ARB LETTER - Monday Post Market Update

005 - Arbitrage Andy buys his first NFT, Bubble Concerns, China

EXOTIC MARKET INTELLIGENCE.

Monday, August 30th 2021

MARKETS

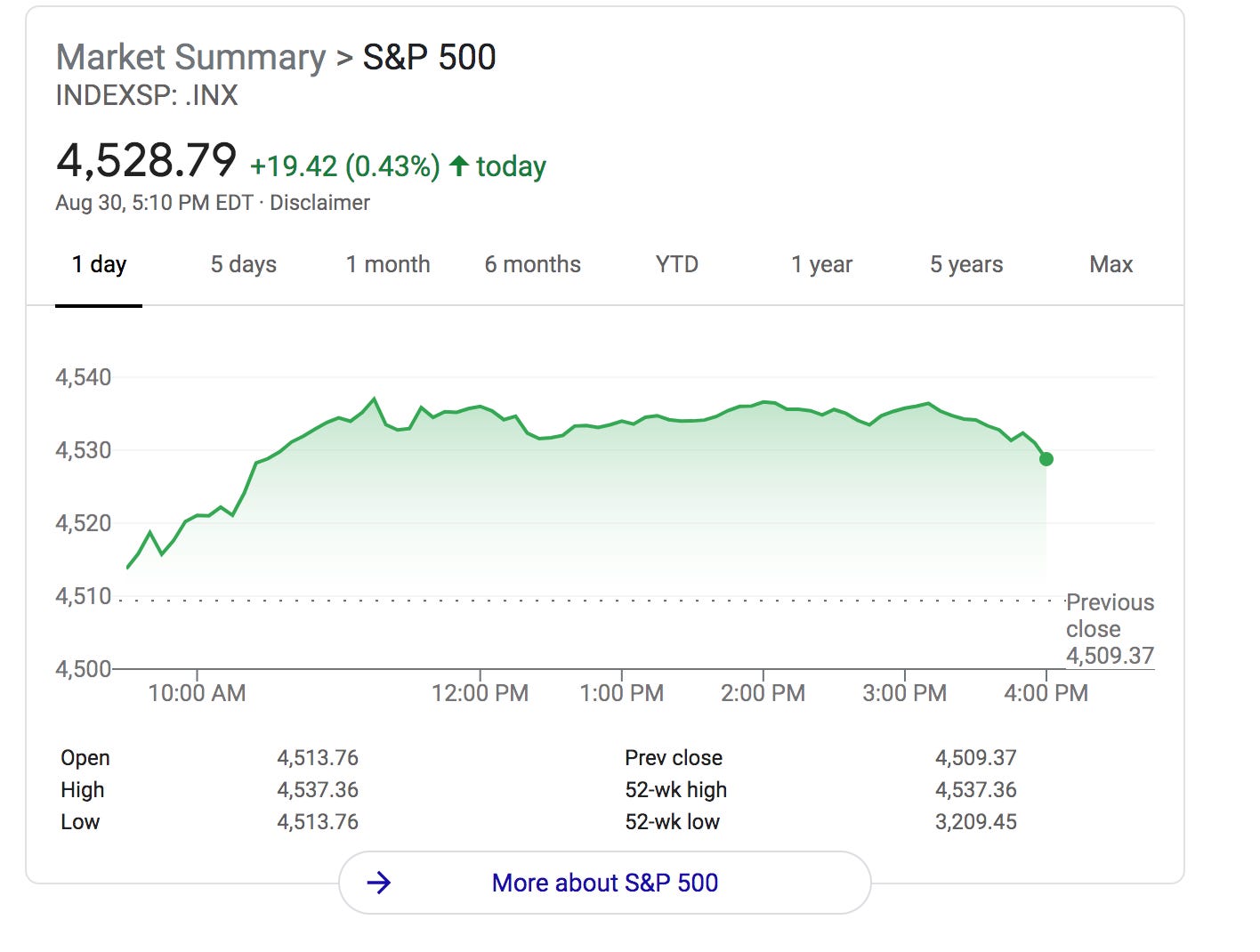

Solid green day AGAIN - I will say my bubble spidey sense is in absolute overdrive with equity markets this frothy. It’s been in fucking overdrive for two years. But alas you can’t not partake in this absolute gluttonous slutty bull market. I already ate some ETH because I bought an NFT for .99 ETH ($2,900) Already down since Saturday. Remember to take profit. Cash is still a position while trading. Nothing below is financial advice.

