new logo alert….. you can cop the shirt HERE for a limited time.

We re-launched the Arbitrage Andy Website.

MARKETS & CRYPTO

Super pumped for more chop and volatility this week as we lay witness to what will likely be several major developments for Russia/China relations, Ukraine’s fate, and how equity markets continue to digest a 25bps rate hike amid global go-political uncertainty. I remain long and bullish on crypto and for now have stopped adding equities outside retirement contributions which, if I am being honest, feel’s pointless anyway given the road our country is going down and the economic situation that is playing out.

A paradigm shift if you will, between traditional legacy currencies and assets that can be manipulated and printed, and new digital - censorship resistant, sound, and decentralized assets. Just one young man’s opinion, but you’re crazy if you think things will look the way they do now in 40 years. I’m also very bearish on the whole “college” experience in the future but that’s a topic for another time. Hope my kid’s ready to learn e-commerce, coding, and sales.

Wall Street pointed toward rocky open on Monday as investors and traders continued to kept an eye on continued efforts to negotiate an end to Russia’s war in Ukraine.

A China Eastern Airlines (600115.SS) Boeing 737-800 with 132 people on board crashed in mountains in southern China on a domestic flight on Monday following a sudden descent from cruising altitude (Reuters). Boeing stock down in pre market.

Goldman is close to announcing that it is the first major U.S. bank to trade an over-the-counter crypto transaction, CNBC has learned. Goldman traded a bitcoin-linked instrument called a non-deliverable option with crypto merchant bank Galaxy Digital, according to the two firms (CNBC). Funny how the big guys are all showing up after shitting on crypto for years huh?

A recent report by KuCoin reveals that the number of crypto transactions has increased by 2,670% in some African countries.

The CEOs of companies including ExxonMobil, JPMorgan, Bank of America are scheduled to meet with some top Biden officials at the White House on Monday to discuss Russia’s invasion of Ukraine, a White House official told CNN.

BTC, ETH, and select alt coins look strong today as equities open slightly down

Oil prices popped by more than $4 on Monday as Brent crude climbed above $111 a barrel, while several European Union nations considered joining the United States in a Russian oil embargo

