Happy Tuesday kings and queens.

As we stand on the brink of a pivotal moment in history, the United States faces not only the complexities of a presidential election but also the looming specter of disruptive events that could reshape our nation's trajectory. The convergence of geopolitical tensions, economic uncertainties, and societal divisions has created a volatile landscape, where the slightest spark could ignite significant upheaval.

Someone a long time ago ( I forget exactly who) told me that success in life is largely a result of accounting for future risks and adjusting so you can avoid the big ones. Calamity, curve balls, and disaster are endemic in our world, only those people who acknowledge this and plan/hedge for it truly succeed, especially in financial markets.

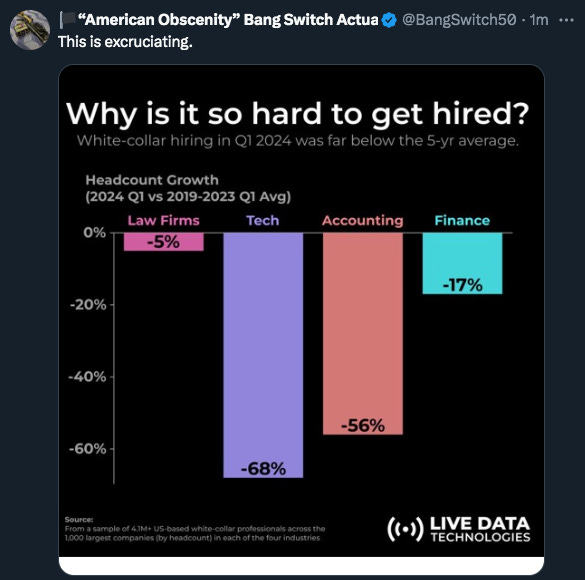

Real inflation is probably over 30%. Lay offs are picking up, Boeing whistleblowers are getting blatantly murked by professional hitmen, and the US Treasury gave us a grim outlook on the future of social security (hint: it’s not going to exist).

Your 401K will not be saving you.

Everywhere you look things are happening that seem absurd or unbelievable. Not super shocking at this point that most people are in a lulled sense of state, just going about their lives like robots.

The purchasing power of the dollar has fallen significantly — those in the know realize inflation is likely closer to 30/40% than the officially toted numbers. Salaries are not keeping up with inflation and the cost of living continues to climb in all states.

Going to start today by going over all relevant crypto and market updates as well as my latest portfolio allocation specifics (there’s been some changes) and what I expect to happen in the last half of 2024. There’s been some big regulatory updates in crypto (the SEC has gone after Uniswap, Robinhood, and other platforms in the last 2 weeks) that will shape price action in the next few months.

On the home front? Right in line with my predictions, it looks like the summer of love is back, only this time the powers that be have no issue leveraging police and law enforcement to try and quell the protests immediately — funny how that works. Where were they when BLM/Antifa burned our country endlessly?

I’ll chat through my take/overview on the Israel/Palestine conflict, review warnings from officials in the US, and forecast what will happen in the next several months.

Additionally - there’s a concerning anti American flavor to many of these protests. Flags are being burned, they’re turning violent, and rhetoric is not only anti semitic but also anti West, in nature. We spent years allowing young people to be indoctrinated by Marxist ideology in our schools, corporations, and institutions. The left and public figures who are now waking up funded woke movements endlessly over the last several years and now their pets are turning on them.

Joe Biden is proposing to bring Palestinian refugees to the US (Egypt and other states have already refused, wonder why?). On top of that we have millions of illegal migrants in the country, tens of thousands of which are Russian and Chinese.

And yet we’re scratching our heads as to how a concentrated and seemingly organized anti American movement is rising up ahead of a pivotal election while our economy is faltering and social division is at all time highs……

Super complicated stuff! Shocking! Could’ve never seen this coming!!!!!!

Bottom line — there are signs telling us what’s likely in store as we move into the summer and fall. The majority of subscribers to Arb Letter are already ahead of the curve assuming you’ve followed our crypto strategy and started paying more attention to what’s happening culturally in the United States.

It is of utmost importance that people know what to expect in the rest of 2024 — at this point it all seems to be some sort of sick movie or play. It’s not all dark though — there is plenty of opportunity to be had if you know where to look.

There’s a reason 24,000+ readers across 50 US states and 165 countries subscribe to Arb Letter — all relevant news developments and straightforward commentary on crypto markets is compiled in a single place. If you enjoy my commentary consider upgrading to paid to receive unlimited access to all premium posts, guides, and archives for less than a large gatorade per month.

There are many countries in the world that when they reached the middle-income stage, they witnessed serious structural problems such as growth stagnation, a widening wealth gap and increasing social unrest.

—Li Keqiang

Markets & Crypto

Let’s talk about where money is going to be made this year.