EXOTIC MARKET INTELLIGENCE.

Sunday - August 23rd 2021

MARKETS

Alright look, if you’ve been in crypto for some time (4/5 years) with even mild conviction you probably knew this day would come. Institutional adoption, Hedge Fund/VC interest, balance sheet power moves, celebrity endorsements, broader adoption, retail craze, during a massive pandemic where so many are isolated and remote.

If you’ve been a crypto critic or you’re brand new to the space, this is also for you as I don’t want you potentially eating crickets if this stuff turns out to be absolute gas to a massive once in a lifetime wealth transfer - shoutout @bowtiedbull.

I am more aggressive in my crypto plays now as I truly think a select few have the capability to massively disrupt traditional financial systems. I got involved in winter of 2017/early 2018 and saw limited upside before getting blindside - crack - blocked by the 2018 bear market.

My holdings got slaughtered, down big on BTC/ETH and easily another couple thousand on ADA, XRP, TRON, and LTC (Lessons there, never sell and try not to trade too much, you will likely lose money, buy on red days and hold). It’s not too late. NOT FINANCIAL ADVICE.

I was so pissed I simply held my sad af -85% bags for years until December 2020 when I went home for a week to cleanse/run in the morning (needed a break from 13 Lagunitas a day cadence and WarZone). I started seeing elevated interest in crypto and murmurings online about a bull market birthing - time to send it.

I had seen the dance before in 2018 (I remember the hype pump) and new it was time to pile in, this time with some bigger size. Fortunately I had enough dry powder I had held off in putting into the 2020 covid equity markets to put some nuts behind this trade. The bet on BTC and ETH paid off, and now I have even found myself exploring lending, staking, and other pioneer concepts that come with this tech and decentralized finance. The technology is pretty wild, and while I consider myself far from a pro in crypto, I know enough to share some tips and basic thoughts:

BITCOIN

BTC - Bitcoin is a digital currency in which a record of transactions is maintained and new units of currency are generated by computational solutions of mathematical problems, and which operates independently of a central bank.

“Bitcoin is the first digital object that cannot be copied, duplicated, pirated or forged. Those are the primary attributes that give its unique value. Bitcoin is the first digitally scarce thing known to mankind, and within its inner workings is a Mathematical mechanism that should make Bitcoin's value continue to rise” (Buy Bitcoin Worldwide).

BTC - BTC is limited in supply, only 21 million ever made (less now since many lost their keys/logins more on that later), infinitely divisible into Satoshis. You can buy any amount or denomination.

Can’t be stressed enough that unlike fiat currencies like the U.S. dollar – as the Federal Reserve can simply decide to brrr the money printer – Bitcoin’s supply is fixed. The Federal Reserve mentioned recently how it printed 22% of the US dollar in circulation this year alone. That alone makes BTC an attractive play.

Bitcoin has user autonomy and ownership

Bitcoin transactions are pseudonymous.

Bitcoin transactions are conducted on a peer-to-peer basis.

Bitcoin payments have low transaction fees for global payments.

Bitcoin payments are mobile and streamlined

Institutions

We have seen a surge in institutional demand recently - a key adoption driver.

Michael Saylor, CEO of MicroStrategy is perhaps the most ardent corporate champion of Bitcoin:

“Our point of view is being a leveraged, bitcoin-long company is a good thing for our shareholders,” MicroStrategy CEO Michael Saylor. In the long term he could be a certified send god for this call.

On Thursday August 19th, Coinbase announced that it will purchase more than $500 million in cryptocurrencies to add to its holdings. The crypto exchange’s CEO, Brian Armstrong, also tweeted that Coinbase will invest 10% “of all profit going forward in crypto (Coindesk).

Grayscale, a pioneer in the digital-currency and crypto asset management space has grown the the total value of assets under management by all-time high of $52 billion.

BTC is here to stay in some form and the recovery from the latest dip validates this thesis tremendously. Institutions are aggressively buying. If Bitcoin grows and scales, maybe takes, 15% of the global currency market, the total price per bitcoin would be roughly $500,000 (Investopedia). That dip was a textbook shakeout in my humble opinion. More recently Bitcoin has been bitch slapping gold as a store of value.

Michael Saylor has conviction. So does Elon Musk, Jack Dorsey, Druckenmiller, Cathie Wood, and other super smart rich people who can literally spend things into existence. Not to mention a viciously loyal retail community of OG whales holding tremendous size.

