Hey yall hope your Monday wasn’t too bad - hopefully you saw our recent posts: The Simple Blueprint for Getting Rich and How to Become Sovereign and Ungovernable which will help you take some action towards becoming more independent from your day job so Monday’s in the future won’t suck so bad.

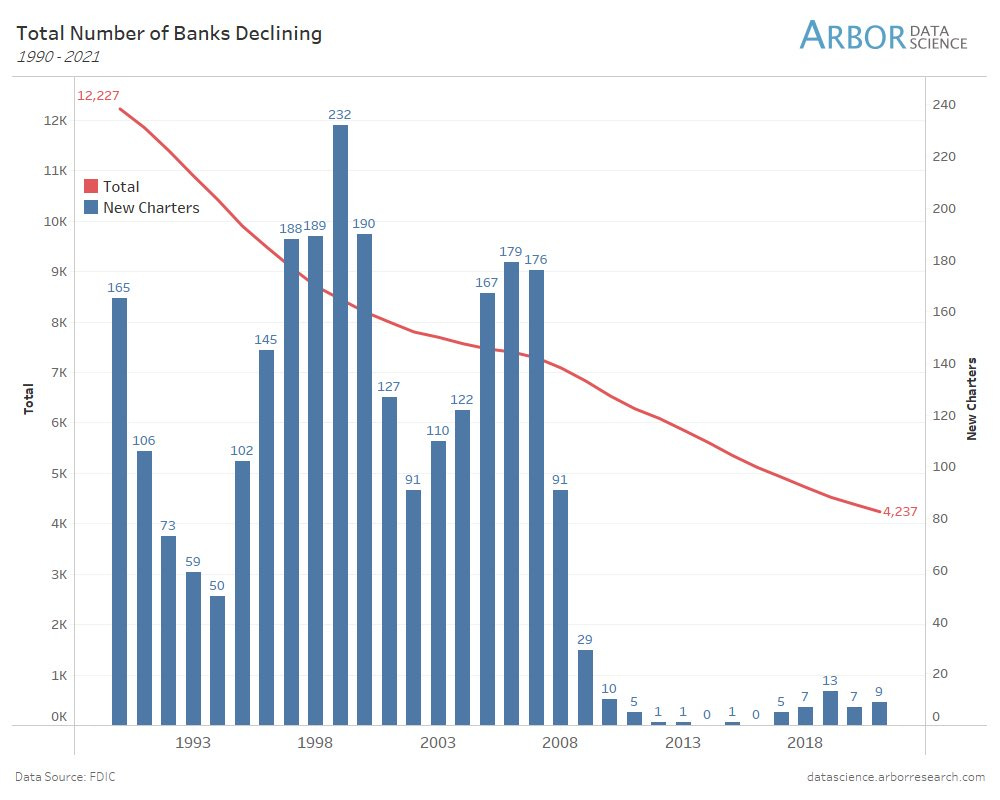

This week all eyes will be on equity markets and the banks that were teetering last week, both in terms of CDS (credit Default Swap prices) and bearish share price moves.

We remain skeptical of several players and suspect that behind the scenes there are scrambling efforts to try and come up with a solution that doesn’t lead to more imminent failures and contagion.

Janey Yellen called an emergency meeting with financial regulators last week presumably to come up with solutions to the active banking crisis that we fully expect to keep panning out, especially with a Fed rate hike last week.

First Republic Bank, Deutsche Bank, and Charles Schwab are all under scrutiny by market analysts and onlookers looking to get ahead of the next big blow up.

First Citizens agreed to buy Silicon Valley Bank for $500 million taking on over $119 billion in deposits as more details begin to emerge about how big the blow up actually was. According to various reports the SVB blow up costed the FDIC $20 billion.

That’s just the FDIC’s loss lmao.

