Financial Markets

Hey guys happy Friday - quick markets and news round up for all subs today.

At the moment indices have surged quite a bit and shrugged off concerns of the debt ceiling issue or the probability of a more intense recession — call it the calm before traders and investors start reacting to the next fed decision. Long term core holdings for us like $NVDA (+118%) and $MSFT (+85%) have performed very well on this medium term bounce.

$PLTR is even showing signs of life as well after a steep fall when the fed pivoted and covid money dried up (see below chart). I added some shares of $AMZN this week with some couch money I had laying around and also made deposits to my dividend account where I added more $T , $VZ, $MMM and $VALE.

I’m hesitant to put anymore cash in at this moment as I think we’ll either see a strong trend continuation (pump) or a pretty quick reversal next week — either way we benefit.

I haven’t added anymore crypto exposure expect for a small add of $BTC - but expect crypto to surge next week if the rally in equities continues and $DXY doesn’t go on some northwards bender all week. With the addition of a whole range of APY incentives and deposit programs from other banks, credit card companies, and tech companies it’s clear that ultra wealthy investors still have appetite for 4-5% gains until things become more certain on the macro front and there are changes made to rates.

We managed to take advantage of the strong bounce from $META although I wish I had gobbled up more — hindsight trading is 20/20 but this was a no brainer as the stock had been absolutely pummeled - you think lord zuck will give up that easily? *insert skeptical lizard face*

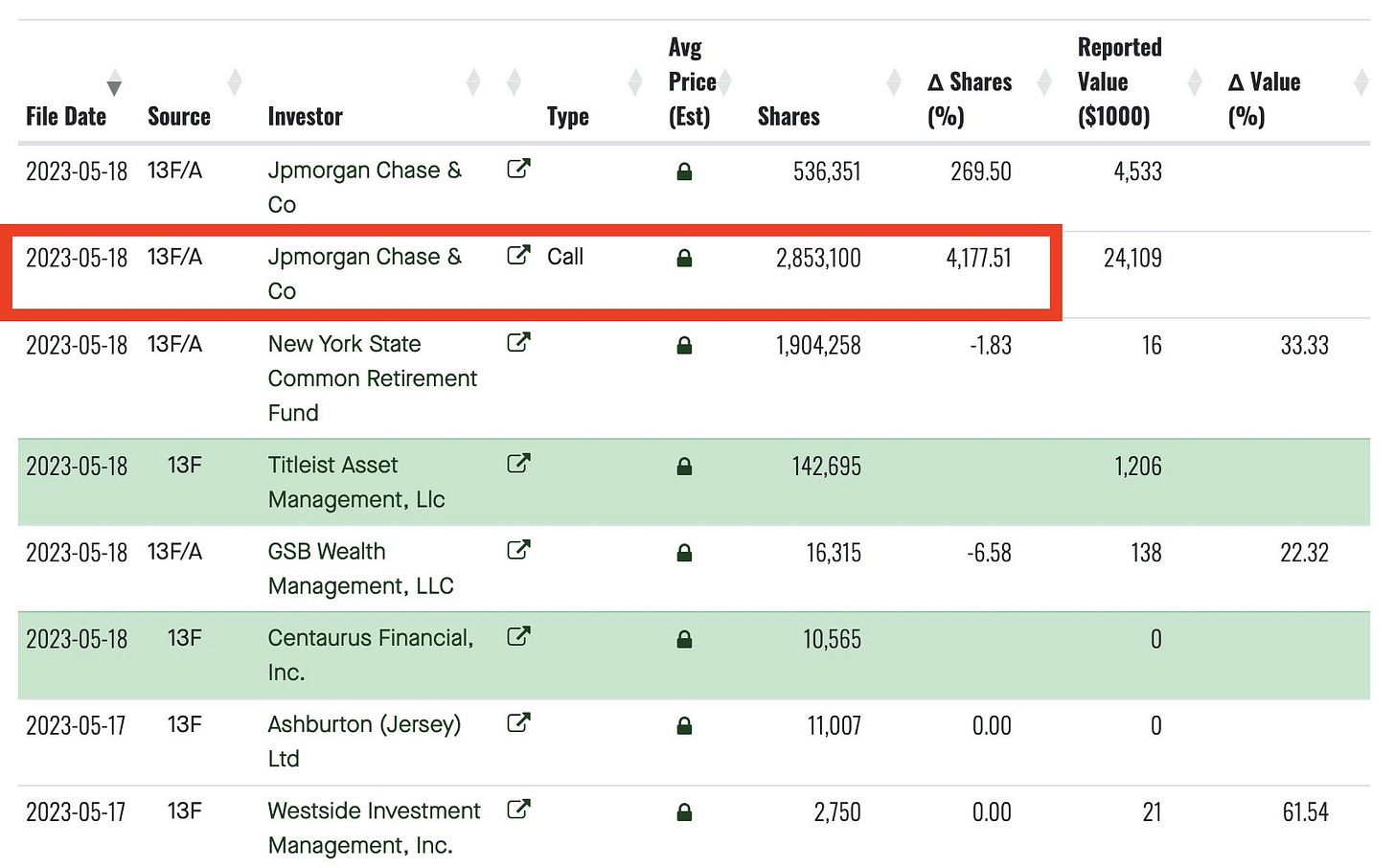

Cathie Wood $ARKK has purchased an additional lot of 286,714 shares of PLTR 0.00%↑ his week. JPMorgan has also added a pretty large amount of call options on the name this week (see below graphic from @iamrocketmen on Twitter)