At this point $70K/$80K is close in my opinion, much much higher long term, with institution - induced choppy-ness to shake out non believers along the way. I think everyone should own it, I’m allocated at well over 25% but if you’re risk averse 5% - 10% seems reasonable, irresponsible to not have exposure in this inflation ridden environment. Bitcoin was designed for this. I am strongly confident in it’s use as a store of value for now. Dollar cost average on an exchange like CoinBase or Gemini. Once you have more than you could comfortably lose to a lucky hacker, buy cold storage, a Ledger or Trezor and transfer off any crypto you want to hold longer term. This holds your private keys offline, enhancing security. Hacks, while rare, do happen. It’s emerging tech, that’s the price you pay for massive upside.

One observation to note - you sacrifice liquidity speed by moving to cold storage since you have to enter your keyword phrase to confirm transfers (sort of like the nuclear football for your crypto). This takes several minutes generally. If the market dumps, it can be stressful (yes this has happened to me). That’s why it’s important to divide your cold storage and exchange allocations carefully. Be confident in this as a long term hold but never put too much at risk. Personally I think the risk/reward here is money. Not Advice. If any pros have ways around this feel free to message me.

ETHEREUM

ETH - Ethereum is a decentralized, open-source blockchain supporting smart contract functionality. Ether is the native cryptocurrency of the ethereum platform. It is the second largest cryptocurrency by market capitalization behind BTC. Ethereum was invented in 2013 by programmer Vitalik Buterin. Side Note - check out the cringiest video I’ve ever seen in my entire life below. Don;t let this turn you off from ETH. Unfortunately big brain time doesn’t mean big social awareness time for these fin-tech lords. The second video is the quickest way to conceptualize ETH in a few minutes.

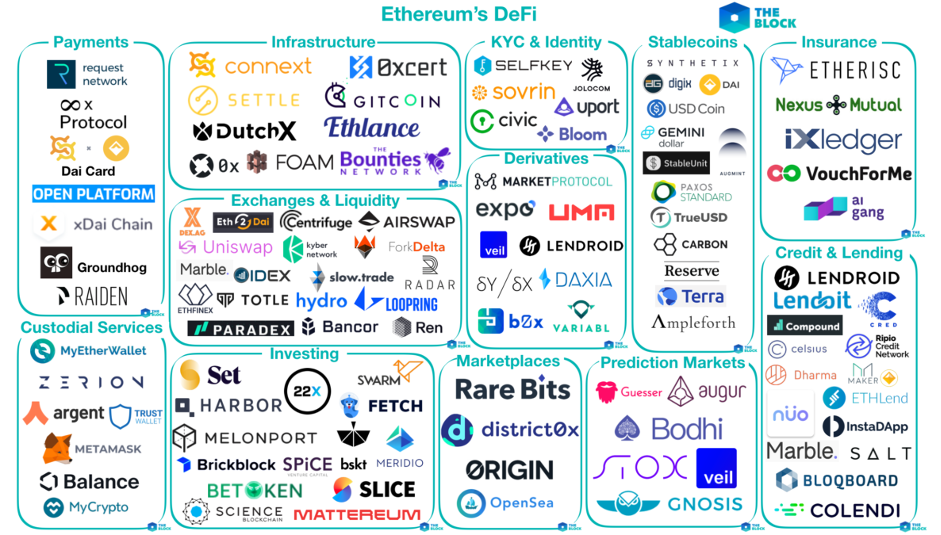

ETH is also the first version of programmable money in the world, storing instructions/orders on the blockchain that will self-execute when pre selected conditions are met (which are also known as smart contracts). Different corporations have steadily begun to explore infrastructure changes and the implementation of smart contracts into proceses. Great overview of smart contracts by IBM.

A Smart Contract is a collection of code and data on the Ethereum Blockchain. Smart contracts can define rules, like a regular contract, and automatically enforce them via the code (Ethereum.org).