According to a recent Goldman Sachs' prime services weekly report, global hedge funds have made moves to reduce their investments and exposure in U.S. banking stocks to the lowest level in almost a decade and have withdrawn from shares that are sensitive to lending in response to the recent banking upheaval that started earlier this month with SVB and select US banks

Marathon Asset Management LP made around $30 million in a few days because of a well timed bet on Credit Suisse Group AG bonds (Bloomberg)

Binance and Changpeng Zhao are being sued by the CFTC (Commodity Futures Trading Commission) over Regulatory Violations

Arbitrum’s native ARB (not our token) tokens totaled more than $2 billion in trading volume in the first 24 hours since going live last week - The ARB token serves as a means of governance for the protocol. Holders of ARB can participate in decision-making processes, such as proposing and voting on protocol upgrades or changes - however, like most airdrops the token has dumped in price trading around $1.22 as of 12:30pm ET (CoinDesk)

Chinese state-owned banks are reportedly actively approaching cryptocurrency businesses in Hong Kong, suggesting renewed Chinese government support for crypto friendly ventures - (via The Straight Times)

Money pulled from eurozone banks is at record rate in February according to the Financial Times

Saudi Aramco takes a 10% stake (worth almost $3.6 billion at the current exchange rate) in Rongsheng Petrochemicals, who is the biggest of the Chinese 'teapot' oil refiners (Twitter via Javier Blas)

Equity markets remained somewhat flat Monday as the Dow Jones saw a nice bump. The Nasdaq finished down ever so slightly and the S&P was barely up. There seems to be some confusion as to what is going to happen next with big banks, inflation, and market sentiment.

It is unclear if the banking crisis is completely over but for now inflation continues to dampen the longer term outlook for tech heavyweights and high growth stocks. First republic bank and Deutsche Bank, who struggled last week saw small bounces today as the alarm cooled off a bit surrounding liquidity and deposit scares.

Crypto markets have been the subject of much discussion and peculation as Bitcoin and Ethereum continue to outperform equities, gold, and other assets, though a small correction seems to be underway this afternoon.

Michael Saylor, the psychotic bitcoin size god and CEO of MicroStrategy announced this morning that his company has acquired another 6,455 bitcoins.

In another bright spot for long term adoption and legitimacy — the Nasdaq announced that it is aiming to debut its crypto custody services by the end of the second quarter per Bloomberg on Friday. This is a huge sign that traditional finance institutions and organizations are seeing the opportunity ahead for Bitcoin and want to get in on the action.

This, along with future regulatory clarity, should be positive forces for the growth in adoption and acceptance of Bitcoin for much larger groups. It’s great to see these pieces of news come out in the wake of FTX, where many retail and institutional grade investors likely still have hesitance to enter the space for fears of security and custodial risks.

On the darker side Federal prosecutors in New York are charging Terraform Labs founder Do Kwon with fraud after he was arrested by police in Montenegro. Do Kwon cost investors billions and fueled the broader losses in crypto at the time, estimated at around $300 billion in value across the entire cryptocurrency space.

One thing’s for sure, Saylor does not lack conviction. It seems at this point he will either go down as one of the smartest and ballsiest traders in history or as the clown who ended up accumulating an ultimately worthless asset though we don’t think the latter is the case).

Our advice for now is to avoid speculative alt coins as they will likely continue to bleed out alongside Bitcoin — who has been showing impressive strength through macro uncertainty. Bitcoin dominance, is the metric that tracks its share relative to that of the rest of the market and is typically an indicator of how BTC performs compared to other altcoins.

Currently, BTC dominance stands at a high not seen since June 2022 (CryptoPotato). This is great if you hold primarily Bitcoin, not so good if you are heavy into alts.

