Morning everyone.

We’ve got a heater today so strap in - and no it’s not about Travis Kelce and Taylor Swift.

Today we’re talking about ways to ensure you “make it” in the current environment — namely within crypto markets and the tertiary opportunities the next bull run are going to provide to the public and investors.

We’re at an interesting juncture right now from a financial markets perspective:

The offensive into Gaza seems likely to start soon. This will have serious consequences for our relations with Iran, will likely spark up attacks by Hezbollah, and could rag the US into s direct support role

Iran is acting aggressive — BOOKMARK THIS — I fully believe that Iran will play a central role in the escalation of the current crisis in Israel soon — this is one of the ways WWIII could begin. While this isn’t going to be a WWIII doomer post — do note — things are escalating in the middle east, there is likely going to be an escalation very soon. Don’t take it lightly.

The Chinese and Russians are making clear posturing moves in Europe and in the Mediterranean — this could prove disastrous if Iran directly involves themselves in the conflict with Israel and Gaza or if there’s a Gulf of Tonkin - esque event or accident in the Mediterranean

There is a growing battle between pro war supporters in the US and those who think we need to focus attention and funds at home

Treasury Bills and Bond markets are making the wealthy wealthier, inflation is eating away at the middle an lower classes, and equities are looking skittish — to be blunt 7% a year is not going to get anyone who is not already wealthy, wealthy, at this point — you need to look for bigger opportunities and edges (Bill Ackman closed most of his bond shorts this week)

The good is news we may potentially be back and presented with an enormous wealth generating opportunity once again in the crypto markets.

It’s been quite a week for crypto. Bitcoin has ripped back over $31,000 touching $34,000 and even $35,000 momentarily, Ethereum looks poised for a big run as soon as Bitcoin cools off, and certain alt coins have been showing impressive strength despite the current macro environment.

There’s also mounting pressure on the SEC both in terms of approaching ETF deadlines but also in terms of public pressure and optics. SEC Commissioner Hester Pierce made her opinion clear on the can kicking the SEC has been employing since last year regarding crypto ETFs.

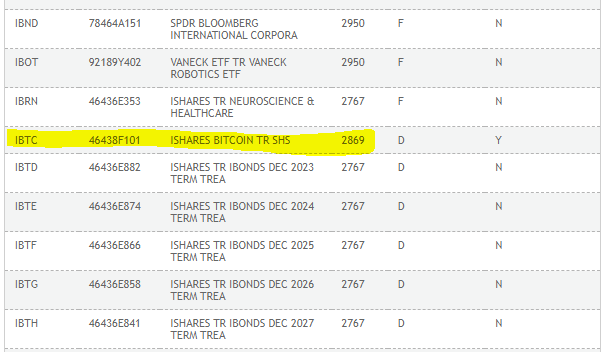

Said she hopes the SEC is going to take a more productive approach to crypto soon and that she is disappointed with efforts so far. A US Court of Appeals issued a mandate Monday that the SEC must re-review Grayscale's spot Bitcoin ETF application. BlackRock's Bitcoin ETF was listed on the Depository Trust & Clearing Corporation and there have been some rumors of the SEC communicating with potential Bitcoin ETF issuers — on top of that we have several applications for ETH Spot ETFs.

Wall Street is getting more involved in crypto by the day.

Which is good and bad.

But good for prices.

Many people were blindsided by the price action today and the sudden violent pumping that occurred within crypto. They had either been blown out of their positions by the massive market dump, lost all their crypto on exchanges that went belly up, or lost interest in crypto all together.

But this pump is out for blood this time.

Could it be short lived?

Sure.

But this pump seems different — namely because we are on the cusp of a major series of ETF approvals and because it really does seem like Bitcoin primarily, is beginning to demonstrate it’s value as a safehaven asset during times of market and geopolitical uncertainty. The numbers don’t lie and recently people have been getting back into beat up positions in alts and Ethereum — though Bitcoin is seeing an impressive amount of hodlers and people refusing to sell — the amount of long term holders of. Bitcoin has never been higher.

Add on top of that the trends we are watching with regional banks and the intense stubborn inflation, and I think we are starting to see one of the biggest turning points in crypto’s history.

I’m of the opinion that the coming bull market in crypto is going to be absurd. I think all the conditions are present to watch Bitcoin and other quality assets in the crypto space appreciate sizably in the coming months and years. The haves and have nots are going to be decided soon.

Crypto is just one of the ways to ensure you get a piece of a new developing global economy that is digitized and put on chain. Blockchain adoption is spreading rapidly, banks and large insitutions are working with tokenizing assets, and financial products are close to being brought to the masses (and those who want a simple way to gain exposure to crypto).

The window to allocate properly and benefit financially is narrowing — in fact I’d argue it’s in the last innings entirely. Once potential ETFs are approved and institutional money begins to flow in — not only will the market become more centralized (which is ironic) and crowded but price will rapidly appreciate. Millionaires will be mad in this next bull run. Many will wait way too long to get their allocations squared away and miss the boat entirely.

They’ll re-enter at much higher levels and miss the opportunity to potentially change their lives.

Let’s start by discussing why this pump is different and why it may defy all logic very soon, moving to unimaginable heights while everything else remains bogged down by geopolitics, war, and economic uncertainty.

Then we’ll walk through useful tips to profit and benefit from this rare perfect storm alignment of markets and technology.

The time is here young kings — don’t screw it up.

“You should buy Bitcoin because "they aren't making any more of it….. There will only be 21 million Bitcoin for the whole planet”

—Billionaire Ricardo Salinas

“The market is ready for a spot Bitcoin ETF”

—CFTC Commissioner Summer Mersinger