces that have been well received by our subscribers including:

2022 Arbitrage Andy Watch Review

If you’re inclined check them out.

If you’re like most retail investors you’re down bad at this point. The truth is unless you’ve been employing a disciplined short selling or options strategy these markets have been brutal for most conventional long oriented portfolios.

In this edition of Arb Letter we will cover the following:

Inflation Recap and what it means for markets

Hedge Fund, Trading, and Institutional Trends

Ways to protect your money/trade volatility

Crypto bullish upcoming catalysts

This will in summation, be a broad introduction into some of the ways you can trade and read markets like the pros at top funds with our summary of the CPI print as well as regulatory developments in crypto, and what we think is in store for the next 3 months of 2022.

We do these deep dives 1-2 a week at Arb Letter. They’re about $0.70/pop and we aim to synthesize all relevant market information for the week for you with an educational piece as well with no fluff attached.

I’m not Warren Buffet or Bill Ackman - but I know enough to share some knowledge and tips so that you can make more money and preserve more capital while knowing more about what’s actually going on. My goal is to break things down simply for people of all walks of life to understand and benefit from.

These are wildly unprecedented markets, and as macro/social/political events escalate in the coming months getting unfiltered information is key to outperformance and preparation.

Inflation Recap

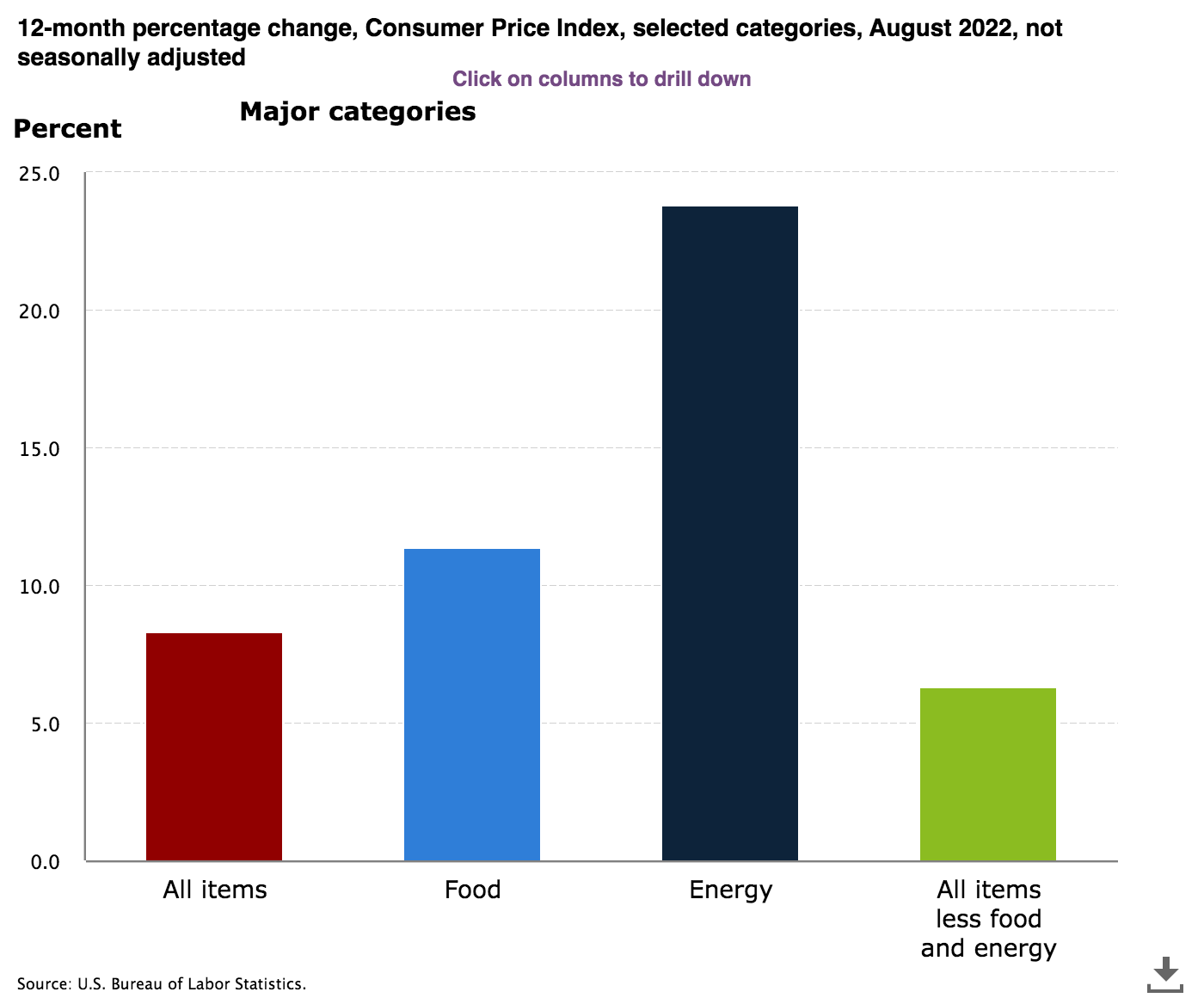

As mentioned earlier US CPI came in yesterday at 8.3% above the expected 8.1% and a bit lower than the previous print at 8.5%.

Increases in the shelter, food, and medical care indexes were the largest of many contributors to the broad-based monthly all items increase.

If you care to look through the specifics of the CPI components and how they are derived and averaged you can view it HERE.

Unfortunately the implication here, and the primary reason that markets fell aggressively is that the notion that inflation potentially peaked can be thrown out the door - and remember - inflation in reality is likely double what they’re saying it is.

We will likely get continued pressure from Fed policy via more aggressive rate hikes through the end of the year which could cause more selling.