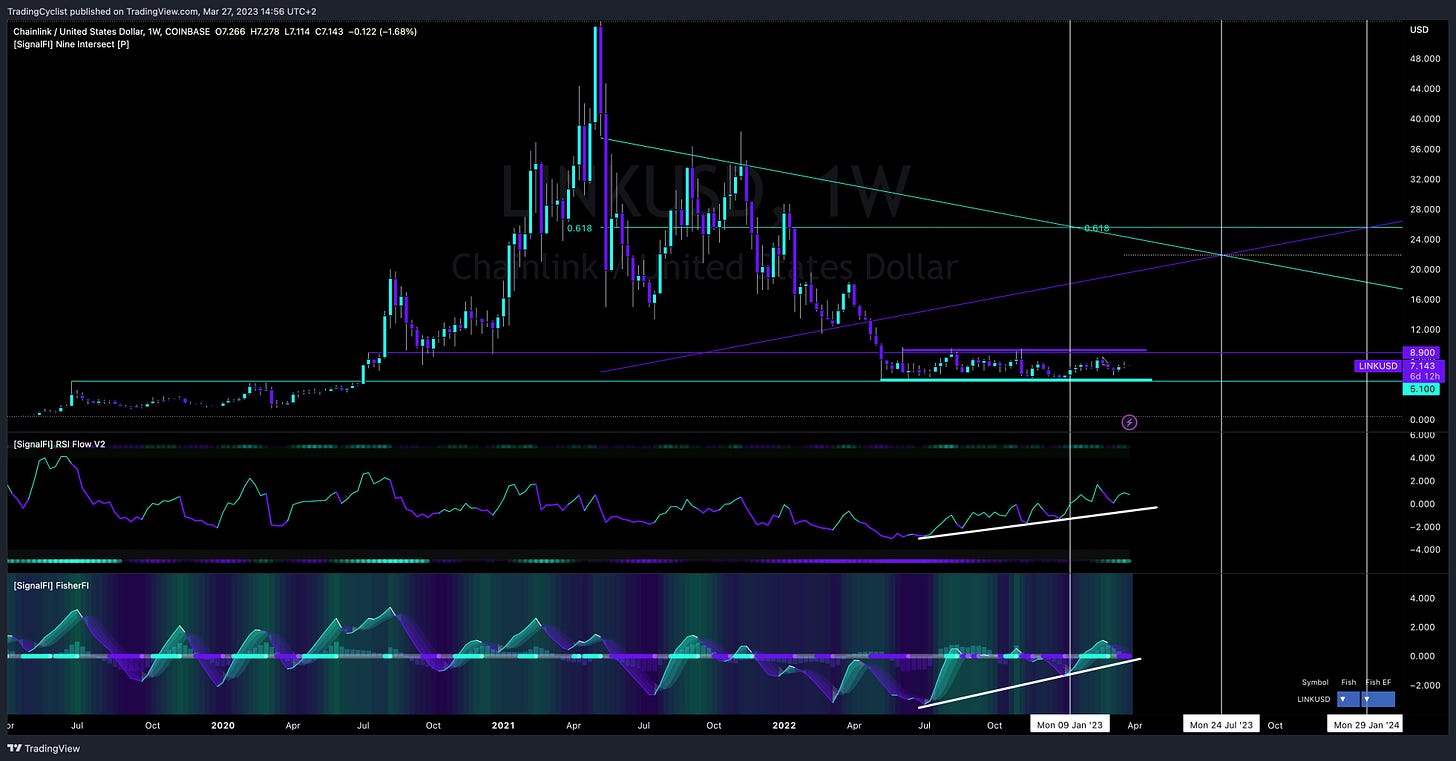

One of our favorite alt coins/projects, Chainlink, has steadily been chugging along, though admittedly, very slowly.

Chainlink has been ranging in a nice accumulation zone, not showing a particular sense of where it is going to go next but more importantly not god dumping to extreme lower levels.

