Welcome and happy Friday.

If you’re new to Arb Letter we’re a bi weekly newsletter/post on financial markets, global news, and life.

We differentiate from other newsletters by being ruthlessly pragmatic, honest, and straightforward. No fluff, BS, or boomer talking points, just the essentials you need to be aware of to crush that interview, hedge your portfolio, or just crush the week. Take a look through our 89+ posts.

Wild week for markets as the European Central Bank raised rates to .75bps, crypto pulled a flash dip on Tuesday, and the energy crisis worsens both in the United States and across the pond in Europe where it is sure to make for an awful winter in the countries impacted by Putin’s weaponization of energy.

We hooked up some Arb for ya’ll with one of our partners Jomashop on the heels of the 2022 Watch Review to get you some codes as we enter end of year in case you’re looking for a watch or other luxury item.

The watch review was our most engaged and subscribed post out of all 89 that we have done in the last year so go check it out if you’re inclined.

Use the codes below to score some savings - although Jomashop does a pretty solid job of sourcing on the low low.

ANDY10 for $10 off $160

ANDY55 for $55 off of $1000

ANDY100 for $100 off of $3000

We’ll get back at it on Monday with a full review of where we stand in crypto markets and how to best manage your portfolio during this chop and macro uncertainty. We’ll also provide a list of the best resources we use in crypto to stay in the know about what’s happening and what might come next.

MARKETS

Markets continued to be volatile this week with some more green on Thursday as all three major averages/indices are on pace to break a 3-week losing streak. The ECB (European Central Bank) raised rates this week by .75 bps hinting at another similar hike in October.

This week Jerome Powell reiterated the Fed’s commitment to tackling inflation, again reinforcing expectations for a potential third straight 75-basis-point rate hike that could come on September 21.

Some tech stocks have been given some moments of respite from the vicious selling that characterized the first half of the year though most mega caps are moving below their 200 day moving averages including EV vehicle giant TSLA.

JPMorgan analyst Harlan Sur recently lowered the price target on Nvidia from $230 to $220 after the chip makers recent bans on imports (Yahoo Finance)

Shares of DocuSign climbed over 17% in extended trading after an earnings beat.

Cathie Wood, manager of ARKK, said this week she expects a Fed pivot in 3-6 months

Slide - a startup that provides user experience infrastructure for decentralized applications (dapps), has raised $12.3 million in a seed funding round (Coindesk)

FTX Ventures and @SBF_FTX are acquiring a stake in Anthony Scaramucci’s SkyBridge Capital

Guggenheim’s Scott Minerd, believes we will still see a 20% sell off in equities

The White House Office of Science and Technology Policy on Thursday warned that cryptocurrency mining operations could potentially harm the US’ ability to battle climate change (CNBC).

Jay Sammons, a former executive with Carlyle Group is partnering with Kim Kardashian to launch SKKY Partners, a new private equity firm that will invest across several sectors, including hospitality, media and various consumer products (CNN).

Crypto surged late on Thursday evening after a bloody week with Bitcoin making a nice run back to $21,000+ and Ethereum reaching over $1,700 ahead of the highly anticipated merge event expected to play out in the middle of this month.

As a reminder the merge will mark the transition to a PoS consensus mechanism, which requires all market participants to hold a minimum number of coins/tokens (32 ETH) to validate transactions – contrasted with the current PoW (Proof of Work) setup, in which miners solve computational/math problems to verify transactions in return for rewards that are paid in Ethereum (ETH) (Coindesk). We don’t expect this to be immediately bullish as supply isn’t expected to be impacted for several months but who knows - maybe retail will bid it up aggressively.

In 24 hours roughly $268M of mostly short positions were liquidated in the crypto markets as bears got too cocky.

We are beginning to see a recovery in many different alt coins that we are bullish on in the long run including DOT, MATIC, UNI, and LINK. I expect these to bounce strongly into the weekend if legacy financial markets have a neutral to positive day today.

In our letter last week we expressed the sentiment that it seemed to be just getting a bit too bearish after months of selling.

We stand by that viewpoint, and our view is that Bitcoin and Ethereum will recover more quickly than equities if we do see a period of sustained up markets. From a high level - in our opinion - much of the bad news is out (inflation, europe, etc.)

With the massive de-leveraging and liquidation cascades of July and August, many of the bad actors and highly levered players are removed from the markets which should help prevent anymore market altering god sell offs.

SEC Chair Gary Gensler had some words this week for crypto market regulation efforts, stating that he encourages intermediaries in the crypto space as well as crypto security token projects and potentially stablecoins to register with the SEC (Coin Telegraph).

Gensler stated:

“I look forward to working with crypto projects and intermediaries looking to come into compliance with the laws…. I also look forward to working with Congress on various legislative initiatives while maintaining the robust authorities we currently have. Let’s ensure that we don’t inadvertently undermine securities laws underlying $100 trillion capital markets.”

Sentiment

“What we have again learned since the middle of August, is that (stocks and bonds) can both go down at the same time….. In a world like that, you have to look at short-dated fixed income, and you have to look at cash as an alternative.”

