It’s Sharky Out There

Wanted to start with a story today as you all come back from your summer weekend.

Funny thing. As we navigate predatory firms and actors in financial markets, real life predators are spending more and more time in New England waters. The summer of 2022 has brought an unusual number of shark attacks to Long Island and New England, with nearly six occurring in a period of three months.

Some Arb subscribers might know this but not only do I fear/love reading about sharks but I am also a large WWIII history buff/nerd and that’s certified no cap.

One of the wild and terrifying stories I find many people haven’t heard of is that of the USS Indianapolis, which is timely, considering the sharks lurking in crypto markets and right off the East Coast.

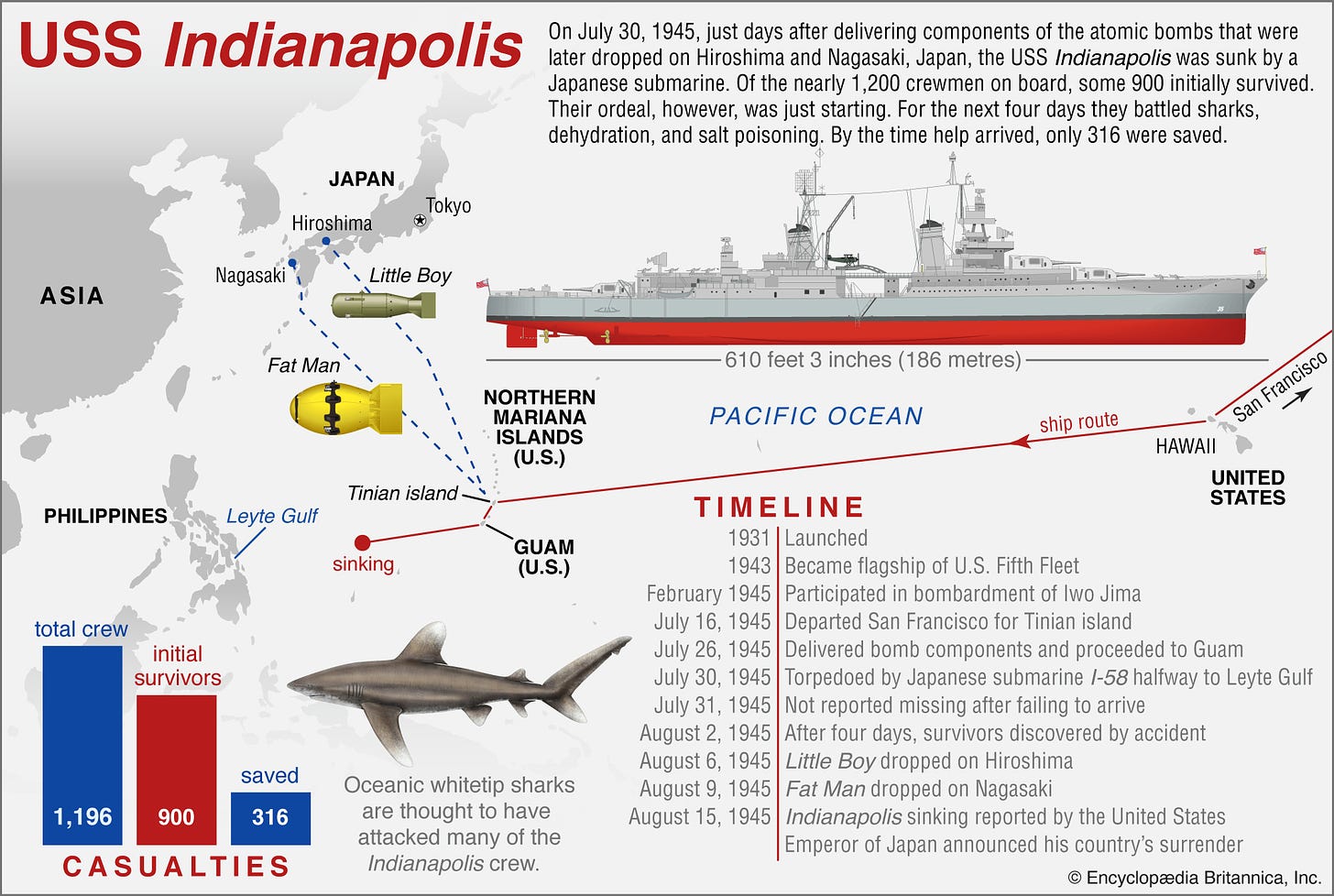

Towards the end of WWII in the Pacific theater things we’re beginning to heat up sizably ahead of the bombing of Hiroshima. The USS Indianapolis, a US Naval Heavy Cruiser Ship had delivered the crucial components of the first operational atomic bomb to a naval base on the Pacific island of Tinian.

On July 28th, the ship returned to link up with the USS Idaho ahead of the invasion of Japan.

That night, moving through the ocean without an escort, the USS Indianapolis was hit with a Japanese submarine’s torpedo. The explosion ripped a 7 foot hole in the side of the ship and it began to take on considerable amounts of water.

Suddenly another torpedo hit the middle of the ship setting off ammunition batteries and effectively blew the ship in half in a massive explosion. Roughly 900 of the 1,196 men on board survived the sinking and initial explosion.

The ship sank entirely in 12 minutes.

Of the Indianapolis’ original 1,196-man crew, only 317 remained when sea planes and small boats came to the rescue days later.

900 went into the water and 317 came out.

(You may remember this line from Jaws).

Some surely died from thirst, or exposure to the initial blast, but the rest?

They were eaten alive by Oceanic White Tip, Tiger, and other species of sharks.

The first night, the sharks focused on the floating dead. But the survivors’ struggles in the water only attracted more and more sharks, which could feel their motions through a biological feature known as a lateral line: receptors along their bodies that pick up changes in pressure and movement from hundreds of yards away.

As the sharks turned their attentions toward the living, especially the injured and the bleeding, sailors tried to quarantine themselves away from anyone with an open wound, and when someone died, they would push the body away, hoping to sacrifice the corpse in return for a reprieve from a shark’s jaw (Smithsonian).

