ARB - Top Investment Opportunities for 2022

025: Merry Christmas Eve & Wishing Everyone a Profitable 2022

ARB LETTER - 025 - Dec. 26th 2022

Merry Christmas to those that celebrate and happy Holidays to all. It’s been a wild year and I wanted to do a quick overview of the core concepts we covered this year in Arb Letter. This week’s edition of Arb Letter is brought to you by Jay Butler. Jay Butler is an American loafer brand I have been sporting for about 3 years and they are truly durable loafers that will survive chaotic nights out at the bars and long morning commute walks as well. Really solid brand overall and we appreciate their partnership. If you’re interested in checking them out, you can do so HERE.

I intend to make big swells in the financial media space in 2022 and you’re all a huge part of that and will continue to be, I appreciate each and every one of you who subscribes and spreads the based word. Thank you Size Lords. A quick snapshot of the most relevant world news bits now.

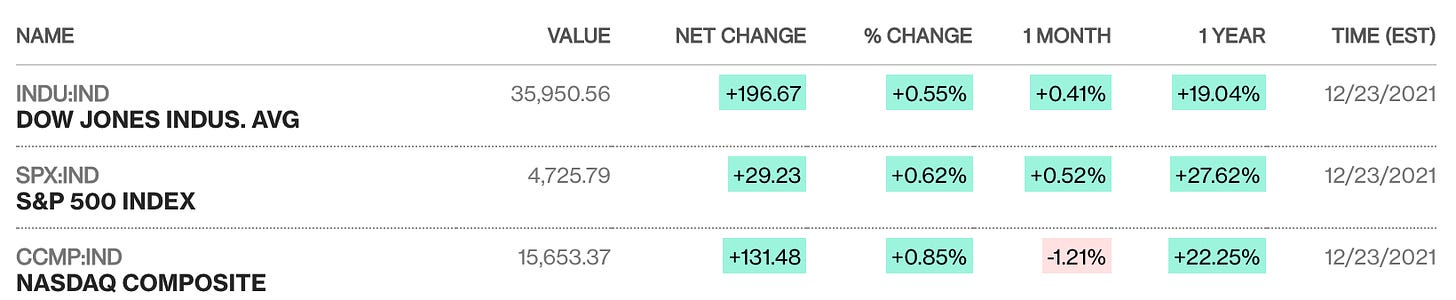

Modern Market Insights

The Dow Jones Industrial Average moved to a robust 35,950.56. The S&P 500 rose 0.62% to 4,725.79 and closed at a record high. WOOF.

Archbishop Desmond Tutu, the Nobel Peace Prize-winning Anglican cleric defined by his work in civil rights in South Africa has died.

New satellite images captured by private U.S. company Maxar Technologies show that Russia has continued to build up its forces in annexed Crimea and near Ukraine in recent weeks while pressing the United States for talks over security guarantees it is seeking (Reuters). Maxar said a new brigade-level unit, comprised of several hundred armoured vehicles that include BMP-series infantry fighting vehicles, tanks, self-propelled artillery and air defence equipment, had arrived at the Russian garrison.

Jack Dorsey drew heat, criticism, and a block from Andreessen Horowitz’ Marc Andreessen, after tweeting: “You don’t own ‘Web3,’” he wrote. “The VCs and their LPs do. It will never escape their incentives. It’s ultimately a centralized entity with a different label. Know what you're getting into…"

FYI - Web3 is an idea of an internet in which all data and content are registered on blockchains. (and therefore decentralized to some extent), although the precise definition and mechanics of the concept remain somewhat unclear. The key. argument here is whether or not a blockchain based web will lead to less censorship and true free speech.

President Biden got trolled hard af yesterday during a NORAD Santa tracker event for kids when a parent caller ended his kids conversation with “Let’s Go Brandon” Biden responded by saying I agree lmfao.

Vice President Kamala Harris, during an interview aired Sunday, answered “democracy” when asked what’s the biggest national security challenge facing the US. Video HERE.

