Alright folks well we just passed the 16,000 subscriber mark and I wanted to say thank you to each and every one of you for following Arb Letter.

We’ve built a valuable community here and the goal is to continue to aggressively grow it to get better content, topics, and coverage.

We’ll be covering a mix of topics in the traditional Arb Letter format today.

Markets

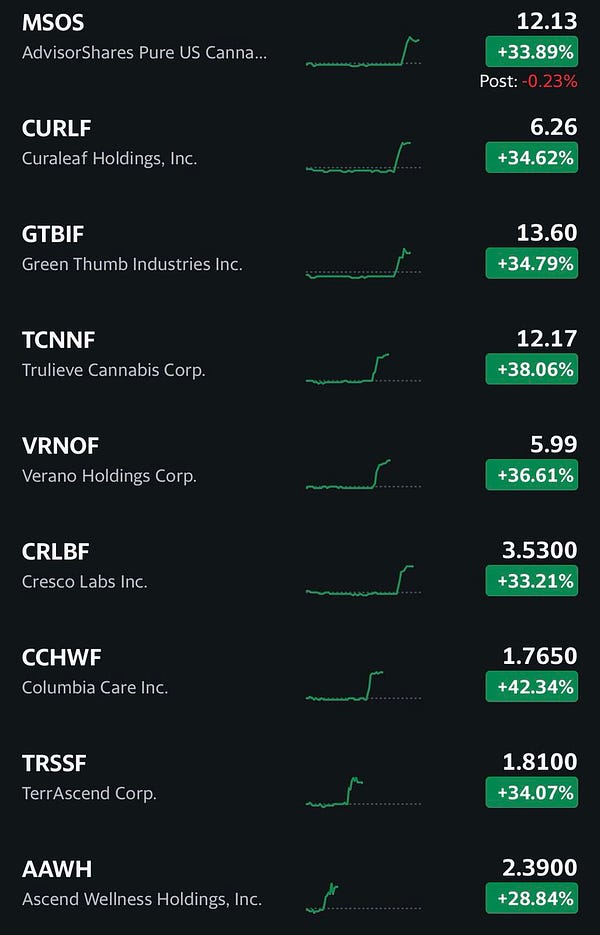

US President Joe Biden helped ignite a resurgence in weed stocks with his announcement of a pardon (more details below). Option holders are probably going wild right now. Maybe some momentum to be had in this sector?

Obviously you’re not early now on the initial move, but if the Devil’s Lettuce manages to stay central through bad times (which it should logically) we could see the beginning of a jazz cabbage rally.

Some good momentum to get caught up in, just know when to take profits, unless you’re building a cartel size weed position with a long term view.

Probably calls for a ceremonial sizzling plate of steak fajitas and a blunt that gets all the homies sent to the Andromeda Galaxy.

Job reports come out this morning. Expectation is 275K in September. UPDATE (Just in) - September payrolls are 263K. Investors will be focused on how the Fed reacts to this report but the markets are likely going to sell off today in anticipation of further rate hikes by the Fed.

The weak rumors and dreams of a pre mature pivot will likely be crushed today.

Any more evidence that they need to crank down even harder on combating inflation and we probably begin the next leg down.

With unemployment rate at 3.5% vs. the previous 3.7% and the expected 3.7% the Fed will likely see this as a challenge and proceed with another 75 or 100 bps hike.

Might get bloody - at this moment before open Nasdaq futures are already down 2%.

Economists expect non-farm payrolls will be announced at 8:30 a.m. ET by the Bureau of Labor Statistics (BLS)

Shares Tilray (TLRY.O) and Canopy Growth, two sizeable weed companies (WEED.TO) jumped about 22% and 32% yesterday - some really solid responses by marijuana companies on the Biden news…..

More market chatter about Ripple $XRP as the crypto project/token battles legally with the SEC. XRP has been up in the past several weeks showing some solid strength relative to other crypto assets

At this point it’s a waiting game in crypto to see if:

a.) crypto decouples from legacy markets

b.)which projects/assets make it through the bear market

c.) a matter of being patient

I like a vanilla narrative story to get bullish on, I admittedly don’t know that much about XRP but I do have a position that I have casually accumulated over the past 3 years or so.

I’ve also heard a lot about QNT but again, not too familiar with that project.

We like the upside here from a positive result of ongoing legal proceedings.

The crypto ecosystem was hit with yet another hack event when an attacker stole 2 million BNB (~$566M USD) from the Binance Bridge.

This event didn’t immediately impact the markets but it has implications that suggest many crypto exchanges could potentially not be as secure as they claim.

The European Central Bank is now concerned about a potential wave of defaults on banks, per reports via Bloomberg.

