Morning everyone.

Got a new report style guide today I want to feel out — if people like it then maybe I start doing it quarterly.

We didn’t get one of the classic super violent sell offs that characterize bull markets — YET. Instead we’ve had a long slow grind down. Many are probably wondering the following:

Am I going to be a bag-holder?

Is the bull market over?

Are my entry levels good?

Will Bitcoin hit another ATH?

Will I get another chance to print on memes and alt coins?

The results of the polling we did over the last week do give us some hints and color on what to expect in the coming months and in 2025. We have a solid contingent of long term holders and guys with pretty large net worth numbers so the poll results are interesting. We will talk through broader takeaways and then get into specific holdings and the % of people who listed them (Essentially a look into the most common alt and meme positions).

Before we get into the crypto results and analysis let’s start today with a financial markets and global news summary.

Financial Markets

Should be a busy week on the equity front. We have some Fed speeches, earnings, and interesting action in the Bond market.

S&P 500 futures: were trading below 5800 for the first time since November 5th (Kobeissi Letter)

MicroStrategy has acquired another 2,530 BTC for ~$243 million at ~$95,972 per bitcoin

Market Declines on Rising Bond Yields: U.S. equities fell sharply last week, pressured by rising government bond yields and concerns over elevated valuations.

Bank Earnings on Deck: Major financial institutions, including JPMorgan Chase and Goldman Sachs, will report earnings this week, kicking off the earnings season.

Key Economic Reports Ahead: The release of CPI, PPI, and retail sales data this week will provide fresh insights into inflation and consumer spending.

Fed Speeches in Focus: Federal Reserve officials are scheduled to speak, offering potential signals on the direction of monetary policy.

TikTok Faces Critical Deadline: TikTok may face a U.S. ban if its parent company doesn’t divest by this weekend, which could impact tech and social media sectors.

JPMorgan announced to all 300,000 employees that they must return to office full-time in March (brutal)

Global News

Fires continue to devastate Southern California amid growing online and social pressure on public officials in the state. Up to 14 are now dead and damage had surpassed $100B. The last estimate I saw said over 12,000 structures have been annihilated by the fires.

Looting, crime, and arson are being widely reported and many of the fires are not contained yet. Scum like Governor Gavin newsom continue to scapegoat and blame others while people suffer without answers or accountability for operational failures.

Former FBI Director Wray said in 60 Minutes recently: “The Chinese government is prepositioning on American civilian critical infrastructure to lie in wait on those networks to be in a position to wreak havoc & inflict real world harm at a time & place of their choosing.”

The man who was arrested by police last week with a blowtorch near the Kenneth Fire in West Hills, California, has since been identified as, Juan Manuel Sierra-Leyva, and is an illegal alien.

Oil reached a four-month high as U.S. sanctions on Russia's energy sector heightened concerns about global supply. Benchmark Brent crude futures climbed over 1% early Monday.

China’s Trade Surplus has reached a record level of nearly $1 Trillion

The Crypto Dip, When Do We Reverse?

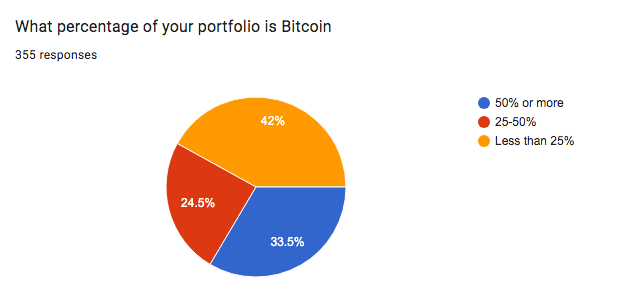

So first off we have responses for Bitcoin — this is not particularly surprising to me, as most of you by now understand Bitcoin’s advantages in the current macro environment AND the value of anchoring a long term portfolio with a larger allocation, especially when the volatility starts up.

Bitcoin is king. This isn’t going to change. We ended up with approximately 33.5% of you who are holding 50% or more of your portfolio in Bitcoin. That’s actually super based.

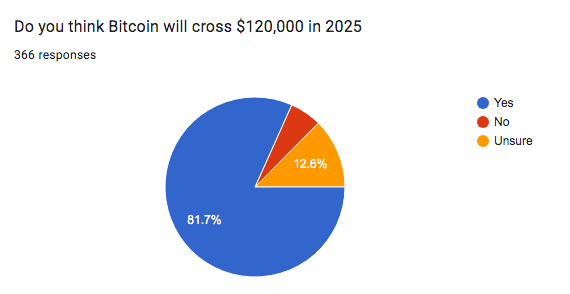

In the chart above you can see 81% or so of responders think that we will surpass $120,000 in 2025. This make me a bit weary as it’s a large percentage — but good to keep in mind the majority of readers, followers, and subscribers likely have strong conviction in Bitcoin, by now I don’t know how you can’t, so maybe this is a good sign. Worth noting most major predictions are bullish right now as well:

Tom Lee, Head of Research at Fundstrat: Predicted Bitcoin could surge to $500,000 with the establishment of a U.S. Bitcoin Strategic Reserve.

Robert Kiyosaki, Author of Rich Dad Poor Dad: Projected Bitcoin reaching $200,000 to $250,000, and potentially $500,000 if supported by government buying.

Alex Thorn, Head of Research at Galaxy Digital: Forecasted Bitcoin surpassing $150,000 in the first half of the year and testing $185,000 by the end of 2025.

H.C. Wainwright, Investment Firm: Estimated Bitcoin could hit $225,000 per coin by the close of 2025.

Standard Chartered, Financial Institution: Suggested Bitcoin prices might climb as high as $180,000 during the year.

Let’s move into some of the alpha that can be inferred from some of the responses, both in terms of positioning but also the alt and meme coins that most people are in at the moment. Then I will cover the alts I have been buying and we can get into some of the forecasts for when we might see the market take off in 2025 as well as the resources and influencers people listed to stay on top of the latest news this cycle.

We are dumping today and some guys are panicking. There is no need to panic guys, you need to be cool. If you apply the basic strategies we talk about in these guides you will be well positioned to benefit from these dips which should really be viewed as “gifts” at this point.

Let’s get into it lords and make these bandos.