Morning everyone - we’re testing out a Saturday release of Arb Letter so we’ll review the viewership and open stats and make a decision as to if Saturdays are truly better than Fridays.

Fridays have largely been quiet this year.

As I am writing this I am sipping steaming espresso on a deck overlooking the ocean. It’s 80 degrees.

Dozens of tequila sodas + a splash of pineapple await me this evening.

Not a bad switch from the Northeast at the moment.

Life is glorious.

Stocks dipped after labor data was released Friday morning. The data showed that payrolls rose by 263,000 in November.

The market dropped immediately. Imagine that, the market dropping on news people kept their jobs!

Serious clown world.

Some of the positive momentum and sentiment that followed later in the day was due to the appearance that Fed Chair Jerome Powell more or less confirmed the slowing of rate hikes starting as early as December as inflation begins to slowly wane.

For those of you that follow - the World Cup continues today with a highly anticipated match up between the USA and The Netherlands.

MARKETS

Investors in equities and crypto had a decent end to the week with less of the aggressive selling that has define the last 2/3 weeks. Most traders and investors will be waiting to see if the Fed chooses to reduce the magnitude of rate hikes after many 75bps hikes.

50bps would potentially confirm some bullish biases and line up with the majority opinion which is that the Fed will ease hikes into 2023 and be done completely by spring of next year.

All eyes will be on the the Fed's two-day meeting on Dec. 13-14, in which the central bank is expected to slow to a 50 basis point interest rate hike from the 75 basis point hikes we have seen this year

Mike Novogratz, the Galaxy Digital CEO, Luna Tattoo wearing investor has lost 64% of his net worth this year. This includes a $76.8 million exposure to FTX that rocked this company

Elon Musk said that Sam Bankman-Fried probably donated over $1 billion to support Democratic elections.

Reports are indicating Crypto broker Genesis (potential bankruptcy) owes the the crypto exchange Gemini $900 million. Remember we think Gemini is one of the safer options for exchanges since they are audited regularly and hold assets 1:1 BUT that doesn’t mean they are exempt from a large problem. Allocate between exchange and cold storage based on your risk preferences. Always assume there is a small chance you could lose access to withdrawals and liquidity.

Rolex, Patek, JLC, and Audemars Piguet watch prices have begun to drop pretty steadily since some of there high valuations at the top of the stock market and crypto bubble. Could be a time to snatch a sick piece if you are in the market.

Check out our guide to buying luxury watches here.

Russia on Saturday rejected a $60 price cap on its oil agreed by the EU, G7 and Australia, which Ukraine said would contribute to the destruction of Russia’s economy (Insider Paper)

Bloomberg reports that executives in Goldman Sach’s global markets division received a warning this week that their compensation 'will be slashed by a low double-digit percentage.' There are rumors that many of the large banks are going to be reducing bonuses and compensation

Maxine Waters is in hot water after she posted a tone deaf tweet commending SBF for how he has come out regarding FTX.

LedgerX, one of the few solvent pieces of Sam Bankman-Fried’s crumbled FTX empire, is up for sale, per Bloomberg (Unusual Whales).

Per the NY Post a scientist who worked at Wuhan lab says COVID was man-made virus - Andrew Huff said COVID leaked from the Wuhan Institute of Virology in China two years ago.

This week a South Korean judge dismissed arrest warrants for Terra co-founder Do Kwon's former associates and key influencers

Florida has announced they will pull $2 billion worth of state assets managed by BlackRock Inc., accelerating Republicans’ fight with the world’s largest money manager over its ESG investing practices.

ESG has been taking L’s left and right as many of the ambiguous and loose schemes across the world and across companies fall apart at the seams due to market volatility and mass layoffs. We will continue to monitor the ESG narratives as we expect some opportunity to emerge in this space soon.

The markets right now are still subject to the Fed’s every word and to the litany of macro events that could unfold and tank markets any hour. FTX and crypto blow ups continue to hamper any real recovery for the moment.

Our advice (and it’s informal of course) is that now is the best time to be stacking cash, making another income, or working towards starting a business.

Sure, there may be some solid buys at the moment but you really shouldn’t be buying more risk on assets if you aren’t secure in your cash position, emergency fund, and ability to weather the storm if we do see market and macro conditions worsen.

Again, that’s our take.

When conditions ease and we start to see some bullish momentum you can always get in at that point. Many will likely try to triple and double down on underwater positions and become “stuck”.

Market Sentiment

"Let me be clear on one point: I can't predict the short-term movements of the stock market, what is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over."

— Warren Buffet

“Sam and his cohorts perpetuated a fraud, they used customer money to make bets that he ‘poorly risk managed’ after he made them”

—Mike Novogratz

Twitter Leaks

Lots to talk about today on the news and global news front. It seems tyranny, suppression of free speech, manipulation of social media, and silencing of dissidents are major themes here in the US and abroad at the moment.