Deutsche Bank will pay $75 Million to the victims of Jeffrey Epstein

Disney has pulled the plug on $1 Billion development in Florida

Lazard CEO Ken Jacobs will step down as CEO and will hand over reins to Peter Orszag after the investment bank cut the more than 300 employees, roughly a tenth of its workforce

Apple, AAPL 0.00%↑ has now restricted use of ChatGPT and other external artificial intelligence tools as it aims to develop its own similar technology according to the WSJ

Meta is going to start laying off employees next week in its latest and potentially largest round of mass cuts

Almost 38.5% of American homes — the equivalent of about 89.1 million — faced difficulty in paying for usual home expenses between April 26 and May, per Bloomberg (Unusual Whales)

30% of Gen Zers owned homes at age 25 in 2022 according to Redfin.

Germany's stock-market DAX index has hit an all-time high

Morgan Stanley’s James Gorman plans to step down as chief executive officer/CEO in the next 12 months and move into the role of executive chairman (Bloomberg)

Following the announcement of U.S. Secretary of State Antony Blinken's upcoming visit to Papua New Guinea, China issued has a warning against the introduction of "geopolitical games" in the South Pacific (US news)

There have some been some notable developments in crypto that will shape short to medium term prices and trust in the industry as a whole.

Chiefly Ledger, one of the ore popular cold storage options and one that we have relied on traditionally posted some concerning tweets this week and one highly controversial one (now deleted) which Ledger said was written by a customer support agent and had stated that it was “possible” for Ledger to write firmware that could extract users private keys.

The deleted tweet said, “Technically speaking it is and always has been possible to write firmware that facilitates key extraction. You have always trusted Ledger not to deploy such firmware whether you knew it or not.”

Ledger was debuting a recovery service in which they would require a KYC and TECHNICALLY have access to user private keys. A good lesson that crypto is an emerging technology and we will continue to see these unsettling developments across all verticals in the industry. We may end up pivoting to Trezor as a result of this development.

Coinbase Cloud announced they will run an oracle node to help advance the important work of securely connecting smart contracts with real-world data

Ripple launches CBDC platform; claims that central banks will not use or interact with XRP

A test of potential use cases for the digital Hong Kong dollar is underway (Blockworks)

Blockchain-based play-to-earn project Axie Infinity's native cryptocurrency AXS rallied after CoinDesk reported on Axie's card-based strategy game debuting on the Apple app store (CoinDesk)

Tether, the creator of USDT, has announced that they will be starting to purchase Bitcoin with a whopping 15% of net realized operating profits starting this month.

JP Morgan insiders have sold a combined $22 million worth of shares over the last week alone (Whale Wire)

Revolut's accounting firm said it was unable to fully verify $591 million of the company's revenues (BlockWorks)

Chainlink co-founder Sergey Nazarov has commented on Chainlink (LINK) and the developments on how the CCIP protocol is developing. In an interview with Bloomberg Crypto, Nazarov discussed many of the developments and growing use cases for Chainlin, Oracles, and Cryptographic Truth.

“I think the world right now is run by a number of brands,” he said. “The U.S. dollar is one of those brands, various banks are brands, insurance companies are brands. And those brands make promises which are only backed by the decisions of people. And, in many cases, those decisions will not result in what the consumer believes they will result in.”

—Sergey Nazarov

Chainlink, the foremost decentralized oracle network in the web3 industry, has enabled over $7 trillion worth of transactions and dominates the majority of DeFi platforms.

It achieves this by supplying vital real-world financial data and essential services like Proof of Reserve, setting a new transparency benchmark for financial products and institutions.

We remain staunchly bullish on Chain Link as more institutions like Fidelity, BNY Mellon, and others realize that being able to have a complete verifiable source of truth for contracts is highly valuable in a market climate where investors are losing trust in transparency from legacy institutions.

Market Sentiment

The answer to anything that is "it's a bubble" is, okay, how much can i make before the bubble bursts and how do i protect myself from the bursting NOT, i must avoid this like the plague

—Jim Cramer

“I think, at the end of the day, we’ll arrive at a world where everything is cryptographically guaranteed including currencies, banks, insurance companies – everything.

Because if you ask a person where they want to put their faith – in another person who can control the outcome of their financial life or if they would rather put their faith in a system that can’t deviate and can only act in very specific ways – then I think that second option is the far superior option.”