Apple, Microsoft, Amazon, and Google bolstered Nasdaq gains as Dow Jones slows down a bit and the S&P 500 decelerates

Affirm (AFRM) – Affirm climbs over 40% in trading today after the digital payments specialist announced a partnership with Amazon.com (AMZN)

Moderna (MRNA) – Moderna fell over 2.7% in the premarket after 1 million more Covid-19 vaccine doses have been pulled from circulation in Japan over contamination concerns. Stock is down 3.37% as of 2:11pm ET

PayPal Holdings (PYPL) is looking at ways to let its US customers trade individual stocks on its platform

Last week Jerome Powell highlighted past mistakes where policy makers made early moves in dealing with high inflation. He made clear that a slowing of the Fed's bond purchases does not mean a rise in short-term rates is imminent. Not sure I buy that Jerome.

Don Kohn, former Federal Reserve vice chair for financial supervision, has warned of imminent risks to the stability of the global financial system. This is great!

OpenSea is raking it in on the recent NFT boom. It just passed $3 billion in monthly volume. Mutant Apes, Punks, and Bastard Gans collections have seen insane growth. Some floor prices are softening today on OpenSea. Steph Curry bought the Bored Ape below for $180K. This space is WILD. Trade with caution.

China Limits Online Video-games to three hours a week for young people with new legislation. All online gamers under 18 are required to “connect” to a system that monitors and regulates play. Holy fuck! Communism is great!

Futures for Robusta Coffee - used to make espresso so you can juul in the stall and shit for 3 hours a stay - have hit 4 year highs -Many analysts are pointing to poor weather in Brazil as well as continued Covid-19 restrictions in Vietnam

Hurricane Ida weakened to a tropical storm with life-threatening flash flooding Monday, New Orleans and half the state of Louisiana is without power, one person dead reported so far. Ida making Henri look like a D-League Hurricane.

US Forces continue to work to pull out of Afghanistan with US officials cautioning against a likely last minute attack on the Kabul airbase. US Troops in many positions apparently tasked with “clean up duty” cleaning facilities that will be in Taliban hands in mere days. Can’t make this shit up. Mass loss of faith in Military Brass being shared on social media.

EXOTIC NEWS

China used to be the playground of Wall Street, politicians, and tech innovators but it would seem as the communist behemoth continues to implement new tech crackdowns, that the golden days are over, or have at least evaporated temporarily. As mentioned earlier the Chinese government literally limited how long some of it’s people can play video games. Allocating literal time windows for acceptable playing. That’s a wildly significant action when combined with the pattern of recent tech legislation and hostility towards foreign data and even money.

Unfortunately this recent pattern of tech/data crackdowns isn’t that new. In May 2021, Chinese tech magnate and Size Lord Wang Xing posted a poem over a thousand years old on social media. Many read the poem as a criticism of the Chinese government's antitrust crackdown. His company's stock fell over $37 billion in the following weeks (NPR). I mean this guy got absolutely fucked over posting a poem.

Most recently some of China’s most valuable public companies could not proceed with American stock listings after reports have emerged that Beijing is planning a wider crackdown on tech companies going public overseas.

That development means that more than $2tn of capital invested in the US shares of Chinese companies could be at risk. (Guardian).

I’d like to also remind the class that we saw the following series of events unfold and escalate over the last two years:

Trump cranks down on China hard/ big Tech steps up reliance on China

Jack Ma almost got clapped (he likely saw the Verdansk Gulag in real life)

Trump supports (possibly helped finance with CIA? I would lol) pro-democracy protests’ that were happening in President Xi’ backyard and up his ass

Historical tariffs and economic penalties on China

Joe Biden/ Hunter Biden China allegations

Taiwan is literally about to get absolutely murked by China who is emboldened by the US Afghanistan pull out and that regional strategic outcome

COVID - 19 from Wuhan (very likely a man-made bio weapon)

China buying up US property (China is buying up runways and businesses)

Extent of China’s involvement in COVID 19 is actively being debated

China benefits strategically from Lithium in Afghanistan and US technology left behind

We’ve seen a tumultuous relationship grow over several years between China and the US. We will explore China in further detail in the coming weeks. Additionally I will walk through my thoughts on how BABA, JD, and other Chinese names that might make attractive opportunities if some of these names bottom out. It wouldn’t appear like the legislation and actions by the Chinese Government are going to cease anytime soon and that makes China a very difficult investment front at the moment. The number and intensity of changes being implemented/forced on the Chinese people is unprecedented. More on this later.

NFTs UPDATE

The NFT madness continues with Mutant Apes moving into 3rd on OpenSeas Top NFTs - The top NFTs on OpenSea, ranked by volume, floor price and other statistics.