Turkey’s President Recep Tayyip Erdoğan has sent a crypto law to the country’s parliament as reported by several international news agencies - Bitcoin and other select cryptocurrencies are growing increasingly popular in Turkey, where inflation has increased and the native currency, the lira, hit record lows VS. the U.S. dollar

Chinese stocks that trade in the U.S. have always been risky and unpredictable for investors, but Americans interested in opportunities in China now face somber prospects as regulatory concerns and unsatisfactory plays wither out.

Matthew Kennedy, a senior strategist with Renaissance Capital has noted, ““Even if the Chinese government and the U.S. government gave these companies the green light, the average return for [Chinese based] 2021 U.S. IPOs is negative-42%. Only 12% are trading positive,”

My Top Investment Picks for 2022

As we reflect on the last year of financial market devlopment and technology, It’s impossible to ignore the environment that money printing and loose Fed policy has created. There is an old saying from either the Weimar Republic or US during the Great Depression (can’t remember which), that says if you’re getting incredibly rich on paper, and everyone else is getting rich on paper, then the party is about to stop. I agree with this sentiment, with the rise of retail trading, $GME/$AMC phenomenon, and aggressive asset buying by the Federal Reserve this past year, we’ve started to see the types of situations that scream massive bubble. 13 year olds on youtube are making millions with shit-coins and equity options, surely this can’t last forever and we’d all do well to orient ourselves accordingly.

When I think about 2022 - I think about two primary facets I want for the majority of my assets:

A.) Inflation Resistant Investments (Crypto/Gold/REITs)

B.) Large dominant companies that can weather macro impacts(Tech/Consumer)

For me, crypto is the ultimate hedge to a weakening dollar/and decline of an extremely inefficient traditional finance landscape. Conversely, I believe is strong concentrated allocation in some of the bigger tech/consumer names that will continue to grow aggressively with developing technology, blockchain/smart contracts, and AI. These two allocations ensure you likely won’t miss substantial upside from fast growing sectors regardless of timing in the next 3-10 years.

My Core Equity Holdings:

$NVDA, $MSFT, $AMZN , $ARKK, $ARKG , $SQ , $CHWY , $FB

My Riskier Equity Macro Related Plays:

$POWW, $PLTR, $LMT , $BABA , $SE , $SWBI

I will look for opportunistic plays in the equity markets and will of course continue add to both retirement accounts as well as brokerage accounts, but currently I have about 65% of my net worth in cryptocurrencies, as this is whereI see the biggest opportunity for expansive and sudden growth. As broader equity themes I find Chinese names interesting given the cheap levels they reside at as well as Defense/Data plays like $PLTR, $LMT, $LDOS.

