EXOTIC MARKET INTELLIGENCE.

Friday September 24th 2021

“We are not in a bubble, that I know" - Cathie Wood

EXOTIC MARKETS

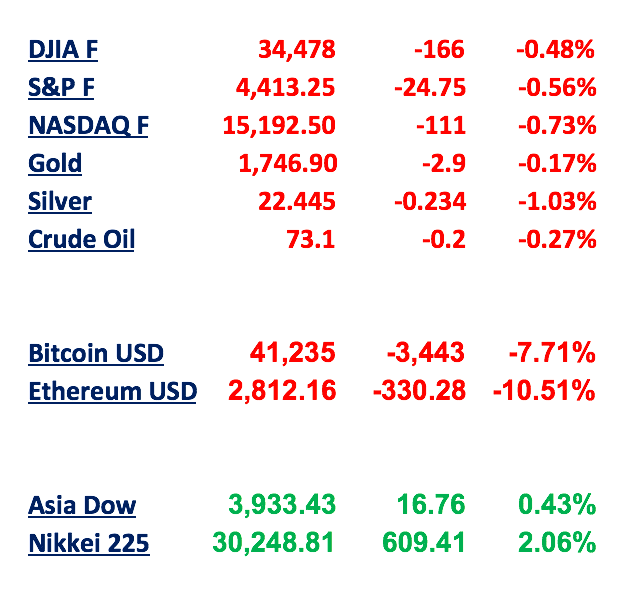

Good morning frens. Say it back. What a wild week. Crypto volatility, the implications of the Evergrande situation, and continued fears of hyper inflation plague the financial fields of battle. PLTR plays played out exceptionally well yesterday but I have a feeling we are going to have a low volume red Friday across the board.

Would love to be wrong. I am out of dry powder until pay day or direct deposit to buy the dip so will be patiently waiting this weekend. Nice dip though.

*China news is developing as I type this and it seems some older information is being disseminated by ill actors - more below in Exotic News. This is bullish. *NFA.

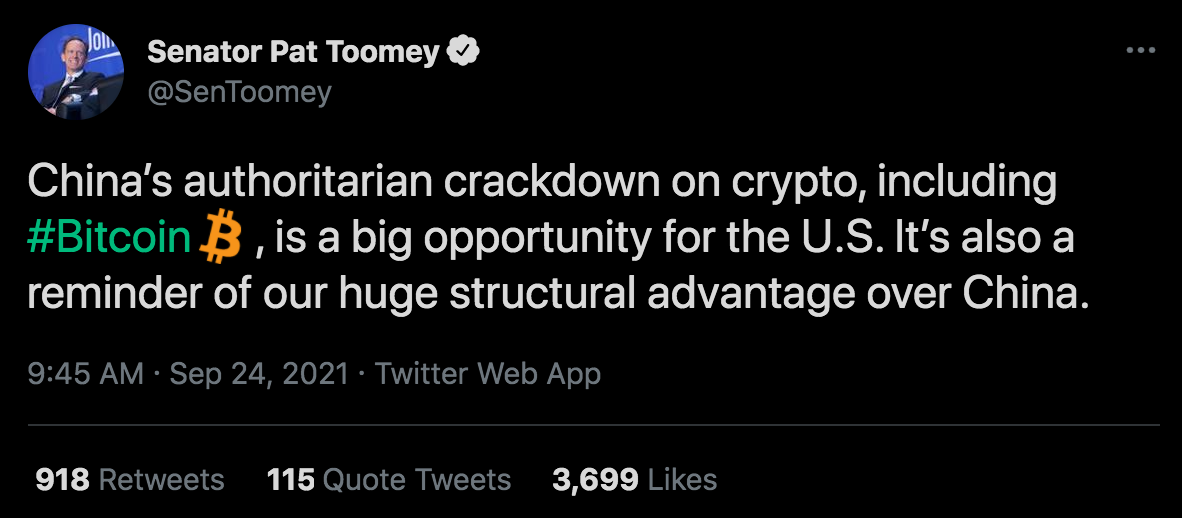

China’s central bank renewed its tough talk on bitcoin Friday morning, calling all digital currency activities illegal, hinting at more severe crackdowns. More on this below.

The PBOC has reportedly printed nearly $100 billion this week. LOL.

Coindesk (COIN), Marathon Digital Technology (MARA), Square (SQ), and other crypto/mining related stocks were among initial losers this morning

Investors in an Evergrande offshore bond say they have not received a closely watched interest payment of $83M due Thursday night NY time.

Fed Reserve officials hinted on Wednesday that they’re ready to begin “tapering” — which is the process of gradually pulling back the stimulus they’ve handed out during the pandemic. LMAO yeah let’s see how that pans out guys.

Cambrian Asset Management, a California-based investment firm with over $200 million in AUM (assets under its management), announced this week its launch of the Cambrian Bitcoin Systematic Trust and Cambrian Ethereum Systematic Trust products. Quant shit. Read more HERE.

