Hope everyone had a solid week, it was nice to see some green candles in the markets for a change even if it ends up being short lived. Political rhetoric has amplified in the US over recent mass shootings and key issues like Roe V Wade. More support is being given by the United States to Ukraine to fight Russia.

We have some commentary in this edition on some of my favorite gun stocks to trade during political cycles. Catch up on your reading and peep the Guns in America Post for a summary of my stance on firearms in America.

MARKETS & CRYPTO

Thank the lord we’ve seen a semi reasonable bear market rally, but the question is how long before we continue to turbo dump. Jamie Dimon of JP Morgan said this week at a conference that an economic hurricane is down the road. His calls, very similar to Bill Ackman’s Covid “Hell is Coming” psy op, may be rooted in shilling market frame conducive to the success of his hedges/positions.

Now I am looking to see signs of a further sell off and most will likely be looking to the Fed to see if we continue to sustained hawkish efforts to reel in inflation which is persisting. Janet Yellen this week admitted that she (and all of the Fed) was wrong to call inflation transitory. Tech stocks look bad ahead of market open and it’s possible we dump into the weekend here as savvy investors sell to de-risk over the weekend.

US private payrolls rose just 128,000 in May, well below the 300,000 expected, according to ADP.

New York passes Bitcoin mining ban bill.

Block has partnered with Apple to integrate Square payments with 'Tap to Pay' on iPhones (Watcher Guru)

Japan Passes Bill to Legalize Stablecoins

Tesla (TSLA) is moving ahead with freezing hiring and will need to cut staff by about 10%, Elon Musk said in an internal email according to Reuters.

After market close yesterday, retailers Lululemon Athletica (LULU) and RH (RH) topped quarterly views, with RH giving weak guidance.

Crypto markets have continued to look shakey over the last week with a bit of pump earlier in the week that has since puttered out. Do Kwon of $LUNA has launched his second version of the ponzi scheme LUNA 2.0 (if you buy that you deserve to be poor). Additionally we have seen a risk off event play out as ETH falls to the $1,700 level and additional alts with lower market caps continue to get absolutely slaughtered. There have been some interesting adoption updates with fast casual restaurants announcing the acceptance of cryptos

One event I will likely try to attend in person is Smart-con 2022. Main reason is to see Sergey Nazarov and former Google CEO Eric Schmidt speak on smart contracts and oracles.

Chainlink Labs announced that former Google CEO Eric Schmidt, who joined Chainlink Labs as a strategic advisor last December, will speak at SmartCon 2022 alongside Chainlink co-founder Sergey Nazarov, Chainlink Labs’ Chief Scientist Ari Juels, and Chainlink Labs’ Chief Research Officer, former Diem CTO Dahlia Malkhi, with more speakers being announced.

Well folks, it’s that time of year when politicians start running their mouths of about infringing on our 2A rights and have started to introduce new legislation and measures to make guns harder to get along with ammunition, parts, and accessories.

Throughout the last 10 years I have traded Gun and gun related stocks based on some of the cyclical patterns they exhibit, and while I am not an oracle I am starting to see some bullish indicators that lead me to believe there is some upside in the short to medium term. Institutional indicators on SWBI for instance, have indicated high options activity with call option volume (bullish).

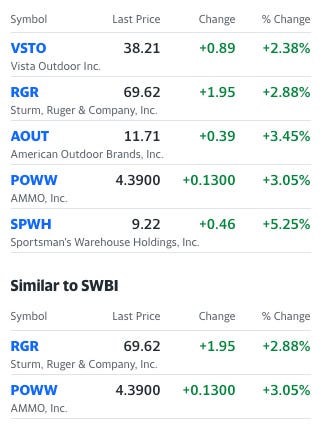

Below you can see the names that I typically trade during times of ant gun rhetoric, holiday seasons (when these stocks perform well), and societal unrest.