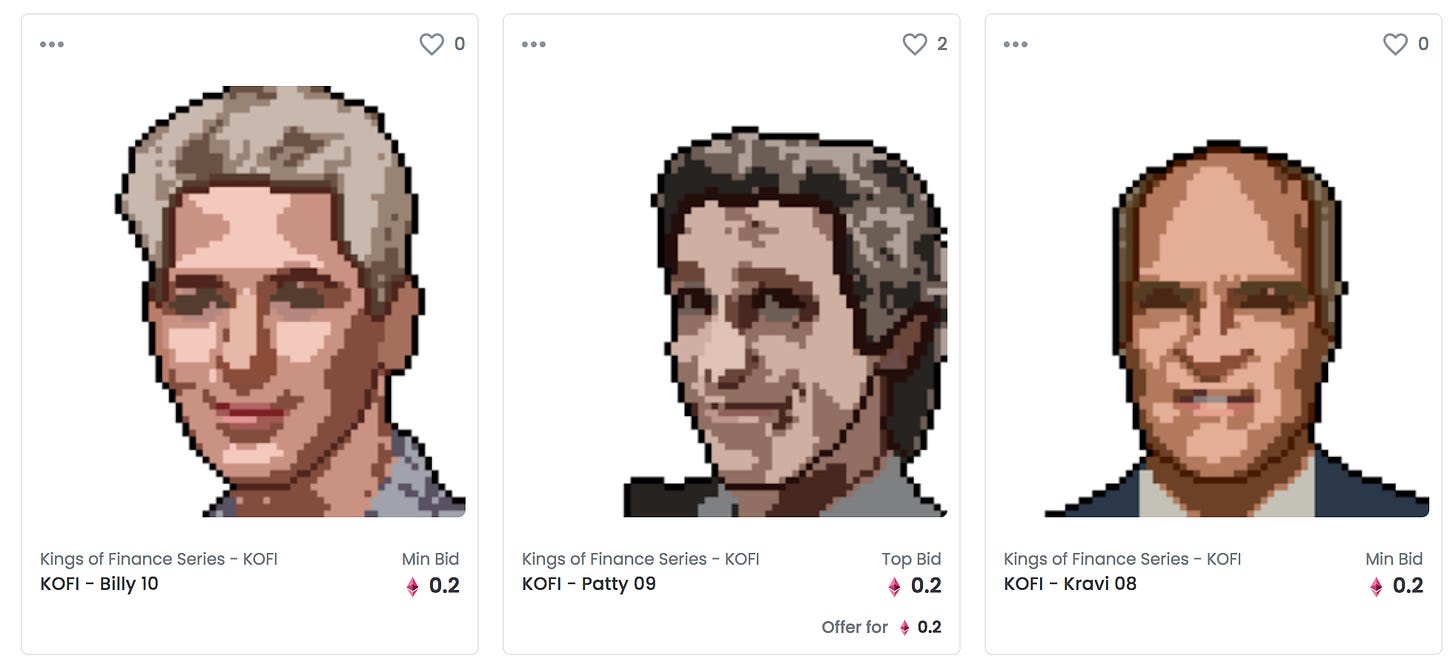

We labored over the weekend intensively with 3 bottles of wine and created the following Kings of Finance or KOFI Series NFTs, filled with all of Wall Street’s most notorious characters in a more traditional time. You can bid on the collection here. So far we have sold KOFI - Gordy 02 for 0.2 ETH and have other 0.2 ETH bids on KOFI - Patty 09 and KOFI - Wolfie 01. The NFT experiment so far has been pretty interesting to explore but I recommend everyone do their own diligence and research as I have no clue what I am doing yet lmao. Day trading them is an absolute technological feat in itself. Requiring all kinds of new proceses with crypto and blockchain technology. The markets being made on OpenSea alone are fascinating to watch, highly recommend checking it out. A preview of the KOFI collection is below, all bids welcome:

Like crypto treat NFTs with caution. I am bullish on the overall space but I definitely bought the local top (market bought) on my recent Bastard Gans Punk. I am holding my NFT longer term anyway which is generally the way I treat most of my speculative investments. Let me in know in the comments if you guys want more NFT specific content.

For more, check out the Arbitrage Andy (Instagram, Twitter, Merch Store).

Best newsletter I‘ve ever read, More NFT please!

Killing the game with this newsletter! Due to the recent boom in the NFT landscape I’d love to hear more on your take. What’s your outlook and downside risks that you see?