Morning everyone — free post for all subscribers today to sum up the week on the markets and news front.

If you missed it — I launched Risk On this week — the podcast aimed at covering many of the same topics we do here in a concise and straightforward manner. We have our first interview coming up next week so be sure to follow on Spotify and get caught up ahead of that launch (likely Monday).

I want to thank all of you who tuned in so far from a statistics perspective it’s been a huge success with thousands of listens and downloads since the launch last week. Excited to continue to grow it and bring interesting folks on for interviews.

Remember — if you guys enjoy it — make sure to leave a review which will help the algo and ranking in Spotify. I will update you all as it becomes available on alternative platforms.

Financial Markets Updates

Markets were a bit jittery on the heels of the Presidential Debate earlier this week but have since bounced, with a solid recovery from crypto and NVDA 0.00%↑ .

Key factors include Boeing's shares dropping about 4% due to a large-scale strike affecting production, Adobe facing an 8% decline after issuing a weaker-than-expected outlook, and Oracle rising 6% on strong long-term revenue projections. Gold prices have reached new highs as investors anticipate potential Federal Reserve rate cuts.

This week, oil markets saw a surge in prices, driven by tightening supply concerns and strong global demand. Saudi Arabia and Russia extended their voluntary production cuts, with both countries signaling their commitment to bolstering prices through reduced output. Meanwhile, U.S. crude inventories dropped more than expected, further supporting the bullish trend.

Concerns over economic slowdowns in Europe and China were tempered by stronger-than-expected demand in Asia, keeping oil prices elevated and signaling continued volatility in the energy markets.

Gold has surged to new highs this week

Silver is ripping SILV 0.00%↑

England's High Court of Justice has ruled Tether's stablecoin USDT is a property

Tech Stocks Rebounded: Major tech stocks like Apple, Microsoft, and Nvidia saw gains, recovering from last week’s sell-off, driven by optimism around new product launches and easing inflation fears. Apple, in particular, saw a boost following the announcement of the iPhone 15 series.

Tesla Stock Volatility: Tesla has experienced sharp fluctuations after the company lowered prices on its electric vehicles again in the U.S., raising concerns about profit margins. Despite this, investor sentiment remains divided, with some analysts maintaining bullish long-term outlooks due to EV market growth, particularly in China.

Energy Stocks Rise: Energy sector stocks saw gains as oil prices continued to climb, with Brent crude surpassing $92 per barrel amid tightening supply from OPEC+ cuts. Companies like ExxonMobil and Chevron benefited from the strong oil market.

Arm’s IPO Success: Semiconductor designer Arm's highly anticipated IPO was a success, with the stock surging by nearly 25% on its first day of trading, highlighting strong demand for tech IPOs despite broader market uncertainty.

Financial Sector Worries: Bank stocks faced pressure this week, with concerns around interest rates and slowing loan growth affecting investor sentiment. JPMorgan, Wells Fargo, and Bank of America saw modest declines as the market eyes the Federal Reserve’s rate decision next week. Financial sector names might experience further volatility in the event Kamala Harris wins in November with a lack of clear policy on the horizon.

Size Lord Michael Saylor has bought yet another batch of Bitcoin in the past few weeks. He’s either the future world’s richest man with the single most conviction on earth or he will go down as the biggest bag holder in history.

This week, the crypto markets have been volatile but showed resilience amid macroeconomic influences. Bitcoin bounced back to trade above $58,000 after briefly dipping below $56,000, spurred by the release of favorable U.S. Consumer Price Index (CPI) data and expectations of a potential Federal Reserve rate cut.

This has helped lift sentiment across the market, with many altcoins also seeing gains. Ripple (XRP) was among the top performers, climbing over 6% due to strong institutional interest, including the launch of a new XRP Trust by Grayscale. I do not think having a small bag of XRP is a bad idea.