The rough average price target on Wall Street for $SWBI is $22.5, which means analysts expect the stock to gain by 61.99% over the next twelve months (this may have shifted a little bit). This guidance means little me and I primarily look to find the bottom of multi year channels to find entries that take advantage of the often violent upside moves during this anti gun sabre rattling from democratic administrations.

My basic strategy is to buy call options with higher than normal strike prices and medium term expiry to try and take advantage of fear which typically translates into higher guns sales and emotional trading of these names. From a range perspective I like this level for either a common shares long with a $18.00-$22.00 target by Fall. As of this morning SWBI is dumping some more, decent opportunity to make an entry in my opinion.

Remember nothing is guaranteed here and this isn’t formal investment advice, these stocks can act erratically. I am providing a framework for thinking about this thesis and taking advantage of some of the bullish catalysts we have seen in the last several months. Some of the best trade opportunities come in times of hysteria or fear mongering. Politicians/ the media seem reluctant to let the gun angle drop this time, and historically, during, for example the Obama Era (which you can see above) we see large bull trends for gun stocks. you can clearly see the surges and pull backs within SWBI specifically during different administrations/time periods.

Full transparency - I own JUL15 $20.00 Calls on SWBI and I currently have a sizeable position in $POWW, an ammunition manufacturer. $RGR is far off it’s range it typically likes during times like this (between $80.00-$85.00). $VSTO and $AOUT do very well during the holiday season traditionally, but there may be an opportunity in the short term for these names as more Americans buy guns, ammo, and outdoor equipment/accessories.

After the mass shooting at a high school in Parkland, Fla., in 2018, Jon Hale, the director of sustainability research for the Americas at Sustainalytics, a unit of the investment research firm Morningstar, said that he heard from financial advisers who were “getting all kinds of calls from clients concerned about whether they have guns in their portfolios.”

There are risks involved in these stocks, and their has been an aggressive push from companies and fund managers with an ESG angle looking to purge all gun stocks from portfolios.

While I recognize the tragedies and wanton destruction of lives that have occurred in these mass shootings, politicians use the emotional pain and trauma of these events to further THEIR agenda. That’s how sick and twisted they really are. At the end of the day, you aren’t going to stop a bad person from committing atrocities because you impose gun laws that hurt normal citizens and strip them of their ability to defend themselves. I trade emotion and fear.

“I am convinced that a criminal who wants a firearm can get one through illegal, untraceable, unregistered sources, with or without gun control.” -Senator Joe Biden, 1985

MARKET SENTIMENT

“Numbers this strong would likely reverse any hopes the Fed would consider a pause in rate hikes after the June/July increases, because it would signal the labor market remains very tight,”

Tom Essaye of the Sevens Report (CNBC)

“I believe it’s transitory, but I don’t mean to suggest these pressures will disappear in the next month or two,”

Janet Yellen

GLOBAL NEWS

World market continue to face strong macro headwinds fueled by a drawn out conflict in the Eastern part of Ukraine as well as serious supply chain woes. Anti gun rhetoric has persisted in the US media as more and more mass shootings occur in a shorter time frame. War games continue with an economic flair as Oil continues to trade in a volatile manner.

New York to raise legal age to buy semiautomatic rifles to 21, up from 18

Oil prices dipped in the morning of Asia trading hours after the Financial Times reported Saudi Arabia is prepared to increase production if Russia’s output markedly drops following European Union sanctions (CNBC).

Turkey's annual inflation reaches 73.5% in May, the highest level in about 24 years.

U.S. President Joe Biden, Erdogan and NATO counterparts will be meeting in Madrid from June 28-30.

Biden said that if Congress could not ban assault weapons, then they should raise the age to purchase those type of guns from 18 to 21. He also said that background checks should be strengthened and called for the passage of "Red Flag" laws which allow courts to remove firearms from those deemed a danger to themselves or others (US Today). Biden recently revealed his lack of education on firearms and ammunition by saying that he planned on banning 9MM (a pistol round) because it is high power and has the ability to destroy human lungs? wtf bro lol.