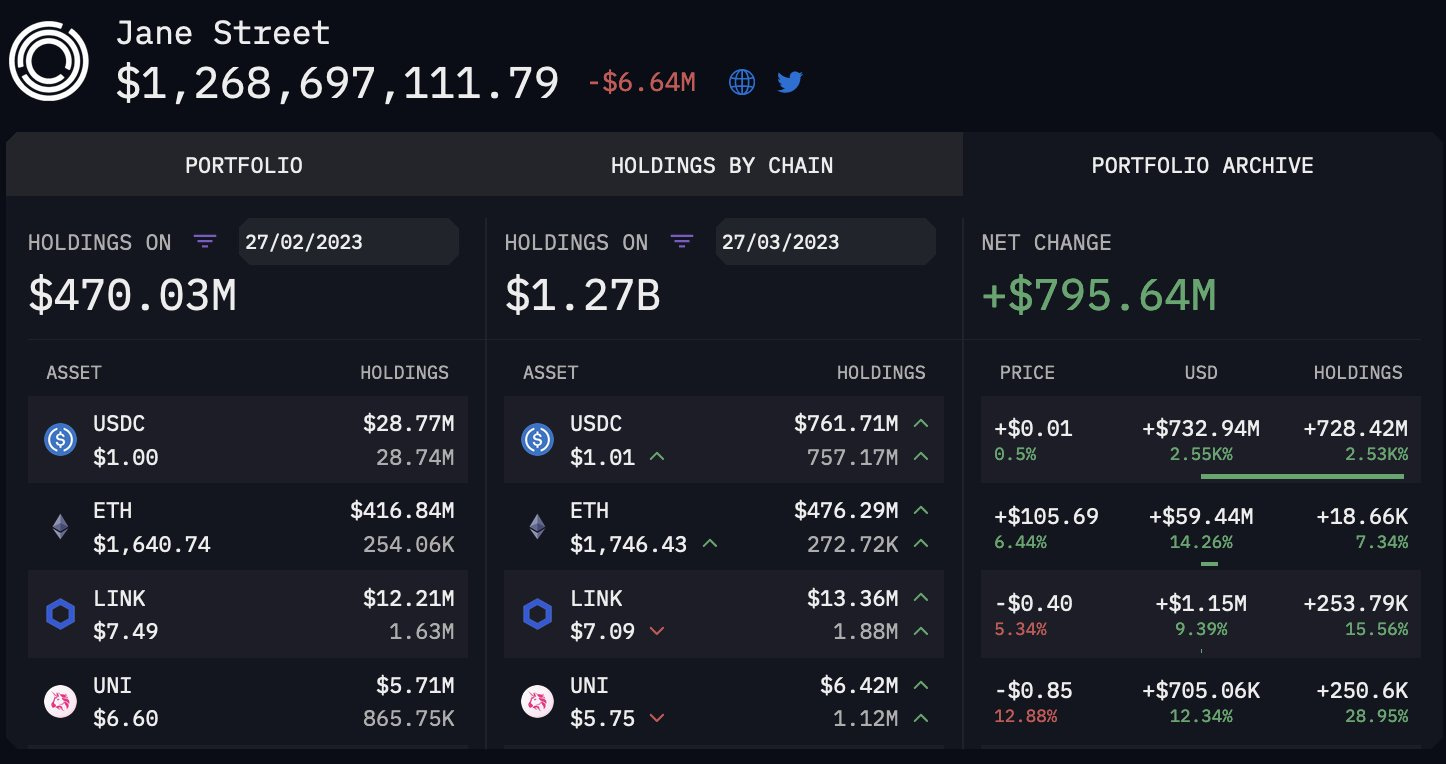

Many technical analysts and traders have begun to point out the bullish divergence in the RSI slope — which could implies that a move northwards is set to come soon. Take a look at this recent post from Arkham Intel on Twitter. It suggests that Jane Street, an absolute Wall Street behemoth, has LINK as their third highest allocation o their on chain balance.

Arkham’s label attributions are algorithmically greater than 95% confidence and the firm noted on Twitter that this appears to be coming into their main wallets rather than an OTC service.

Chainlink’s recently announced partnership with international banking network SWIFT is one of the reasons we are hyper bullish on this project for years to come. As the premier decentralized oracle network in crypto, Chainlink may eventually prove to be absolutely indispensable for facilitating smart contract communication with off chain data for mega global enterprises and financial firms.

The Chainlink ecosystem already has some massive names like VISA, SWIFT, Google Cloud, etc but we could eventually see this range of partnerships, and more importantly usage, explode.

If that happens, we expect significant price appreciation for LINK.

Patience my sons and daughters. Our day will come.

Market Sentiment

"Gold is toppy at these levels… But you also have to look at why we are up here. We have a banking contagion that continues to grow and we don't know when it will end. There is not a lot of confidence in equity markets in this environment and people are looking for places to put their money. There are solid reasons why gold could push past the 10% level."