GLOBAL NEWS - INFLATION

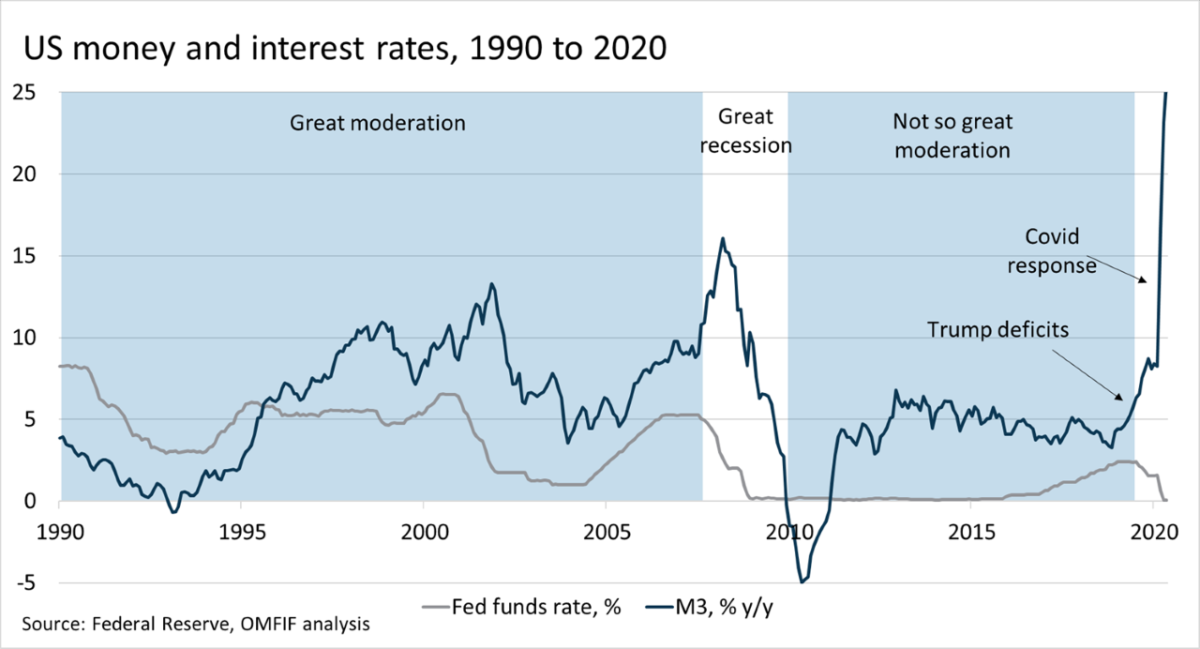

In case you didn’t realize it, we are in the middle of some of the worst inflation our country has ever seen in its history. The Covid 19 pandemic paired with the Federal Reserve’s extremely dovish policy and money printing helped contribute to the creation of over 40% of all dollars in existence.

The fact of the matter is that we really shouldn’t be underestimating just how bad this is. Combined with several of the emerging macro factors of the last several months, Inflation is going to become a bigger part of everyone’s life in the United States an across the globe.

The Bloomberg Opinion twitter account blessed us with an absolute gem of a post Sunday morning. Tone deaf doesn’t do it justice.

You can read the tweet HERE, we didn’t embed it in case they delete it lol.

Critics slammed a Bloomberg Opinion tweet Saturday that said inflation hurts most people making "less thank 300k," adding that people should take the bus, stop buying in bulk and should "try lentils instead of meat." The tone deaf post

The tweet also read, "nobody said this would be fun." The March 13 op-ed from Teresa Ghilarducci, headlined, "Inflation Stings Most If You Earn Less Than $300K. Here's How to Deal," says that public transportation prices are only up 8% compared to 38% for gasoline. (Fox News

The legacy media is entirely out of touch with everyday Americans who are feeling the negative and heavy cost of inflation nearly everyday as they just try to survive. Initially they denied inflation was as bad as expert aware saying it is. Now that the current administration has made matters worse, the mainstream media is some how trying to argue as to why high inflation might actually be a good thing? unbelievable lol. Kill your dog to cut back on pet cost? Eat lentils? Nah I am good.

It’s no secret inflation has become a large issue that even normies and regular people are starting to understand and feel.

The Annual inflation rate in the US accelerated to 7.9% in February of 2022, the highest since January of 1982, matching market expectations. Energy remained the biggest contributor (25.6% vs 27% in January), with gasoline prices surging 38% (40% in January).

Inflation accelerated for shelter (4.7% vs 4.4%); food (7.9% vs 7%, the largest since July of 1981), namely food at home (8.6% vs 7.4%); new vehicles (12.4% vs 12.2%); and used cars and trucks (41.2% vs 40.5%). Excluding volatile energy and food categories, the CPI rose 6.4%, the most in 40 years. Still, the surge in energy costs due to war in Ukraine is still to come. The inflation was seen peaking in March but the recent developments in Europe coupled with the ongoing supply constraints, strong demand, and labour shortages will likely maintain inflation elevated for longer. source: U.S. Bureau of Labor Statistics

The reality of the situation is that it is likely to get worse before it gets better. That means it is a good idea to start identifying assets or allocations that can effectively weather the high inflation storm we are living through. We will do a breakdown on this later this week.

The impact of inflation combined with social unrest and hindrances to the global supply chain, will make for a painful next year of higher consumer prices, limited supply of key imports, and lower quality of products overall. Even around the upcoming elections, politicians would do well to bear in mind the age old moniker, “you are only three square meals away from full blown riots in the streets”.

The Federal Reserve and our government has gone to great lengths to polish or shine up the reported inflation number, changing the way in which it is calculated and derived. Most critical thinkers and reasonable economists believe the actual number is much higher. Not what anyone wants to hear but it is in fact true.

The divergence between these two numbers is due to a process called reweighting. The CPI functions like a weighted average for all the goods and services which typical urban consumers might purchase, but it needs to be periodically updated to reflect consumers’ changing preferences to ensure an accurate number. Right now that is done every two years through changing the weightings assigned to the components of goods and services within the index and is part of the normal procedure. My guess is the actual net inflation number is 15-20%.

GLOBAL NEWS - RUSSIA UKRAINE

President Joe Biden has plans to make a stop in Poland this week to Europe for urgent talks with NATO and various European allies about Russian aggression. Poland, who is a crucial ally in the Ukraine crisis, is currently harboring thousands of American troops and taking large amounts of Ukrainian refugees.