While we should be cautious of overreacting, we could be looking at a sustained sell off into year end for tech and high growth names.

The report is one of the last the Fed will see ahead of their Sept. 20-21 meeting, where the central bank is expected to deliver its third consecutive 0.75 percentage point interest rate hike to tamp down inflation.

In short - we likely see more pain ahead before things get better. The notion that we may have peaked with inflation and are close to a fed pivot is now history.

Another component of this equation to note is the upcoming mid term elections. You want to ensure that you have your ducks squared away before then as we will likely see heightened volatility leading up to the elections.

Additionally we expect energy prices, particularly gasoline to sky rocket after mid terms hurting the lower and middle classes immensely.

Why?

Well for starters Biden is likely utilizing our strategic reserves to suppress gas prices and curry favor with most Americans ahead of an absolutely critical mid term election season v. Republicans. You and. I would do the same thing if we were in his shoes.

BOOKMARK THIS ONE. GAS WILL SOAR IN JAN/FEB.

"US August CPI is due. Consumer prices do not measure the cost of living. Fantasy numbers in US CPI calculation further divorce this price measure from the cost of living. However, the Fed’s June policy error elevated the importance of consumer price inflation"

- UBS Paul Donovan

Hedge Fund, Trading, and Institutional Trends

Hedge funds traditionally thrive on market volatility, particularly fundamental L/S funds and stock pickers.

In the recent tumultuous macroeconomic environment, several fund strategies have drawn strong interest from investors seeking defense from the volatility but also from the unpredictable nature of fed hikes, impacts from the War in Ukraine, and the bloody sell off of consumer and tech names that has endured the better part of the year.

To put things into perspective yesterday’s sell off was the worst day for the Dow Jones since June of 2020. The Nasdaq added to the slaughter falling nearly 5.2%. Chip giant Nvidia (NVDA) fell over 9% and Covid 19 darling Carvana (CVNA) was pounded as well falling more than 12.5%.

If you pay attention and do a bit of research, you can see quite clearly which type of hedge fund strategies have been performing extremely well in this seemingly chaotic environment. Replicating some of their exposure and techniques can be highly profitable.