— Sean Lusk, co-director of commercial hedging at Walsh Trading (Kitco.com)

“The US banking system is safe”

— The White House

Global News

A quick round up of top news points followed by focus sections on larger countries dealing with issues that are playing out live.

Notice below, the abundance of news re: CBDCs and shifting from the US Dollar, definitely worth paying attention to as inflation mounts, Bitcoin rallies, and people continue to lose trust in banking systems. Not a coincidence.

Kenya signed a recent deal with Saudi Arabia and UAE to buy oil with Kenyan shillings instead of US dollars

The National Academies of Sciences, Engineering, and Medicine (NASEM) has appointed a committee to review evidence on the relationship between the vaccines and specific adverse events that have occurred after vaccination, including infertility and sudden death (Zero Hedge)

On Thursday, the central bank of the United Arab Emirates declared that it plans to finalize the initial phase of its central bank digital currency strategy, which involves developing a proof-of-concept for both wholesale and retail CBDCs by approximately mid-2024

The Matsu Islands that make up a small archipelago in the East China Sea have been recently cut off from the outside world after two underwater internet cables were severed by Chinese ships last month

After conducting a closed pilot program with varied financial institutions in 2023, the Central Bank of Brazil’s president Roberto Campos Neto, has said he is aiming to launch a CBDC in 2024

In February 2023, the Bank of England and HM Treasury released a consultation paper that outlined the case for a digital pound to be implemented

Jack Ma, Cofounder of Alibaba made a recent rare public appearance in China

FBI Director Christopher Wray told a Senate hearing on worldwide threats to U.S. security that the Chinese government could use TikTok to control software on millions of devices and drive narratives to divide Americans over Taiwan (Unusual Whales)

Authorities were responding earlier today to a 70-car train derailment with leaking hazardous material in Richland County, North Dakota. This comes on the heels of an explosion of a chocolate factory in Pennsylvania that killed 7 and other strange train issues across the United States including one playing out as I type this. Emergency crews are responding to a report of a runaway train carrying 180 railcars at 80mph with no crew on board near the Kelso area of California.

An active shooter event took place with multiple casualties reported inside at the Covenant School in Nashville Tennessee this afternoon, at least seven are dead including 3 children. The shooter is dead and is being reported to be a 28 year old female who was armed with at least two rifles and a handgun as of 2:20pm ET. Super upsetting stuff - we will report more as we learn the details

An American contractor was killed and five U.S. troops and a second U.S. contractor were wounded when a suspected Iranian-linked drone attacked a coalition military base in northeast Syria late Thursday, the Pentagon said in a statement (USA Today).

China/Russia

Putin recently quipped after a meeting with President Xi: “We are in favor of using the Chinese yuan for settlements between Russia and the countries of Asia, Africa and Latin America.”

The imposition of sanctions on Russia due to its invasion of Ukraine, along with the United States' more confrontational stance towards China, has resulted in a situation where both Russia and China are expediting their efforts to diversify away from the dollar, creating a sizeable problem for the West and our track record of dollar dominance.

Remember that The Bank of Russia is preparing to roll out the first consumer pilot for the digital ruble on April 1st 2023. It is quite clear that our enemies are aligning militarily, strategically, and now fiscally — no doubt to circumvent more sanctions from the West in response to the Ukraine War but also to ensure that if conflict arises the two nations dont suffer from being too dependent on the US Dollar.

According to Foreign Policy Xi and Putin have held 40 one-on-one meetings since 2012, twice as often as either has met with any other world leader since.

And there’s good reason to be fearful of this alliance, as historically, the countries have not exactly been the best of friends — differing significantly on culture, territory, customs, and strategic goals.

This partnership comes at a time when the US and West is perceived to be week in the global order after a disastrous pull out of Afghanistan, dwindling military recruitment numbers, and an unclear ending to the current conflict in Ukraine that is drawing more and more concern from global leaders who think it could dramatically escalate, pull in a NATO country, or turn nuclear.