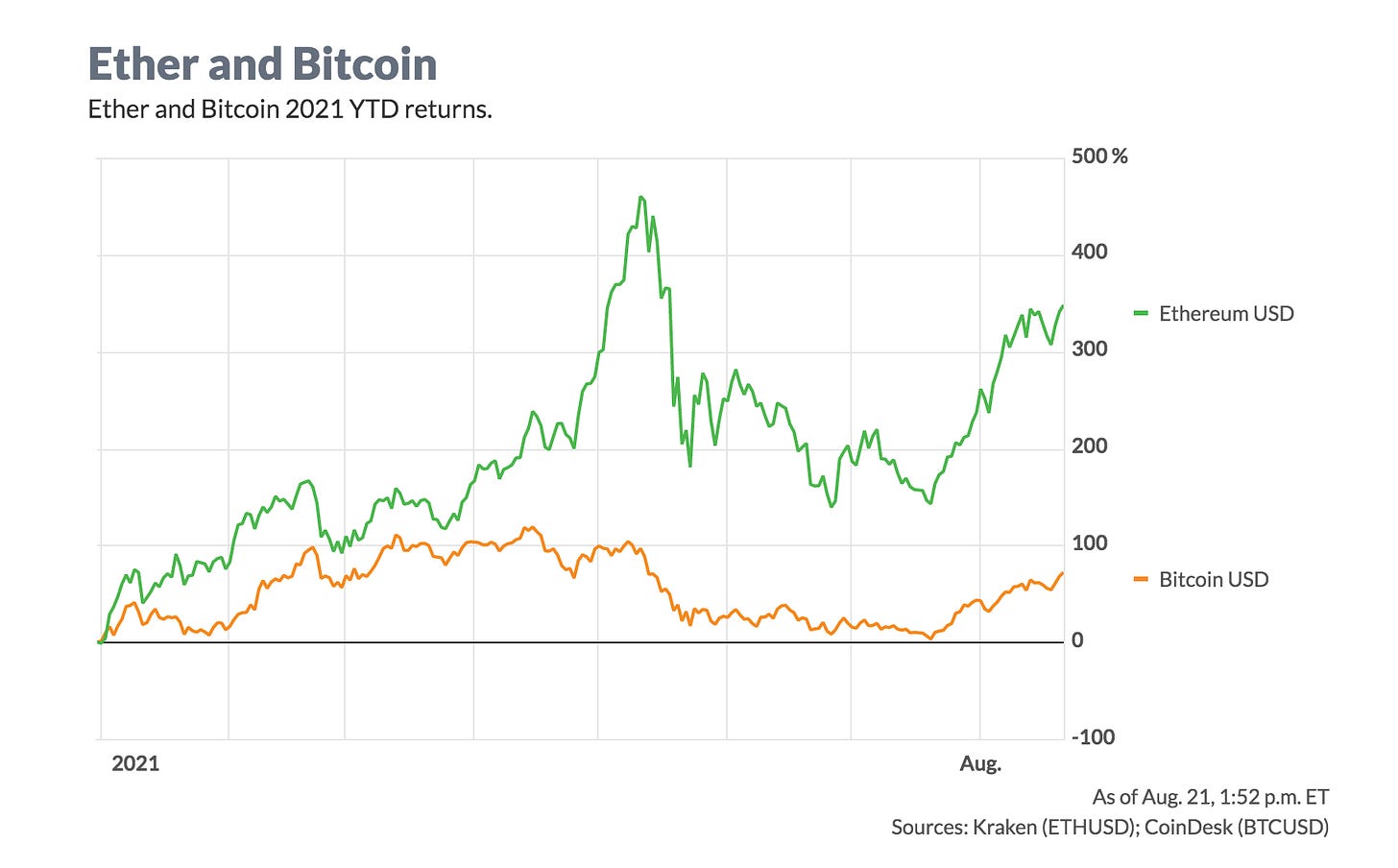

Ethereum makes up a decent chunk of my current crypto portfolio. I imagine I look at ETH the same way smarter people probably thought about APPL, FB, AMZN, NFLX etc. early on. I think ETH is EASILY a top 3 investment opportunity for the next 10 years. I see $10K by early next year and $20K+ down the road. That’s not advice. Again, ETH + BTC could easily be a bullish 75% of a crypto portfolio, with the remaining 25% in blue chip Alt Coins that we will touch on later, like LINK, DOT, ADA, UNI, SUSHI, AAVE, and MATIC. This is my preferred structure in a bull market to hedge risk but grab some wild upside from Alt pumps, something that happened on the reg in 2017. Again - my preference of a balance of size on, with some risky active trades and longer term core holds I won’t touch. Not advice.

Ethereum also initially appears to bring a lot more to the party than Bitcoin. Bitcoin’s major marketing point has been its claim by enthusiasts to be a store of value and as a currency to a lesser extent, but Ethereum’s network is viewed by many as a powerful, open-source, decentralized backbone off which a number of applications can be based (MarketWatch). I am bullish short term on ETH to$4,500/$5,000 range but will likely still hold 75% long forever even if I take some profit.