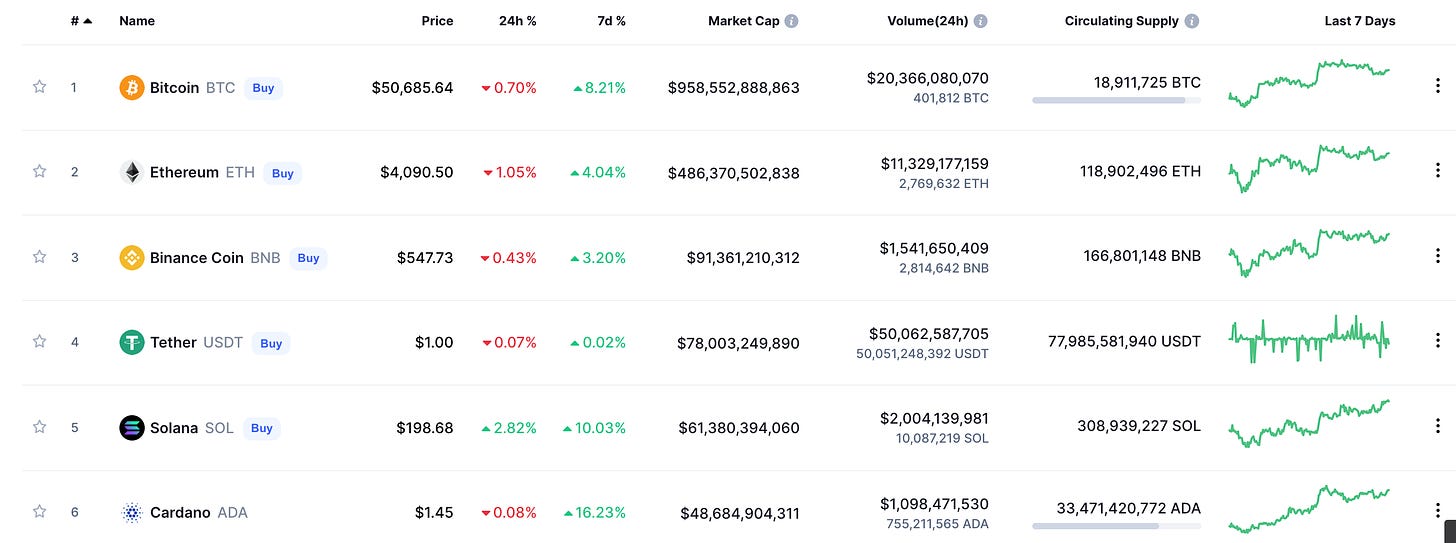

As we enter 2022 most crypto “professionals” I know ascribe to two major theories. First, potentially a longer bull cycle where crypto continues to move up until about March/April where most anticipate rate hikes by the Fed or a broader sell off in legacy markets. We likely see institutional announcements in January and February and in my humble opinion, this is when we have a good chance of BTC hitting 75K+ and ETH to 5K+.

I lean towards this drawn out bull market theory and while many traditional crypto OGs that I respect make it well known on Twitter and other platforms that they expect another vicious bear market like the one from 2018, I think that is unlikely. The amount of institutional money/interest and players in the space now is absolutely nothing like 2018. I believe many (including myself) are still scarred from that period where many coins/tokens went down 75-100% and stayed down lmao.

While it’s easy to say crypto will go up or down, there are nuances to the way that we will see market action play out particularly as it relates to black swan/ and potentially unprecedented macro events (new variants, war, equity market corrections, potential hyper inflation, and domestic unrest). My strategy as it has always been, is to keep core blue chip holdings (BTC/ETH/LINK) and gradually grow exposure to smaller riskier projects and tokens as I take small amounts of profits or see opportunities to buy on bloody days.

Remember crypto is highly volatile and this is not financial advice - merely my gut feeling and thought process for how I will approach the next several months.

Crypto will give many the chance to generate enormous wealth in their lifetime. There may be few other opportunities of this magnitude to come in the next 25 years so it will pay to research quality projects, dollar cost average into long term positions, and take some profits here and there to weather any periods of large sell offs. Remember, we are watching the real time paradigm shift of Wall Street Vs. Crypto. Decentralization Vs. Centralization/Crony Capitalism. Defi vs. legacy finance systems. Crypto has the capacity to set many people free and return agency/ownership to citizens that have been disparaged by money printing, corruption, and the darker sides of how banking/wealth work in America today. Do not take it lightly or you may find yourself priced out of a once in a lifetime opportunity to front run half the population.

Year End Store Sale

We will are running one final year end sale to get rid of excess inventory and prepare for our Store Upgrade in 2022. We support your business and look forward to forging some new partnerships in 2022 to up the quality of our merchandise and expand the product offering into more luxury and lifestyle oriented items. More on that later.

Below are some of the more popular products this year. Sale goes Live tomorrow and runs through Friday. I will post the discount code on instagram, twitter, and within this newsletter for web access tomorrow.

Enjoy the time off and please let me know what topics you’d like discussed more in depth in the comments below. Cheers - Andy

Whats the thesis on Chewy?