"Deployment of Russian tactical nuclear weapons on the territory of Belarus will cool the hot heads in unfriendly countries"

— Deputy Chairman of the Council of Belarus, Valery Belsky (Trollstoy Twitter)

In the new stage of it’s ongoing prolonged war with Ukraine, Russia has heightened tensions with the West by announcing plans to deploy "tactical nuclear weapons" in Belarus, according to President Vladimir Putin. The term "tactical nuclear weapons" typically refers to smaller more mobile weapons intended for limited tactical battlefield use, rather than larger "strategic" nuclear weapons with long-range capabilities like ICBMs.

Putin has also just recently revealed that 10 fighter jets capable of carrying such weapons are already stationed in Belarus, and he also announced that Russia would make moves to set up Iskander hypersonic missiles, which are armed with nuclear warheads and have a range of roughly 300 miles in Belarus.

North Korea

North Korea has bee particularly active in recent months, both in terms of missile tests around Japan, and in their rhetoric about defending against Western aggression. North Korea claimed last week that about 800,000 of its citizens have recently volunteered to join or reenlist in the military to fight against the United States, according to North Korea’s state newspaper.

North Korea launched a Ballistic Missile in the direction of the Sea of Japan this weekend and the launch marks the seventh missile test this month as tensions are becoming more and more amplified between North Korea and it’s pro West neighbors.

South Korea’s Joint Chiefs of Staff said the two North Korean missiles were fired from a western inland area south of the North’s capital of Pyongyang from around 7:47 a.m. to 8 a.m. and traveled around 370 kilometers (229 miles) before landing at sea (AP).

This missile launch comes shortly before the U.S. aircraft carrier USS Nimitz along with other ships from an accompanying strike group are scheduled to dock at a South Korean naval base in the southeastern port city of Busan on Tuesday (CNBC).

Israel

Hundreds of thousands of Israelis protested against Netanyahu’s government driven judicial reforms amid various reports his governing coalition is becoming increasingly divided on the issue.

The outrage is stemming over far right/ultra nationalist bills that would drastically change the balance of power between the different branches of government within Israel. Those against it, argue that these bill will work to significantly weaken the country’s Supreme Court, giving almost unlimited powers to the incumbent coalition.

The protests were intense and large and demonstrators eventually breached police barriers in an attempt to reach Netanyahu's house based just inside Jerusalem.

Violence has begun to spread and Israeli officials and authorities are struggling to contain the rage and anger that many of the protestors have.

France

Over the weekend, the level of protests in France increased as law enforcement officials used over 4,000 nonlethal dispersion grenades to disperse individuals who were expressing their grievances regarding French President Emmanuel Macron's proposed pension reforms.

Videos dumped on social media featuring riot police beating civilians with batons as well as unconscious or seriously harmed police being dragged away from scenes of action.

Some 441 police officers were injured and 475 people are understood to have been arrested on what has been dubbed “Black Thursday” (The Independant). Critics accuse Macron of effectively ruling by his choice, cementing decisions and ramming them through to approval without regard for democracy or the will of the French People.

One things for sure, he’s pissed off the wrong contingent of people, who have revolution in their hearts and frustration with the way the European country has been run in the last year.

Hope you guys enjoyed today’s summary of markets and global news.

We will see paid subs tomorrow for a deep dive on 10 Long Term things you can start this week to delay gratification and reap the benefits of your work this summer. It will be geared towards personal development, business building, and physical/mental health.

Arbitrage Andy Instagram

Arbitrage Andy Store

Arbitrage Andy Twitter

*DISCLAIMER - None of this is financial advice, it is important that you do your own research and make your own investment decisions. I am a former trader and currently work within sales/financial technology/brand building/e comm.

Because I have built such a massive digital network building Arbitrage Andy & Arb Letter, Arb Letter looks to leverage that information and sentiment for you to make informed decisions that cut through the noise and bias of modern media and news.

Probably. Apples and oranges tho. Many tech stocks at the time were nothing burgers but many also had tangible product.

Crypto is ethereal, greater fool, product to me.

Give me farm land or even gold

Andy, I know you are a crypto fan and we are not of the same generation, but some of us will NEVER buy crypto.

Your thoughts on Gold/silver?