No major news outlets are reporting on the news but Elon Musk released emails proving broad censorship, manipulation, and rogue decisions were being made at Twitter during the Hunter Biden Story and last election. We have the screenshots.

This shit is straight up not okay lol.

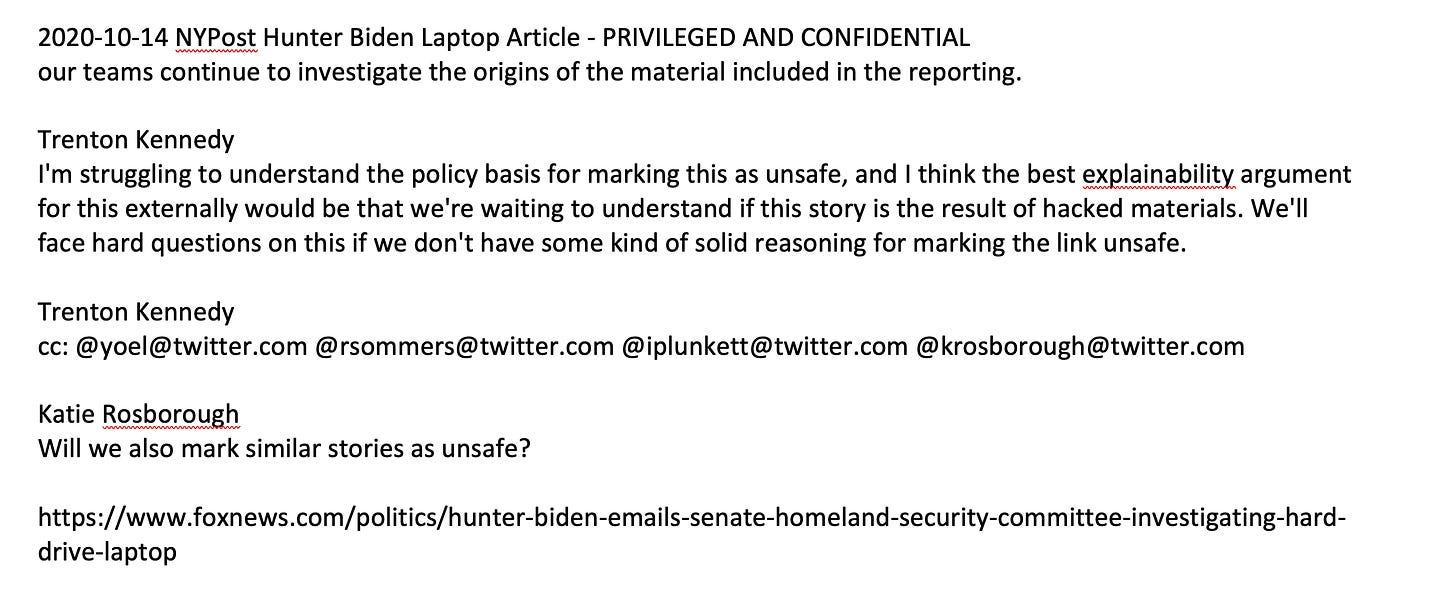

There was essentially a large effort to use the guise of “hacked information” as the primary excuse for an effort internally to suppress the Hunter Biden story.

Forget the fact of how concerning it is that the FBI was telling companies to report the Hunter Biden story as “hacked”, once it was realized internally that the story was potentially real and not “hacked” information, you can see how confused people became.

Unfortunately nobody had the balls to reverse the decision and everyone continued to stew in the woke tech ambiguity where individuals decide what is okay to show people and what is not based on their own political loyalties and dogma.