—Sergey Nazarov - Chainlink Co Founder

"Increasing the debt limit the way Congress and presidents have repeatedly done, and most likely will do this time around, will mean there will be no meaningful limit on the debt.

This will eventually lead to a disastrous financial collapse"

—Ray Dalio

Global News

As the War in Ukraine putters along, political tensions are growing in the US as key politicians position themselves for the presidential election in 2024. A number of hot issues will likely take center stage like gun control, abortion, trans rights, federal agency corruption, the economy, and our relationship with China. At least nine individuals lost their lives on Thursday as Russian missiles targeted various cities throughout Ukraine. Kyiv, Odesa, and Kharkiv witnessed damage to buildings and infrastructure, leading to power outages in multiple regions.

In US politics the huge bombshell of the week was the final release of the John Durham report covering the investigation into Trump and Russia. The contents of the report paint the FBI in a very poor light showing a lack of judgement and that the agency relied primarily on intelligence and leads from political opponents of Trump. You can read our analysis of it HERE.

Sen. Dianne Feinstein’s office said she is suffering from Ramsay Hunt syndrome, a complication from the shingles virus, and that she contracted encephalitis earlier this year (AP)

The Pentagon has miscalculated the worth of the weapons it dispatched to Ukraine at roughly $3B—an oversight that could benefit the war effort, enabling the Defense Department to send additional weaponry without seeking funds from Congress.

US Presidential candidate Robert F. Kennedy Jr. says Bitcoins “is an exercise in democracy”

Zelensky arrived today in Saudi Arabia for Arab League summit

New Census data from The Hill shows that nine of the 15 fastest-growing cities in the country are located in the South

U.S. military officials are now walking back claims that a strike in Syria killed a senior al-Qaeda figure, following claims by the dead man’s family that he had no ties to terrorists but was actually tending to sheep when he was slain by the missile (WP)

A New York City hospital employee who was pregnant has been placed on leave after a viral video that appeared to show her attempting to take a rental bike from a group of young Black men garnered millions of views — it’s now been proven by the woman’s lawyer she did in indeed pay for the bike. Might be some lawsuit money in her future

The FBI has suspended the whistleblower agents that are testifying about FBI’s ongoing weaponization against conservatives to congress, this comes after the damning implications of the John Durham report demonstrating abuses of power and scope by the FBI in their investigation of President Trump

Recent legislation reintroduced would create a federal U.S. agency to enact "enforceable behavioral codes" and various other rules for digital platforms such as Twitter (DiscloseTV)

Witnesses to Jordan Neely chokehold death on a NYC subway have called Daniel Penny a ‘hero’ and several have offered to testify on his behalf

Bank of America allegedly gave FBI Access to Jan. 6 bank records without customers' knowledge (ZeroHedge)

Articles of impeachment are to be filed against Biden led by Marjorie Taylor Greene

South Africa’s foreign ministry summoned the U.S. ambassador to a meeting Friday to express its “utter displeasure” over allegations he made that the country had supplied Russia for its war against Ukraine ( NBC News)

The United States and Taiwan have concluded negotiations on a trade agreement to deepen and expand economic ties, amid growing tensions between Washington and Beijing (InsiderPaper)

China is shifting its focus from the significant Belt and Road Initiative it launched in 2013, choosing instead to aim for smaller direct investments in strategic ventures such as renewable energy and communication initiatives. The Belt and Road Initiative initially entailed massive loans for colossal infrastructure projects primarily in the southern hemisphere of the globe

In Hiroshima, the site of the world's first atomic attack at the end of World War II, leaders from seven of the globe's most influential democracies are convening for the Group of Seven summit including Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

People are growing weary and tired of the War in Ukraine and with the quasi-recession we find ourselves in globally. I expect tensions to mount as we lead up to the US Presidential election in re: to Ukraine AND Taiwan.

It makes sense strategically to take advantage of any chaos within the US to make a move when our attention is focused elsewhere.

Next week we’re going to put out a few more positive Arb Letter’s since a lot of our coverage has been doom and gloom recently ( I recognize that).

We’ll focus specifically on a piece about 10 stocks we are eyeing to acquire in the next two months as well as a lifestyle piece.

If you’re interested in some of our premium posts the following have been the most read and engaged over the last 3 weeks:

9 Mistakes Most People Will Make

Indispensable Skills Everyone Will Need Moving Forward

Financial Opportunities Most Will Miss

The Simple Blueprint for Getting Rich

Paid subs get access to our entire archive of 195+ posts.

*Disclaimer — I am a former commodities trader and current enterprise salesman/e commerce guy with a monkey brain — this is not formal investment, political, or life advice. Please research all of your investments before throwing money at them and ensure you are not investing irresponsibly or making poor strategic life decisions.

Andy - could you comment on what would happen to bonds that individuals may hold (such as I bonds) if the government does not raise the debt ceiling in time? Are those defaulted on?