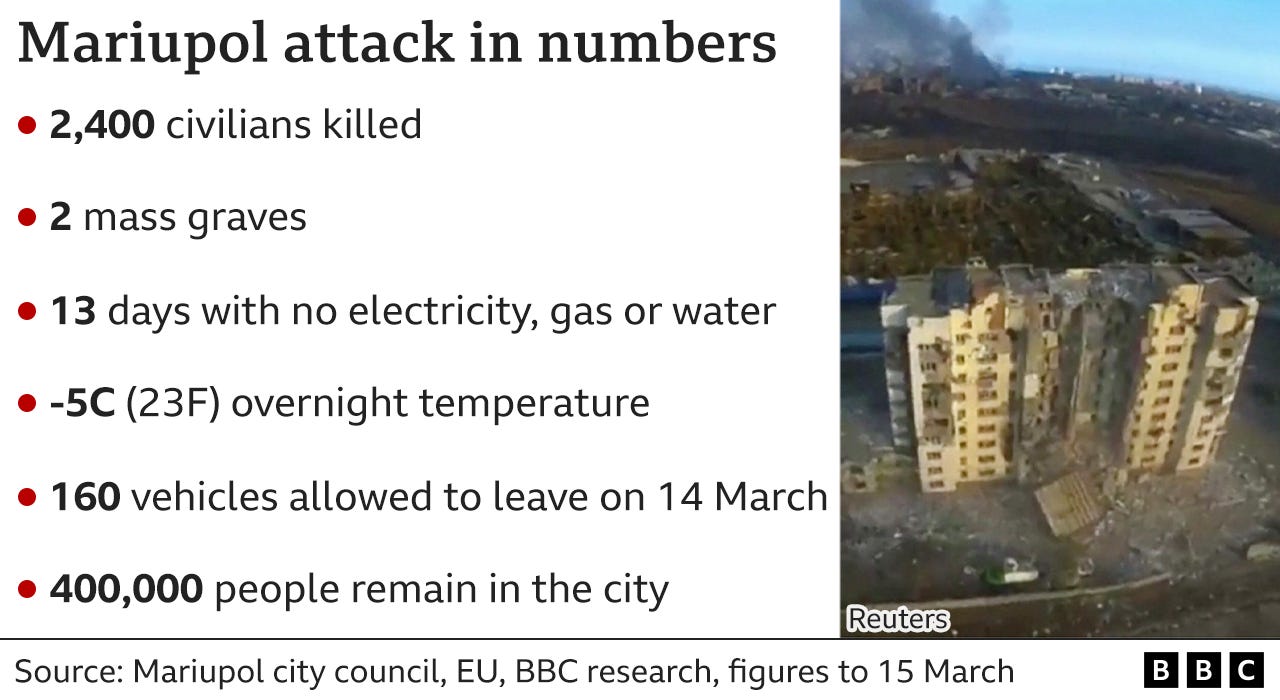

Of particular focus the last 48 hours is the coastal city of Mariupol, where fierce fighting has been transpiring. Civilians are trapped in the city amidst heavy Russian shelling and attacks that have included tanks, armored vehicles, rockets, and lately indiscriminate destruction of civilian buildings and dwellings.

The situation has deteriorated and civilians are right in the middle of harm’s way suffering under horrid conditions.

"Some have developed sepsis from shrapnel in the body," said Anastasiya Ponomareva, a 39-year-old teacher who fled the city at the start of the war but was still in contact with friends there. "Things are very serious."

The city is encircled by Russian troops and remains under constant bombardment with almost 400,000 people still trapped without running water, and food and medical supplies quickly running out. The local authorities say the war there has left at least 2,400 civilians dead, but even they acknowledge that this is an underestimate (BBC).

Stalingrad 2.0 it seems.

Do you think inflation is going to get better or worse? Is there a real threat of nuclear war if the situation in Ukraine expands or comes to involve NATO forces? Let me know in the comments.

If you missed last week’s edition - you can read it HERE.

Reading the Sovereign Individual and seeing how closely it's predicted things that would happen in a massive transition, I do think Inflation gets worse. Not to be a negative nancy but I dont see how it gets better when the issues in Ukraine seem to be getting worse. Supply chains are damaged, costs of essential goods are staying higher, and wages are lagging behind. How long will people be able to weather out the storm?