-Mohamed El-Elrian - Allianz SE Economist

"I think that people are grossly underestimating what the Fed is going to have to do to fight inflation”

-Richard Bernstein Advisors CEO Richard Bernstein Thursday on CNBC's "Closing Bell: Overtime."

GLOBAL NEWS

The most impactful news this week aside from the passing of Queen Elizabeth on Wednesday is the worsening state of the global energy crisis. According to Western sources Ukraine is gaining some momentum in it fight against Russia.

While most expressed sorrow at Queen Elizabeth II’s passing this week, others took it as an opportunity to mouth off.

US professor Uju Anya, an associate professor of second language acquisition at Carnegie Mellon University, made some shocking comments about the Queen’s passing this week.

Jeff Bezos the size lord founder of Amazon retweeted the ugly message and wrote: “This is someone supposedly working to make the world better? I don’t think so. Wow.” (NYPost).

The U.S. announced yet another new plan for over $3 billion of aid for Ukraine and 18 of its neighbors on Thursday. Defense Secretary Lloyd Austin met with various allies in Germany while Secretary of State Antony Blinken made an unscheduled visit to Kyiv to meet with leaders on the state of the Ukrainian defense against Russia.

President Zelenskyy said this week that Ukraine's efforts at counteroffensives are playing out successfully as the country recaptured nearly 1,000 square kilometers (~390 square miles) from Russian forces

The Justice Department has said it will appeal U.S. District Judge Aileen Cannon's ruling for a special master to review documents seized during the raid on Trump's Mar-a-Lago home

North Korea has passed a law declaring itself to be a nuclear weapons state, according to state news agency KCNA (BBC)

The Dutch agriculture Minister has RESIGNED after massive farmers protests against new climate goals that would shut down 11,200 farms (PeterSweden via Twitter)

Steve Bannon has been indicted on alleged charges of money laundering, fraud and conspiracy related to supposedly cheating donors of a fundraiser used for building a wall on the US-Mexico border, though there are no records of any complaints by any donors about this misconduct.

NY AG paraded Bannon with a perp walk in front of reporters yesterday, Bannon stated to reporters, "This is what happens in the last days of a dying regime…. they'll never shut me up. They'll have to kill me first."

With Europe raising rates and facing the prospect of a brutal Winter without Russian gas we’re cautious to up any foreign allocations in the UK or Europe.

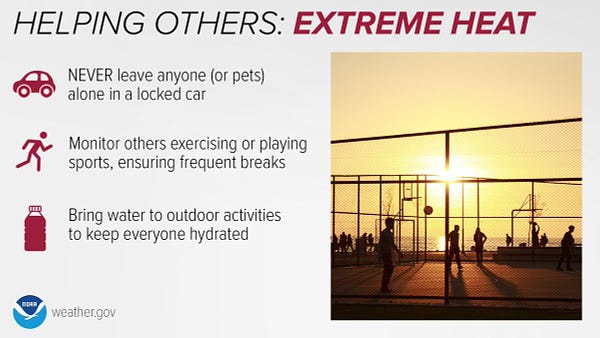

We’ve already started to see US states suffer from the global energy crisis and heat waves as California sends rolling blackout warnings and asks citizens to cut back on energy usage.

Elliot Mainzer, president of California Independent System Operator (ISO), which runs the state’s electrical grid, said it has “entered the most intense phase of this heatwave” and warned residents that “blackouts, rolling, rotating outages are a possibility” (Al Jazeera).

On the global currency side - the USD may be softening, opening up an opportunity for other assets to surge.

With the DXY weakening in the last couple days, gold, oil, and crypto have climbed aggressively. Wall Street and experts still seem torn on whether the worst of sell offs are behind us but one things for sure.

With heightened political tension, claims from the White House that crypto is bad for the environment, and a shit ton of sidelined capital, what comes next could be biblical.

While we haven’t made any major changes to holdings, we’ve started to pick up some cheaper tech names, blue chip crypto assets, and gold. Remember, ultimately the name of the game in recessionary periods is simply to survive. You don’t want to paper hands your assets to the big boys, you actually want to add assets if anything so that when the period ends, you benefit from the pent up surge of deflated prices.

I leave you with this quote ahead of the weekend.

“All empires fall, eventually. But why? It’s not for lack of power. In fact, it seems to be the opposite. Their power lulls them into comfort. They become undisciplined. Those who had to earn power are replaced by those who have known nothing else. Who have no comprehension of the need to rise above base desires”

-Max Berry, Lexicon

See paid subs Monday for crypto overview and resource guide.

SHOP LEHMAN BROTHER MERCH

Arbitrage Andy Store

Arbitrage Andy Twitter

*DISCLAIMER - None of this is financial advice, it is important that you do your own research and make your own investment decisions. I am a former trader and currently work within sales/financial technology/brand building/e comm.

Because I have built such a massive digital network building Arbitrage Andy & Arb Letter, Arb Letter looks to leverage that information and sentiment for you to make informed decisions that cut through the noise and bias of modern media and news.