However, not all coins fared well. Aave (AAVE) and Helium (HNT) both saw declines of around 6% and 4%, respectively, as the market absorbed outflows from ETFs and reduced decentralized finance (DeFi) activity.

The overall market remains cautiously optimistic, with investors eyeing potential price surges following the anticipated Fed rate cut on September 18, which could boost liquidity and favor riskier assets like cryptocurrencies.

Despite short-term volatility, the long-term outlook remains positive, especially for Bitcoin, which analysts predict could reach new highs in the next year. Make sure to check out our post from earlier in the week talking through some potential ideas to hedge your portfolio in the event of a Kamala win in November.

Key events to watch in the coming week include regulatory developments, particularly ongoing legal issues involving major players like Binance, and the Federal Reserve's rate decision, which could set the tone for the remainder of the month.

Our time in crypto will come — but only the patient and convicted will ascend to Valhalla.

Geopolitics Updates

This week saw significant developments across multiple geopolitical hotspots, further shaping the global landscape. In Ukraine, fierce counteroffensives in the east and south, particularly near Bakhmut, have escalated the conflict, with Russia responding through increased airstrikes.

Meanwhile, tensions between China and Taiwan continue to rise as Beijing ramps up military drills around the island, prompting a stronger U.S. naval presence in the region.

North Korea has also been active, launching several ballistic missiles in response to U.S.-South Korean military exercises, stoking concerns of potential conflict on the Korean Peninsula. In Libya, violent clashes between rival militias in Tripoli have destabilized the capital, worsening the humanitarian crisis and impacting oil production.

At the BRICS summit, discussions focused on reducing reliance on the U.S. dollar and expanding membership, with countries like Saudi Arabia and Argentina signaling interest in joining the bloc.

Additionally, West Africa remains a point of concern as Niger’s military junta solidifies power in the wake of a coup, reflecting broader instability and rising anti-Western sentiment in the region. These geopolitical events are reshaping alliances and fueling uncertainty across key regions, with significant implications for global security and economic stability.

A Georgia judge dismissed two criminal counts in the U.S. state's 2020 election interference case against Donald Trump and one other count against allies of the former president - (Reuters)

A 27-year-old man has been accused of planning an attack on soldiers in a northeastern Bavarian town. Authorities said the man had intended to use two machetes to kill as many German soldiers as possible during their lunch break (DW)

Nancy Pelosi just bought into an LLC that looks to buy commercial office property in San Francisco, buy the bottom!

Supercore inflation has risen by 4.5% year-over-year in August and is now double the levels seen before 2020. Supercore inflation is a key metric followed by the Fed which is calculated as core services less housing inflation (Kobeissi Letter)

Sweden announces it will start paying migrants who haven’t managed to integrate into Swedish society USD 35 000 per person to move back to their home countries (Visegard 24)

Democrat Senator Richard Blumenthal said in an interview this week that US citizens will be shocked, astonished, and appalled when the truth finally comes out about the Trump assassination attempt (JackPosobiec)

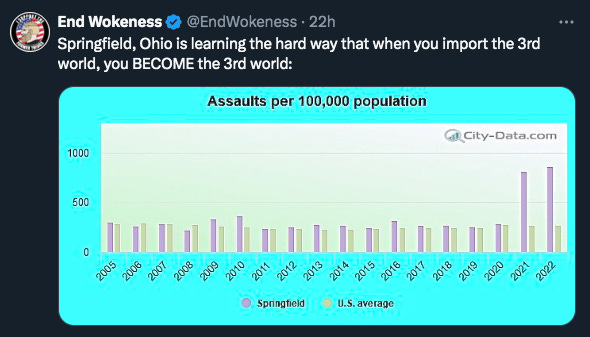

Haitians in Ohio

By now most people have heard about the Haitian illegal migrants in Springfield, Ohio. Donald Trump brought up the talk off some of these people kidnapping and eatings pets, wildlife, and other animals in the town after videos and pictures surfaced online in the past several weeks.

