EXOTIC MARKET INTELLIGENCE.

EXOTIC MARKETS

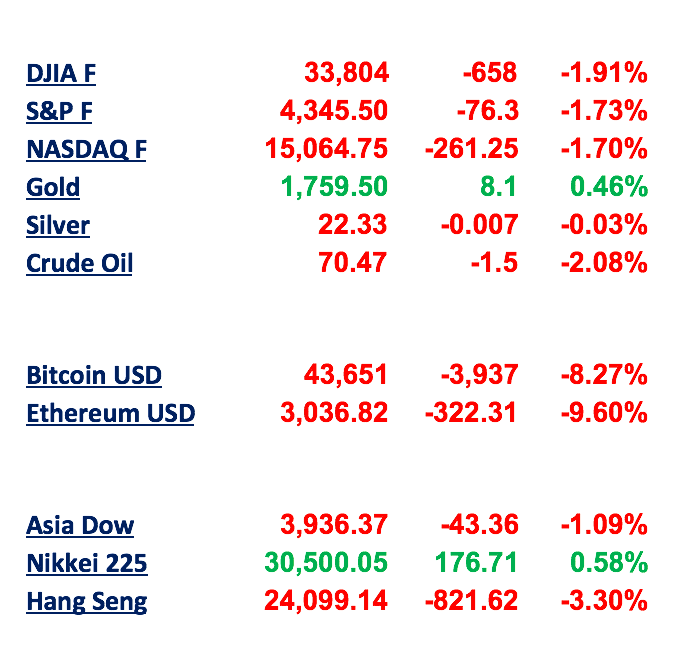

Woke up this morning around 6:30am to a cluster fuck absolute shit show. Futures blood red, crypto down 15%, and murmurs of serious escalation in China re: Evergrande. I have a bad feeling about this, and as previously mentioned I worry about blue chip crypto (BTC, ETH, LINK) weathering a broader global equity sell off in the near term.

Global stock markets tumbled Monday, with Dow futures’ decline of nearly 700 points, or nearly 2%, leading the way lower in the United States. A number of emerging investment risks led to the widespread selling (CNBC).

I bought the crypto dip AGAIN. Snagged some BTC, LINK, ETH, and ADA. How can you not?

China Evergrande shares plummeted 10.2% after earlier losing as much as 19% to more than 11-year lows.

U.S. Treasury Secretary Janet Yellen issued another plea to Congress to look to raise the federal debt ceiling. More below.

The Federal Reserve’s two-day September policy meeting, which starts tomorrow is a wild card for markets. Central bankers are considering when to begin tapering bond purchases against a backdrop of elevated inflation and a recovering economy (CNBC).

Pfizer (PFE) and BioNTech (BNTX) said Monday morning that their Covid vaccine is safe and generates a “robust” immune response in a clinical trial of kids 5 to 11. Seems a bit odd to me.

SpaceX returned its Crew Dragon spacecraft from spacial orbit on Saturday

Bank and financial stocks, including JPMorgan (JPM), Bank of America (BAC) and Citigroup (C) fell in Monday’s premarket as bond yields slide.

Compugen, DraftKings, Coinbase and Square were among the biggest ETF losers in early trading Monday morning

House lawmakers are scheduled to vote this week on an increase in the debt ceiling (LOL), with low likelihood of passage - the treasury would likely run out of cash by October per Yellen. Sounds like we’re printing more cash.

EXOTIC NEWS

First I think it would benefit all of the ARB readers to have a high level understanding of the Evergrande situation.

Founded in Guangzhou in 1996, Evergrande has epitomized China’s freewheeling era of borrowing and building, but with liabilities of nearly two trillion yuan ($305 billion) its possible collapse looms as one of China’s largest for years (Reuters).

Evergrande grew immensely to become one of China's biggest companies by borrowing more than $300bn (£217bn).

Last year, Beijing officials brought in new rules to control the amount owed by big real estate developers. The new measures by Beijing led Evergrande to offer its properties at severe discounts to guarantee money was coming in to keep the struggling business afloat. It is now struggling to meet the interest payments on its debts.

Evergrande's debt crisis continues to scare investors in Asia today as raising concerns about an inevitable default by the Chinese company could spread to other parts of the economy and world. There is mounting pressure on Xi Jinping’s government to prevent financial and economic contagion impacts from destabilizing the world and the second largest economy.

Contagion is already a major issue as Hong Kong real estate giants, including Henderson Land Development Co., saw the largest selloff in more than a year as traders speculated if China will extend its property clampdown to the South Asia financial hub.

China Evergrande Group’s debt situation has dragged down everything from bank stocks to Ping An Insurance Group Co. as well as high-yield dollar bonds. Crypto markets and US Equity Futures also collapsed this morning leaving many late longs bag-holding and praying for a swift bounce.

With the collapse of Evergrande looking all but inevitable, Analysts in Asia, Europe, and the United States are warning about the severe spill over to financial markets we will see. Evergrande has over $305 Billion in liabilities, with sizable portions due on Thursday. Major banks have reportedly been told that they will not receive interest payments on loans due Monday, while interest payments of $84m (£61m) for those select bonds are also due Thursday.

“If as expected Evergrande is defaulting on its debt and goes through a restructuring, I don’t see why it would be contained,” Michel Lowy of banking and asset management firm SC Lowy, which focuses on distressed and high-yield debt, said.

The primary concern for financial players is that an Evergrande fire sale could crush prices, causing leveraged developers to blow up and lead to an ensuing explosion of sectors comprising almost a quarter of China’s economy.

“Evergrande is just the tip of the iceberg,” said Louis Tse, managing director at Wealthy Securities, a Hong Kong-based brokerage. Chinese developers were under substantial repayment pressure on dollar-denominated bonds, he added, while markets had become nervous that Beijing would push listed real estate groups to cut the costs of housing in mainland China and Hong Kong (FT).

“We do not believe the government has an incentive to bail out Evergrande (which is a private-owned enterprise),” Nomura analyst Iris Chen said in a note to clients recently. We will monitor Evergrande developments closely but for now there seems this could be a great dip to buy for select cryptos and stocks. Not financial advice.

My father told me to never let a good crisis go to waste so Andy & Company has quickly sourced some Evergrande merchandise to commemorate the giant’s likely collapse.

For more, check out the Arbitrage Andy (Instagram, Twitter, Merch Store).

Merch. Too funny.