Happy Friday lords and kings. A quick note today to cap off a strong week for equities and crypto.

It’s double guac season at chipotle again.

If you missed our premium posts today you can find them below:

It’s crypto pump season again — if you are sidelined or underexposed I HIGHLY suggest checking out our paid posts in the Arb Letter archive. It’s $5/month to access leading strategy and calls that have proven time and time again to pay off. The nice thing about my strategy is that anyone can do it and it keeps things simple. No overtrading, no shitcoin scams, and no feeling FOMO when we inevitably god pump.

If $5 is too much to learn and access the basics so be it — but thousands of our subs have changed their lives by positioning themselves ahead of when the retail masses run everything up to Valhalla.

There is also a free trading crypto guide on the Arbitrage Andy website as well as recommended books on the industry and a list of the top influencers to follow for alpha.

Financial Markets

This week, the stock market has continued its strong momentum, with the S&P 500 performing exceptionally well, up about 21% so far this year. This marks one of the best annual performances for stocks in recent memory. Several factors, including Federal Reserve rate cuts, a slowing but stable inflation rate, and solid corporate earnings, are supporting the market’s upward trend. However, volatility is still a concern due to global risks, such as geopolitical conflicts and the upcoming U.S. presidential election, which could lead to short-term fluctuations.

The Federal Reserve’s recent interest rate cuts have been viewed favorably by the market, as they are seen as efforts to stabilize the economy, particularly the labor market. Analysts are closely monitoring labor market data (which is clearly not great), as this will impact future rate decisions. Historically, stocks perform well when rates are cut during periods of non-recession, and many believe the Fed is aiming for a “soft landing” for the economy, which bodes well for equity markets.

Nonetheless, the election and geopolitical factors could introduce near-term uncertainty.

In terms of sectors, large-cap stocks have been outperforming small caps in this rate-cutting environment. Sectors like healthcare and consumer staples have historically shown resilience during these periods (good to keep in mind).

However, major tech companies, particularly those heavily investing in AI, are facing challenges as investors scrutinize the potential returns on their investments — though TSM 0.00%↑ is up big. As we enter the fourth quarter, earnings reports will likely play a pivotal role in determining the market’s direction, especially as the gap in profitability between tech giants and other sectors narrows.

Overall, while the market remains strong, upcoming political events and global economic conditions could lead to increased volatility. However, this volatility could also present buying opportunities for investors.

Job cuts have bumped this month, as expected, and stand at 73,646 month-to-date (MacroEdge)

Singapore's largest bank DBS has launched token services to enable blockchain-based banking.

Gold closed at its highest daily level all time yesterday

470 tech companies have had layoffs this year so far — 141,145 employees laid off (Layoffs.fyi). Meta is laying off employees across multiple departments, including WhatsApp, Instagram, and Reality Labs (Layoff Tracker)

20% of men aged 24-34 are still living with their parents, compared to only 12% of women, according to the WSJ (Unusual Whales)

The Volatility index, $VIX, has been trading above its 200-day moving average for 64 trading sessions, the longest stretch since 2020 (Kobeissi Letter)

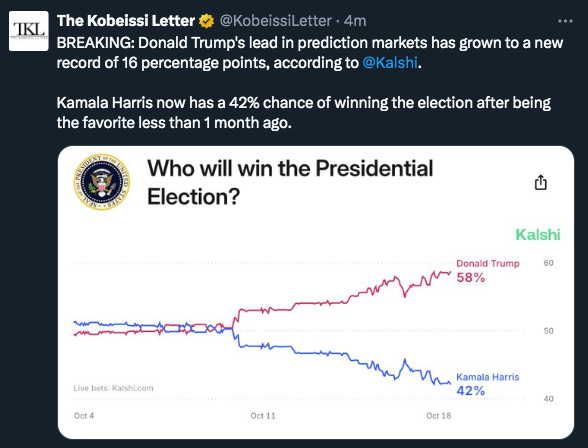

Crypto is clearly pricing in a Trump win at this point. Some soy-boys were coping on instagram I noticed, chirping my account and others like it for providing updated odds from Polymarket and other sources. Imagine getting mad at betting odds lol.

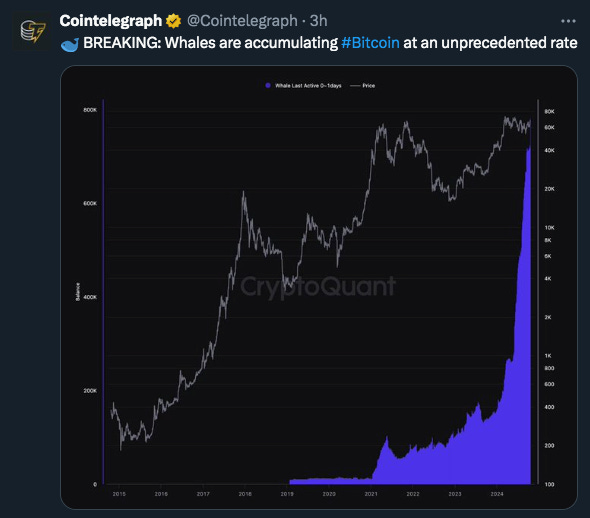

Cointelegraph pointed out that Bitcoin whales are accumulating coins at an unprecedented rate. This, coupled with strong inflows and positive sentiment about price direction could lead us to hit all time highs VERY soon.