Evidence and updates suggest that the Russians are gaining traction in Eastern Ukraine after re-assessing battle plans and narrowing the field of attack in the historically contested Donbas region. Does make me wonder how much Western fueled propoganda and bias we have seen so far in the coverage of this conflict. As I have mentioned before, the Russian war machine is one of the oldest in existence and relies on numbers and raw power to overwhelm opponents. Putin undoubtedly used conscript and lesser trained battalions to feel out Ukrainian resistance and soften key defensive regions. Russia officials and Putin were recorded this week expressing the sentiment that they are using a slow grind in Ukraine to create pain for NATO and Western powers through economic and supply chain constrictions.

The Wagner Group, the Russian mercenary group who’s been active in Ukraine in the last several months, seems to be expanding it’s footprint on the African continent. This past week mercenaries in Wagner group are accused of executing civilians. Wagner is infamous for alleged war crimes in Syria and other theaters of operation. The unit is notorious for it’s tactics and disregard for human life. They’ve been accused of atrocities already in several African countries and the recent activity in Mali is pretty sinister.

The mass executions began on the Monday, and the victims were both civilians and unarmed militants, witnesses said. Soldiers picked out up to 15 people at a time, inspected their fingers and shoulders for the imprint left by regular use of weapons, and executed men yards away from captives (NYT).

Russia’s interest in Africa, triggered by Moscow’s isolation following its annexation of Crimea and ventures into eastern Ukraine, also provides an opportunity to advance Putin’s vision of a post-liberal international world order.3 This takes the form of challenging democratic norms and the principles of a rules-based international system. Rather than offering an alternative model, as does Chinese authoritarianism, the Russian strategy appears to be aimed at smearing the perception that democracy offers a more effective, equitable, transparent, or inclusive form of governance. This worldview, in which all political systems hold moral and governance equivalence, plays to the advantage of Moscow’s elite-focused, transactional, and unregulated model. (Africa Center).

We touched on the rise of crime in cities in our last paid post. The bold increase in crime is objective at this point and anyone denying it in the name of wokeness is as dangerous as the perpetrators themselves. People have been stabbed, shot, and raped, and the NYPD seems useless to stop the rise in aggressive crime all across the city.

ANNOUNCEMENTS

We’ve gotten some questions on our paid posts and what they include. Here is the simple run down for what is included.

Free subscribers get:

Once a week public posts with high level analysis/commentary

Paid Subscribers get:

Subscriber-only posts each Monday

Access all Post Archives (read over 52+ articles at your leisure)

Deep dives, interviews, and focus pieces

Ability to comment on all posts

If you enjoy Arb Letter, paid is a no brainer and I say that in the most non shill manner. And because I believe in complete transparency, we’ve set the pricing (~$5.00/month) low enough to give everyone a chance to access it, but high enough where the value we offer and time we put in is compensated. Some of our recent paid posts include:

Remember, a huge part of developing an abundance mentality and healthy relationship with wealth is viewing money as a tool. If you’re looking to become sharper and more educated on financial markets, global news, and current events paid is for you. We’ve had hedge fund PMs, banking analysts, private equity associates, tech savages, and many more subscribe to paid. The demand and reception of paid has been unexpectedly high and in the future if the trend continues more and more content will be offered to paid subs.

Hope to see you guys join - cheers.

SHOP LEHMAN BROTHERS MERCH DROP

Arbitrage Andy Store

Arbitrage Andy Twitter

*DISCLAIMER - None of this is financial advice, it is important that you do your own research and make your own investment decisions. I am a former trader and currently work within sales/financial technology/brand building/e comm.

Because I have built such a massive digital network building Arbitrage Andy & Arb Letter, Arb Letter looks to leverage that information and sentiment for you to make informed financial & life decisions that cut through the noise and bias of modern media and news.

“I trade emotion and fear” - me too