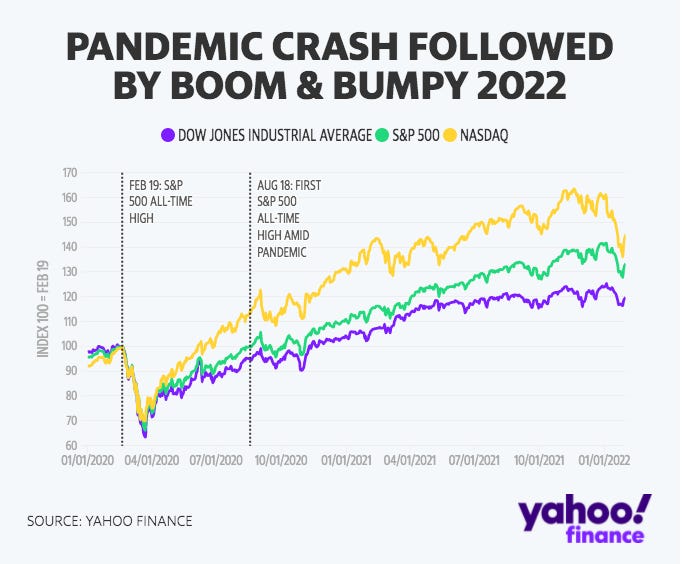

The market has proven to be a fickle beast as of late, dumping constantly before appearing to have met some sort of local bottom for the time being during the latter half of Friday and yesterday. Markets pumped hard yesterday with the S&P 500, Nasdaq, and crypto seeing abundant green candles, though the S&P had its worst month since March 2020. Is this temporary or just a small relief bounce before the real show gets started? Let me know what you think below.

I got involved with intra day option trading ETFs as I mentioned last week and reminded myself why I tend to not do that. When you actively trade (think you’re smarter than the market) you will lose. It’s just like trying to trade to win back the $10,000 you just lost on some derivative doge coin Hong Kong scam ponzi. You get emotional and try to hard and tend to underperform harder.

Obviously we could still god dump hard, wrecking all new bull market proponents overnight. I look around and to me the worst of the Fed’s Hawkish rhetoric is past us until march, to me anything else from them outside obvious fundamental trends shifts of the economy is FUD. Crypto is recovering with traditional markets and I think it would be dumb to ignore the possibility that we recover and continue to pump across all assets. Little has been done in the way of ACTUALLY tapering asset purchases and buybacks.

If the Ukraine/Russia conflict comes to some sort of a nothing-burger, than that could definitely add fuel to the fire. I’m ultimately pretty pessimistic on the Fed’s ability to have a material and noticeable impact on inflation at this point. Next meeting is in March. I have added to a few core tech holdings ($QQQ, $PLTR, and $NVDA as well as $BTC on this broader dip. Will wait before adding more into equities outside 401K/retirement contributions.

MARKETS

After today's close, tech heavyweights Alphabet (GOOGL), Advanced Micro Devices (AMD) and PayPal (PYPL) report earnings. Starbucks (SBUX) also announces results after the bell. The Ukraine situation

AMC stock sky rocketed Tuesday after the most profitable quarter since before the onset of the Covid-19. Shares shot up 10.5% to the $17.70 range

UPS soared 15% and broke out of a flat base in heavy trading, becoming the best performing stock in the S&P 500 today.

U.S. manufacturing activity fell to a 14-month low in January during a surge of COVID-19 infections in the latest Omicron wave

Russian citizens reportedly own 16.5 trillion rubles ($214 billion) worth of cryptocurrencies, according to government estimates - amid continued conversations between Russia’s Ministry of Finance and Putin who, recently, has an interest in crypto devlopment (Coin Telegraph).

UBS has announced its highest annual profits recently. Highest since before the 2008 financial crisis, they also announced plans to double their share buyback program after impressive performance across varied global markets

MicroStrategy has purchased an additional 660 bitcoins for ~$25.0 million in cash at an average price of ~$37,865 per - Saylor is the ultimate Size Lord

The Meta-backed cryptocurrency venture Diem said late Monday that it had sold off its assets to Silvergate Capital, a crypto-focused bank in California, after regulators including the Federal Reserve opposed to the project. (NY Post)

Israel’s most valuable private technology company is in conversations to purchase a U.S.-based business to establish a beach head in the world’s biggest economy ahead of a planned IPO ( Bloomberg).

Morgan Stanley recently said that “ The Metaverse is an $8 trillion market hat will replace the internet

Bahamas-based crypto exchange FTX has announced recently that it has raised $400 million in a new round of funding, this deal values the company at a nice solid number of $32 billion, up from nearly $25 billion in October 2021. This is some serious size.

GLOBAL INTELLIGENCE

Pfizer and BioNTech may file Tuesday for permission to use their Covid vaccine in a two-shot course for kids under 5 years old, according to people in discussions who spoke to The New York Times. Why?

Kowa, a Japanese pharmaceutical company, said on Monday that ivermectin demonstrated an "antiviral effect" against Omicron and other COVID-19 variants in a non-clinical study, Reuters reports.

There seems to be an incident in Ukraine involving a Drone Strike according to Russia State Media - this is occurring live as of 12:20pm ET roughly. Markets seem to be ignoring at the time of this newsletter writing.

Boris Johnson said today that there is ‘clear and present danger’ of imminent Russian campaign in Ukraine

Russian President Vladimir Putin has accused the US of using Ukraine as a tool against his country, and of ignoring Russia's security concerns.

The Ukraine Russia conflict is heating up as negotiations transpire and Russian military units continue to aggregate near and around Ukrainian borders and chokepoints.

Massive protests have erupted in Canada over Covid 19 mandates and restrictions, led primarily by thousands of the countries truck drivers who recently drove cross country in a show of non compliance. Protests developed locally over the last several weeks.

Canadian PM Justin Trudeau and his family are have fled and are in an unknown location during the unrest. LMAO can this guy get any softer? Dear god.

OTHER UPDATES

If you don’t follow us on twitter make sure to follow to keep up to date on memes, market commentary, partnerships, and more. Some free alpha and absolute degenerate market commentary as well.

Trading Floor Trap God Mouse Pad

Arbitrage Andy Trading Floor Trap God Mouse Pad are back in stock. Fastest sell out item we have ever had on the store before. Will add some new styles this week. Link below to cop. Make sure you are doing hybrid WFH like a pimp.

AVAILABLE HERE

Next newsletter should hopefully have our 1st podcast episode with the NYSE’s Peter Tuchman, we are working on finishing touches and editing right now.

Good luck trading this week. We are working on getting an introduction to options basics guide together, in the meantime feel free to let me know below what other topics you want covered.