The media and moderators in this debate were quick to label this as false and as misinformation — David Muir the biased ABC host said the city manager of Springfield claimed there was no evidence to suggest this was happening.

But the phenomenon is spreading — this week multiple cats in Houston, Texas have been cut up and mutilated in recent weeks according to media reports (KPRC 2 Houston).

Residents of the town have become increasingly vocal about the issues the town faces as more than 20,000 Haitians have been imported into the city under the Biden Administration. Car insurance premiums have risen due to crashes fro inexperienced drivers, a school bus was hit recently. Assaults are up, and many residents are complaining about. a blatant shift in resources to accomodate the new arrivals.

This week a new development emerged — Springfield City Hall was evacuated on Thursday morning. The Springfield Police Division held a public briefing at 2:30 p.m. to address the evacuation and the threat received by City Hall, though they did not entertain any questions.

Initially, the Springfield Police confirmed to 2 NEWS that the evacuation was in response to an unspecified threat. Later, they clarified that the action was a precautionary measure following a bomb threat received by the city. Law enforcement promptly initiated an investigation into the matter.

All is not well in Springfield.

Bottom line here is the direct and intentional misdirection of this issue by officials and the media. If there is even a shred of truth to the reality in Springfield, the entire nation should care, the media should be investigating it. Instead they are eager to write it off and try to protect the optics of the situation caused by the Biden Administration’s disastrous border policy.

Aurora, Colorado police took to X this week to identify 10 known Tren de Aragua gang members in the town. That was supposed to be misinformation as well remember?

Shameless shit.

Russia & Nuclear Threats

If there’s one thing to “nothing ever happens” camp loves to talk about it’s that the threat of nuclear annihilation is so low nobody should waste any time considering it. According to them that’s the stuff of doomers and preppers.

But the reality is concerns about the chances of a nuclear incident or war are expanding as the conflict in Ukraine hits a serious crossroads. We received confirmation earlier this year in that President Biden had approved in March a highly classified nuclear strategic plan for the United States that reorients America’s deterrent strategy to focus on China’s rapid expansion in its nuclear arsenal (NYT).

Coincidentally the U.S. Defense Department has ordered a study to simulate the impact of a nuclear conflict on global agriculture. Weird! Why would they be doing that?

The nuclear threat has been a persistent undercurrent throughout the Ukraine-Russia conflict, but recent developments have intensified concerns. This week, reports emerged of potential Ukrainian strikes deep inside Russia, including drone attacks and sabotage operations targeting key military and infrastructure sites. These incidents, occurring further from the immediate battlefield, have raised alarms over how Russia may react to the growing reach of Ukrainian operations.

While Moscow has consistently signaled its readiness to defend its territory, including with nuclear weapons, experts remain cautious about the likelihood of such an escalation.

Western intelligence continues to monitor the situation closely, emphasizing that any move toward nuclear engagement would dramatically change the scope of the conflict, likely drawing in a broader international response. For now, the strikes inside Russia are seen as part of Ukraine's broader strategy to pressure Moscow, but the risk of miscalculation adds a dangerous new dimension to the war.

Former Putin adviser Sergei Karaganov stated in Russian media that Russia has the "right to respond" to any attacks on its territory. Meanwhile, Putin has issued a warning that the use of Western-supplied weapons to strike targets within Russia could lead to direct conflict with NATO, framing it as an act of war.

In an era of severe media corruption and endless lies — all global citizens should be weary of this situation developing in Europe. As. I have said before based on the policies, approach, and decisions made by our state leaders, it would appear that a careless and reckless strategy is being employed when dealing with nuclear superpowers.

Nobody wins in that worse case outcome.

I will see you guys next week — the new episode of Risk On drops on Monday on Spotify.

Have a great weekend.

Andy

Risk On Podcast

Gemini Crypto Sign Up

Arbitrage Andy Twitter

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before investing and ensure you have a good understanding of your personal risk tolerance.