Recent ETH Updates

The switch to an eco-friendly model addresses long-term sustainability concerns to some extent

Ethereum can integrate smart contracts with real-world API, evading blockchain's constraints and limitations, everything will be interconnected

Corporations are increasingly starting to use ETH

EIP 559 - More ETH burned/supply gone

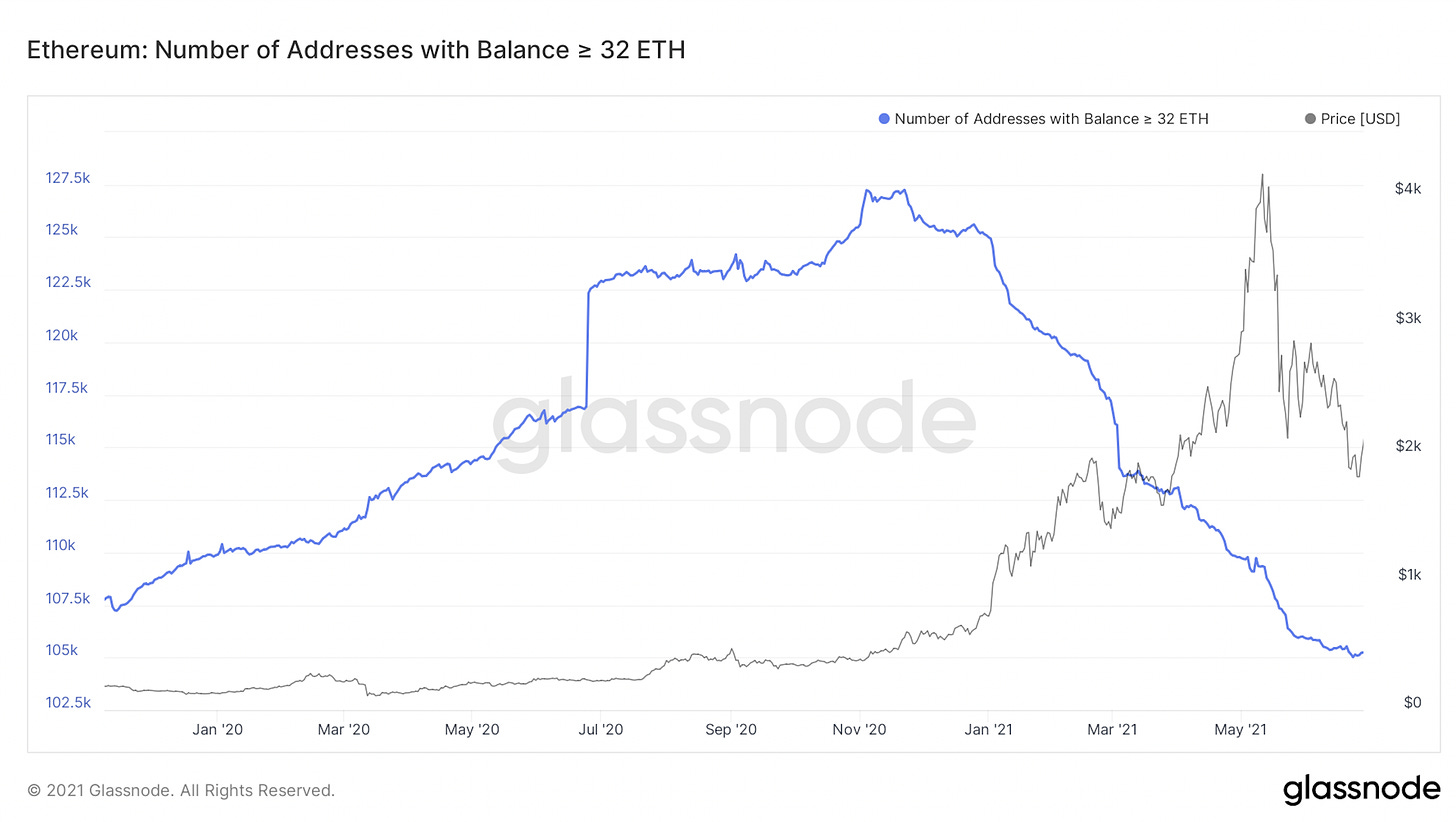

You can stake ETH and earn interest (higher than any bank) if you have 32

My general strategy I would echo to anyone who is interested, is to get some exposure to BTC and ETH that your comfortable with, buying consistently to your preferred allocation on mostly red days. If you’re new, don’t gamble on random shit-coins if you can’t afford to lose money. One of the downsides of this emerging tech is shit-coins, scammers, and noise. Stick to blue chip crypto (BTC/ETH) and high quality alts you have researched. Jury still out on DOGE. Imagine missing out on a pop. More on my Alt picks and NFTs later - happy trading and feel free to leave questions/insights in the comments. This analysis is sure to be missing items, but this is the what you needed to know yesterday summary.

-Andy

CRYPTO BASICS BOOK LIST

For more, check out the Arbitrage Andy (Instagram, Twitter, Merch Store).

Got into crypto cause of your memes, holding cause i dont want to eat crickets

So if BTC has a finite supply what happens when it halves? Still trying to understand the halving that happened earlier this year and if that creates more supply like when fed prints money.