In initial reports that seem to be true - Nancy Pelosi bought millions of shares of a Cannabis company in the weeks leading up to Biden’s announcement

Connecticut-based advisory firm Tuttle Capital Management submitted a preliminary prospectus filing with the United States Securities and Exchange Commission for two new exchange-traded funds (ETFs) that focus around betting against investment tips from Jim Cramer, the former fund manager and media pundit who’s been at war with the retail trading community and public since the AMC/GME debacle. (Coin Telegraph).

Cramer really does seem to want that smoke. The former manager and media pundit must have been quite shocked this week when he found out there is a formal process underway to create an ETF that bets against him.

He has started to lash out on Twitter speaking about his Bitcoin bull market gains.

In our opinion this entire phenomenon represents old era of stock pickers and entertainers that don’t jive extremely well with the younger generation who has been jaded by the events of the Citadel/Melvin Capital/Robinhood/AMC/GME events.

Those events solidified the opposition of the retail masses to the institutions who inherently control the majority of market mechanisms, sentiment, policy, and direction.

There is very much an us vs. them attitude now between Wall Street and normal people.

Chainlink Update

If you’re new around here you probably don’t know what Chainlink ($LINK) is. If you’ve been following Arbitrage Andy and Arb Letter you know that we are long term bulls on the oracle , we’re a shameless long term investor in the potential of ChainLink and not just by necessity lol.

I could talk your ear off for hours about why Chainlink is going to make me and every other holder enormously wealthy but we’ll save a full update for another time. Perhaps, when the first major pump occurs.

Chainlink has seen some bullish updates within the last several weeks with the announcement of staking and a CCIP/Swift Partnership at Smartcon 2022 in NY (A Smart contract conference).

The former CEO of Google Eric Schmidt, alluded to the gravity of what Chainlink is doing within the oracle and smart contract space.

As someone who has been holding Chainlink for a long time, it's pretty wild to see the positive reinforcement and growth play out step by step.

Of course we want to see that value reflected in the token and that wait is taxing.

Now to be fully transparent we don’t have a great entry on our DCA, partly because (and I will admit this openly) we got caught away buying Chainlink towards the latter half of the crypto bull run we just saw.

No shame, but it did hurt our average price. Now with that being said, a few follow up points:

Our investment horizon on this asset/company is 2-5 years. So I’m not majorly concerned with where the entry is, so long as I keep accumulating, sure it sucks holding the bag but not as important as we don’t need the liquidity - we expect mass appreciation to $100+ (complete spitball) on this asset in due time as blockchains become integrated with real world data, enterprise adoption spreads, and macro calms down.

I think most retail investors who qualify for staking will have the opportunity to stake a meaningful amount and have the chance at a first decent and secure staking arrangement within the crypto space

The amount of promising news and updates from Chainlink is reassuring and make me excited for the upcoming release of staking and CCIP partnerships. There are breadcrumbs globally as well that suggest a larger effort is underway to implement Chainlink.

The large-scale push for global CBDCs has synergies with the way that LINK can function and we already know about a CCIP and World Economic Forum interest in the protocol. I am bullish on many different facets of this asset.

Most recently we’ve seen announcements of partnerships with other financial firms including Two Sigma.

THIS IS A BIG DEAL.

Chainlink was a solid performer in the last bear market, so assuming we can get some degree of calm on the macro front and inflation front, we might see it creep up and explode again with the enterprise adoption, partnerships, and update we’ve seen so far.

We’re not sponsored by Chainlink.

Looking at crypto right now I am bit concerned that the jobs report will inevitably lead to a sell off into the weekend.

Though I should mention recently that crypto and particularly Bitcoin, has looked good compared to a number of assets. Fund managers and other folks are likely taking notice of it.

Wouldn’t be surprising to see markets tank at open today given the implication that the Fed isn’t doing enough to fight inflation.

Still, will be interesting to see how they go about it with the international calls for easing of rate hikes, and the already pivoting institutions like the Bank of England.

Global News

It seems each and everyday the world gets crazier and crazier. There’s been heightened rhetoric around the use of nuclear weapons by Putin or NATO as the world still tries to figure out who was responsible for the Nord Stream sabotage.

OPEC announced a large supply cut recently driving the White House mad and prompting criticism from allies of the US.

In a statement from the White House and President Biden it stated that Biden had directed the Department of Energy to release another 10 million barrels from the Strategic Petroleum Reserve for next month.

So our enemies are slowly beginning to wage economic war against us…..

And just a reminder - do ya’ll remember when the tri state area was running those odd nuclear warning ads and New York City ran a video about it?

Well in a bizzare step up the US Government made a move to purchase drugs to help combat the effects of radiation poisoning.

Details below. This is either a fabulous psy op or telegraphing about what the government knows could happen if things continue to deteriorate in Europe and Ukraine.

People really should not discount the possibility of a nuclear incident in the coming months, either by error, “accident” or intentional military deployment. All signs point towards this being a very real threat at the moment.