The situation at the US Southern Border continues to deteriorate with record numbers of migrants from Haiti and other countries swelling around border chokepoints

The new Democrats' Reconciliation plan would scale back Roth conversions, and completely eliminate the ability for the richest Americans to convert traditional IRAs into Roth IRAs by 2032.

Deutsche Bank's investment banking unit will report revenues around 10% down on last year in the third quarter of 2021 according to CFO James Moltke. Poor Deutsche lmao (FN London).

EXOTIC NEWS

CHINA. CHINA.

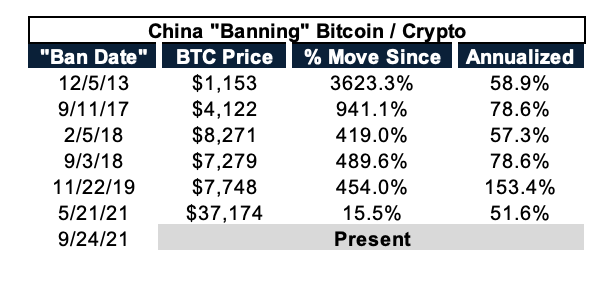

This isn’t the first or second or even third time that China has announced a “ban” on Crypto and it seems once again that the market has overreacted. There are also claims by some notable crypto influencers and professionals questioning the integrity of this morning’s rumors. The following excerpt is from TrustNodes and was flagged on twitter by Anthony Pompliano, the crypto guru.

Bloomberg, the anti-bitcoin publisher of the pre-internet age, has sent out outright fake ‘breaking news’ that sent bitcoin’s price down by $2,000 from $45,000 to $43,000.

As can be seen above Bloomberg said, without linking to a source, “the Chinese central bank says all cryptocurrency-related transactions are illegal.”

That’s false. What China’s central bank said is just a re-iteration of what they said in 2017. Published on September 15th, PBOC stated:

“Virtual currency-related business activities are illegal financial activities. Carrying out legal currency and virtual currency exchange business, exchange business between virtual currencies, buying and selling virtual currencies as a central counterparty, providing information intermediary and pricing services for virtual currency transactions, token issuance financing, virtual currency derivatives transactions and other virtual currency related Business activities suspected of illegal sale of tokens and tickets, unauthorized public issuance of securities, illegal operation of futures business, illegal fund-raising and other illegal financial activities are strictly prohibited and resolutely banned in accordance with the law. Those who carry out related illegal financial activities constitute a crime shall be investigated for criminal responsibility in accordance with the law.”

Hmmm, sound fucky! This adds validation to my over arching theory that any FUD possible is being thrown at Bitcoin and crypto because people and the elite are starting to realize that it is going to be a powerful technology that will change the global financial infrastructure. The Fed knows it too.

In my opinion, you can smell the bullish-ness for crypto right now. Continually we have seen efforts to spread FUD, a crypto term for Fear, Uncertainty, and Doubt. Unfortunately as pioneer technologies like crypto spread, nefarious actors will and have attempted to influence prices with news, rumors, and other leaks designed to impact price negatively. Long term I am as bullish as ever. If something has immense value are you going to go around acknowledging that or gaslight people into thinking it actually isn’t valuable so you can obtain more? Trading 101.

What is clear is that China is preparing to make a more sustained and obvious stance against the West and against innovation/capitalism.

Where China is concerned however, you’d expect them to be a bit more alert about people escaping their devaluation amid mass money printing, but there’s nothing they can do because bitcoin is peer to peer and can be traded as such outside any banking system, so it can’t be stopped.

PBOC acknowledges as much, saying crypto trading is rising in China. As you’d expect, because this printing may be just the beginning as 20% of China’s GDP in the property market finds itself in distress (Trust Nodes).

China’s communist authoritarian crackdowns over the last several months are now having broad implications for the global financial markets that we should certainly monitor closely but also take with a grain of salt. They aren’t our friends. To pretend as much is blatant naïveté and arrogance.

Still, these short term volatile inflections are concerning and as I have mentioned before the ultimate test in my mind for Bitcoin and other top cryptos is how they will react in the medium term to a broader equity sell off/depression. In that environment Gold and Silver may perform well but which asset will emerge as the superior one? Doubt it will be the dollar. We hit the point of no return already there and the consequences of slutty money printing will come home to roost eventually. Middle and lower class will take the brunt of negative side effects from inflation.

I firmly believe this wave of FUD will disappear soon (it already is as I type this, as crypto and markets edge back up). Evergrande seemed to be an overreaction and now this China FUD in the same week? Seems to me like a classic case of sentiment manipulation.

Have a great weekend everyone and don’t be alarmed by low vol trading over the weekend, it tends to move prices more rapidly.

ANDY

Evergrand and Inflation inspired Merch from this week. Some best sellers below.

For more, check out the Arbitrage Andy (Instagram, Twitter, Merch Store).