If you’re in the office or powering up your computer today and you’re miserable just imagine being in the absolute middle of the ocean surrounded by bleeding sailors, a shipwreck, and hundreds of sharks that are there for one reason.

Why do I bring up this insane story? Well for one it’s summer and everyone loves a good shark tale during the beach months. But this story along with the Saltwater Crocodile buffet at Ramtree island, stands out as an episode from the war where humans were at the complete mercy of predators.

Many people and the media broadcast the opinion that sharks are typically harmless and that your chances of running into one are incredibly slim. But as the Indianapolis incident shows us, under the right conditions predators act primally and they act quickly without remorse.

There’s always a bigger fish out there. If you don’t know who it is, it’s not you.

Beyond the very present danger of sharks in the ocean.

The recent volatility, scammers, ponzis, and other predatory actors make it even more important to find quality when picking primary allocations and alt coins/other assets within the space.

We cover crypto extensively in Arb Letter because we believe it is

We are going to cover several catalysts and events that we feel are going to directly impact people’s portfolios in the coming months in crypto markets. If you have more than $5,000 in crypto, this post will help you make better decisions in the coming days of volatility.

Knowledge is power and while we are far from experts, we have seen this dance over and over again and therefore have some valuable insights to share with you.

There will be some excellent events this year to capitalize on market movement and trends as retail starts to get curious and the Fed gives us a much wanted potential pivot.

QUICK CLARIFICATION

We’ve gotten some questions on our paid posts and what they include, since this is a paid post, here is the simple run down for what is included.

Free subscribers get:

Occasional market updates with high level analysis/commentary

Paid Subscribers get:

Subscriber-only posts each week

Access all Post Archives (read over 77+ articles at your leisure)

Deep dives, interviews, and focus pieces on finance and global events

Ability to comment on all posts

Most of the hedge funds analysts, PMs, traders, bankers, and salespeople in our community are on premium. If you enjoy Arb Letter we’ve set the pricing (~$5.00/month) low enough to give everyone a chance to access it, but high enough where the value we offer and time we put in is compensated. Some of our recent paid posts include:

Let’s dive into the water.