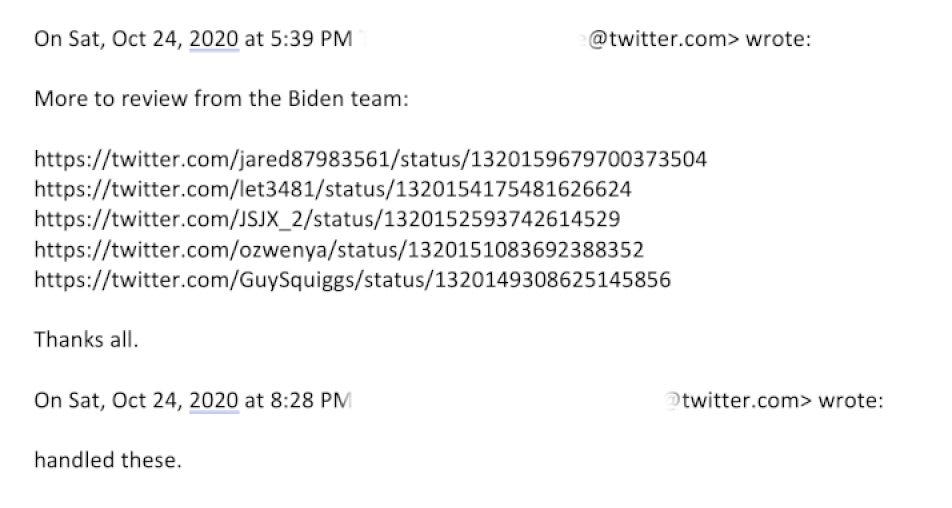

In 2020 requests from connected actors to delete tweets were a regular occurrence. One executive would write to another: “More to review from the Biden team.” The reply above came back: “Handled.”

These decisions were made at the highest levels of the company, but apparently were made without the knowledge of CEO Jack Dorsey, with former head of legal, policy and trust Vijaya Gadde playing a key role.

We saw her get fired in the immediate aftermath of Elon’s takeover and she desperately tried to prevent the buyout. The reasons why are now obvious. Twitter blatantly colluded with the Biden campaign to censor information regarding the 2020 election.

This my friends is good old fashioned election interference.

Can’t state how big of a deal this is that it is now proven. Question is will GOP/Republicans do anything or just sit on their hands as they have for years now.

HERE is a good breakdown of the leaks.

Read it all for yourself and decide how serious it is.

This isn’t something to just discount or say “We ALrEadY KnEw”

We suspected as much but now we have proof this was systematic and intentional.

Don’t kid yourself, this interference drastically shifted the course of that election and the information people were allowed to see and ingest.

Elon Musk should mark himself safe soon because he is certainly starting to poke the side of a far spanning and powerful deep state bear.

The vehement and visceral kickback to Elon’s takeover of Twitter should now be perfectly evident and the best part?

The rabbit hole supposedly continues into a massive web of influence.

This isn’t far right conspiracy guys. This is grade A sinister censorship and manipulation of public opinion.

China

Now let’s move overseas where we re seeing censorship, suppression ,and tyranny PHYSICALLY play out.

While there is a lot to touch on from a global news perspective one phenomenon is particularly unprecedented.

Within the last several weeks we have begun to see leaked footage of massive protests and riots across China as citizens begin to revolt against the zero covid policies of the mighty eastern empire.

Back around the time Xi was dealing with an onslaught of pro democracy protests during the last months of the Trump administration, Covid 19 made it’s way around the world with high speed.

Many theories have circulated as to the origin of Covid 19 and if it was man made or lab manufactured.

This morning videos appear to show the rounding up of families to be sent to the Covid camps. Remember this is a more sinister version of what Australia did during the pandemic in an effort.

Based on wha we now know about Covid 19, the origins, the efficacy of vaccines, and the abuse and lies that were propagated during two years of lockdowns, this is truly absurd behavior.

Today we’ll cover what’s going on in China, the implications for global markets and supply chains, and the links to the CCP that seem to be becoming clearer and clearer.

The scale and intensity of the protests we are seeing in China are unprecedented. One has to understand how bad conditions have to be for people to feel that protesting is the only option left.

Over the years the CCP and Chinese Government have been at the forefront of censorship, big brother surveillance, and more Orwellian measures that truly send shivers down the spine.

It’s no secret that Chinese police stations and government officials use huge networks of facial recognition cameras that can retroactively trace people for days or even months.

It’s honestly like something out of a twisted dystopia movie where the government can control your movement, purchases, thoughts, and ability to survive.

In Shanghai, protesters had initially gathered to pay tribute to victims of an apartment block fire in the western Xinjiang region. Many believed Covid measures had prevented escape from the flames and many had also seen the video footage of CCP thugs welding people shut in their apartments to prevent virus transmission.

The Chinese have real name registration that links your national ID via your phone number to any online service – social media companies are bound by law to comply, and police enforce it.

Raided by the state in broad daylight in your own home!

That is China at the moment.

I don’t know about you guys but this utter failure by China at containing Covid and successfully dealing with these outbreaks looks more to me like an opportune moment for Xi to crackdown on his populace and ensure that he is monitoring sentiment and unrest.

The Chinese cannot afford much more of this and I suspect in the coming weeks if we see these large scale demonstrations continue we will likely see the CCP crack down with stronger and more aggressive military force on those responsible.

Hope you guys have a great weekend.

I will see all paid subs Monday for a look into our gift list for tech/finance professionals with a focus on gaining efficiency and impact in your side hustles, businesses, and day job.

Andy - gonna go 9.8/10 on this one. Stock market moves opposite what you expect are common in late stage bull markets

Excellent read for a warm Saturday! Checking in from Brazil.