With everything going on in geopolitics and Gamestop/equities it’s been a bit since we’ve done a proper crypto update — but it’s well past time we did a comprehensive one.

Crypto had what I like to call a mini mania phase — where one of the new “metas” or themes took away any sense or logic most people had and consequently the majority of market participants, especially new ones, are probably hosed right now.

A lot of the super negative aspects of the space are showing themselves right now.

We have ponzis, scams, and celebrity tokens taking up the masses attention which preceded this current correction we find ourselves in— and we really shouldn’t be surprised.

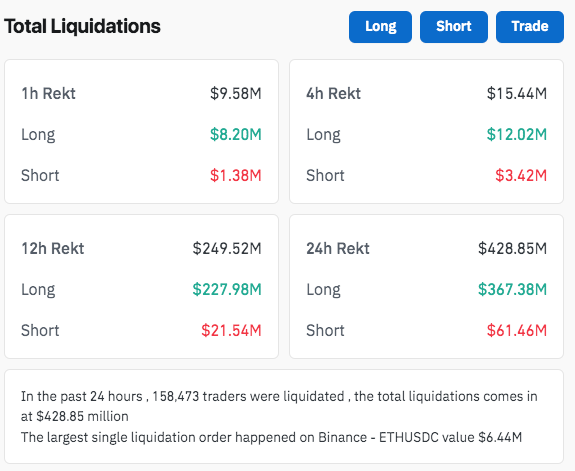

On top of that we have reckless traders employing high amounts of leverage to try and predict the next major direction of the market — the result in the last 24 hours is over $420M of liquidations on exchanges. The largest was on Binance for over $6M — that guy’s not having a great week.

People are attempting to gamble themselves into “making it” — people would rather ape into the most recent celebrity meme coin than buy up “long term” bets. And look — I get it — I burned at least 4 ETH in the Blast Dapp YoloGames like an idiot (fun as hell) — but that was money I could afford to play with. We all need to degen sometimes but some people are playing with their entire portfolio or large chunks of capital that would be much better invested in an asset with an actual future.

There’s also a super warped sense of what a lot of money is on Twitter as of late — some claiming that $8M isn’t a lot……

We’re in some weird dystopian magic coin jungle and everyone’s chasing the first sign of a potential turbo pump instead of seeing the broader picture.

Wages aren’t high enough, people can’t afford starter homes, and our society loves to tell everyone that “getting rich quick” is super easy. That may be the case for a handful of people who manage to be in the right place at the right time with substantial contrarian view points and conviction, but for most people that’s simply not reality.

With the advent of the most recent meme coin craze — it can be difficult to stick to the strategy that works over the long term in crypto, especially when you hear about 100Xs overnight.

For those relatively new to crypto remember to read my beginner’s guide here for a comprehensive view of the landscape (before or after this post) — for those of you that have been hear awhile today we will be taking a look at:

An overview of the market over the past several weeks and why certain things are dumping hard

Mistakes many are making in the market that will hurt more when we rally

The changing dynamic between crypto and equity markets

How to win moving forward

Which alts and coins to look at seriously in this cool off period

Bullish and technical indicator trends over the last two weeks

Expectations for what’s going to run hard in the coming weeks and months

There’s likely many who have a bad taste in their mouths if they got caught up in the meme coin and shitcoin madness — as many of those coins corrected hard when BTC fell below $70,000. Today I will detail my positions, thoughts, and analysis on what’s going on in the market in the hopes that we can provide some clarity and confidence for what comes next.

It’s not over — but there are many pitfalls that people are falling into that can prevent you from making good money this cycle.

The next several weeks will be the deciding factor for those who make it and those who wash out.

Those who make it will take proper care to position themselves before the true mania phase kicks in and new ATHs are reached — those who wash out will try to foolishly trade the job, lose valuable time and energy, and worst of all, be sidelined when the real momentum picks back up.

It’s never been more important to stay the course.

When the games and illusions do stop — we could see an absolutely Biblical pump. There will not be a single worse feeling than watching us full send if you are underexposed, or worse, caught with your pants down because you messed around in meme coins, ponzis, or overtraded.

The folks who are sidelined when the bull pumps return in their full strength will run off the sidelines to get in and end up being the bag-holders of next cycle when the market decides it’s time to take profits.

Ask yourself the following questions if you are in crypto right now:

Are you positioned properly for a massive run up with no stops?

How would you fare if we drop another 20%?

Do you have a good balance of quality assets and riskier meme/alt based plays?

Do you have the discipline to sit on your hands when needed?

Do you have a range picked out for when you would take some profit?

If the answer to one or more of these is shakey or unclear — it’s time to do some thinking and reflection. More people will end up losing money this cycle because they are set on immediate gratification and restlessness.

Let’s start with a market overview so you can understand what’s going on underneath the hood and factor that in to your view on where we go next.

I want everyone who reads Arb Letter to print handsomely in the coming months.