It’s time to get your ducks in a row if for some reason you’ve been hesitant in crypto. We very well could be on the verge of the next leg higher when things start to get silly. Bitcoin will make it’s move to an ATH and potentially six figures sooner rather than later.

Knowing this gives you the ability to front run the inevitable catch up played by others assets which likely include Ethereum and hopefully alts that have been neglected due to meme coin metas this year.

If you guys want some free Bitcoin and want to get on my preferred exchange you can use my Gemini link HERE. Get $50 in bitcoin when you trade $500. No gimmicks, it’s easy.

Look guys, I’ve said it before and I will say it again. Gold is at all time highs. Bitcoin is coiling. It’s evident that money printing and devaluation is going to continue. Unless you already own your home or you’re already rich, you NEED to find a way to preserve your wealth AND outperform other assets to get ahead.

Crypto is going to go on a biblical run — sure it matters if Trump or Kamala wins in the short term, but the result is likely going to be the same. A glorious melt up.

Do not miss this. It is going to get silly. Next week or the week after we are going to follow up on our Risk On episode with Colton Kirkpatrick the founder of $ZYN and bring on Mayne (@Tradermayne) on X. Mayne is a legend in crypto with over 400,000 followers. We will talk markets, the bull run, and the prop firm he founded Breakout Prop — the first crypto prop firm to offer perpetual futures liquidity directly sourced from tier 1 centralized exchanges.

Geopolitical News

The big geopolitical news this week came when Israel announced on Thursday that Yahya Sinwar, Hamas' top leader and longtime commander in the Gaza Strip, was killed by troops during an operation in the Palestinian territory. Prime Minister Benjamin Netanyahu described his death as a significant step in the downfall of Hamas' rule.

In the drone video below you can see him on his last leg, reports indicate that IDF troops stumbled upon several militants on a routine patrol. IDF spokesman Daniel Hagari stated that the forces were unaware of Sinwar's presence but continued their operation. Troops spotted three men moving from house to house and engaged them before they split up. Sinwar ran alone into a building and was later located by a drone. He was killed when a tank fired a shell at the building.

His body was found (horribly mutilated) with a flak jacket, a gun, and 40,000 shekels. No hostages, who Sinwar was thought to be using as human shields, were found, and his small group suggests he was either trying to move unnoticed or had lost much of his protection.

Israel gotta be close to hitting that 25 kill streak at this point, regardless of how you feel, their efficiency in the region post October 7th is impressive.

North Korea sent their first contingent of 1,500 soldiers to Vladivostok according to reports by the Seoul spy agency, though NATO cannot confirm this as of now

Five Israeli soldiers were killed in southern Lebanon yesterday in battles with Hezbollah (Trey Yingst)

Italy has blocked all paths for gays to have children after passing law banning international surrogacy (AF Post)

Most Taiwanese believe China unlikely to invade in coming five years, per Reuters/Unusual Whales

Putin says he will not attend G20 summit in Brazil (WatcherGuru)

Tech Censorship

The shadowban and censorship machine is alive and well ahead of this election. An initial senior software engineer at META recently acknowledged to an undercover journalist with O’Keefe Media that Facebook suppresses conservative content. He revealed that posts critical of figures like Kamala Harris are "automatically demoted" with shadowbanning tactics in place to limit their visibility.

A second employee at META, Matthew Fowler a Software Engineering Manager said “Usually the disinformation we saw was pro-Trump... We'll investigate, and then it goes just up to another team to take it [the post] down”.

Expect this to ramp up by a factor of 100 if the left wins this election. It has implications for freedom, freedom of speech, elections, and general societal sentiment.

Al Smith Dinner

The Al Smith Dinner is an annual white-tie charity event held in New York City, named after Alfred E. Smith, a former governor of New York and the first Catholic nominee for president of the United States. The event, organized by the Archdiocese of New York, has been held since 1945 to raise money for Catholic charities that support underprivileged children.

The dinner is notable for bringing together prominent political figures, especially during presidential election years, when it traditionally invites both major party candidates.

Although it's a lighthearted event filled with humor and speeches, it provides a rare opportunity for candidates to showcase a more personal and often self-deprecating side. The event fosters a sense of unity and civility, even among political rivals, and is one of the few occasions where candidates or officials from different political ideologies can share a stage in a friendly atmosphere. Most involved were good sports about the fun that was had.

Last night’s dinner was full of great content — you can watch the full roast by Trump HERE.

Some highlights included:

“Right now we have someone in the White House who can barely talk, barely put together two coherent sentences, who seems to have the mental faculties of a child... But enough about Kamala Harris.”

To Chuck Schumer: "If Kamala loses, you still have a chance to become the first woman president."

"I used to think the Democrats were crazy for saying men have periods but then I met Tim Walz”

“I'm not worried about these White Dudes for Harris because all of their wives and their wives' lovers are voting for me” (LOL)

Going to be a very interesting couple of weeks as the Presidential race accelerates — anything can happen and likely will happen as we wait to see the direction the country takes in the next 4 years.

Have a great weekend — we will be back next week.

Andy

Risk On Podcast

Gemini Crypto Sign Up

Arbitrage Andy Twitter

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before investing and ensure you have a good understanding of your personal risk tolerance.

Every single cycle without fail...

I think I bought enough cyrpto...

And then I'm like "Damn, I should have bought more."

This cycle will not be any different.

Will we see link get back to 2021 levels?