OPEC announced its largest supply cut since 2020 prompting backlash from the Biden Administration who called the decision short sighted and detrimental to the world while we deal with the consequences of the War in Ukraine…… That’s uhhhh kind of the point lol (Russia is in this group).

The US conducted a series of raids in Syria with special operations forces neutralizing ISIS operatives

The United States Department of Health and Human Services this week announced that it has purchased $290 million to acquire drugs for use in radiological and nuclear emergencies. Totally normal!

Two Russian nationals were detained by US officials after sailing over in a small boat to St Lawrence Island in Alaska.

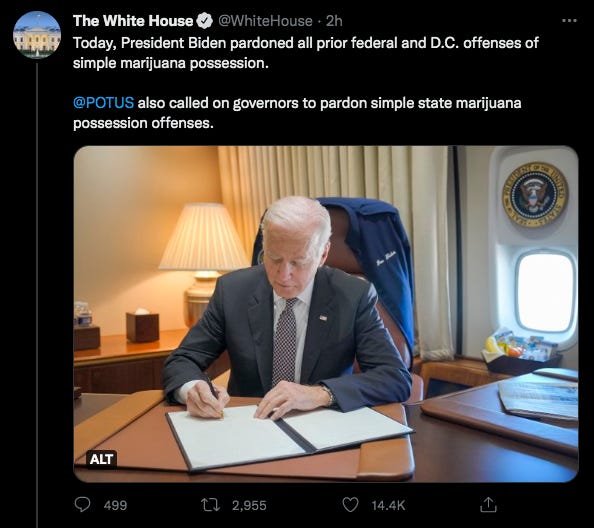

President Joe Biden on Thursday chose to pardon thousands of individuals convicted of possessing marijuana, marijuana related stocks soared into the atmosphere

The final decision on whether to bring a case against Hunter Biden will be made by Delaware US Attorney David Weiss who was close to Trump.

Reports suggest that the Feds for months had enough evidence to charge him with tax crimes and lying about his drug abuse so he could buy a gun, a new report revealed Thursday. (NY Post/Washington Post). Interesting to see that a publication like the Washington Post was willing to report on this and do it with such detail.

As a left leaning company, this could suggest a start of distancing from the Biden’s by some components of the democratic left (just a thought). Seems this time Hunter may not just skirt by. At the time of me writing this I am already starting to see major publications releasing this story on Hunter.

Thursday at least 36 people were killed, 24 of them children, in a massacre at a child care center in northeastern Thailand believed to be the country’s deadliest shooting incident on record (CNN). Truly sickening.

Kanye West appeared on Fox News anchor Tucker Carlson’s show last night. He spoke on the push for obesity in America, Trump, Biden, and other hot topics.

When Tucker Carlson asked the rapper what he thought potentially made the “White Lives Matter” statement so controversial, West blamed “a group mob” of “liberal Nazis” as well as the media, which he said pushes white societal

President Biden mentioned at a fundraiser that we have never been closer to the “prospect of Nuclear Armageddon”. This comes on the heels of a call by President Zelensky of Ukraine to preemptively strike Russia before they get the chance to employ Nuclear weapons.

Like we spoke to in our post keep your eyes open and take in all these events. War is being practically manifested by these people and I do truly fear for a larger conflict to unfold.

Biden also said Russian President Vladimir Putin is “a guy I know fairly well” and that the Russian leader is “not joking when he talks about the use of tactical nuclear weapons or biological or chemical weapons.

What you’re witnessing on the global stage is the first round of engagements of a new type of Cold War. North Korea earlier this week hurled a missile over Japan, Russian commanders and strategists including Dmitry Medvedev are openly warning of the use of nuclear weapons, and we now have the US government buying pills to treat the side effects of nuclear blasts?

I fail to believe that the economic sanctions in place, no matter how severe they are, will deter the use of weapons if Putin becomes too desperate. We’ve already observed a clear proxy alliance against Russia from the US and her allies and Putin is well aware that the clock is ticking.

When you think it can’t get worse it just does - man.

If you missed our deep dive on Crime in the United States, you can read it HERE.

We’ll be dropping some really cool posts in the next two weeks for paid subs including:

An interview with a former Army Ranger and Weight lifting psycho

An introduction to options trading

A marijuana industry piece this Monday

Given the amount of time and effort we put into our deep dives we have to price access accordingly and the simple truth is people typically don’t value free shit.

The reality is we should charge more as this sub pays for itself over and over again. Instead of buying an extra slutty cheeseburger or shitty almond milk latte each month you can level up and ensure you’re becoming more informed and sharper each week.

When you’re up to it, join the thousands who choose to get access to some of the best financial and macro commentary on the internet.

See you guys Monday for our Marijuana Industry Overview and some of our top stock picks for the Devil’s Lettuce bull run of the next several years.

None of this is to be construed as formal legal, financial, or life advice. I write commentary to inform and prompt critical thinking. These are the opinions and thoughts of a former trader and salesmen turned commerce/financial media brand.